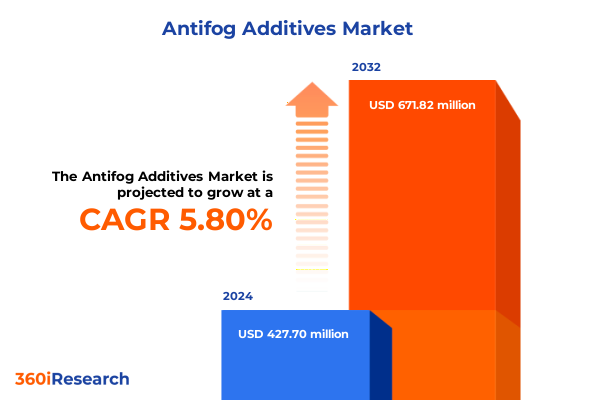

The Antifog Additives Market size was estimated at USD 452.36 million in 2025 and expected to reach USD 476.85 million in 2026, at a CAGR of 5.81% to reach USD 671.82 million by 2032.

Unlock the Science and Significance of Antifog Additives as Essential Functional Materials That Enhance Clarity and Performance Across Industries

Antifog additives are specialized functional materials engineered to inhibit condensation and fog formation on a variety of substrates, including polymer films, optical lenses, textiles, and medical devices. These performance enhancers are typically formulated from esters and surfactants that reduce surface tension and promote uniform water dispersion, thereby preserving clarity and functionality under changing humidity and temperature conditions. The underlying chemistry involves balancing hydrophilic and hydrophobic domains to prevent droplet coalescence on critical surfaces, ensuring long-term performance and durability.

Originally developed for photographic and automotive optics applications, antifog chemistries have evolved to address the rigorous demands of high-speed film production lines and precision medical instruments. Advances in polymer science have enabled the refinement of water-soluble polyvinyl alcohol and polyethylene oxide coatings, while novel amphoteric and nonionic surfactants deliver rapid moisture control across diverse film substrates. As a result, modern formulations can be seamlessly integrated into extrusion, injection molding, or dip-coating processes, offering uniform distribution and minimal particulate contamination.

Recent growth in e-commerce-driven packaged goods and stringent safety regulations in healthcare have accelerated demand for robust antifog solutions. Consumer expectations for transparent, fog-free packaging in fresh produce and perishable foods, combined with critical visibility requirements in diagnostic devices and headlamp assemblies, have positioned antifog additives as essential enablers of product quality and user experience. In parallel, regulatory scrutiny around low-migration and biocompatibility parameters has propelled the development of next-generation chemistries that balance high performance with environmental and health compliance.

Navigate Transformative Technological and Regulatory Shifts That Are Redefining the Antifog Additives Industry and Shaping Future Innovation Trajectories

The antifog additive landscape is undergoing a fundamental transformation driven by sustainability imperatives and innovative chemistries. Leading producers are investing in bio-based intermediates derived from glycerol and polyglycerol esters to reduce reliance on petrochemical feedstocks, while prioritizing low-migration profiles to comply with global food-contact and medical device regulations. Meanwhile, major players such as DSM and Clariant have introduced eco-friendly formulations that minimize environmental impact without compromising performance, signaling a broader industry shift toward green chemistry and circular economy principles.

Simultaneously, regulatory frameworks in key markets like the European Union and Japan have tightened standards around residual monomers and potential endocrine disruptors, prompting suppliers to accelerate development of next-generation surfactant and polymer-based systems. Emerging nanostructured coatings offer disruptive potential by incorporating nano-scale barriers that repel water droplets and enhance surface durability, although rigorous approval cycles and scale-up challenges remain. As a result, converters and brand owners have become influential stakeholders, demanding comprehensive life-cycle data and transparent supply chain traceability to mitigate compliance risks.

