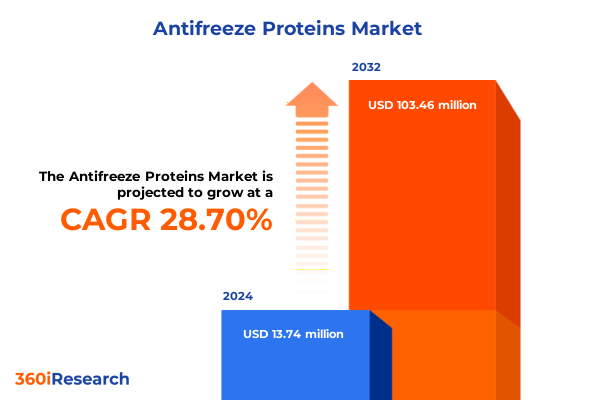

The Antifreeze Proteins Market size was estimated at USD 17.54 million in 2025 and expected to reach USD 27.35 million in 2026, at a CAGR of 28.85% to reach USD 103.46 million by 2032.

Unveiling the Crucial Role and Broad-Spectrum Applications of Antifreeze Proteins in Biotech, Food, Agriculture, and Pharma

Antifreeze proteins represent a groundbreaking class of biopolymers that organisms have evolved to survive subzero temperatures. Unlike traditional small-molecule antifreezes, these ice-binding proteins operate at remarkably low concentrations by adsorbing to nascent ice crystals and inhibiting their growth, thus preventing cellular damage and preserving function. This unique mode of action stems from a combination of thermal hysteresis and ice recrystallization inhibition, mechanisms that have been elucidated through decades of structural biology and biophysical research. Recognized initially in polar fish, these proteins have since been identified across an astonishingly diverse array of taxa, including insects, plants, fungi, and bacteria, each adapted to its own ecological niche and freezing challenge.

Over the past two decades, scientific understanding of antifreeze proteins has expanded beyond natural sources to encompass recombinant expression systems and synthetic biomimetic analogues. Advances in molecular engineering have enabled researchers to tailor ice-binding affinities, thermal hysteresis profiles, and solubility characteristics to meet specific application requirements. As a result, antifreeze proteins have transitioned from academic curiosity to commercially viable ingredients across multiple sectors. Driven by their noncolligative properties and the ability to protect biological systems with minimal osmotic disturbance, these proteins are redefining standards in cryopreservation, food texture optimization, and beyond.

Charting the Transformative Shifts Reshaping Antifreeze Protein Innovation, Regulation, and Supply Chains in 2025 and Beyond

The landscape of antifreeze protein development is undergoing a profound transformation fueled by convergence in biotechnology, synthetic chemistry, and data-driven design. Recent breakthroughs in recombinant expression platforms have significantly increased yields while reducing impurity profiles, enabling scalable production that was once confined to labor-intensive natural extraction processes. Concurrently, biomimetic innovations-such as peptoid-based analogues-have emerged to offer tunable performance characteristics and enhanced stability at extreme temperatures, broadening the scope of possible applications beyond biological systems.

Regulatory frameworks are also evolving in parallel, reflecting a growing recognition of these proteins as safe and effective for diverse end uses. In the frozen food industry, novel guidance for protein-based additives is being finalized in key markets, streamlining approval pathways for products that meet defined safety and functional criteria. In the pharmaceutical and cryobiology sectors, updated best-practice standards now integrate ice-binding proteins as adjuncts or alternatives to conventional cryoprotectants, encouraging innovation in cell and tissue preservation protocols. This regulatory alignment is reinforced by collaborative consortia uniting academic researchers, industry stakeholders, and standards bodies to establish consensus on quality, potency, and traceability measures.

Supply chain resilience has also been reshaped by these shifts. Historically dependent on seasonal harvests or cold-water fisheries, the market now benefits from vertically integrated production models that combine microbial fermentation with continuous downstream processing. These advances reduce lead times and logistical complexity, while digital monitoring and predictive analytics optimize inventory management and ensure reliable cold-chain performance. As a result, stakeholders across agriculture, cosmetics, cryopreservation, and pharmaceuticals are witnessing a fundamental redefinition of what is possible with nature-inspired freeze-protection technologies.

Assessing the Cumulative Impact of U.S. Trade Policies and 2025 Tariff Increases on Imported Cryoprotective Proteins

In 2025, the United States has intensified its trade policy focus on biotechnology and related inputs, leading to the extension of exclusions for certain critical materials under Section 301 until August 31, 2025, followed by the imposition of punitive tariffs on select imports from China. While many pharmaceutical finished products enjoyed reprieve in earlier phases, recent policy announcements indicate plans for “major” tariffs on inbound drug ingredients and biologics, with proposed rates exceeding 25% on goods deemed to present national security concerns or unfair competitive advantages.

