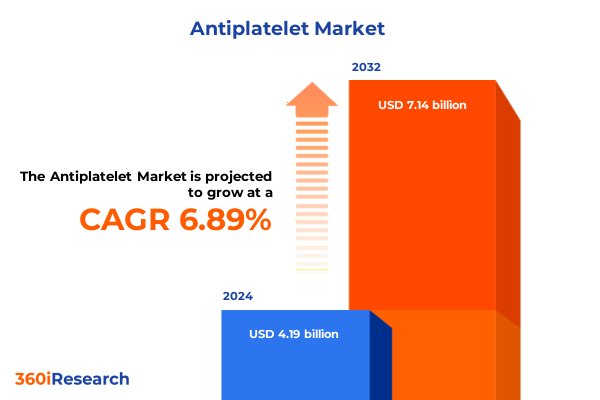

The Antiplatelet Market size was estimated at USD 4.46 billion in 2025 and expected to reach USD 4.75 billion in 2026, at a CAGR of 6.95% to reach USD 7.14 billion by 2032.

Comprehensive overview of antiplatelet therapy dynamics highlighting evolving clinical benefits patient outcomes and strategic opportunities across the ecosystem

Cardiovascular disease remains a leading cause of morbidity and mortality worldwide, and antiplatelet therapies play a pivotal role in preventing thrombotic events and improving patient outcomes. As clinical guidelines evolve to emphasize tailored regimens and combination strategies, stakeholders across the value chain-from pharmaceutical innovators to clinical practitioners-are recalibrating priorities to meet increasingly complex therapeutic needs. This introduction sets the stage for an in-depth exploration of key factors transforming the antiplatelet landscape and identifies the strategic imperatives that will define future success.

Over the past decade, advancements in molecular pharmacology have expanded the spectrum of antiplatelet agents beyond traditional aspirin therapy to include next-generation P2Y12 antagonists and emerging phosphodiesterase inhibitors. In parallel, regulators have signaled greater receptivity to therapies demonstrating robust risk-benefit profiles in real-world settings, prompting a wave of clinical trials and post-market studies aimed at optimizing dosing and reducing adverse events. Consequently, manufacturers are navigating an environment in which scientific differentiation and patient adherence solutions are as critical as chemical innovation.

This executive summary provides a structured analysis of the most significant trends shaping the antiplatelet market. It begins by examining transformative shifts in technology and patient engagement, then assesses the cumulative effects of new US tariff policies on supply chains and pricing. Subsequent sections distill granular segmentation perspectives, regional dynamics, and competitive positioning before outlining actionable recommendations, rigorous research methods, and concluding reflections designed to inform strategic decision-making.

How advancing technologies novel mechanism insights and patient-centric approaches are revolutionizing antiplatelet therapy delivery and shaping competitive landscapes

Recent years have ushered in a series of transformative shifts that extend well beyond molecule discovery, ushering in an era of integrated care models and precision therapy. Advancements in digital health platforms have enabled remote monitoring of platelet function, facilitating timely adherence interventions and dosage optimizations. Moreover, artificial intelligence–driven tools now support the early identification of high-risk patients by analyzing complex datasets, thereby informing clinician decision making and refining treatment algorithms.

Simultaneously, the pharmaceutical industry is responding to payer demands for value-based evidence by embedding real-world data into post-approval studies. This has accelerated the adoption of outcome-oriented contracts, in which reimbursement levels align with measurable reductions in ischemic events. Furthermore, patient-centric initiatives-such as mobile adherence reminders and virtual coaching-have enhanced engagement, reducing discontinuation rates and strengthening the overall value proposition of antiplatelet regimens.

As a result of these converging forces, competitive dynamics are shifting from a singular focus on molecular potency to a holistic emphasis on integrated solutions that encompass diagnostics, digital adherence platforms, and outcome-based contracting. Stakeholders that pivot rapidly to embrace this new paradigm-leveraging partnerships with technology providers and health systems-stand to capture disproportionate market share while delivering superior clinical and economic benefits.

