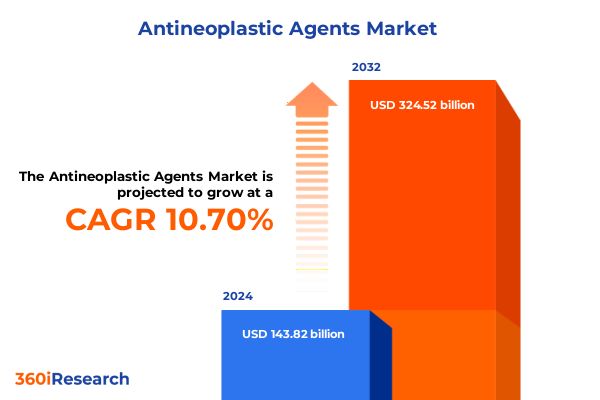

The Antineoplastic Agents Market size was estimated at USD 158.96 billion in 2025 and expected to reach USD 175.70 billion in 2026, at a CAGR of 10.73% to reach USD 324.52 billion by 2032.

An Overview Of The Antineoplastic Agents Market Highlighting Critical Advances Challenges And Strategic Imperatives For Oncology Stakeholders

An Overview Of The Antineoplastic Agents Market Highlighting Critical Advances Challenges And Strategic Imperatives For Oncology Stakeholders

The antineoplastic agents landscape sits at the intersection of cutting-edge science and urgent clinical need, driven by the imperative to improve outcomes for patients confronting cancer worldwide. From foundational cytotoxic therapies to next-generation targeted agents, the field has evolved through successive waves of innovation that have transformed once uniformly fatal diagnoses into chronic conditions amenable to management and, in some cases, remission. With the advent of precision medicine and molecular diagnostics, drug developers now tailor treatment regimens to the genetic and phenotypic profiles of individual tumors, enhancing efficacy while mitigating toxicity.

This report’s introduction provides context for stakeholders seeking to understand the dynamic forces propelling market growth and diversification. It underscores the synergistic relationship between academic research, biotech entrepreneurship, and large pharmaceutical companies, each contributing unique capabilities in discovery, clinical validation, and global commercialization. By examining recent scientific breakthroughs, regulatory milestones, and shifting payer landscapes, the introduction frames the strategic imperatives facing industry participants, highlighting the value of agility, collaboration, and robust evidence generation to secure competitive differentiation and sustainable impact.

How Immunotherapy Targeted Treatments And Personalized Medicine Are Rewriting The Competitive Landscape Of Antineoplastic Agents Globally

How Immunotherapy Targeted Treatments And Personalized Medicine Are Rewriting The Competitive Landscape Of Antineoplastic Agents Globally

Over the past decade, the oncology sector has witnessed a paradigm shift from broadly cytotoxic regimens toward treatments that leverage the immune system, block key molecular drivers of malignancy, and address tumor heterogeneity with unprecedented specificity. Immune checkpoint inhibitors have demonstrated durable responses in subsets of patients with melanoma, lung cancer, and other solid tumors, catalyzing intense interest in combinations that amplify antitumor immunity. Meanwhile, the entry of CAR-T cell therapies into clinical practice heralds a new frontier in adoptive immunotherapy, although manufacturing complexities and cost challenges persist.

Targeted small molecules against aberrant kinases continue to expand their footprint, with next-generation inhibitors overcoming resistance mechanisms and extending progression-free survival. Advances in biomarker discovery and companion diagnostics are refining patient selection, ensuring that the right therapies reach the most responsive populations. Transitioning from one-size-fits-all approaches, developers now integrate genomic, proteomic, and real-world data to optimize trial design and accelerate regulatory approval, reshaping trial endpoints and redefining standards of care.

Evaluating The Cumulative Impact Of 2025 United States Tariffs On Antineoplastic Agents Supply Chain Costs And Patient Access Considerations

Evaluating The Cumulative Impact Of 2025 United States Tariffs On Antineoplastic Agents Supply Chain Costs And Patient Access Considerations

Beginning in April 2025, the U.S. administration implemented a broad 10 percent tariff on nearly all imported goods, including critical active pharmaceutical ingredients and finished drugs, aiming to fortify domestic manufacturing capacity through Section 301 and Section 232 authorities. Concurrently, proposals emerged to impose harsher levies of up to 25 percent on pharmaceutical imports, with vocal consideration of tariffs as steep as 200 percent under national security justifications. These measures mark a significant policy shift given the longstanding tariff-free status of the majority of drug imports.