Antifreeze proteins, particularly those sourced or manufactured in China and classified under advanced biochemical composites, are anticipated to face a 25% tariff as of September 1, 2025, if not covered by renewed exclusions. Companies relying on recombinant expression platforms in Asia are evaluating the cost implications of these trade barriers, with some exploring near-shoring strategies to mitigate price volatility and logistical disruptions. Meanwhile, ongoing negotiations aim to carve out carve-outs for life-science inputs, highlighting the sector’s critical role in national health and agricultural security. As the tariff framework solidifies, producers and end-users are restructuring supply agreements, diversifying sourcing options, and investing in domestic capacity to maintain cost-effective access to these high-value proteins.

Dissecting Market Dynamics Across Antifreeze Protein Types, Sources, Production Technologies, Physical Forms, and Application Verticals

Market segmentation for antifreeze proteins encompasses multiple dimensions, each revealing distinct demand drivers and commercial opportunities. On a molecular level, the protein class is categorized into Type I through Type V, each defined by unique structural motifs and thermal hysteresis profiles. This classification informs selection criteria for downstream uses, ranging from high-activity marine-derived Type III variants to glycoprotein forms favored in cosmetic formulations.

Source differentiation also plays a pivotal role. Natural extraction from animal, fish, microbial, and plant matrices continues to serve niche applications where regulatory or perception advantages exist, even as synthetic and recombinant expression routes gain ascendancy. The choice between microbial fermentation and recombinant expression is driven by production scale, purity requirements, and cost constraints, while synthetic strategies facilitate batch-to-batch consistency and novel functional tuning.

Physical form further influences market dynamics. Liquid formulations offer immediate usability in cryopreservation workflows and food processing lines, whereas powdered variants excel in supply chain flexibility, shelf-stable storage, and incorporation into solid dosage systems. Application segmentation underscores the proteins’ versatility: in agriculture they enhance crop protection, pesticide formulations, and seed coatings; in cosmetics they enable hair, personal care, and skin care innovations; for cryopreservation they serve as adjuvants in cell culture, organ preservation, semen and tissue storage; in frozen food they preserve texture and quality of confectionery, ice cream, meat, and seafood; and in pharmaceuticals they underpin cold-chain transport, drug formulation, and vaccine stabilization.

This comprehensive research report categorizes the Antifreeze Proteins market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Source

- Technology

- Form

- Application

Navigating Distinct Growth Trajectories and Adoption Drivers for Antifreeze Proteins in the Americas, EMEA, and Asia-Pacific Regions

The Americas region, led by North American biopharmaceutical hubs and large-scale agricultural operations, is characterized by early adoption of advanced cryoprotective proteins. The presence of leading contract development and manufacturing organizations has accelerated integration of recombinant AFPs into clinical supply chains and high-value frozen food products. Additionally, regulatory clarity regarding food additives and biologics in the United States and Canada fosters innovation in both established and emerging end-use segments.

Europe, Middle East & Africa presents a multifaceted landscape where stringent food safety and cosmetic regulations coexist with robust agritech and cryobiology research clusters. The EU’s evolving guidelines for novel protein additives in food and cosmetics have opened pathways for specialized AFP applications, while collaborative public-private research consortia support organ preservation initiatives. In Africa and the Middle East, nascent opportunities in vaccine stabilization and post-harvest storage are gaining traction, driven by growing infrastructure investments and climate resilience programs.

Asia-Pacific remains the fastest-growing market, underpinned by expanding aquaculture, frozen food processing, and cell therapy manufacturing capacities. Countries such as Japan and South Korea have a legacy of fish-derived AFP research, now complemented by China’s recombinant innovation ecosystems. Investments in local production and government incentives for biotech scale-up are catalyzing wider deployment, as manufacturers seek cost advantages and proximity to burgeoning end-use markets in India and Southeast Asia.

This comprehensive research report examines key regions that drive the evolution of the Antifreeze Proteins market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling the Leading Innovators and Strategic Collaborators Driving Advances and Competitive Positioning in the Antifreeze Protein Arena

Leading the charge in recombinant antifreeze protein innovation, a Norwegian specialty enzyme developer has leveraged microbial expression platforms to produce high-purity, heat-stable variants, positioning itself at the forefront of next-generation cryoprotectant solutions. In contrast, a Canadian biotech innovator has focused on carbohydrate-based glycoprotein analogues, securing strategic licensing partnerships with global cosmetics and pharmaceutical firms to extend shelf life and enhance cell viability under stress conditions.

Japanese corporations continue to capitalize on their extensive expertise in food processing, delivering native and modified fish-derived proteins that elevate frozen product quality and minimize ice recrystallization. Meanwhile, specialty agritech firms in North America have formed alliances with seed coating companies to co-develop AFP-infused crop protectants, marrying protein innovation with smart delivery technologies. On the contract manufacturing front, global CDMOs with multi-site bioreactor networks are integrating AFP production into broad biologics service offerings, enabling rapid scale-up for both clinical and commercial supply requirements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Antifreeze Proteins market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A/F Protein Inc.

- AGC Biologics

- AquaBounty Technologies Inc.

- Clariant International AG

- Glanbia Nutritionals

- Guangdong VTR Bio-Tech Co., Ltd.

