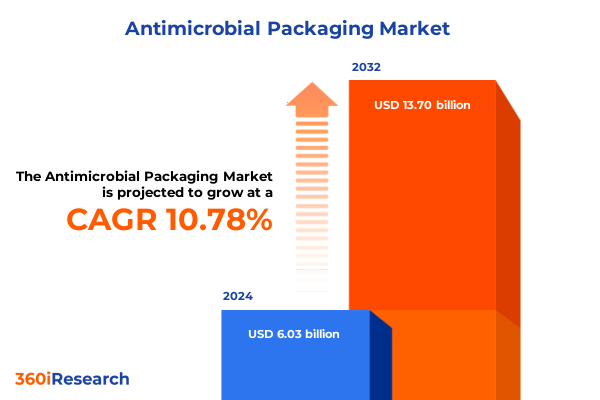

The Antimicrobial Packaging Market size was estimated at USD 6.60 billion in 2025 and expected to reach USD 7.22 billion in 2026, at a CAGR of 10.99% to reach USD 13.70 billion by 2032.

Antimicrobial Packaging Emerges as a Critical Innovation to Enhance Safety and Extend Shelf Life Across Diverse Consumer Products

Antimicrobial packaging systems integrate active agents directly into packaging materials to inhibit microbial growth, effectively extending the lag phase of contamination and reducing the proliferation of spoilage and pathogenic microorganisms. By incorporating polymers or coatings embedded with enzymes, organic acids, metal ions, or natural extracts, these advanced materials elevate the core functions of traditional packaging-maintaining quality, safeguarding safety, and prolonging shelf life. The technology enhances barrier properties without compromising material integrity, enabling brands to deliver fresher, safer products with minimal reliance on chemical preservatives.

The momentum behind antimicrobial packaging reflects broader post-pandemic shifts in consumer expectations and supply chain priorities. Heightened awareness of foodborne pathogens and renewed focus on healthcare safety have spurred demand for packaging that adds a proactive microbial defense. Concurrently, sustainability mandates are driving the adoption of bio‐based and compostable antimicrobial solutions that align with environmental commitments. Consequently, manufacturers and retailers are exploring novel formulations-from chitosan coatings derived from crustacean shells to carbon‐dot‐infused biodegradable films-to satisfy regulatory requirements and deliver clean‐label, ecofriendly protection in an increasingly discerning market.

Innovative Material Breakthroughs and Technological Advances Are Reshaping the Antimicrobial Packaging Landscape for Sustainable Protection

The antimicrobial packaging landscape is undergoing transformative shifts propelled by a convergence of material science breakthroughs and evolving regulatory frameworks. Biodegradable and compostable polymers such as polylactic acid and polyhydroxyalkanoates now incorporate antimicrobial coatings, enabling brands to address escalating environmental and hygiene requirements simultaneously. At the same time, natural extracts like essential oils and plant peptides have gained prominence as consumer‐friendly antimicrobial agents that fulfill ‘clean‐label’ aspirations without sacrificing efficacy. These developments are redefining design priorities, with sustainability and functional performance no longer seen as mutually exclusive in next‐generation packaging solutions.

Parallel advancements in nanotechnology and smart packaging are reshaping the industry’s competitive landscape. Silver and zinc oxide nanoparticles embedded in polymer matrices provide long‐lasting antimicrobial action at minimal loading levels, while active sensors and controlled‐release systems enable real‐time monitoring of package integrity and microbial threats. These intelligent formats not only extend product shelf life but also generate valuable data on storage conditions and supply chain performance, unlocking new avenues for quality assurance and consumer engagement. As these innovations mature, they will drive differentiation across sectors, from fresh produce to pharmaceuticals, and set a new standard for protective packaging solutions.

Navigating the Cumulative Effects of 2025 United States Tariffs on Raw Materials and Finished Goods in the Antimicrobial Packaging Industry

In February 2025, the administration reinstated a full 25% Section 232 tariff on steel imports and elevated aluminum duties to 25%, closing previous exemptions to safeguard domestic producers. These measures directly impact the cost structure of metal‐based packaging inputs-including tinplate for food cans, closures, and foil laminates-forcing converters to reevaluate material sourcing and pricing strategies amid heightened production costs.

Just months later, on June 4, 2025, the tariff on steel and aluminum imports surged to 50% under a presidential proclamation, intensifying pressure on manufacturers reliant on imported metals. While the steel and aluminum contents of finished goods now incur steep duties, non‐metal components remain subject to standard rates, complicating total landed cost assessments. Many producers must choose between absorbing tariffs, passing costs down the value chain, or shifting toward alternative substrates-each strategy carrying operational and financial trade‐offs.

Major industry voices have voiced concerns over these escalations, highlighting inflationary consequences for end consumers. The Can Manufacturers Institute, for instance, warned that increased tinplate costs will translate into higher retail prices for canned foods, with consumer wallets ultimately bearing the burden. Meanwhile, some beverage and food brands are exploring aseptic cartons, flexible pouches, and glass alternatives, although supply chain retooling and logistic constraints limit the pace of material transitions.