Examining the multifaceted effects of United States 2025 tariff adjustments on supply chain stability pricing frameworks and strategic market positioning in antiplatelet therapies

The introduction of new United States tariffs in early 2025 has created ripple effects across global antiplatelet supply chains, particularly for APIs and key raw materials sourced from international manufacturing hubs. Pharmaceutical companies are confronting increased landed costs and tighter margins, prompting a reevaluation of procurement strategies. In response, some manufacturers are pursuing dual-sourcing arrangements and local near-shoring partnerships to diversify risk and maintain uninterrupted availability of critical compounds.

Concurrently, pricing pressures have intensified as payers scrutinize cost trajectories and demand greater transparency around cost components. To mitigate margin erosion, several market participants have renegotiated long-term contracts and explored vertical integration opportunities, including toll-manufacturing and captive API production. These shifts underscore a broader trend toward supply chain resilience, in which the agility to reconfigure logistical networks becomes as valuable as traditional scale economies.

Despite these challenges, tariff-induced disruption has also spurred innovation in cost management. Companies are investing in process intensification techniques-such as continuous flow manufacturing-to improve yield and reduce energy consumption. Furthermore, strategic collaborations with customs and trade experts are streamlining compliance workflows and accelerating clearance timelines. Ultimately, organizations that proactively adapt to this new trade environment will fortify their competitive positioning and safeguard patient access to vital antiplatelet therapies.

In-depth exploration of market segmentation perspectives from drug type formulations and indications through to mechanisms modes of delivery and end-user dynamics

When examining antiplatelet therapy through the lens of drug type, it is evident that a distinct competitive hierarchy has emerged. Traditional COX inhibitors like aspirin retain broad utilization for primary prevention, while monoclonal antibody derivatives such as Abciximab and small-molecule agents including Ticagrelor and Prasugrel have gained traction in acute settings due to their rapid onset and reversible binding characteristics. Clopidogrel’s entrenched role in maintenance therapy persists, yet newer P2Y12 inhibitors are capturing incremental share among higher-risk cohorts. Meanwhile, phosphodiesterase inhibitors like Dipyridamole continue to serve niche populations with specific contraindications to other agents.

In terms of drug formulation, oral dosage forms dominate long-term management channels, with tablets and capsules ideally suited for once-daily dosing schedules that enhance adherence. Conversely, injectable formulations remain indispensable in procedural and acute care pathways, enabling controlled administration in peri-operative and catheterization scenarios. The interplay between indication and formulation is particularly pronounced in stroke management, where intravenous therapies facilitate immediate platelet inhibition in acute ischemic events, while subpopulations with hemorrhagic risk require tailored oral regimens post-stabilization.

Mechanism of action offers further granularity, revealing that P2Y12 inhibitors command significant attention for their proven efficacy in reducing recurrent events, whereas selective COX inhibition maintains cost-effectiveness in broader primary prevention. Phosphodiesterase inhibitors carve out a specialized niche, balancing hemodynamic profiles with bleeding risk. The choice between intravenous and oral administration correlates closely with patient setting, as hospital and clinic environments favor parenteral options, while ambulatory and homecare settings rely on oral therapies. Distribution channels reflect this dichotomy: hospital pharmacies manage emergency and inpatient demand, online platforms cater to refill convenience, and retail outlets serve community-based chronic therapy. Ultimately, the end-user spectrum-from ambulatory surgical centers to homecare environments-underscores the need for a diversified portfolio that addresses both acute intervention and long-term maintenance seamlessly.

This comprehensive research report categorizes the Antiplatelet market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Drug Type

- Drug Formulation

- Indication

- Mechanism of Action

- Mode of Administration

- Distribution Channel

- End User

Strategic regional analysis highlighting diverse market drivers regulatory frameworks and growth trajectories across the Americas Europe Middle East Africa and Asia Pacific

The Americas region continues to lead global antiplatelet consumption, driven by well-established cardiovascular care infrastructure and substantial research investments. In the United States and Canada, market evolution pivots on payer negotiations and guideline updates, with decision makers prioritizing therapies that demonstrate both clinical superiority and cost containment. Latin American markets present a contrasting landscape, where emerging economies are expanding hospital capacity and generic adoption accelerates due to budgetary constraints and national procurement initiatives.