The immediate fiscal impact on antineoplastic agents became apparent in a recent analysis by Ernst & Young, which estimated that a 25 percent tariff on pharmaceutical imports could elevate U.S. drug costs by nearly $51 billion annually, translating into price increases approaching 12.9 percent if fully passed through to U.S. payers and patients. Hospitals and health systems are bracing for higher acquisition expenses, potentially disrupting treatment protocols and inflating overall oncology care expenditures. Manufacturers have responded by accelerating dialogue with regulators to seek tariff exemptions and exploring blended sourcing strategies, but uncertainties around exemptions and phase-in timelines persist.

Beyond cost escalation, experts warn that tighter import controls may exacerbate existing supply vulnerabilities, particularly for low-margin generic injectables and biosimilars which rely on international suppliers for nearly 40 percent of APIs. Modeling scenarios suggest that sustained high tariffs could compel some generic producers to exit the U.S. market, aggravating shortages and constraining patient access to essential cancer therapies. While the administration’s intent is to incentivize reshoring of pharmaceutical production, the multi-year horizon for capacity expansion underscores the risk of interim disruptions that could undermine treatment adherence and clinical outcomes across oncology practice settings.

Uncovering Strategic Insights Through Detailed Product Type Route Administration Indication And Distribution Channel Segmentation Dynamics

Uncovering Strategic Insights Through Detailed Product Type Route Administration Indication And Distribution Channel Segmentation Dynamics

The antineoplastic agents market demonstrates distinct growth patterns when deconstructed by product type. Traditional cytotoxic classes, such as alkylating agents, antimetabolites, and mitotic inhibitors, remain foundational, particularly in combination regimens. Hormonal therapies, encompassing anti-estrogens, aromatase inhibitors, and LHRH agonists, continue to play a pivotal role in managing breast and prostate cancers, especially as maintenance strategies. Targeted interventions like tyrosine kinase inhibitors-ranging from BCR-ABL and EGFR to VEGF inhibitors-address molecularly defined malignancies, while monoclonal antibodies directed against CD20, HER2, and the PD-1/PD-L1 axis deliver precision-based immunomodulation.

Differentiation also emerges across routes of administration. Intravenous infusions dominate hospital settings for high-potency biologic therapies, yet the convenience and adherence advantages of oral oncolytics have unlocked new opportunities across outpatient and community care channels. Subcutaneous formulations are gaining traction, offering enhanced patient comfort and reduced infusion center burdens without compromising pharmacokinetic consistency. Shifting patient preferences and provider resource optimization have driven portfolio expansions and lifecycle management initiatives to introduce user-friendly dosing formats.

In terms of indications, hematological cancers remain a critical segment, with therapeutic advances in leukemia, lymphoma, and multiple myeloma delivering accelerated approvals and robust pipeline activity. Solid tumors such as breast, colorectal, and lung malignancies-particularly non–small cell lung cancer-continue to garner significant R&D investment, reflecting high incidence rates and unmet needs in targeted patient subgroups. Distribution channels further refine market access, with hospital pharmacies anchoring inpatient administration, while retail and online pharmacies broaden reach by facilitating chronic management and specialty drug dispensing. Each channel’s regulatory, reimbursement, and logistical considerations shape go-to-market strategies and influence formulary placements for leading antineoplastic agents.

This comprehensive research report categorizes the Antineoplastic Agents market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Indication

- Route Of Administration

- Distribution Channel

Analyzing Regional Variations In Antineoplastic Agent Adoption Market Dynamics And Growth Drivers Across Major Global Territories

Analyzing Regional Variations In Antineoplastic Agent Adoption Market Dynamics And Growth Drivers Across Major Global Territories

Geographic disparities in oncology therapy adoption reflect underlying variations in regulatory frameworks, healthcare infrastructure, and payer models. In the Americas, the United States remains the preeminent market with rapid incorporation of novel immunotherapies and precision agents, driven by an accelerated approval pathway and robust private payer reimbursement. Canada follows with a structured formulary review process that balances innovative access with cost-effectiveness evaluations, often resulting in negotiated listings for breakthrough therapies.

