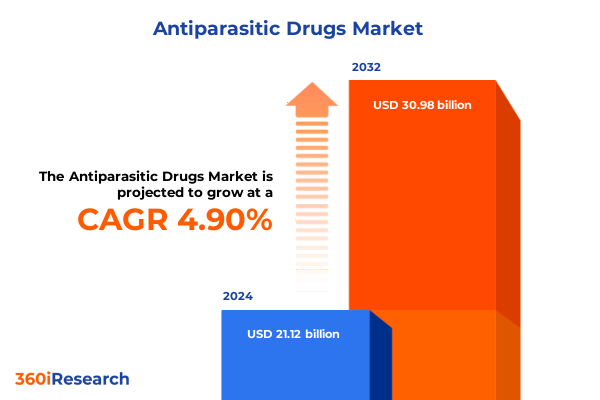

The Antiparasitic Drugs Market size was estimated at USD 22.18 billion in 2025 and expected to reach USD 23.30 billion in 2026, at a CAGR of 4.88% to reach USD 30.98 billion by 2032.

An All-Encompassing Overview of the Veterinary Antiparasitic Drug Market Setting the Stage for Strategic Decision Making

The world of veterinary antiparasitic therapeutics has evolved substantially over recent years, driven by shifting disease patterns, novel molecular targets, and changing regulatory frameworks that place a premium on efficacy, safety, and environmental stewardship. As livestock producers, companion animal veterinarians, and aquaculture operators contend with an array of parasitic threats-from gastrointestinal nematodes in cattle to ectoparasites in dogs and shrimps-there is a growing imperative to understand how drug classes, delivery formats, and governance policies intersect to shape market trajectories. With the rise of resistance to legacy compounds and heightened scrutiny of drug residue in food chains, stakeholders require a clear, strategic overview of the landscape to inform R&D pipelines, procurement strategies, and portfolio decisions.

Against this backdrop, this executive summary distills key developments in the antiparasitic drug arena, framing transformative innovations alongside emerging headwinds such as trade restrictions and supply chain vulnerabilities. The analysis underscores how shifts in molecular innovation, regulatory harmonization, and end-user requirements coalesce to impact opportunity windows across amino-acetonitrile derivatives, benzimidazoles, macrocyclic lactones, and the nascent spiroindoles segment. By establishing this contextual foundation, we set the stage for a deeper examination of tariff ramifications, segmentation insights, regional nuances, and competitive positioning, equipping decision-makers with the intelligence needed for resilient, forward-looking strategies.

Revolutionary Transformations Shaping the Veterinary Antiparasitic Drug Landscape Through Technological and Regulatory Evolution

Over the past decade, the antiparasitic drug landscape has been redefined by a series of ground-breaking innovations and regulatory reforms that have transformed how end-users address parasitic threats. Technological leaps in molecular modeling and high-throughput screening have accelerated the discovery of new anthelmintic classes, with spiroindoles emerging as a promising frontier following the success of macrocyclic lactones. Concurrently, precision dosing technologies and sustained-release formulations have gained traction, enabling veterinarians to administer targeted therapies with greater consistency and reduced off-target effects.

In parallel, regulatory bodies worldwide have tightened safety and environmental guidelines, raising the bar for residue monitoring and ecological risk assessments. These reforms have prompted manufacturers to invest in greener synthesis routes and robust pharmacovigilance infrastructures. Moreover, digital platforms for parasite burden diagnostics are scaling rapidly, creating integrated ecosystems that link real-time field data with treatment protocols. As a result, the intersection of novel chemistries, advanced delivery systems, and digital health tools is ushering in an era of precision parasitology, in which data-driven decisions and sustainable practices converge. This transformative shift is not merely incremental; it represents a fundamental reimagining of the veterinary antiparasitic paradigm, demanding agile strategies and collaborative innovation across the value chain.

Assessing the Far-Reaching Cumulative Effects of United States Tariff Policies on Antiparasitic Drugs Up to 2025

The cumulative impact of United States tariff policies through 2025 has manifested in complex cost structures and strategic recalibrations for stakeholders in the antiparasitic drug supply chain. Since the initiation of Section 301 levies on key chemical intermediates and excipients, manufacturers have encountered elevated input costs that have rippled through production, procurement, and distribution networks. These higher landed costs have, in many cases, been absorbed by producers seeking to maintain competitive pricing for livestock and companion animal markets, exerting pressure on R&D budgets and margin buffers.