Technological collaboration and digitalization are further catalyzing change, with manufacturers forging strategic partnerships to integrate artificial intelligence in formulation screening and predictive performance modeling. By leveraging data-driven platforms, R&D teams at Evonik and other innovators are optimizing additive blends for specific substrates and end-use conditions more efficiently, reducing time-to-market and material waste. These collaborative ecosystems are redefining traditional value chains, as cross-sector alliances enable co-innovation between specialty chemical providers, film producers, automotive OEMs, and end users.

Examine How the 2025 U.S. Trade Tariffs Have Reshaped Supply Chains Cost Structures and Competitive Dynamics Within the Specialty Antifog Additives Sector

The introduction of broad-based U.S. tariffs on imported chemical intermediates in 2025 has triggered an 8–15 percent increase in landed costs for select specialty additives. Tariff-related expenses are compounded by higher freight insurance premiums and additional customs documentation requirements, which in turn have compressed margins for contract manufacturers and toll processors with fixed-price agreements. Consequently, many formulators are revising supply agreements and negotiating price escalation clauses to safeguard profitability amid sustained cost volatility.

In anticipation of escalating duties, buyers have engaged in significant stockpiling of critical raw materials, notably ethylene glycol esters and nonionic surfactants, to avoid abrupt price surges. This behavior echoes similar patterns observed across the chemical sector in early 2025, where companies like Lanxess and downstream users positioned inventories to offset tariff-driven inflation. However, stockpiling has also strained warehousing capacity and created periodic supply gaps, underscoring the fragile balance between cost mitigation and operational resilience.

Moreover, the evolving tariff regime has prompted specialty chemical producers to explore alternative sourcing strategies, including increased domestic production and regionalization of supply chains under trade agreements such as USMCA. While these shifts can reduce exposure to import duties, they often entail higher base production costs and require substantial capital investment. At the same time, evolving classification rules and origin verifications have raised administrative overhead, necessitating dedicated compliance teams to navigate the complex trade environment.

Explore the Comprehensive Segmentation Landscape That Enables Strategic Decisions by Examining Type Form Process Application End Users and Sales Channels

A granular understanding of market segmentation is essential for aligning product development and go-to-market strategies. Under type segmentation, antifog solutions are categorized into polymer-based and surfactant-based systems, with polymer variants further differentiated by chemistries such as polyethylene glycol, polyethylene oxide, and polyvinyl alcohol, while surfactant grades span amphoteric, anionic, cationic, and nonionic classes. Form-based segmentation distinguishes liquid concentrates from powder blends, each offering unique handling and performance characteristics suited to specific processing environments. Application process insights reveal the compatibility of antifog additives with diverse manufacturing methods, including coating operations, extrusion processes, and injection molding, which influence efficacy and distribution within substrates.

Application segmentation further refines the landscape by mapping functional requirements to end-use platforms, from glassware and optical films and lenses-encompassing camera optics, display panels, and prescription lenses-to polymeric films and sheets available in flexible and rigid formats, as well as textile substrates of natural and synthetic origin. End-user segmentation identifies key verticals, including automotive exteriors, headlamp assemblies, and interior components; consumer electronics and household appliances; healthcare diagnostics and medical instrumentation; and packaging segments such as food, industrial, and medical films. Finally, sales channel segmentation contrasts traditional offline distribution through direct sales and distributor networks with online channels, including e-commerce marketplaces and manufacturer-operated portals, reflecting evolving procurement behaviors and digital engagement models.

This comprehensive research report categorizes the Antifog Additives market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Form

- Application Process

- Application

- End User

- Sales Channel

Uncover Regional Dynamics Shaping Adoption and Innovation of Antifog Additives Across the Americas Europe Middle East Africa and Asia Pacific Markets

The Americas region, anchored by robust manufacturing hubs in the United States and Canada, benefits from advanced pilot facilities and regulatory frameworks that support rapid commercialization of new antifog innovations. Strong partnerships between specialty chemical producers and packaging converters drive continuous performance improvements, while proximity to automotive OEM clusters fosters applications in headlamp optics and exterior components. The well-developed logistics network and preferential trade agreements under USMCA further streamline cross-border distribution, enabling resilient supply chains and responsive service models tailored to North and Latin American markets.