Alongside Section 232 actions, a continuing 30% tariff on Chinese imports under Section 301 applies broadly to packaging components such as rigid containers, decorative finishes, and barrier films. This dual tariff environment elevates complexity for global supply chains, compelling companies to deepen supplier vetting, pursue near‐shoring options, and negotiate tariff engineering solutions to mitigate duty liabilities and ensure continuity of supply.

Uncovering Impactful Market Segmentation Dynamics by Packaging Type End Use Application Antimicrobial Agent and Material Innovations

The market divides along packaging type into flexible formats such as films, pouches, and wrappers, each further differentiated by multilayer and plastic films, flat and stand-up pouches, and flow and skin wraps, alongside rigid formats including glass and plastic bottles, boxes and cans, and PET and PP trays. This layered classification enables a nuanced assessment of material performance, cost dynamics, and application suitability across industry verticals.

Segmentation by end-use application reveals specialized requirements for bakery products, cosmetics, dairy, fresh produce, and meat and seafood. Within these categories, distinct sub-segments-such as bread versus pastries, cheese versus milk, fruits versus vegetables, and fresh versus processed meats-drive tailored antimicrobial strategies to address unique spoilage mechanisms and regulatory standards.

When viewed through the lens of antimicrobial agents, the landscape spans enzymes, polymer-based systems, organic acids, and metals and metal ions. Copper and its derivatives, nanosilver and ionic silver, and the varied chemistry of zinc illustrate how agent properties-release kinetics, spectrum of activity, and regulatory approvals-influence incorporation methods and package architectures.

Material type segmentation underscores the balance between performance and sustainability. Bioplastics like PHA and PLA, coated and uncoated paperboards, and conventional polymers such as polyethylene, polypropylene, and polystyrene each offer distinct pathways for integrating antimicrobial functionality while navigating recyclability and circular economy mandates.

This comprehensive research report categorizes the Antimicrobial Packaging market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Packaging Type

- End-Use Application

- Antimicrobial Agent

- Material Type

Exploring Regional Adoption Trends and Unique Drivers across Americas Europe Middle East Africa and Asia Pacific in Antimicrobial Packaging

In the Americas, robust regulatory oversight from agencies such as the FDA and USDA ensures that antimicrobial packaging solutions meet stringent safety and efficacy criteria. This framework, combined with high consumer awareness of foodborne risks and growing demand for minimally processed products, continues to drive adoption in both food and healthcare segments. North American manufacturers are also leveraging near-shoring strategies to reduce tariff exposure, further bolstering the region’s resilience against global supply chain disruptions.

Europe, the Middle East, and Africa share a commitment to sustainability, reinforced by the EU’s Packaging and Packaging Waste Regulation and similar directives in the Gulf Cooperation Council and South Africa. These mandates encourage recycled-content usage and restrict single-use plastics, prompting pharmaceutical and food companies to pursue bio-based antimicrobial packaging that aligns with circular economy goals. Meanwhile, varied regulatory harmonization across countries requires agile compliance approaches to maintain market access and consumer trust.

Asia-Pacific leads global antimicrobial packaging adoption, propelled by rapid urbanization, expanding cold-chain infrastructure, and evolving food safety legislation in China, India, Japan, and Southeast Asian economies. Government incentives and investment in e-grocery and temperature-controlled logistics amplify demand for active packaging that ensures product integrity over extended transit times. Local innovation hubs and partnerships with global material suppliers further accelerate the commercialization of region-specific antimicrobial solutions.

This comprehensive research report examines key regions that drive the evolution of the Antimicrobial Packaging market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Strategic Initiatives and Competitive Positioning of Leading Players Driving Innovation in the Antimicrobial Packaging Market

Major established players are shaping the antimicrobial packaging sector with differentiated portfolios that span polymer science, material additives, and converter partnerships. Amcor leverages its global footprint in flexibles and rigid formats to integrate antimicrobial films for perishable goods, while BASF provides tailored silver-ion and organic acid compounds under brands such as Irgaguard®. Sealed Air’s Cryovac® and Freshness Plus™ technologies combine oxygen scavengers and antimicrobial agents in vacuum-sealed formats, addressing shelf-life challenges in seafood and meat markets. Mondi and Constantia Flexibles extend the value proposition with recyclable paper and board solutions enhanced by zinc oxide coatings, aligning with increasing demand for sustainable packaging alternatives.

Recent industry developments underscore the pace of innovation and collaboration. In late 2023, Lonza introduced new high-performance antimicrobial polymers targeting pharmaceutical and medical-device applications. BASF’s launch of a bio-based antimicrobial coating for paperboard in November 2023 demonstrated the shift toward renewable inputs. Amcor’s partnerships in early 2024 to develop recyclable antimicrobial pouches for dairy and snacks illustrate how cross-sector alliances are unlocking new product formats. These strategic moves highlight the importance of R&D agility and supply chain partnerships in maintaining competitive advantage in this dynamic market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Antimicrobial Packaging market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ahlstrom-Munksjö Oyj

- Amcor plc

- BASF SE

- Berry Global Group, Inc.

