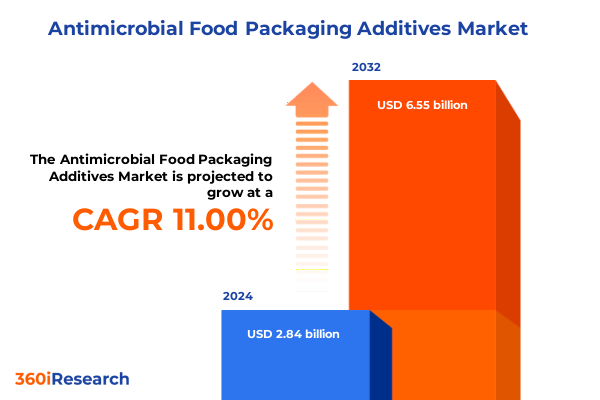

The Antimicrobial Food Packaging Additives Market size was estimated at USD 3.12 billion in 2025 and expected to reach USD 3.43 billion in 2026, at a CAGR of 11.16% to reach USD 6.55 billion by 2032.

Unlocking the Potential of Antimicrobial Food Packaging Additives to Safeguard Safety, Extend Shelf Life, and Enhance Consumer Confidence

Antimicrobial food packaging additives represent a pivotal innovation in the food industry, merging safety, sustainability, and product quality into a unified strategy. Rising consumer awareness of foodborne pathogens and the increasing complexity of global supply chains have elevated the demand for solutions that extend shelf life without sacrificing safety. As the food sector pursues cleaner labels and minimal processing, antimicrobial additives offer a powerful means to mitigate microbial growth, ensuring products maintain freshness from production through consumption.

Recent advances in biotechnology and materials science have made these additives more effective and versatile than ever. Manufacturers are now able to incorporate natural agents such as plant extracts and bacteriocins directly into packaging substrates, achieving targeted antimicrobial action. These innovations align with stricter regulatory frameworks worldwide that prioritize consumer health and environmental responsibility. Consequently, packaging designers and food producers are collaborating more closely to integrate antimicrobial functionalities at the earliest design stages.

By fostering this convergence of technology, regulation, and consumer demand, the antimicrobial food packaging additives market is poised for transformative growth. Decision‐makers must grasp the nuances of these emerging technologies and their regulatory implications to capitalize on the competitive edge offered by advanced packaging solutions. This section lays the foundation for understanding the key drivers propelling the adoption of antimicrobial food packaging in today’s dynamic marketplace.

Dynamic Technological Advances and Regulatory Paradigm Shifts are Redefining the Antimicrobial Packaging Industry with Unprecedented Innovation and Market Opportunities

The antimicrobial packaging landscape is undergoing a profound transformation driven by breakthroughs in nanotechnology, biopolymer engineering, and active packaging techniques. Nanostructured carriers are now being used to control the release of antimicrobial agents, enabling sustained efficacy over extended periods. Additionally, the advent of multifunctional films that can sense and respond to microbial contamination in real time is redefining the concept of smart packaging. Together, these technological strides are reshaping the competitive environment, compelling incumbent players to innovate rapidly or risk obsolescence.

Concurrently, regulatory authorities globally are tightening standards for food safety, putting a premium on packaging that can demonstrably reduce microbial hazards. Recent policy measures in North America and Europe have introduced more rigorous testing requirements for materials that come into contact with food, prompting manufacturers to invest substantially in compliance initiatives. The alignment of regulatory expectations with technological capabilities is catalyzing a new era of collaboration between packaging suppliers, additive specialists, and food producers.

Moreover, shifts in consumer preferences toward sustainable materials have prompted a pivot from traditional plastics to biopolymers such as polylactic acid and cellulose derivatives. These biopolymers, when combined with natural antimicrobial substances, create packaging solutions that satisfy both environmental and safety goals. As market incumbents and new entrants alike harness these transformative shifts, the industry is set to enter a rapid growth phase characterized by differentiated value propositions and heightened consumer trust.

