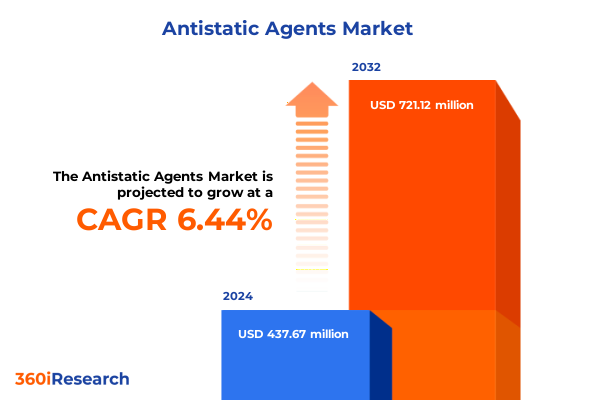

The Antistatic Agents Market size was estimated at USD 459.26 million in 2025 and expected to reach USD 486.26 million in 2026, at a CAGR of 6.65% to reach USD 721.12 million by 2032.

Unveiling the Essential Role of Antistatic Agents in Safeguarding Modern Product Quality Across Diverse Manufacturing Sectors

In today’s manufacturing environment static electricity represents an often-overlooked threat that can lead to production inefficiencies product defects and even safety hazards. Antistatic agents serve as critical additives designed to neutralize electrostatic build up on diverse material surfaces enhancing performance and protecting both products and personnel. With end use industries ranging from automotive to electronics packaging and textiles these specialized chemistries play a foundational role in maintaining quality standards and ensuring compliance with increasingly stringent regulatory requirements.

As global production networks become more interconnected and product complexity continues to rise the importance of reliable static control solutions has never been greater. End use manufacturers seek agents that deliver rapid discharge rates maintain long term stability and integrate seamlessly into existing formulations. The latest technological breakthroughs coupled with evolving environmental mandates are driving a shift toward more sustainable and multifunctional antistatic solutions. This comprehensive overview illuminates the current landscape of antistatic agents examining the forces that are reshaping demand their multifaceted applications and the strategic considerations that will underpin future growth.

Highlighting the Dynamic Shifts in Antistatic Agent Applications Driven by Technological Advances and Regulatory Pressures

The antistatic agent market is undergoing transformative shifts fueled by innovation in material science and mounting pressure to meet sustainability targets. Traditional commodity grade agents are giving way to next generation formulations incorporating nanostructured additives and bio based polymers that deliver enhanced conductivity along with reduced environmental impact. Breaking away from the one size fits all approach manufacturers are now tailoring surface active chemistries to specific substrate interactions enabling optimized performance in demanding high speed production lines.

Alongside technological advancements an uptick in global regulatory scrutiny concerning volatile organic compounds and persistent chemicals has compelled suppliers and end users to pivot toward more ecofriendly alternatives. This shift is not purely regulatory but also increasingly customer driven as brands seek to demonstrate environmental responsibility throughout their supply chains. Consequently the landscape of antistatic solutions is evolving from reactive static discharge control to proactive material engineering strategies emphasizing multifunctional performance attributes that align with circular economy principles.

Examining the Far-Reaching Impact of 2025 United States Tariffs on the Antistatic Agent Supply Chain and Cost Structures

The introduction of incremental tariff measures in the United States during the first half of 2025 has introduced new complexities for stakeholders within the antistatic agent supply chain. Key raw material imports originating from various international suppliers are now subject to duties that have accentuated cost pressures and prompted critical reassessments of supplier relationships. As a result many formulators have experienced compression of margins forcing either absorption of higher input costs or strategic adjustments to their pricing models.

In response manufacturers and distributors have rapidly diversified sourcing strategies seeking alternative low cost origins and exploring vertical integration opportunities. Domestic capacity expansions have accelerated as potential antidotes to elevated import expenses with some industry participants investing in localized production hubs. Concurrently, compliance teams are engaging more closely with customs intermediaries and legal experts to navigate tariff exemptions and leverage classification amendments. These collective adaptations underscore the importance of supply chain agility in a shifting trade environment and mark a pivotal moment for redefining cost management frameworks and partnership ecosystems.

Deriving Actionable and Comprehensive Insights from Agent Type Application Form and End Use Industry Segmentation for Strategic Decision Making

A nuanced examination of agent type segmentation reveals that surface active chemistries continue to dominate surface treatment processes by enabling rapid electrostatic dissipation across coated films fabrics and engineered plastics. In contrast, external antistatic agents applied as post treatment coatings are favored for low volume production runs where ease of application outweighs long term durability. Internal antistatic agents integrated directly into polymer matrices offer greater longevity and enhanced performance in high abrasion automotive interiors and advanced packaging solutions.

