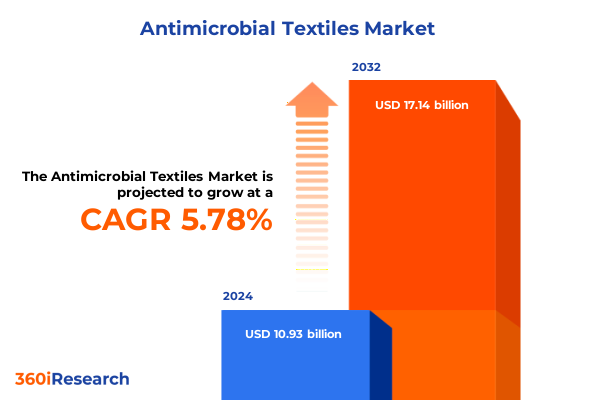

The Antimicrobial Textiles Market size was estimated at USD 11.56 billion in 2025 and expected to reach USD 12.23 billion in 2026, at a CAGR of 5.78% to reach USD 17.14 billion by 2032.

Setting the Stage for Antimicrobial Textiles: Navigating the Interplay of Health Imperatives, Sustainability Goals, and Technological Innovation

Against a backdrop of renewed global health vigilance and escalating consumer demand for enhanced hygiene solutions, antimicrobial textiles have emerged as a pivotal innovation at the intersection of material science and public safety. Over the past few years, the convergence of heightened awareness around pathogen transmission and a growing emphasis on product lifecycle sustainability has catalyzed cross-sector collaboration between textile manufacturers, chemical formulators and regulatory bodies. As a result, antimicrobial textiles no longer occupy a niche segment; rather, they are rapidly embedding themselves into mainstream applications ranging from hospital bed linen to everyday sports apparel.

This dynamic landscape is underpinned by regulatory evolutions that mandate rigorous testing standards for antimicrobial claims, compelling industry stakeholders to invest in specialized in vitro assays, standardized efficacy testing and comprehensive durability evaluations. In parallel, consumer expectations have evolved beyond basic protection, increasingly favoring products that align with environmental stewardship and circular economy principles. Such evolutionary pressures are driving the adoption of biobased agents and next-generation coatings that promise low ecotoxicity and minimal human allergenicity.

Innovation is equally shaping the narrative as the advent of nanotechnology and advanced surface engineering techniques enables the creation of textiles with multifunctional properties. Antimicrobial treatments are being integrated into fibers at the filament stage rather than as post-production finishes, ensuring more uniform efficacy and extended performance over repeated wash cycles. Moreover, digital tools are facilitating real-time monitoring of treatment integrity, empowering end users to make informed decisions.

Together, these developments set the stage for a new era in which antimicrobial textiles fundamentally enhance both personal well-being and environmental resilience, establishing the context for the in-depth analysis that follows

Unveiling the Revolutionary Trends Reshaping the Antimicrobial Textile Landscape from Nanotechnology Breakthroughs to Sustainable Material Innovations

In recent years, several transformative trends have begun to redefine the antimicrobial textile landscape, fostering breakthroughs that extend beyond conventional chemical treatments. Advanced chemistries leveraging microencapsulation and controlled-release mechanisms now deliver sustained antimicrobial activity, allowing fabrics to neutralize pathogens over prolonged periods without compromising breathability or hand feel. Concurrently, precision nanocoatings engineered at the molecular level provide targeted action against bacteria, fungi and viruses, representing a paradigm shift from broad-spectrum to highly specific germ-fighting functionalities.

The sustainability agenda is further reshaping innovation trajectories as manufacturers and formulators adopt bio-based active agents sourced from natural extracts, algae derivatives and enzymatic catalysts. These green alternatives not only minimize ecological footprints but also respond to consumer demands for transparency and lower environmental impact. Closed-loop processes that reclaim and recycle treatment chemistries underscore a commitment to circularity, ensuring that antimicrobial performance is delivered with responsible resource management.

Digitalization of textile manufacturing is emerging as another critical inflection point, with Industry 4.0 platforms enabling automated quality control, predictive maintenance of coating lines and blockchain-enabled traceability of raw materials. This convergence of digital and material science accelerates product-to-market cycles while guaranteeing compliance with evolving regulatory frameworks governing antimicrobial efficacy claims.

