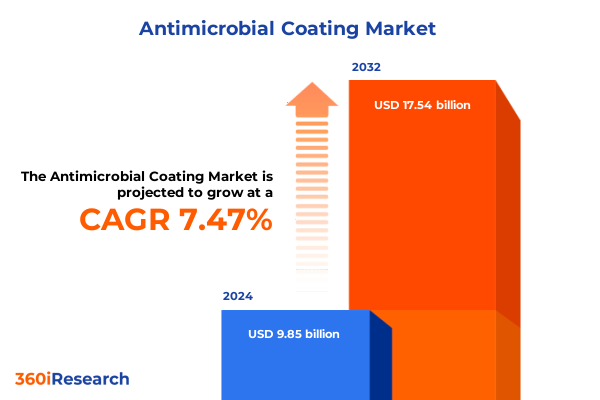

The Antimicrobial Coating Market size was estimated at USD 10.56 billion in 2025 and expected to reach USD 11.32 billion in 2026, at a CAGR of 7.51% to reach USD 17.54 billion by 2032.

Exploring the Crucial Role of Antimicrobial Coatings in Protecting Surfaces and Promoting Hygiene Across Diverse End-Use Environments

Antimicrobial coatings have emerged as a critical defense mechanism against microbial contamination, transforming the way surfaces are protected in environments ranging from healthcare facilities to transportation hubs. These advanced surfaces leverage biocidal agents to inhibit the growth of bacteria, fungi, and viruses, supporting rigorous hygiene protocols and contributing to public health objectives. As end-use industries intensify their focus on infection control and longevity of infrastructure, the role of antimicrobial coatings has expanded beyond niche applications into mainstream adoption across diverse sectors.

In recent years, regulatory bodies and standards organizations have tightened requirements for surface cleanliness and biosecurity, driving manufacturers to innovate coatings that deliver both efficacy and durability. Moreover, the heightened awareness of pathogen transmission following global health events has underscored the strategic importance of proactive antimicrobial solutions. Stakeholders now seek materials that seamlessly integrate into existing production processes, uphold environmental benchmarks, and provide transparent performance data.

Consequently, advancements in material science-coupled with increased collaboration between suppliers, formulators, and end-users-have accelerated the evolution of coating platforms. Today’s offerings not only combat microbial proliferation but also enhance substrate resilience, chemical resistance, and aesthetic properties. As a result, these multifunctional coatings support both safety and design imperatives, laying the foundation for further innovation and broader market penetration.

Unveiling the Pivotal Transformative Shifts Driving Innovation and Adoption in the Global Antimicrobial Coatings Industry Landscape

The antimicrobial coating market is undergoing transformative shifts driven by breakthroughs in nanotechnology, sustainable chemistry, and digital manufacturing. Nanoparticle-based formulations utilizing silver, copper, and zinc oxide deliver enhanced biocidal performance at minimal material loading, optimizing both efficacy and cost-effectiveness. Meanwhile, titanium dioxide variants activated by ultraviolet light ensure photocatalytic self-cleaning properties, heralding new possibilities for low-maintenance surfaces in high-traffic areas.

Furthermore, sustainability priorities have spurred the development of eco-friendly binders and solvent-free processes, minimizing volatile organic compound emissions. This alignment with green building standards and automotive industry regulations has broadened adoption, particularly among environmentally conscious stakeholders. Simultaneously, the integration of smart sensors into coating applications is enabling real-time monitoring of microbial presence and coating integrity, fostering predictive maintenance and reducing lifecycle costs.

In addition, cross-industry partnerships are catalyzing novel use cases, such as antimicrobial linings for food packaging and protective layers for electronic components. This convergence of expertise is unlocking synergistic benefits, from enhanced product safety to reduced antimicrobial resistance risk. As digital platforms facilitate faster formulation iterations and tailored service offerings, manufacturers are better positioned to address evolving customer needs, thereby reshaping competitive dynamics and driving sustained market growth.