Evaluating the Cascading Effects of 2025 United States Tariff Adjustments on Supply Chains, Cost Structures, and Innovation Trajectories in Food Packaging Additives

The implementation of targeted tariffs in 2025 on select packaging materials and additives by the United States has introduced a complex set of challenges and opportunities for market participants. Import duties on critical raw materials have elevated production costs for domestic converters, compelling many to reassess supplier strategies and localize sourcing where feasible. As a result, companies are navigating a shifting cost structure that impacts both high‐volume commodity plastics and specialized biopolymers.

This tariff landscape has also influenced the competitive balance between natural and synthetic additives. Suppliers reliant on imported essential oils and plant extracts have faced increased pricing pressure, spurring a reevaluation of sourcing models and prompting some to explore domestic cultivation and extraction partnerships. In parallel, manufacturers of inorganic antimicrobial compounds have sought to mitigate cost escalations by enhancing process efficiencies and leveraging economies of scale.

Despite these headwinds, the tariff adjustments have stimulated innovation as enterprises seek to differentiate through value‐added formulations and integrated service offerings. Packaging developers are collaborating more closely with additive specialists to optimize formulations that use locally sourced inputs, ensuring supply chain resilience. This strategic realignment is fostering a more robust domestic ecosystem while enabling U.S. producers to maintain global competitiveness in antimicrobial packaging solutions.

Granular Market Segmentation Insights Unveil Material Preferences, Additive Types, Applications, and Channels Driving Growth in Antimicrobial Packaging

A nuanced segmentation analysis reveals distinct material preferences and emerging growth pockets within the antimicrobial packaging market. When examining packaging material, biopolymers including cellulose‐based, polyhydroxyalkanoate, polylactic acid, and starch‐derived variants are increasingly favored for their biodegradability and compatibility with natural antimicrobials, while traditional substrates like aluminum and tin continue to serve niche applications requiring high barrier performance. Glass and coated paper and board maintain relevance in premium and sustainable segments, emerging alongside advanced plastic grades such as polyethylene terephthalate and polypropylene.

In terms of additive type, natural compounds like bacteriocins, essential oils, enzymes, and plant extracts are capturing premium positioning for clean‐label applications, whereas synthetic additives comprised of organic and inorganic compounds offer precise antimicrobial efficacy and cost advantages for high‐volume food processing sectors. Application‐wise, bakery and confectionery items leverage sachets and films for moisture control and mold inhibition, while meat, poultry, and seafood packaging increasingly incorporates antimicrobial trays and films to extend freshness. Ready‐to‐eat and fresh produce segments are driving demand for labels and coatings that can integrate active compounds without altering sensory properties.

Further, form factors such as extrusion coatings and laminated films provide tailored release profiles, and the choice between monolayer and multilayer films influences performance metrics and recyclability. Distribution channel segmentation highlights offline retail’s continued dominance in traditional grocery formats, with online retail rapidly gaining share as e‐commerce penetration deepens. End‐use analysis underscores food service and institutional players prioritizing long shelf life and simplified inventory management, while retail brands emphasize brand integrity and sustainability credentials to meet consumer expectations.

This comprehensive research report categorizes the Antimicrobial Food Packaging Additives market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Packaging Material

- Additive Type

- Form

- Application

- End Use Industry

- Distribution Channel

Regional Market Dynamics Highlight Distinct Drivers Across the Americas, Europe Middle East & Africa, and Asia Pacific Shaping Adoption of Antimicrobial Solutions

When interpreted through a regional lens, the antimicrobial packaging additive market exhibits varied growth dynamics across the Americas, Europe Middle East & Africa, and Asia Pacific. In the Americas, robust food safety regulations and strong investment in cold chain infrastructure underpin widespread adoption of advanced antimicrobial films and sachets. North American producers, in particular, are leveraging local research collaborations and pilot testing to accelerate commercialization of novel bio‐based formulations.

Across Europe, Middle East & Africa, stringent regulatory oversight paired with sustainability mandates is steering demand toward recyclable substrates and natural antimicrobial agents. Manufacturers in the European Union are prioritizing compliance with the latest food contact material directives, prompting investments in certification processes. Meanwhile, emerging economies within the Middle East and Africa are showing early adoption of antimicrobial labels and trays to reduce spoilage in challenging distribution environments.