Collaborative ecosystems encompassing start-ups, academic research institutions and larger industry incumbents are driving open innovation, accelerating the translation of laboratory breakthroughs into scalable manufacturing processes. Such partnerships are fostering joint investments in pilot facilities, shared testing protocols and co-development agreements, collectively fueling the next wave of high-performance, multifunctional antimicrobial textiles

Assessing the Ripple Effect of Recent United States Tariff Measures on the Antimicrobial Textile Industry’s Supply Chain and Competitive Dynamics

The introduction of revised tariff schedules by United States authorities in early 2025 has initiated far-reaching repercussions across the antimicrobial textile value chain. Increases in import duties on key chemical intermediates and treated fabrics have led to a reevaluation of global sourcing strategies, prompting many brands and suppliers to explore alternate geographies or to consider near-sourcing options within domestic production hubs. This realignment has been particularly pronounced among manufacturers reliant on metal-based active agents such as silver and copper, where duty escalations have significantly inflated landed input costs.

Offsetting measures have included strategic inventory build-ups ahead of tariff implementation deadlines, as well as the renegotiation of supply agreements to incorporate cost-sharing mechanisms. In certain cases, formulators have accelerated the adoption of biobased alternatives to mitigate exposure to tariff-impacted chemical imports, while others have explored regional partnerships in Asia-Pacific and EMEA to diversify procurement channels and minimize risk concentrations.

End users have felt the cumulative impact through incremental price adjustments and, in some instances, extended lead times for specialty products. Healthcare and hospitality operators with stringent antimicrobial standards have responded by consolidating orders with vertically integrated suppliers capable of internalizing input fluctuations. Looking ahead, the tariff-driven imperative for agility is expected to drive further consolidation among mid-tier suppliers, as well as heightened emphasis on innovation that can decouple performance from tariff-sensitive inputs

Deep Dive into Segmentation Dynamics Revealing How Active Agents, Material Types, Functionality, Channels, and End-Use Categories Influence Market Progress

In analyzing market segmentation, the landscape of active agents encompasses biobased agents derived from natural sources offering eco-friendly profiles, metal-based agents renowned for potent antimicrobial properties delivered through copper, silver and zinc constituents, and synthetic organic agents which include polyhexamethylene biguanide known for its broad-spectrum efficacy, quaternary ammonium compounds with customizable structures and triclosan which has historically dominated antibacterial formulations. Transitioning to material types, blends marry performance fibers to optimize durability and comfort, natural fibers such as cotton, hemp, silk and wool provide intrinsic breathability and biodegradability, while synthetic fibers including nylon, polyester and rayon offer scalability and cost benefits. Functionality segmentation reveals that antibacterial finishes remain the bedrock of protective textiles, antifungal treatments ensure defense against mold proliferations particularly in humid environments, and antiviral technologies have surged in prominence as public health priorities shift. Distribution channels range from established brick-and-mortar retail networks where tactile evaluation remains critical to burgeoning e-commerce platforms facilitating wider accessibility and customization options. Application across end-use categories underscores healthcare priorities, where hospital and surgical textiles such as bed sheets, curtains, doctor coats, surgical drapes, gowns and mask covers demand rigorous sterility standards, hospitality sectors leverage antimicrobial treatments for hotel linen including bathrobes and bedsheets as well as restaurant table covers like napkins and tablecloths, residential use extends to home furnishings such as bed linen, curtains and towels alongside upholstery choices for cushion and sofa covers, while the sports and active wear segment integrates antimicrobial finishes into running and training footwear as well as performance jerseys, leggings and shorts to address odor control and athlete safety

This comprehensive research report categorizes the Antimicrobial Textiles market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Active Agent

- Material Type

- Functionality

- End-User

- Distribution Channel

Illuminating Regional Divergences in Antimicrobial Textile Demand and Production across the Americas, EMEA Territories, and Asia-Pacific Markets

Regional analysis of the antimicrobial textile market reveals distinct demand drivers and production dynamics across the Americas, Europe Middle East & Africa (EMEA) and Asia-Pacific. In the Americas, heightened investment in healthcare infrastructure and stringent hospital accreditation standards are driving robust uptake of hospital-grade antimicrobial linens and surgical drapes. The region’s proximity to major chemical exporters and established textile clusters facilitates rapid product innovation and scaled deployment of next-generation antimicrobial treatments.