Assessing the Far-Reaching Consequences of Recent U.S. Tariff Adjustments on the Antimicrobial Coating Supply Chain and Cost Structures

Recent adjustments to United States tariff policies in 2025 have introduced significant reverberations across the antimicrobial coating supply chain. Tariffs on copper nanoparticles, essential for their inherent antimicrobial properties, have elevated raw material costs, compelling formulators to reassess procurement strategies. At the same time, duties on titanium dioxide and specialty silver-ion compounds have created cost differentials that vary by supplier origin, influencing sourcing decisions and inventory planning.

Consequently, many manufacturers are exploring domestic refining and secondary processing partnerships to mitigate import-related expenses, while others are passing incremental costs to end-users through tiered pricing structures. This dynamic has intensified negotiations between coating producers and major end-use industries such as healthcare facilities and transportation OEMs, who require predictable pricing to manage their own operational budgets.

Moreover, the tariff landscape has prompted a diversification of supply chains, with an increased emphasis on alternative antimicrobial technologies that rely on quaternary ammonium compounds or emerging zinc oxide formulations. These shifts are complemented by optimized logistics networks designed to minimize transit delays and inventory holding costs. As formulators balance compliance, cost containment, and performance criteria, the cumulative impact of U.S. tariffs in 2025 underscores the strategic imperative of supply chain resilience and agile procurement practices.

Illuminating How Distinct End-Use Industries, Coating Types, Advanced Technologies, Application Methods, and Forms Shape the Antimicrobial Coating Market

Market segmentation provides a multidimensional lens through which the antimicrobial coating landscape can be understood, considering end-use industries, coating types, enabling technologies, application methods, and product forms. End-use industries range from aerospace and medical devices, where stringent safety standards prevail, to building and construction and transportation sectors that prioritize longevity and aesthetic integration. This diversity necessitates flexible formulation strategies that address unique biocidal performance requirements and environmental exposures.

Based on type, coatings are categorized into antibacterial, antifungal, and antiviral classes, each tailored to inhibit specific microbial threats. Antibacterial variants dominate in medical and food processing environments, while antifungal products find critical applications in marine and building materials. Antiviral coatings have surged in focus, driven by heightened public health concerns and the need for rapid microbial deactivation on high-touch surfaces.

Technological segmentation further illuminates innovation trajectories, encompassing copper nanoparticles and alloy powders, quaternary ammonium compounds, silver-ion formulations in nano silver particles and polymer-infused matrices, and titanium dioxide coatings in photocatalytic and UV-activated variants. Zinc oxide emerges as a versatile option, prized for its broad-spectrum efficacy and regulatory acceptance. Each technology brings distinct advantages in terms of efficacy, durability, and application conditions.

Application methods encompass brush, dip, roll, and spray coating techniques, dictating how formulations adhere to substrates and influence throughput rates in manufacturing. Meanwhile, product forms such as gels, liquids, powders, and sprays provide versatility for coating complex geometries and facilitating on-site maintenance programs. By integrating these segmentation insights, industry participants can align R&D efforts with customer-specific demands, ensuring optimized performance across diverse operational scenarios.

This comprehensive research report categorizes the Antimicrobial Coating market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Technology

- Application Method

- Form

- End-Use Industry

Revealing Key Regional Dynamics Influencing Demand Growth Innovation Adoption and Competitive Positioning in the Americas EMEA and Asia-Pacific Markets

Regional market dynamics play a pivotal role in shaping opportunities and competitive strategies. In the Americas, strong regulatory frameworks and robust healthcare infrastructure drive demand for high-performance antibacterial and antiviral coatings. Innovation hubs in North America support partnerships between material scientists and end-users, accelerating product validation and commercialization. Latin American markets, although more price-sensitive, present growth potential in building applications as urbanization and infrastructure projects expand.