Europe, the Middle East, and Africa exhibit significant heterogeneity in market dynamics. Western European countries leverage centralized reimbursement assessments to drive standardized adoption of high-value therapies, while Eastern European markets are witnessing gradual uptake as healthcare funding improves. In the Middle East, government-backed health reforms and insurance expansions are increasing access to novel antiplatelet agents. Sub-Saharan Africa continues to grapple with infrastructure challenges, yet growing public-private partnerships are enhancing supply chain reliability and clinician training in acute care settings.

Asia-Pacific markets are characterized by rapid growth in both developed and emerging economies. Japan’s mature healthcare ecosystem prioritizes innovative therapies supported by robust clinical data, whereas China and India are experiencing a surge in pharmaceutical manufacturing and generic entry. Southeast Asian nations are investing in digital health platforms that improve patient adherence, while Australia and New Zealand emphasize pharmacovigilance and therapeutic monitoring. Taken together, regional nuances in regulatory frameworks, infrastructure maturity, and funding models underscore the importance of tailored market access strategies.

This comprehensive research report examines key regions that drive the evolution of the Antiplatelet market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Critical competitive analysis revealing how leading pharmaceutical players deploy innovation pipelines partnerships and market tactics to secure advantage in antiplatelet therapies

Leading multinational pharmaceutical companies continue to vie for dominance through differentiated pipelines and strategic alliances. For instance, global innovators with legacy antiplatelet franchises are investing in next-generation molecules that promise improved safety profiles and compatibility with emerging interventional technologies. These legacy players often complement organic research efforts with targeted acquisitions of specialty biotech firms, bolstering their R&D pipelines and accelerating product launches in priority markets.

At the same time, several companies are forging co-development partnerships that leverage each partner’s strengths-combining clinical trial expertise with advanced formulation capabilities or digital health integration. Such alliances enable more flexible risk-sharing structures and faster time to market. Mid-sized players and regional specialists are also intensifying efforts to secure niche positions by focusing on underserved indications, such as peripheral artery disease, and investing in real-world evidence programs that demonstrate value in specific patient cohorts.

Generic and biosimilar manufacturers have not been passive observers; they are augmenting traditional cost-leadership strategies with value-added services such as patient support programs and homecare infusion solutions. These providers often collaborate with distribution networks to streamline procurement and enhance supply chain transparency. As competition intensifies across the antiplatelet sector, companies that effectively integrate innovation, partnership, and service differentiation will establish sustainable competitive advantages.

This comprehensive research report delivers an in-depth overview of the principal market players in the Antiplatelet market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Alta Laboratories Ltd.

- Apotex Inc.

- AstraZeneca PLC

- Bayer AG

- Boehringer Ingelheim International GmbH

- Bristol Laboratories Ltd.

- Bristol-Myers Squibb Company

- Cipla Limited

- Daiichi Sankyo Company, Limited

- Dr. Reddy’s Laboratories Ltd.

- Genentech, Inc. by F. Hoffmann-La Roche AG

- Lupin Ltd.

- Natco Pharma Limited

- Otsuka Pharmaceutical Co., Ltd.

- Perrigo Company PLC

- Pfizer Inc.

- Sanofi S.A

- Shenzhen Salubris Pharmaceuticals Co., Ltd.

- Sun Pharmaceutical Industries, Inc.

Actionable strategies for industry leaders to optimize portfolios strengthen resilience enhance stakeholder engagement and capitalize on emerging opportunities in antiplatelet care

Industry leaders should prioritize portfolio diversification by expanding beyond single-mechanism agents into combination therapies and digital adherence offerings. This approach can create differentiated value propositions that resonate with payers and providers seeking comprehensive solutions rather than standalone drugs. Furthermore, accelerating investments in near-term supply chain resilience-through local API sourcing, process intensification initiatives, and advanced analytics-will mitigate the impact of external trade disruptions and ensure continuity of patient care.