Within EMEA, regulatory harmonization across the European Union and Gulf Cooperation Council countries has created a fertile environment for cross-border product approvals and collaborative research initiatives. Stringent biocide regulations and consumer preference for sustainably produced textiles are spurring the development of bio-based and biodegradable antimicrobial agents, while advanced manufacturing hubs in Western Europe and Turkey continue to serve as critical supply nodes for specialty textiles.

Asia-Pacific remains the global epicenter of textile production, with established manufacturing capacities in South and Southeast Asia offering cost advantages for large-volume orders. Simultaneously, rapidly growing middle-class populations in China, India and Southeast Asian economies are catalyzing domestic demand for antimicrobial home furnishings and performance wear. Government incentives for technological upgrading and export-oriented policies are further reinforcing the region’s role as a linchpin in global supply chains.

Across all regions, strategic shifts toward near-shoring, digital traceability and sustainability commitments are converging to redefine traditional geographic footprints. As a result, leading textile manufacturers and formulators are recalibrating their regional strategies to balance cost efficiency, regulatory compliance and proximity to end-user markets

This comprehensive research report examines key regions that drive the evolution of the Antimicrobial Textiles market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Collaborators Driving Growth through R&D, Partnerships, and Value-Added Offerings in Antimicrobial Textiles

A review of key industry participants underscores a growing emphasis on differentiated product portfolios and strategic alliances. Several leading firms have amplified their R&D investments in next-generation biobased agents, securing patents for novel antimicrobial compounds derived from marine biomass and plant extracts. These innovations are being piloted in collaboration with global textile producers, enabling rapid scale-up and integration into existing fiber production lines.

Multinational chemical formulators are forming joint ventures with regional textile manufacturers to co-develop tailored antimicrobial treatments that align with local regulatory frameworks and end-use requirements. By establishing in-region application facilities, these alliances ensure uninterrupted supply and reduce the logistical complexities associated with cross-border shipments of treated fabrics.

At the same time, specialist start-ups are carving out niche positions by leveraging digital platforms to deliver customized antimicrobial solutions. Through integrated software interfaces, customers can specify performance targets such as bacterial reduction rates, wash durability thresholds and environmental impact criteria, prompting automated formulation adjustments and real-time production monitoring.

Partnerships with academic institutions and contract research organizations are further accelerating time to market, as co-funded trials and shared testing laboratories de-risk product approvals. This collaborative model has enabled leading players to secure key distribution agreements with healthcare networks and hospitality chains, positioning them at the forefront of large-scale implementation of antimicrobial textile solutions

This comprehensive research report delivers an in-depth overview of the principal market players in the Antimicrobial Textiles market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aditya Birla Group

- Apex Mills Corporation, Inc.

- Balavigna Mills Pvt. Ltd.

- Beijing Konfitex Technology Co., Ltd.

- Cotton Incorporated

- Emes Textiles Pvt. Ltd.

- HeiQ Materials AG

- HeiQ Materials AG

- Herculite Products Inc.

- Indorama Ventures Fibers Germany GmbH

- LifeThreads LLC by Piranha Brands LLC

- Milliken & Company

- Mollyflex Srl

- Rajshree Group of Industries

- Stafford Textiles Limited

- Sunny Special Dyeing & Finishing Co., Ltd.

- Swicofil AG

- Teijin Limited

- Tiong Liong Corporation

- Toray Industries, Inc.

- Toyobo Co. Ltd.

Strategic Roadmap for Industry Leaders to Capitalize on Emerging Opportunities and Address Operational Challenges in the Antimicrobial Textile Sector

To navigate the evolving antimicrobial textile market and capitalize on emerging growth opportunities, industry leaders should prioritize the integration of sustainable active agents into their product pipelines. By establishing partnerships with suppliers of bio-based compounds and investing in scalable extraction processes, firms can reduce reliance on tariff-sensitive chemical imports while meeting growing consumer demands for eco-friendly solutions.

Optimizing supply chain resilience will require the adoption of digital traceability frameworks that monitor raw material origins, treatment chemistries and manufacturing parameters in real time. Leveraging blockchain-enabled platforms can ensure end-to-end visibility, support rapid response to regulatory audits and enhance brand trust among end users.