Furthermore, the tariff environment has accelerated efforts to diversify sourcing strategies. Companies have explored alternative suppliers in Asia-Pacific and Europe, while some have considered nearshoring critical synthesis steps to mitigate future tariff exposure. Trade tensions have also heightened supply chain scrutiny, with increased lead times for raw materials prompting buffer stock strategies and strategic stockpiling. The knock-on effect has been a more defensive posture in contract negotiations and long-term procurement agreements, as players strive to lock in favorable terms. Looking forward, the sustained influence of tariff policies underscores the importance of supply chain resilience, proactive duty mitigation planning, and adaptive pricing frameworks to safeguard continuity of supply and preserve competitive positioning in a dynamically shifting trade landscape.

Unlocking Deep Insights from Granular Drug Class and Veterinary Segment Analyses Steering Informed Strategic Decisions

Deep segmentation of the antiparasitic drug market reveals nuanced adoption patterns and innovation hotspots that are critical for portfolio prioritization. When examining drug classes, amino-acetonitrile derivatives have gained ground due to their novel mode of action and potent efficacy, prompting manufacturers to accelerate clinical development pathways for compounds like monepantel. The benzimidazole family remains foundational for broad-spectrum coverage, yet the differentiated performance of albendazole, fenbendazole, mebendazole, oxibendazole, and thiabendazole in specific host species and parasite burdens requires a granular approach to positioning. Macrocyclic lactones continue to dominate the market, driven by the proven track record of abamectin, doramectin, eprinomectin, and ivermectin, each presenting distinct pharmacokinetic profiles and label expansions. Meanwhile, the emergence of derquantel in the spiroindole segment signals a pioneering step toward addressing resistance concerns, while also inviting new regulatory scrutiny and field evaluations.

Evaluating the veterinary application segments further sharpens strategic insights. In aquaculture, the treatment of fish and shrimp populations leverages specialized formulation technologies to address unique environmental constraints and regulatory requirements. Companion animal segments, encompassing both canine and feline populations, demand palatable oral and topical formats designed for ease of administration and owner compliance. Livestock treatments for cattle, poultry, and swine hinge upon efficacy in high-throughput production settings and adherence to stringent withdrawal periods. Recognizing these distinct segment drivers enables companies to tailor their development roadmaps, commercial models, and support services to the precise needs of each end-use population, thereby maximizing value capture and therapeutic impact.

This comprehensive research report categorizes the Antiparasitic Drugs market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Drug Class

- Veterinary

- By Spectrum of Activity

- Route of Administration

Illuminating Critical Regional Variations in Antiparasitic Drug Adoption and Demand Trends Across the Americas EMEA and Asia-Pacific Markets

Regional dynamics play a pivotal role in shaping demand, regulatory frameworks, and commercialization strategies for antiparasitic drugs. In the Americas, broad regulatory harmonization across NAFTA partners and strong end-user awareness have supported widespread adoption of advanced macrocyclic lactone and benzimidazole formulations in both livestock and companion animal sectors. However, emerging production hubs in South America are driving cost-sensitive procurement strategies and fostering collaboration on field efficacy studies to tailor treatments for local parasite strains. EMEA markets exhibit a high degree of regulatory rigor, with the EU’s environmental risk assessments and residue monitoring directives influencing pipeline prioritization and post-approval surveillance commitments. The region’s growing aquaculture sector also demands specialized treatments that meet stringent discharge and water quality standards.

In Asia-Pacific, a rapidly expanding aquaculture industry underscores the need for scalable and environmentally compatible solutions, while companion animal segments are benefiting from rising pet ownership and increased spending on preventive care. Regulatory pathways in key markets such as Australia, Japan, and China are evolving, combining global best practices with region-specific data requirements that can extend approval timelines. Moreover, strategic partnerships between multinational pharmaceutical companies and local veterinary service providers are becoming more prevalent, as they facilitate market access and knowledge transfer. Appreciating these regional distinctions-from tariff sensitivities in the Americas to compliance complexities in EMEA and growth imperatives in Asia-Pacific-is essential for developing targeted market entry and growth strategies that align with local stakeholder expectations.