Europe, the Middle East & Africa (EMEA) exhibit a mosaic of regulatory environments, with stringent European Union standards propelling adoption of eco-certified formulations. Sustainability initiatives and green procurement policies spur demand for low-VOC, solvent-free coatings. In the Middle East, emerging industrial zones leverage antimicrobial coatings for water treatment and oil exploration equipment, while Africa’s focus on healthcare accessibility opens avenues for portable sterilization solutions and durable medical device coatings.

Asia-Pacific commands significant growth prospects, driven by rapid industrialization, rising healthcare expenditures, and large-scale infrastructure investments. Advanced manufacturing facilities in East Asia pioneer novel silver-ion and copper-alloy technologies, while Southeast Asia’s booming food and beverage sector adopts antimicrobial packaging and storage solutions. Regional supply chain integration, coupled with cost-competitive raw material sourcing, reinforces Asia-Pacific as a strategic production hub, influencing global price dynamics and technology diffusion.

This comprehensive research report examines key regions that drive the evolution of the Antimicrobial Coating market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Leaders Showcasing Their Technological Innovations Strategic Partnerships and Competitive Advantages in the Antimicrobial Coating Sector

Leading companies in the antimicrobial coating arena are distinguished by their commitment to innovation, strategic collaborations, and environmental stewardship. Industry incumbents have expanded research alliances with universities and start-ups to accelerate the development of next-generation biocidal agents and multifunctional coatings. Partnerships with logistics and distribution specialists have enhanced global reach, ensuring timely delivery of complex formulations to end-users across various industries.

Strategic acquisitions and joint ventures have enabled these companies to diversify their technology portfolios, integrating proprietary silver-ion technologies with photocatalytic systems and quaternary ammonium compounds. Many have invested in state-of-the-art pilot plants to validate product performance under real-world conditions, from simulated hospital surfaces to marine vessel hulls. These capabilities reinforce customer confidence and support regulatory approvals in highly controlled markets.

Moreover, sustainability has emerged as a critical differentiator, with leading players adopting circular economy principles. By offering take-back programs for coating waste and investing in biodegradable binder research, they appeal to environmentally conscious stakeholders and comply with evolving international standards. As a result, these firms fortify their competitive advantages, setting benchmarks in quality, compliance, and market responsiveness.

This comprehensive research report delivers an in-depth overview of the principal market players in the Antimicrobial Coating market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Akzo Nobel N.V.

- Axalta Coating Systems Ltd.

- BASF SE

- BioCote Limited

- Diamond Vogel, Inc.

- DuPont de Nemours, Inc.

- Hempel A/S

- Koninklijke DSM N.V.

- Lonza Group AG

- Nippon Paint Holdings Co., Ltd.

- PPG Industries, Inc.

- RPM International Inc.

- Sika AG

- The Sherwin-Williams Company

- Troy Corporation

Delivering Strategic Actionable Recommendations to Empower Industry Leaders in Harnessing Antimicrobial Coating Innovations for Enhanced Performance and Growth

To capitalize on emerging trends and navigate market complexities, industry leaders should prioritize targeted R&D investments in novel biocidal chemistries and eco-friendly binders. Collaboration with academic institutions and specialized start-ups can accelerate the commercialization of breakthrough formulations, while pilot-scale testing ensures performance validation before full-scale rollout. In parallel, exploring alternative supply chains and forging domestic partnerships will safeguard against tariff fluctuations and import disruptions.

Furthermore, organizations must strengthen engagement with regulatory bodies to anticipate evolving standards and secure expedited approvals. Implementing digital tools for real-time monitoring of coating efficacy and lifecycle performance can differentiate offerings and support value-based pricing models. By integrating predictive maintenance analytics, companies can demonstrate long-term cost savings, fostering deeper client relationships.