Strategic collaboration models offer a clear avenue for shared risk and accelerated innovation. Joint ventures with textile producers in target regions, coupled with contract research agreements with academic labs, can expedite the commercialization of breakthrough antimicrobial technologies. Co-location of pilot application lines within key manufacturing clusters also serves to streamline logistics and reduce lead times for high-volume orders.

Finally, engaging proactively with standards bodies and regulatory agencies will be critical to shaping frameworks that support both efficacy and safety. Participation in industry consortia, contribution to antimicrobial testing guidelines and investment in third-party certification programs will help position product portfolios at the forefront of compliance and market acceptance

Comprehensive Research Approach Combining Primary Interviews, Secondary Intelligence, and Rigorous Validation Techniques to Ensure Robust Market Insights

Our approach to mapping the antimicrobial textile landscape combines rigorous primary research with extensive secondary intelligence, ensuring that findings are both comprehensive and actionable. The primary research phase involved in-depth interviews with a diverse range of stakeholders, including textile mill executives, chemical formulators, healthcare procurement specialists and regulatory compliance experts, providing real-world insight into current challenges and strategic priorities.

Secondary research encompassed a systematic review of industry publications, peer-reviewed journals, patent filings and international standards documentation. This layer of analysis validated emerging trends such as the shift toward biobased active agents, the adoption of controlled-release technologies and the evolution of digital traceability platforms.

Quantitative data was triangulated across proprietary databases, trade association reports and custom surveys to ensure robust cross-validation of key findings. Statistical methods were applied to identify correlations between regulatory changes, tariff impacts and regional demand patterns, while scenario modeling techniques explored the potential implications of evolving market dynamics.

Quality control protocols were maintained throughout the research process, with multiple rounds of peer reviews and stakeholder debriefs conducted to refine insights and address any data gaps. This iterative methodology guarantees a high degree of confidence in the strategic recommendations and segmentation analysis presented within this report

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Antimicrobial Textiles market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Antimicrobial Textiles Market, by Active Agent

- Antimicrobial Textiles Market, by Material Type

- Antimicrobial Textiles Market, by Functionality

- Antimicrobial Textiles Market, by End-User

- Antimicrobial Textiles Market, by Distribution Channel

- Antimicrobial Textiles Market, by Region

- Antimicrobial Textiles Market, by Group

- Antimicrobial Textiles Market, by Country

- United States Antimicrobial Textiles Market

- China Antimicrobial Textiles Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3498 ]

Synthesizing Key Takeaways on Innovation Pathways, Regulatory Imperatives, and Growth Catalysts Shaping the Future of Antimicrobial Textiles

The evolution of antimicrobial textiles is being driven by a unique confluence of public health imperatives, environmental sustainability objectives and rapid technological innovation. As the industry moves beyond traditional chemical treatments toward advanced biobased compounds and digitalized manufacturing ecosystems, it is poised to deliver unprecedented levels of protection across diverse end-use scenarios.

Key drivers include the implementation of targeted regulatory frameworks, the adoption of circular economy principles and the integration of smart technologies that enable real-time performance monitoring. While tariff adjustments have introduced new challenges in global supply chains, they have also accelerated strategic realignments that favor near-sourcing and collaborative innovation models.

Looking ahead, the interplay between segmentation dynamics-spanning active agent choices, material types, functional performance, distribution channels and end-user applications-and regional growth trajectories will determine competitive positioning. Industry leaders who successfully align product portfolios with evolving consumer preferences, regulatory expectations and sustainability mandates will be best positioned to capture the full potential of the antimicrobial textile revolution

Engage with Ketan Rohom to Unlock Exclusive Market Intelligence and Propel Decision-Making with the Comprehensive Antimicrobial Textiles Research Report

To gain an in-depth understanding of the transformative forces shaping the antimicrobial textiles arena and to secure a strategic advantage in this rapidly evolving domain, engage directly with Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch). Drawing upon a meticulously researched report that synthesizes primary insights, advanced segmentation analysis, and regional deep dives, Ketan can provide tailored guidance on harnessing emerging opportunities, mitigating supply chain risks, and optimizing product innovation pathways. Connect today to access this exclusive intelligence package and elevate your decision-making with the comprehensive antimicrobial textiles research report

- How big is the Antimicrobial Textiles Market?

- What is the Antimicrobial Textiles Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?