Asia Pacific stands out for its rapid industrialization, rising urban populations, and flourishing ready‐to‐eat segment, driving appetite for cost‐effective synthetic additives integrated into multilayer films. Regional packaging converters are forging alliances with additive specialists to localize production capabilities, thereby minimizing lead times and meeting surge demands. As each region navigates its unique regulatory and economic contours, global market players must adopt adaptive strategies that cater to localized requirements while maintaining standardized quality benchmarks.

This comprehensive research report examines key regions that drive the evolution of the Antimicrobial Food Packaging Additives market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Leading Industry Participants and Innovators Are Shaping Competitive Strategies Through Strategic Partnerships, Portfolio Diversification, and Technological Investments

Industry leaders are deploying a range of competitive strategies to fortify their position in the antimicrobial packaging additives space. Major chemical and materials companies are expanding their R&D pipelines through both in‐house innovation and strategic acquisitions, integrating cutting‐edge antimicrobial technologies into broader packaging portfolios. At the same time, specialty additive firms are forging partnerships with packaging substrate manufacturers to co‐develop turnkey solutions that streamline customer adoption.

Collaborative ventures between academic institutions and commercial enterprises are also influencing the competitive landscape. These alliances accelerate the transfer of fundamental research on novel antimicrobial agents-such as antimicrobial peptides and advanced nanostructures-into scalable manufacturing processes. Furthermore, targeted investments in pilot production facilities are enabling faster scale‐up cycles, giving first movers the advantage of shortened time to market.

Value chain integration is emerging as a key differentiator, with several players leveraging backward integration to secure access to critical raw materials and ensure supply chain resilience. Concurrently, forward integration through direct engagement with food producers is helping additive suppliers capture downstream insights, tailor formulations to specific applications, and offer value‐added services like shelf‐life testing and regulatory guidance. Together, these strategies are shaping an intensely competitive and evolving market ecosystem.

This comprehensive research report delivers an in-depth overview of the principal market players in the Antimicrobial Food Packaging Additives market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Addmaster (UK) Ltd.

- Americhem, Inc.

- Avient Corporation

- BASF SE

- BioCote Limited

- Camlin Fine Sciences Ltd.

- Dunmore Corporation

- Intralytix, Inc.

- Kastus Technologies

- Microban International, Ltd.

- Mondi plc

- Oplon Pure Science Ltd.

- Phoenix Plastics

- Takex Labo Co., Ltd.

- The Dow Chemical Company

Actionable Strategic Recommendations Equip Industry Leaders to Navigate Regulatory Complexity, Optimize R&D, and Foster Sustainable Market Differentiation

To navigate the evolving antimicrobial packaging additives landscape successfully, industry leaders should first invest strategically in R&D platforms that bridge natural and synthetic technologies, ensuring both sustainability and efficacy objectives are met. Establishing cross‐functional teams that include regulatory, formulation, and supply chain experts will expedite the integration of novel additives into commercial products. Moreover, allocating resources to pilot lines and flexible manufacturing setups will allow faster response to shifting customer demands and regulatory updates.

In parallel, developing localized sourcing strategies is essential to mitigate the impact of trade policies and raw material price volatility. Collaborative agreements with regional growers and extractors of plant‐based antimicrobials can secure supply while reinforcing sustainability credentials. At the same time, securing long‐term contracts with specialized resin producers and inorganic compound manufacturers will stabilize cost structures and reduce operational risks.

Lastly, forging deeper partnerships with food producers and retail brands via joint development programs will create shared value and unlock new application insights. By offering end‐to‐end service packages-comprising formulation guidance, packaging design support, and shelf‐life validation-additive suppliers can establish themselves as indispensable innovation partners and drive accelerated market penetration.