In the Europe, Middle East & Africa region, national health technology assessment bodies exert significant influence over market entry, compelling manufacturers to demonstrate real-world value through health economics and outcomes research. The European Union’s joint procurement initiatives and accelerated assessment mechanisms have streamlined preapproval pathways, yet pricing negotiations and country-level reimbursement divergences require tailored market access strategies. In emerging Middle Eastern and African markets, income disparities and variable infrastructure create pockets of unmet need, prompting public–private partnerships and philanthropic programs to expand oncology care delivery.

In Asia-Pacific, a diverse mosaic of high-income and developing economies drives both opportunity and complexity. Japan and Australia stand out for early adoption of targeted therapies supported by streamlined regulatory pathways and established insurance frameworks. China’s recent reforms have accelerated domestic innovation and encouraged global collaboration, while markets such as India and Southeast Asia focus on generic and biosimilar uptake to expand affordability. Each subregion’s epidemiological profile, healthcare spending trends, and local manufacturing capabilities inform strategic priorities for market entry, commercialization investments, and long-term portfolio planning.

This comprehensive research report examines key regions that drive the evolution of the Antineoplastic Agents market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Exploring Leading Innovators And Strategic Collaborations Driving Competitive Advantage In The Antineoplastic Agents Industry Ecosystem

Exploring Leading Innovators And Strategic Collaborations Driving Competitive Advantage In The Antineoplastic Agents Industry Ecosystem

Major pharmaceutical companies continue to anchor the antineoplastic agents sector, leveraging established R&D infrastructure and commercial networks. Roche’s immuno-oncology franchises, centered on checkpoint blockade, exemplify sustained leadership through pipeline replenishment and label expansions. Novartis has solidified its position in cell therapy, deploying global manufacturing hubs for CAR-T products and forging alliances to scale access. Bristol Myers Squibb advances combination strategies that integrate targeted agents with immune modulators, underscoring a multipronged approach to overcome resistance.

Emerging biotechs challenge incumbents by concentrating on niche targets and novel modalities. Small organizations specializing in bispecific antibodies, oncolytic viruses, and next-generation CAR constructs attract significant venture capital and formative partnerships, often fast-tracking clinical programs through co-development pacts with larger peers. Licensing agreements and asset acquisitions have become routine mechanisms for established players to diversify pipelines and mitigate late-stage attrition risks. Strategic collaborations with diagnostic developers enhance patient stratification capabilities, laying the groundwork for value-based contracting and outcomes-driven reimbursement models.

Cross-sector alliances further shape competitive dynamics, as technology firms integrate artificial intelligence into drug discovery platforms and digital patient support tools. Contract research and manufacturing organizations expand end-to-end services, accommodating small molecule, biologic, and cell therapy workflows under unified quality systems. Collectively, these relationships define an ecosystem that rewards innovation velocity, scale efficiency, and the ability to demonstrate differentiated clinical benefit across diverse patient populations.

This comprehensive research report delivers an in-depth overview of the principal market players in the Antineoplastic Agents market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AbbVie Inc.

- Amgen Inc.

- AstraZeneca PLC

- Bristol-Myers Squibb Company

- Eli Lilly and Company

- Johnson & Johnson

- Merck & Co., Inc.

- Novartis AG

- Pfizer Inc.

- Roche Holding AG

Strategic Actions Industry Leaders Must Undertake To Strengthen Market Position And Drive LongTerm Growth In Antineoplastic Agent Development

Strategic Actions Industry Leaders Must Undertake To Strengthen Market Position And Drive LongTerm Growth In Antineoplastic Agent Development

Industry leaders should prioritize deepening translational research capabilities, ensuring seamless integration of biomarkers and real-world data into every phase of development. By forging multidisciplinary centers of excellence that unite molecular biology, bioinformatics, and clinical operations, companies can expedite proof-of-concept studies and refine patient selection criteria. Concurrently, diversifying manufacturing footprints through regional partnerships and flexible modular facilities will reduce exposure to tariff risks and enhance supply chain resilience in the face of evolving trade policies.

