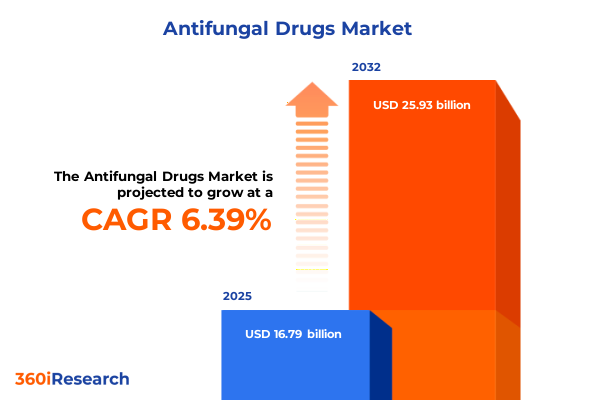

The Antifungal Drugs Market size was estimated at USD 16.79 billion in 2025 and expected to reach USD 17.81 billion in 2026, at a CAGR of 6.39% to reach USD 25.93 billion by 2032.

Understanding the Critical Role of Antifungal Agents in Modern Healthcare Through Emerging Challenges and Patient Treatment Priorities

The rising incidence of fungal infections alongside the emergence of resistant pathogens has thrust antifungal therapies into the global healthcare spotlight. A confluence of factors-including aging populations, expanding immunocompromised cohorts, and heightened environmental exposure-has expanded the patient population at risk. As clinicians and payers grapple with escalating treatment complexities, there is a parallel urgency to innovate beyond traditional formulations and to refine therapeutic regimens.

Advancements in molecular diagnostics have accelerated the identification of pathogenic fungi to the species level, enabling more precise and timely interventions. Meanwhile, breakthroughs in drug delivery modalities are shaping the next generation of antifungal candidates, improving pharmacokinetic profiles and minimizing off-target toxicity. This introduction sets the stage for a discussion of how scientific, regulatory, and commercial forces are converging to define the strategic imperatives for stakeholders across the value chain.

Spotlighting Pivotal Transformations Reshaping the Antifungal Drug Ecosystem Driven by Scientific Innovation Regulatory Reforms and Market Dynamics

The antifungal marketplace is undergoing a profound metamorphosis as novel targets and mechanisms of action come to the fore. Breakthrough innovations in azole chemistry have yielded compounds with expanded spectra and reduced drug–drug interactions, while research into echinocandin analogs is unlocking options for deep-tissue infections that were once refractory to treatment. Alongside these scientific strides, regulatory bodies have begun to streamline approval pathways for therapies addressing unmet medical needs, marking a significant departure from conventional, elongated review processes.

Concurrently, disruptive business models are emerging, exemplified by licensing agreements between biotech pioneers and established pharmaceutical houses. These alliances are accelerating clinical development timelines and mitigating financial risk for early-stage innovators. The net effect of these shifts is a dynamic ecosystem in which agility and collaboration are paramount. As such, stakeholders must adopt a forward-looking stance that embraces digital health platforms, precision medicine frameworks, and real-world evidence to capitalize on this era of transformation.

Analyzing the Complex Cumulative Impact of 2025 United States Tariffs on Antifungal Drug Supply Chains Pricing Structures and Stakeholder Strategies

In 2025, the United States imposed tariffs on select active pharmaceutical ingredients and excipients critical to antifungal drug manufacturing, triggering ripple effects throughout the supply chain. Increased import duties on raw materials have prompted manufacturers to reevaluate sourcing strategies, with some exploring vertically integrated capabilities to insulate against future trade disruptions. However, reshoring production facilities entails sizable capital investment and timeframes that extend beyond immediate tariff relief, creating a strategic trade-off between near-term cost pressures and long-term supply security.

Pricing structures have been particularly impacted, as rising input costs are incrementally passed downstream. Payers and hospital systems are responding with tighter formulary controls and negotiations that shift risk toward manufacturers. In this environment, differentiation through value-based contracting and pharmacoeconomic evidence will be essential for maintaining market access. The cumulative effect of these tariffs underscores the need for stakeholders to proactively model policy scenarios, fortify supplier diversity, and leverage collaborative partnerships to navigate an increasingly complex international trade landscape.