This comprehensive research report examines key regions that drive the evolution of the Antiparasitic Drugs market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Unveiling the Strategic Positioning and Innovation Trajectories of Leading Players in the Antiparasitic Veterinary Pharmaceutical Space

Leading participants in the veterinary antiparasitic segment have pursued differentiated strategies centered on product innovation, strategic partnerships, and end-to-end service models. One major player has expanded its amino-acetonitrile pipeline through targeted acquisitions of small-molecule innovators, while another has fortified its macrocyclic lactone franchise by securing exclusive distribution agreements in key production geographies. A third competitor has emphasized integrated digital health solutions, coupling wearable diagnostics with prophylactic treatment regimens to enhance treatment compliance and real-time monitoring. Across the board, top firms are investing in sustainable manufacturing practices, from green chemistry processes to carbon-neutral facility certifications, in response to both regulatory mandates and stakeholder expectations around environmental stewardship.

Moreover, strategic R&D alliances are increasingly common, with companies collaborating on co-development of next-generation spiroindoles and co-funding field trials to validate efficacy against resistant parasite strains. Business development teams are also exploring licensing deals for region-specific formulations, leveraging local expertise to expedite market entry. Marketing and sales organizations have pivoted toward value-based contracting, emphasizing total cost of care benefits and long-term health outcomes for livestock herds and aquaculture operations. Collectively, these strategic approaches reflect a market in which agility, partnership, and sustainability are paramount, enabling frontrunners to solidify their positions while exploring new avenues for therapeutic differentiation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Antiparasitic Drugs market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 60 Degrees Pharmaceuticals

- Alkem Laboratories Limited

- Aurobindo Pharma

- Bayer AG

- Cipla Limited

- Eisai Co Ltd

- Elanco Animal Health Incorporated

- Fresenius Kabi AG

- GlaxoSmithKline plc

- Glenmark Pharmaceuticals Limited

- Ipca Laboratories Ltd

- J.B. Chemicals and Pharmaceuticals Limited

- Johnson & Johnson

- Lupin Limited

- Mankind Pharma Ltd

- Merck & Co Inc

- Merck KGaA

- Novartis AG

- Pfizer Inc

- Sanofi S.A.

- Sun Pharmaceutical Industries Ltd

- Takeda Pharmaceutical Company Limited

- Viatris Inc

- Zydus Lifesciences Ltd

Actionable Strategic Imperatives for Industry Leaders to Navigate Market Complexities and Capitalize on Emerging Opportunities in the Antiparasitic Domain

To navigate the complexities of evolving trade policies, dynamic regulatory regimes, and diverse end-user requirements, industry leaders should adopt a multi-pronged approach. First, they must prioritize supply chain resilience by diversifying raw material sourcing and exploring nearshoring opportunities for critical intermediates. This strategic move will reduce exposure to future tariff escalations and mitigate the risk of supply disruption. Second, companies should accelerate investments in digital diagnostic platforms and data analytics capabilities, leveraging real-time insights to optimize dosing regimens and demonstrate product differentiation in efficacy studies. Together, these initiatives will enhance customer satisfaction and fortify pricing power.

Simultaneously, organizations need to forge collaborative partnerships with academic research institutions and regulatory agencies to co-create next-generation anthelmintics, particularly in segments facing mounting resistance. These alliances can expedite clinical development, de-risk regulatory approvals, and position firms as innovation leaders. Furthermore, adopting comprehensive sustainability roadmaps-encompassing green chemistry, eco-toxicology assessments, and circular economy principles-will resonate with policymakers and end-users who demand responsible product stewardship. Finally, a cohesive go-to-market model that combines value-based contracting, targeted education programs, and agile commercial teams will ensure that differentiated product attributes translate into tangible adoption and long-term customer loyalty.