Engagement with payers and policymakers is equally critical; proactive dialogue around value frameworks, outcomes-based agreements, and patient-reported outcomes can pave the way for differentiated pricing models that reward therapeutic innovation. Expanding patient support programs and digital adherence solutions will bolster patient retention in long-term regimens, fostering loyalty and improving therapeutic outcomes. Additionally, establishing clear sustainability goals-such as minimizing environmental footprint across the product lifecycle-can amplify corporate responsibility credentials and meet increasingly stringent global regulations.

Finally, cultivating a culture of agility and cross-functional collaboration will enable organizations to pivot in response to scientific breakthroughs and geopolitical shifts. By embedding continuous learning practices and investing in digital transformation, leadership teams can optimize decision-making, accelerate time to market, and secure a competitive advantage in the rapidly evolving antineoplastic agents landscape.

Comprehensive Research Methodology Detailing Rigorous Data Collection Analytical Framework And Validation Processes Underpinning The Findings

Comprehensive Research Methodology Detailing Rigorous Data Collection Analytical Framework And Validation Processes Underpinning The Findings

This study integrates primary interviews with key opinion leaders, including oncologists, pharmaceutical executives, and payers, to capture firsthand perspectives on emerging trends and unmet clinical needs. Secondary research spans peer-reviewed journals, regulatory filings, patent databases, and company disclosures, ensuring a robust foundation of publicly available intelligence.

Quantitative analysis employs a bottom-up approach, synthesizing manufacturing capacity data, clinical trial registries, and aggregate sales information to identify adoption patterns and forecast pipeline momentum. Qualitative assessments leverage an expert advisory panel to validate interpretations, triangulate findings, and refine segmentation frameworks. Data integrity is maintained through cross-verification against multiple sources, while proprietary algorithms standardize terminology and therapeutic classifications. This methodological rigor underpins the reliability of insights and supports strategic decision-making across stakeholder cohorts.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Antineoplastic Agents market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Antineoplastic Agents Market, by Product Type

- Antineoplastic Agents Market, by Indication

- Antineoplastic Agents Market, by Route Of Administration

- Antineoplastic Agents Market, by Distribution Channel

- Antineoplastic Agents Market, by Region

- Antineoplastic Agents Market, by Group

- Antineoplastic Agents Market, by Country

- United States Antineoplastic Agents Market

- China Antineoplastic Agents Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Synthesizing Core Insights Strategic Imperatives And Anticipated Future Directions In The Evolving Antineoplastic Agents Market Landscape

Synthesizing Core Insights Strategic Imperatives And Anticipated Future Directions In The Evolving Antineoplastic Agents Market

In summary, the antineoplastic agents sector stands at an inflection point defined by precision immunotherapy, targeted small molecules, and expanding biosimilar competition. The confluence of scientific innovation, regulatory evolution, and shifting payer expectations presents both opportunities and imperatives for stakeholders to adapt with agility. Strategic segmentation by product type, administration route, indication, and distribution channel reveals nuanced growth vectors that can be exploited through tailored commercialization strategies.

Regional dynamics underscore the importance of localized market access plans, from the expedited regulatory pathways in North America to the value-focused assessments in Europe and the burgeoning innovation ecosystems in Asia-Pacific. Meanwhile, mounting tariff pressures in the United States necessitate proactive supply chain diversification and stakeholder engagement to mitigate cost inflation and safeguard patient access. Leadership teams must therefore balance near-term operational resilience with long-term investments in translational research, digital enablement, and sustainable manufacturing practices to capitalize on the market’s evolution.

Take Action Now Secure Comprehensive Insights On Antineoplastic Agents And Connect With Ketan Rohom For Customized Market Intelligence Solutions

Don’t miss the opportunity to gain a competitive edge with an authoritative and in-depth market research report on antineoplastic agents. Drawing on rigorous analysis and expert insights, this report offers unparalleled clarity on the trends shaping the industry, the strategies driving innovation, and the critical challenges confronting stakeholders. Ketan Rohom, Associate Director of Sales & Marketing, brings extensive experience guiding clients toward data-driven decisions that maximize growth and resilience in dynamic markets. Reach out to Ketan Rohom to discuss how this report can be tailored to your organization’s specific objectives, unlock strategic opportunities, and support evidence-based planning. Secure your copy today and empower your team with the knowledge needed to lead in the rapidly evolving antineoplastic agents sector.

- How big is the Antineoplastic Agents Market?

- What is the Antineoplastic Agents Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?