Extracting Insights from Multifaceted Segmentation of Antifungal Trends Across Drug Classes Therapeutic Areas Distribution Channels and End Users

By examining drug class dynamics, one can appreciate how azoles continue to serve as the backbone of systemic therapy but face competition from allylamines that offer unique targeting of fungal cell wall synthesis. Simultaneously, the rise of echinocandins-offering potent activity against invasive candidiasis-has shifted prescribing patterns in acute care settings. Polyenes, revered for their broad-spectrum potency, are being revisited with novel formulations intended to mitigate nephrotoxicity. When evaluating dosage forms, traditional capsules and tablets maintain prominence in outpatient care, while topical creams, ointments, and powders address dermatophyte infections with localized application. Suspension formulations are gaining traction in pediatric and long-term care segments due to dosing flexibility.

Therapeutic area segmentation paints a nuanced picture: dermatophytosis remains the most prevalent group of superficial infections with Tinea corporis and Tinea pedis accounting for a large share of outpatient treatments, whereas cryptococcosis and aspergillosis-particularly chronic and invasive profiles-drive inpatient and specialty clinic usage. Candidiasis, straddling both oropharyngeal and systemic manifestations as well as vulvovaginal presentations, demands therapies that balance efficacy with mucosal and systemic drug exposure. Distribution channel analysis reveals that while offline channels such as hospitals and clinics dominate high-acuity care, the online channel is rapidly expanding for chronic outpatient regimens and homecare delivery, reflecting broader digital health adoption. End-user segmentation highlights hospitals as epicenters of complex infection management, clinics as pivotal points for early intervention, and homecare settings as emerging arenas for long-term prophylaxis and maintenance therapy.

This comprehensive research report categorizes the Antifungal Drugs market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Drug Class

- Dosage Form

- Therapeutic Area

- Distribution Channel

- End User

Key Regional Dynamics Unveiled for the Antifungal Market in the Americas Europe Middle East Africa and Asia Pacific Reflecting Diverse Healthcare Infrastructures

Regional variations in healthcare infrastructure and reimbursement frameworks are driving divergent antifungal market dynamics. In the Americas, robust patent protections and a growing focus on value-based care are fostering investment in specialty assets, particularly for invasive indications. North American academic medical centers are at the forefront of clinical trials, while Latin American markets show growing demand for cost-effective generics and combination therapies to address resource-constrained settings.

Across Europe, the Middle East, and Africa, disparate regulatory environments are creating a push–pull scenario: the European Union’s centralized approval process accelerates pan-European launches, whereas emerging markets in the Middle East and Africa are characterized by varied registration requirements and fluctuating procurement budgets. These factors influence the speed of market entry and the adoption of newer agents. In the Asia-Pacific realm, rapid urbanization and rising healthcare expenditure are fueling growth in branded innovations, but local manufacturing policies and import sensitivities demand careful supply chain designs. Collectively, these regional insights underscore the imperative for adaptable market access strategies that are tailored to localized clinical and commercial ecosystems.

This comprehensive research report examines key regions that drive the evolution of the Antifungal Drugs market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Pharmaceutical Innovators Driving Growth in the Antifungal Sector Through Strategic Collaborations Product Development and Market Positioning

Major pharmaceutical players have intensified their focus on the antifungal space through strategic acquisitions of biotech firms possessing novel pipelines. These enterprises leverage their extensive commercial networks to expedite global rollout of breakthrough therapies while tapping into established manufacturing platforms to optimize production costs. Meanwhile, mid-tier companies are differentiating through niche portfolios targeting resistant strains and by investing in lifecycle management of legacy assets via reformulation and fixed-dose combinations.

Collaborative ventures between contract research organizations and academic centers are fueling a robust clinical trial ecosystem, with some innovators pursuing adaptive trial designs to accelerate time to market. Partnerships that blend biopharma agility with big-pharma capabilities are further enabling scale-up of complex biologics and small molecules. At the same time, digital health companies are collaborating with drug developers to integrate adherence monitoring and patient support programs, enriching real-world evidence and strengthening market positioning. This confluence of strategic company actions is reshaping competitive dynamics, compelling all stakeholders to refine their value proposition.

This comprehensive research report delivers an in-depth overview of the principal market players in the Antifungal Drugs market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Astellas Pharma Inc.

- Basilea Pharmaceutica Ltd.

- Bayer AG

- Cipla Limited

- Dr. Reddy's Laboratories Ltd.

- Gilead Sciences, Inc.