Rigorous Research Methodology Combining Primary and Secondary Data Collection with Analytical Techniques to Ensure Robust and Actionable Market Insights

This analysis integrates both primary and secondary research methodologies to ensure robust and actionable insights. Primary research involved in-depth interviews with key opinion leaders in veterinary parasitology, procurement managers at major livestock integrators, and field practitioners in aquaculture and companion animal care. These conversations provided first-hand perspectives on efficacy requirements, formulation preferences, and pain points related to supply chain and regulatory compliance. Complementing this, a comprehensive review of regulatory filings, patent databases, and scientific literature enabled quantification of innovation pipelines, identification of resistance trends, and evaluation of environmental risk assessment frameworks.

Secondary research drew upon publicly available sources such as peer-reviewed journals, industry association reports, and government trade data to construct a detailed understanding of tariff histories, segment dynamics, and regional policy landscapes. Analytical techniques, including SWOT analyses, scenario planning, and value chain mapping, were employed to triangulate findings and validate strategic implications. Data quality checks and expert debriefs ensured that insights reflect current market realities and anticipate near-term developments. This rigorous, mixed-method approach fosters confidence in the conclusions drawn and supports decision-makers in crafting evidence-based strategies for the rapidly evolving antiparasitic drug sector.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Antiparasitic Drugs market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Antiparasitic Drugs Market, by Drug Class

- Antiparasitic Drugs Market, by Veterinary

- Antiparasitic Drugs Market, by By Spectrum of Activity

- Antiparasitic Drugs Market, by Route of Administration

- Antiparasitic Drugs Market, by Region

- Antiparasitic Drugs Market, by Group

- Antiparasitic Drugs Market, by Country

- United States Antiparasitic Drugs Market

- China Antiparasitic Drugs Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Concluding Synthesis of Key Findings Underscoring Strategic Imperatives for Sustained Growth in the Veterinary Antiparasitic Drug Sector

In synthesizing the key findings, it is clear that the veterinary antiparasitic drug market is at an inflection point where innovation, sustainability, and strategic resilience intersect. Novel drug classes such as amino-acetonitrile derivatives and spiroindoles are set to address mounting resistance challenges, while established benzimidazoles and macrocyclic lactones continue to evolve through label expansions and enhanced formulations. Concurrently, the lasting influence of United States tariff policies through 2025 underscores the need for agile supply chain strategies and proactive duty mitigation planning.

Regional variances-from the harmonized regulatory environment of the Americas to the rigorous environmental standards in EMEA and the growth-oriented dynamics of Asia-Pacific-demand tailored commercialization roadmaps and strategic partnerships. Leading companies are seizing opportunities by investing in digital health platforms, forging R&D collaborations, and embedding eco-friendly manufacturing practices into their core operations. For industry participants, the path to sustained growth lies in integrating these strategic imperatives into cohesive, data-driven action plans that balance short-term resilience with long-term innovation pipelines. Such an approach will enable organizations to maintain competitive differentiation, optimize resource allocation, and deliver superior therapeutic value across livestock, companion animal, and aquaculture segments.

Immediate Next Steps and Personalized Engagement with Ketan Rohom to Secure the Comprehensive Antiparasitic Drug Market Research Report Today

To procure the full market research report on antiparasitic drugs and gain an in-depth understanding of the factors shaping this critical veterinary segment, you are invited to contact Ketan Rohom, Associate Director of Sales & Marketing. Ketan will provide a customized overview of the research scope, answer any queries regarding methodology or insights, and guide you through the available report packages tailored to your strategic requirements. Engaging directly with Ketan ensures that you receive personalized assistance in selecting the right deliverables, whether you need comprehensive analysis across drug classes, deep dives into regional dynamics, or competitive benchmarking of leading players.

By reaching out today, you can expedite your access to actionable intelligence that will inform product development, supply chain optimization, and go-to-market planning. Ketan’s expertise in translating complex data into clear, high-impact recommendations will help you navigate evolving regulatory environments, anticipate cost pressures from tariff regimes, and capitalize on emerging opportunities in aquaculture, companion animals, and livestock. Don’t delay in securing the insights that will empower your organization to stay ahead of market shifts and drive sustainable growth. Contact Ketan Rohom now to explore report customization options and finalize your purchase of the comprehensive antiparasitic drug market research report.

- How big is the Antiparasitic Drugs Market?

- What is the Antiparasitic Drugs Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?