Comprehensive Research Methodology Integrates Qualitative Interviews, Secondary Data Analysis, and Rigorous Validation to Ensure Robust Market Insights

This research encompasses a comprehensive methodology designed to deliver robust and actionable insights into the antimicrobial food packaging additives market. The process commenced with an extensive literature review of peer‐reviewed journals, regulatory filings, and technology whitepapers to establish a foundational understanding of material science advances and regulatory frameworks. Building on this, a series of in‐depth interviews was conducted with key stakeholders, including R&D heads, packaging engineers, and regulatory specialists to gather qualitative perspectives on market needs and innovation pipelines.

Secondary data analysis played a pivotal role, leveraging industry databases and trade statistics to trace trends in raw material consumption, trade flows, and patent activity. This quantitative assessment was complemented by a rigorous validation phase, wherein preliminary findings were reviewed by an expert advisory panel to ensure credibility and relevance. Scenario planning workshops were also held to stress‐test potential developments in tariff policies and regulatory environments, providing a forward‐looking dimension to the research.

Finally, the synthesis of qualitative and quantitative inputs was structured into an intuitive analytical framework that maps market dynamics across segmentation criteria, competitive landscape, and regional drivers. The methodology’s iterative feedback loops guarantee that the insights reflect the most current market conditions and stakeholder priorities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Antimicrobial Food Packaging Additives market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Antimicrobial Food Packaging Additives Market, by Packaging Material

- Antimicrobial Food Packaging Additives Market, by Additive Type

- Antimicrobial Food Packaging Additives Market, by Form

- Antimicrobial Food Packaging Additives Market, by Application

- Antimicrobial Food Packaging Additives Market, by End Use Industry

- Antimicrobial Food Packaging Additives Market, by Distribution Channel

- Antimicrobial Food Packaging Additives Market, by Region

- Antimicrobial Food Packaging Additives Market, by Group

- Antimicrobial Food Packaging Additives Market, by Country

- United States Antimicrobial Food Packaging Additives Market

- China Antimicrobial Food Packaging Additives Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2385 ]

Synthesizing Core Findings Underscores the Imperative for Collaborative Innovation and Strategic Agility in the Antimicrobial Packaging Ecosystem

The convergence of technological innovation, regulatory momentum, and shifting consumer expectations signals a pivotal juncture for the antimicrobial food packaging additives market. Core findings illustrate that companies prioritizing advanced biopolymer integration and natural antimicrobial agents are best positioned to capture emerging growth in sustainability‐focused segments. At the same time, those leveraging integrated supply chain strategies can mitigate external pressures such as tariffs and raw material constraints.

Furthermore, regional disparities underscore the importance of adaptive go‐to‐market approaches. Tailored strategies that address localized regulatory frameworks, infrastructure capabilities, and consumer preferences will be essential for global players seeking to scale successfully. Equally, the competitive landscape favors organizations that can blend deep technical expertise with customer‐centric service offerings, thereby moving beyond commoditized additives toward holistic packaging solutions.

Looking ahead, the imperative for collaborative innovation remains clear. Cross‐sector partnerships, shared R&D investments, and proactive engagement with regulatory bodies will define the next wave of market leaders. By synthesizing the insights outlined in this summary, stakeholders can refine their strategic roadmaps to harness the full potential of antimicrobial packaging technologies.

Take the Next Step Towards Informed Decision Making by Securing Direct Access to the Full Market Research Report with Our Sales and Marketing Expert

To take your strategic planning to the next level and ensure your organization is fully equipped with the latest market intelligence on antimicrobial food packaging additives, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Engaging directly with Ketan will provide you with tailored guidance on how this market research report can address your unique business challenges, from optimizing your product portfolio to identifying high‐potential partnerships. He will walk you through the report’s structure, highlight the most critical data points, and explain how the findings can be incorporated into your growth strategies.

By contacting Ketan today, you ensure priority access to exclusive insights that are not available through other channels. This personalized consultation will help you understand how to leverage market dynamics, anticipate regulatory changes, and capitalize on emerging applications. Don’t miss the opportunity to secure competitive advantage and drive measurable results. Reach out now to purchase the full report and unlock the actionable intelligence that will empower your decision‐making and accelerate your innovation roadmap.

- How big is the Antimicrobial Food Packaging Additives Market?

- What is the Antimicrobial Food Packaging Additives Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?