- Clariant AG

- Dow, Inc.

- Huhtamaki Oyj

- Mitsubishi Gas Chemical Company, Inc.

- Sealed Air Corporation

- Sonoco Products Company

- The 3M Company

Proactive Strategies and Targeted Actions Industry Leaders Can Implement to Capitalize on Antimicrobial Packaging Opportunities

Industry leaders should prioritize early engagement with regulatory authorities to secure approvals for novel antimicrobial agents and ensure seamless market entry. By collaborating with certification bodies and leveraging third-party validation, companies can pre-empt compliance hurdles and build consumer confidence through transparent efficacy data.

Next, executives must diversify material portfolios to hedge against tariff volatility and raw material shortages. Integrating both domestic and near-shore supply sources, including bio-based polymers and local additive manufacturers, will strengthen supply chain resilience while meeting evolving sustainability targets.

Investing in digital tracking and sensor technologies within antimicrobial packaging will enable real-time monitoring of environmental conditions and product integrity throughout the distribution network. This actionable insight can reduce spoilage risks, optimize inventory management, and support premium pricing strategies for high-value goods.

Finally, forging cross-industry partnerships-with ingredient suppliers, converters, and end-user brands-can accelerate co-development of tailored antimicrobial solutions and expedite time-to-market. By sharing expertise, pooling resources, and aligning commercial incentives, stakeholders can capture emerging growth in segments such as e-grocery, ready-to-eat meals, and sterile medical packaging.

Transparent Research Methodology Outlining Comprehensive Primary Secondary and Analytical Approaches Employed in Study Design

This research combines comprehensive secondary analysis of industry publications, regulatory documents, and peer-reviewed studies with primary interviews of packaging engineers, material scientists, and supply chain executives. Secondary sources included technical journals on polymer science, FDA and USDA guidelines for food contact materials, and trade publications covering packaging innovations and tariff policies.

Primary research consisted of detailed interviews and structured questionnaires with over 25 senior professionals across converters, brand owners, and regulatory bodies in North America, Europe, and Asia-Pacific. These engagements provided qualitative insights on material selection criteria, cost-management strategies under tariff regimes, and end-use performance requirements in bakery, dairy, fresh produce, and pharmaceutical sectors.

Analytical approaches employed in this study feature SWO T frameworks to assess competitive positioning, scenario modeling to quantify tariff impacts on landed costs, and time-series trend analysis to map technology adoption curves. Data triangulation ensures consistent validation across multiple inputs, reinforcing the robustness of our findings and enabling stakeholders to make informed strategic decisions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Antimicrobial Packaging market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Antimicrobial Packaging Market, by Packaging Type

- Antimicrobial Packaging Market, by End-Use Application

- Antimicrobial Packaging Market, by Antimicrobial Agent

- Antimicrobial Packaging Market, by Material Type

- Antimicrobial Packaging Market, by Region

- Antimicrobial Packaging Market, by Group

- Antimicrobial Packaging Market, by Country

- United States Antimicrobial Packaging Market

- China Antimicrobial Packaging Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 3816 ]

Concluding Insights Reinforce the Critical Role of Antimicrobial Packaging in Enhancing Safety Sustainability and Competitive Advantage for Stakeholders

Antimicrobial packaging has evolved from a niche innovation into a strategic imperative for safety-conscious and sustainability-driven manufacturers. The integration of natural and nanoscale agents, alongside smart sensor technologies, is redefining how brands extend shelf life while meeting escalating regulatory and consumer expectations.

Tariff landscapes in the United States have introduced complexity to raw material sourcing and cost management, emphasizing the critical importance of adaptive supply chains and diversified material strategies. Simultaneously, regional dynamics-influenced by regulatory frameworks in the Americas, circular economy mandates in EMEA, and rapid infrastructure growth in Asia-Pacific-underscore the necessity of localized approaches to product development and market entry.

As leading companies deepen their R&D investments and form strategic alliances, the market will continue to fragment along application-specific and sustainability criteria. Stakeholders who navigate this multifaceted environment by aligning innovation with regulatory foresight and supply chain resilience will secure lasting competitive advantage in the antimicrobial packaging domain.

Contact Ketan Rohom Today to Secure Exclusive Access to the Comprehensive Antimicrobial Packaging Market Research Report and Accelerate Your Business Success

For tailored insights into antimicrobial packaging innovations, emerging regulatory impacts, and actionable strategies, contact Ketan Rohom to secure your exclusive copy of the comprehensive market research report. As Associate Director of Sales & Marketing, he will guide you through the robust analysis of market drivers, segmentation dynamics, and competitive landscapes, ensuring you leverage the latest intelligence for strategic growth. Reach out today to accelerate your product development roadmap, optimize supply chain resilience, and achieve a competitive edge with insights only available through our in-depth study.

- How big is the Antimicrobial Packaging Market?

- What is the Antimicrobial Packaging Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?