- GlaxoSmithKline plc

- Glenmark Pharmaceuticals Limited

- Hikma Pharmaceuticals PLC

- Johnson & Johnson

- Merck & Co., Inc.

- Mycovia Pharmaceuticals, Inc.

- Novartis AG

- Pfizer Inc.

- Sanofi S.A.

- SCYNEXIS, Inc.

- Sun Pharmaceutical Industries Ltd.

- Teva Pharmaceutical Industries Ltd.

- Viatris Inc.

- Zydus Lifesciences Ltd.

Formulating Actionable Recommendations to Navigate Regulatory Complexities Optimize Supply Chains and Accelerate Clinical Outcomes in Antifungal Therapy

Stakeholders should prioritize the integration of pharmacoeconomic data into clinical development plans to align with payer expectations and facilitate reimbursement. Early engagement with regulatory authorities across primary and secondary markets will be crucial to secure accelerated pathways and orphan designations for high-unmet-need segments. To mitigate geopolitical risk, supply chain diversification must extend beyond raw-material sourcing to contract manufacturing partnerships that offer geographic redundancy.

Investments in digital patient engagement platforms can drive adherence for long-term therapies and generate valuable real-world insights that support differentiated value narratives. Collaboration between commercial and medical affairs teams can further refine stakeholder communication, ensuring that emerging data on safety and efficacy is effectively disseminated. Finally, a proactive approach to portfolio optimization-prioritizing assets with breakthrough potential while rationalizing older, lower-margin products-will allow companies to channel resources toward strategic growth areas.

Comprehensive Research Methodology Emphasizing Data Sources Expert Interviews Quantitative Analysis and Systematic Validation Protocols for Antifungal Insights

This research is grounded in a systematic review of peer-reviewed journals, regulatory filings, clinical trial registries, and patent databases to ensure a robust evidence base. Qualitative insights were gleaned from structured interviews with over two dozen key opinion leaders, including infectious disease specialists, clinical pharmacologists, and hospital procurement executives. Quantitative analysis incorporated prescription and claims databases, providing granular visibility into utilization patterns across acute and chronic care settings.

A multi-layered validation framework was applied, wherein preliminary findings were cross-checked with primary research panels and adjusted for regional regulatory nuances. Economic and policy scenarios were stress-tested using sensitivity analyses to account for tariff fluctuations and reimbursement shifts. This comprehensive methodology ensures that the presented insights reflect both current realities and plausible near-term developments, equipping decision-makers with confidence in the strategic guidance offered.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Antifungal Drugs market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Antifungal Drugs Market, by Drug Class

- Antifungal Drugs Market, by Dosage Form

- Antifungal Drugs Market, by Therapeutic Area

- Antifungal Drugs Market, by Distribution Channel

- Antifungal Drugs Market, by End User

- Antifungal Drugs Market, by Region

- Antifungal Drugs Market, by Group

- Antifungal Drugs Market, by Country

- United States Antifungal Drugs Market

- China Antifungal Drugs Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Summarizing Key Takeaways and Strategic Imperatives in the Antifungal Drug Sector to Inform Decision Making and Shape Future Clinical and Commercial Pathways

The antifungal sector stands at an inflection point where scientific progress, policy evolution, and commercial innovation converge to redefine treatment paradigms. Key themes include the maturation of targeted drug classes, the ascendancy of novel dosage forms, and the digital transformation of patient management. Navigating tariff-driven supply challenges and regional disparities requires agility, partnerships, and a data-driven approach to value demonstration.

As resistance patterns continue to evolve and patient populations grow, stakeholders must embrace adaptive strategies that integrate cutting-edge science with pragmatic market access planning. The insights distilled in this executive summary aim to illuminate the strategic pathways that will drive both clinical improvements and sustainable commercial success in the antifungal landscape. Armed with this knowledge, decision-makers can confidently chart a course toward innovation and impactful patient outcomes.

Engage with Ketan Rohom to Secure Comprehensive Antifungal Market Expertise and Tailored Research Solutions Delivering Actionable Strategies

To explore the in-depth findings and gain tailored insights into this rapidly evolving antifungal landscape, engage with Ketan Rohom, Associate Director, Sales & Marketing, to purchase the comprehensive market research report that will equip your team with the clarity and direction needed to capitalize on emerging opportunities and achieve sustained competitive differentiation.

- How big is the Antifungal Drugs Market?

- What is the Antifungal Drugs Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?