- Kaneka Corporation

- Kodera Herb Garden Co., Ltd

- MyBiosource Inc.

- Nichirei Corporation

- ProtoKinetix Inc.

- Rishon Biochem Co., Ltd

- Shanghai SyntheAll Pharmaceutical Co., Ltd.

- Shanghai Yu Tao Industrial Co., Ltd.

- Sirona Biochem Corp.

- Unilever

- Wuxi Hisky Medical Technologies Co., Ltd.

- Yantai Langy Biological Technology Co., Ltd.

Strategic Imperatives and Actionable Recommendations for Industry Leaders to Maximize Value and Mitigate Risks in Cryoprotective Protein Markets

Industry leaders should pursue integrated platform strategies that combine proprietary expression systems with advanced downstream purification to secure cost leadership and product differentiation. Co-investment in pre-competitive research consortia can catalyze shared advancements in analytical methodologies, regulatory harmonization, and safety profiling, thereby lowering barriers to entry for novel protein candidates.

Expanding regional manufacturing footprints-particularly in high-growth Asia-Pacific and emerging EMEA markets-will be critical for managing tariff exposure and reducing lead times. Strategic partnerships with logistics specialists can enhance cold-chain resilience, enabling end-to-end solutions that bundle AFP supply with real-time temperature monitoring and predictive analytics.

Diversification of product portfolios through tiered offerings-ranging from premium, pharmaceutical-grade proteins to cost-effective agricultural variants-will broaden addressable markets while insuring against segment-specific volatility. Embedding AFPs into adjacent technology domains, such as hydrogel matrices for tissue engineering or nanostructured ice-control coatings, can unlock new revenue streams and deepen competitive moats.

Employing a Rigorous Research Methodology Integrating Primary Expert Interviews and Comprehensive Secondary Data Sources for Market Validation

This analysis integrates primary research through executive interviews with leading stakeholders across biotech, food, agriculture, and logistics sectors, complemented by secondary data sourced from peer-reviewed literature, regulatory filings, and public financial disclosures. Expert contributions were synthesized via structured questionnaires, ensuring consistency in comparative assessments and thematic insights.

Secondary sources included scientific databases, patent registries, and government trade data to capture technology trends, production statistics, and tariff developments. Data triangulation was employed to validate quantitative inputs, while scenario modeling tools projected impact vectors under alternate regulatory and trade policy frameworks.

Quality assurance protocols encompassed multi-stage peer review by independent subject-matter experts and cross-validation against historical case studies. Proprietary analytical frameworks were applied to segment the market by type, source, technology, form, and application, ensuring a holistic view of competitive dynamics and growth drivers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Antifreeze Proteins market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Antifreeze Proteins Market, by Type

- Antifreeze Proteins Market, by Source

- Antifreeze Proteins Market, by Technology

- Antifreeze Proteins Market, by Form

- Antifreeze Proteins Market, by Application

- Antifreeze Proteins Market, by Region

- Antifreeze Proteins Market, by Group

- Antifreeze Proteins Market, by Country

- United States Antifreeze Proteins Market

- China Antifreeze Proteins Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Synthesizing Key Insights on Drivers, Challenges, and Strategic Pathways Shaping the Future Trajectory of Antifreeze Proteins Globally

Antifreeze proteins stand at the nexus of biology, chemistry, and engineering, offering unparalleled capabilities for ice control across diverse industries. The convergence of recombinant and synthetic approaches, along with progressive regulatory alignment, underpins a robust innovation ecosystem that is reshaping product standards and supply chains.

While trade policies and tariff regimes introduce layers of complexity, proactive supply chain diversification and domestic capacity building can mitigate exposure and ensure continuity. Segmentation analysis reveals ample white spaces in both established and emerging applications, particularly where hybrid protein-polymer systems and integrated cold-chain services promise to create differentiated value.

As the market matures, collaboration between technology providers, end-users, and regulatory bodies will be paramount in driving standardization, interoperability, and scale. Stakeholders that embrace cross-sector partnerships, invest in agile manufacturing, and continuously expand the envelope of protein engineering will be best positioned to capture long-term growth in this dynamically expanding arena.

Engage Ketan Rohom, Associate Director of Sales & Marketing, for Exclusive Access to the Definitive Antifreeze Proteins Market Research Report

To explore the complete analysis, detailed competitive benchmarking, and proprietary data models that can sharpen your strategic planning, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Ketan will guide you through tailored packages that align with your organization’s goals, whether you require a global overview or a deep dive into specific segments.

Your next opportunity to gain a decisive market advantage starts with a brief conversation. Contact Ketan to arrange a personalized briefing, obtain sample insights, and secure access to the full report for immediate deployment across your teams.

Partner with us to transform raw data into actionable strategies and stay ahead of emerging trends in antifreeze proteins. Connect with Ketan Rohom today to unlock unparalleled market intelligence and drive growth in this dynamic sector.

- How big is the Antifreeze Proteins Market?

- What is the Antifreeze Proteins Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?