In Europe, the Middle East, and Africa, regulatory stringency and consumer demand for eco-conscious solutions have positioned the region as a leader in sustainable antifog technology adoption. European additive suppliers are at the forefront of developing low-migration, food-contact-approved formulations and biobased alternatives, propelled by initiatives such as the European Green Deal and REACH compliance requirements. Additionally, emerging markets in the Middle East and Africa are increasingly investing in agricultural film applications for controlled-environment farming and industrial coating systems, creating new growth avenues for high-performance antifog chemistries.

Asia-Pacific is the largest growth engine for antifog advancements, underpinned by expansive food packaging manufacturing in China, India, and Southeast Asia, as well as rapid penetration of e-commerce platforms for perishables. The region’s agricultural sector leverages antifog additives in greenhouse and mulch films to ensure consistent moisture management, while electronics and display manufacturers rely on these chemistries to maintain pixel clarity in smartphones and flat-panel displays. Local producers are scaling up production with integrated downstream capacities, and favorable government policies aimed at enhancing domestic value chains continue to attract foreign investment in specialty additive manufacturing.

This comprehensive research report examines key regions that drive the evolution of the Antifog Additives market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Gain Insider Perspectives on Leading Companies Innovations Collaborations and Competitive Strategies Defining the Antifog Additives Landscape Today

The competitive landscape in the antifog additives market is moderately fragmented, with a mix of global specialty chemical incumbents and agile regional players shaping innovation pathways. Cross-functional consortiums between base chemical suppliers and performance additive manufacturers are emerging as a strategic imperative to accelerate product development, drive cost efficiencies, and navigate complex regulatory regimes. As brand owners increasingly demand end-to-end transparency, leading companies are building in-house regulatory consulting and certification capabilities alongside traditional R&D to differentiate their offerings.

Major industry participants have adopted varied approaches to strengthen market positions. Evonik has leveraged strategic partnerships and continuous research to expand its antifog portfolio across food packaging and horticultural films, while BASF’s recent financial outlook adjustments underscore the sensitivity of additive margins to global trade dynamics. Croda’s global footprint and targeted acquisitions have enhanced its capacity to deliver application-specific solutions, and Clariant’s joint ventures in nano-based coatings illustrate a commitment to high-performance segments. These strategic moves highlight how collaboration, diversification, and niche specialization drive competitive advantage.

Emerging companies focusing on bio-based and nanostructured antifog coatings present disruptive potential, drawing interest from venture investors and larger corporates seeking to expand value propositions. At the same time, start-ups face stringent qualification processes and capital-intensive scale-up requirements, underlining the importance of partnership models with established players. Overall, the balance of power is shifting toward converters and brand owners who prioritize validated performance data and life-cycle analyses, compelling suppliers to bolster digital service offerings and technical support frameworks.

This comprehensive research report delivers an in-depth overview of the principal market players in the Antifog Additives market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AkzoNobel N.V.

- Ashland Global Holdings Inc.

- Avient Corporation

- BASF SE

- Cargill, Incorporated

- Clariant AG

- Corbion N.V.

- Croda International Plc

- DuPont de Nemours, Inc.

- Emery Oleochemicals Sdn Bhd

- Evonik Industries AG

- Fine Organics Inc.

- LyondellBasell Industries Holdings B.V.

- Nouryon Chemicals Holding B.V.

- Palsgaard A/S

- Polyvel Inc.

- Primex Plastics Corporation

- SABO S.p.A.

- Solvay S.A.

- The Dow Chemical Company

Implement Strategic Actions Centered on Sustainability Supply Chain Resilience and Innovation to Secure a Competitive Edge in the Evolving Antifog Additives

Industry leaders should prioritize investment in sustainable feedstocks and bio-based chemistries to align with evolving regulations and consumer expectations. By integrating circularity principles into product design, companies can mitigate future compliance risks, reduce carbon footprints, and capture premium positioning in end-use markets that increasingly value environmental stewardship. Establishing transparent supply chain traceability and leveraging third-party certifications can further enhance credibility and facilitate entry into regulated segments such as food packaging and medical devices.