In addition, aligning sustainability initiatives with customer requirements-such as offering low-VOC product lines or certification-compliant coatings-will enhance brand reputation and open opportunities in green construction and manufacturing sectors. Developing flexible application and service models, including on-site spraying capabilities and training programs, can further embed coatings as indispensable components of operational protocols. These strategic actions will empower market participants to drive growth and resilience.

Outlining the Rigorous Research Methodology Employed to Generate Comprehensive Market Intelligence and Validate Insights in the Antimicrobial Coating Domain

The research methodology underpinning this analysis combines rigorous primary and secondary approaches to ensure comprehensive and reliable insights. Extensive interviews with material scientists, coating formulators, end users, and regulatory experts provided qualitative perspectives on performance requirements, adoption barriers, and emerging application trends. These dialogues were supplemented by a systematic review of patent filings, formulation databases, and technical white papers to map innovation trajectories and competitive positioning.

Quantitative data collection involved gathering shipment volumes, raw material cost indices, and regional demand metrics from reputable trade associations, customs databases, and industry consortiums. Advanced data triangulation techniques validated these figures, while cross-sectional analysis across segmentation axes revealed nuanced market dynamics. In addition, proprietary scoring models assessed the strategic strengths and weaknesses of leading companies, incorporating factors such as R&D intensity, sustainability commitments, and distribution capabilities.

To further enhance accuracy, the methodology incorporated expert panel workshops that reviewed preliminary findings and provided real-world feedback. This iterative validation process ensured that the final insights reflect current industry realities and anticipate near-term developments. Through this integrated approach, stakeholders can trust the robustness of the market intelligence and its applicability to strategic decision making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Antimicrobial Coating market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Antimicrobial Coating Market, by Type

- Antimicrobial Coating Market, by Technology

- Antimicrobial Coating Market, by Application Method

- Antimicrobial Coating Market, by Form

- Antimicrobial Coating Market, by End-Use Industry

- Antimicrobial Coating Market, by Region

- Antimicrobial Coating Market, by Group

- Antimicrobial Coating Market, by Country

- United States Antimicrobial Coating Market

- China Antimicrobial Coating Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Summarizing the Strategic Imperatives and Future Outlook for Stakeholders Navigating the Dynamic Antimicrobial Coating Landscape with Confidence

This executive summary highlights the strategic imperatives shaping the antimicrobial coating market, from dynamic technological innovations to the pressing need for supply chain resiliency in the face of tariff changes. By examining segmentation insights across industries, technologies, and application methods, stakeholders gain a clear understanding of the multifaceted forces driving adoption. Regional analysis further underscores where growth opportunities align with regulatory frameworks and investment trends.

The competitive landscape is defined by companies that excel in innovation, strategic alliances, and sustainability, setting the standard for product performance and market leadership. Actionable recommendations emphasize the importance of targeted R&D, regulatory engagement, digital monitoring solutions, and eco-conscious product lines to achieve superior outcomes. Trusting a robust research methodology ensures that these findings are grounded in both qualitative expertise and quantitative rigor.

As organizations navigate this evolving environment, embracing collaborative partnerships and flexible business models will be critical to maintaining competitive advantage. Ultimately, this report equips decision-makers with the insights and strategies needed to capitalize on current trends, mitigate risks, and drive sustainable growth in the antimicrobial coating sector.

Encouraging Industry Executives to Engage with Ketan Rohom for Tailored Insights and Access to the Complete Antimicrobial Coating Market Research Report

Engage with Ketan Rohom, Associate Director of Sales & Marketing, to explore how our comprehensive report can drive your strategic decisions and keep you ahead of market trends in antimicrobial coatings. By partnering with Ketan, you gain direct access to in-depth analysis, customized insights, and expert guidance tailored to your organization’s unique growth objectives. Don’t miss the opportunity to leverage actionable intelligence and unlock competitive advantages-reach out today and invest in clarity, confidence, and an elevated market position.

- How big is the Antimicrobial Coating Market?

- What is the Antimicrobial Coating Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?