Additionally, companies are advised to engage proactively with regulatory authorities and payers to shape favorable outcome-based reimbursement frameworks. By presenting real-world data demonstrating reduced incidence of recurrent thrombosis and hospital readmissions, organizations can negotiate risk-sharing agreements that link payments to tangible patient benefits. Collaborations with technology partners to integrate remote monitoring and telehealth support can further enhance adherence and strengthen the case for premium contracting terms.

Finally, seizing opportunities in high-growth emerging markets requires bespoke access strategies that address local economic constraints and healthcare infrastructure gaps. This can involve tiered pricing models, public-private partnerships, and targeted physician training programs. By adopting a holistic strategy that combines innovation, policy engagement, and localized execution, industry leaders can capture new growth avenues while reinforcing their position in mature markets.

Robust blended methodology synthesizing primary expert insights secondary literature data validation and rigorous analysis underpinning comprehensive antiplatelet market intelligence

This research adopts a blended methodology that integrates primary and secondary data to deliver comprehensive antiplatelet market insights. Primary research involved in-depth interviews with cardiologists, interventional specialists, hospital procurement executives, and pharmacy directors across key regions. These discussions provided real-time perspectives on clinical preferences, formulary dynamics, and patient adherence challenges.

Secondary research encompassed a thorough review of peer-reviewed journals, clinical trial registries, regulatory filings, and annual reports. Special attention was given to safety and efficacy data for both established and novel antiplatelet agents, as well as analysis of tariff regulations and supply chain best practices. Triangulation techniques were employed to validate findings, cross-referencing quantitative data with expert insights to ensure consistency and accuracy.

Analytical rigor was further reinforced through statistical evaluation and scenario modeling. Sensitivity analyses examined the potential impact of tariff fluctuations, regulatory policy changes, and competitive launches on market dynamics. Finally, a cross-functional advisory board of industry veterans reviewed the methodology and provided strategic guidance, ensuring the study’s conclusions are robust, unbiased, and actionable for decision makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Antiplatelet market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Antiplatelet Market, by Drug Type

- Antiplatelet Market, by Drug Formulation

- Antiplatelet Market, by Indication

- Antiplatelet Market, by Mechanism of Action

- Antiplatelet Market, by Mode of Administration

- Antiplatelet Market, by Distribution Channel

- Antiplatelet Market, by End User

- Antiplatelet Market, by Region

- Antiplatelet Market, by Group

- Antiplatelet Market, by Country

- United States Antiplatelet Market

- China Antiplatelet Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1272 ]

Synthesis of key findings underscoring strategic imperatives collaborative innovation and future readiness in the evolving antiplatelet therapy landscape

The evolving antiplatelet market underscores a clear imperative for organizations to embrace both scientific innovation and integrated care solutions. As digital health tools and real-world evidence reshape value propositions, stakeholders must pivot from traditional drug-centric models to patient-centric ecosystems that deliver measurable outcomes. By doing so, companies will not only meet evolving clinical and economic demands but also foster stronger engagement with payers and providers.

Moreover, the ripple effects of trade policy adjustments have highlighted the need for enhanced supply chain agility and strategic sourcing. Manufacturers that invest in diversified procurement strategies and advanced manufacturing techniques will be better equipped to navigate geopolitical uncertainties without compromising product availability or cost efficiency.

In summary, the strategic convergence of portfolio diversification, regulatory collaboration, and market access innovation serves as the foundation for sustained growth. Organizations that take decisive action-leveraging cutting-edge science, data-driven insights, and adaptable commercial models-will secure a leadership position in the competitive antiplatelet therapy landscape.

Engaging call to connect with Ketan Rohom Associate Director Sales Marketing to secure essential antiplatelet market insights and drive informed decision-making

I invite senior decision makers and strategic partners to connect directly with Ketan Rohom, whose leadership in sales and marketing ensures tailored guidance and priority access to comprehensive market intelligence. Engaging with him will facilitate a seamless acquisition process and personalized support as you explore advanced antiplatelet therapy insights.

Reach out to Ketan Rohom to schedule a dedicated briefing or request a customized proposal, ensuring your organization secures the critical analysis needed to navigate competitive challenges and drive impactful outcomes in antiplatelet care.

- How big is the Antiplatelet Market?

- What is the Antiplatelet Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?