To offset tariff-induced cost pressures, organizations must diversify raw material sourcing across multiple regions while strengthening local manufacturing capacities. Collaborations with regional converters and cross-border joint ventures can create more resilient networks, reduce lead times, and enable rapid responsiveness to geopolitical shifts. Adopting flexible pricing models and dynamic contract terms will also be crucial to accommodate input cost fluctuations and preserve margin integrity.

Additionally, companies should embrace digital innovation by implementing AI-driven formulation platforms and predictive performance analytics, accelerating product development cycles and optimizing material usage. Cultivating strategic partnerships with technology providers and academic institutions can unlock new opportunities in nanostructured coatings and smart surface treatments. By fostering a culture of cross-functional collaboration, organizations can enhance their agility, drive continuous innovation, and secure long-term competitive differentiation in the antifog additives sector.

Understand the Rigorous Research Methodology Combining Primary Interviews and Secondary Data Sources to Deliver Actionable Insights on Antifog Additive Dynamics

This research leverages a dual-pronged methodology, combining primary insights from in-depth interviews with industry stakeholders-including formulators, converters, and end users-with comprehensive secondary data drawn from proprietary databases, regulatory filings, and scientific publications. Primary interviews were conducted with senior R&D and supply chain executives to validate trends, assess technology adoption rates, and capture nuanced perspectives on regulatory impacts. Secondary sources provided historical context and quantitative benchmarks for segmentation and regional analyses.

Data triangulation techniques were applied to ensure accuracy and consistency, cross-referencing interview findings with trade association reports, patent filings, and specialist journals to identify emerging chemistries and sustainability innovations. The segmentation framework was developed through iterative validation with market participants, while tariff impact assessments incorporated real-time trade data, customs records, and expert commentary. This rigorous approach delivers actionable insights and reliable intelligence to support strategic decision-making in the specialist additives domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Antifog Additives market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Antifog Additives Market, by Type

- Antifog Additives Market, by Form

- Antifog Additives Market, by Application Process

- Antifog Additives Market, by Application

- Antifog Additives Market, by End User

- Antifog Additives Market, by Sales Channel

- Antifog Additives Market, by Region

- Antifog Additives Market, by Group

- Antifog Additives Market, by Country

- United States Antifog Additives Market

- China Antifog Additives Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2862 ]

Summarize the Critical Conclusions From the Analysis Emphasizing Opportunities Challenges and the Path Forward for Antifog Additives Innovation and Deployment

Antifog additives represent a critical enabler of product performance and consumer experience across a diverse range of industries, from food packaging and healthcare to automotive and textiles. The market landscape is being reshaped by sustainability mandates, regulatory complexity, and evolving trade policies, compelling suppliers and end users to adopt more resilient and transparent operational models. At the same time, technological advances in bio-based chemistries and nanostructured coatings are unlocking new performance frontiers.

Looking ahead, the convergence of green chemistry principles, digital innovation, and collaborative value chains will define competitive success in this sector. Organizations that proactively align R&D portfolios with regulatory trajectories, diversify supply networks, and harness data-driven formulation tools will be best positioned to capture growth opportunities and mitigate emerging risks. The insights presented in this report furnish a strategic roadmap for stakeholders seeking to navigate the dynamic antifog additives ecosystem and accelerate their innovation agendas.

Connect With Ketan Rohom to Secure Exclusive Access to the Latest Market Research Report and Advance Your Strategic Vision in the Performance Antifog Additives

Ready to gain an unparalleled understanding of antifog additives and position your organization at the forefront of innovation? Connect with Ketan Rohom to secure exclusive access to the latest market research report. With comprehensive insights into segmentation dynamics, competitive strategies, and regional developments, this report will empower your strategic vision and drive informed decision-making in the performance antifog additives domain.

- How big is the Antifog Additives Market?

- What is the Antifog Additives Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?