Turning to application based segmentation, developments within the automotive industry have seen selective uptake of antistatic additives in exteriors for paint systems as well as in interiors to improve user comfort on seating and dashboard components. Within electronics, the relentless miniaturization of PCB and semiconductor architectures has driven demand for agents that provide uniform static control without compromising thermal or electrical conductivities. In the packaging sector, thin films and flexible sheets engineered with antistatic functionalities protect sensitive electronics during transit whereas molded components benefit from masterbatch formulations that deliver consistent dispersion and processing efficiency. Textiles have similarly leveraged surface treatments on fabrics and fibers to prevent static cling and enhance wearer comfort in performance apparel and home furnishings.

The interplay between end use industries underscores that automotive applications remain a cornerstone driver supported by rigorous quality standards while electronics segments demand cutting edge innovations to support next generation device fabrication requirements. Meanwhile packaging and textile sectors continue to adopt antistatic solutions at varying intensities based on product sensitivity and regulatory frameworks. Evaluating form factor preferences highlights that liquid agents maintain widespread usage due to their adaptability in coating processes whereas masterbatch concentrates and powdered additives are gaining traction in molding and extrusion operations where process integration and cost control are paramount.

This comprehensive research report categorizes the Antistatic Agents market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Agent Type

- Form

- Application

- End Use Industry

Unlocking regional dynamics growth opportunities and region-specific innovation trends across the Americas Europe Middle East Africa and Asia Pacific markets

Regional dynamics play an instrumental role in shaping the trajectory of the antistatic agent market as each territory presents distinct regulatory landscapes supply chain infrastructures and end use industry maturities. In the Americas stringent standards for electronic component reliability and a mature automotive sector have fostered consistent demand for high performance antistatic formulations. Research and development centers located near major manufacturing clusters facilitate rapid product customization while well established distribution channels ensure agile market responsiveness.

Across Europe the Middle East and Africa, a combination of rigorous chemical regulations and ambitious sustainability agendas has accelerated the adoption of eco friendly antistatic solutions. Collaborative initiatives between regional policymakers and industry associations are driving harmonization of safety standards thereby simplifying cross border trade and encouraging innovation investment. Manufacturers have capitalized on these conditions by establishing centers of excellence focused on bio based additive development and closed loop recycling methodologies.

In the Asia Pacific region the phenomenal growth of consumer electronics automotive and packaging industries has elevated requirements for antistatic performance alongside cost competitiveness. Key markets in China India Japan and Southeast Asia are investing heavily in domestic specialty chemical production capacities to reduce import dependencies and gain greater control over supply chain resilience. Partnerships with local research institutes and government backed innovation programs are fueling breakthroughs in next generation conductive polymers and multifunctional coatings tailored to high volume manufacturing environments.

This comprehensive research report examines key regions that drive the evolution of the Antistatic Agents market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Profiles of Leading Antistatic Agent Manufacturers Highlighting Innovation Collaboration and Market Positioning

Leading players have differentiated themselves through strategic investments in R&D collaboration and geographic expansion to address the evolving needs of antistatic applications. Global specialty chemical companies have channeled resources toward developing low migration agents that align with food contact and medical device requirements while smaller innovators have focused on niche segments such as bio derived antistatic additives for sustainable textile treatments. Alliances between raw material suppliers and formulation experts are becoming increasingly common as stakeholders seek to accelerate time to market and co create next generation product offerings.

Furthermore, mergers and acquisitions have emerged as a key lever for companies aiming to broaden their technology portfolios and capture synergies across complementary chemistries. Forward looking organizations are also prioritizing digitalization of their supply networks employing advanced analytics and blockchain enabled traceability to ensure consistent quality control and regulatory compliance. As environmental social and governance imperatives continue to intensify, top tier manufacturers are embedding sustainability metrics into corporate scorecards thereby ensuring their product roadmaps align with long term decarbonization goals.

This comprehensive research report delivers an in-depth overview of the principal market players in the Antistatic Agents market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- ADEKA Corporation

- Ampacet Corporation

- Arkema S.A.

- BASF SE

- Clariant AG

- Croda International Plc

- Dow Inc.

- DuPont de Nemours, Inc.

- Evonik Industries AG

- Kao Corporation

- Mitsubishi Chemical Group Corporation

- Nouryon N.V.

- Solvay S.A.

- Tosaf Compounds Ltd.

Empowering Industry Leaders with Pragmatic Strategies to Navigate Regulatory Challenges and Drive Growth in Antistatic Agent Markets

In the face of evolving regulatory frameworks and supply chain uncertainties industry leaders should adopt a proactive stance centered on agility and sustainability. Prioritizing investment in multifunctional antistatic chemistries capable of meeting both performance and environmental criteria will help differentiate portfolios and reduce regulatory exposure. Diversifying raw material procurement by expanding partnerships across multiple geographies can mitigate tariff risks and strengthen resilience against geopolitical disruptions.

Simultaneously organizations should deepen collaboration with end use customers through joint development programs harnessing virtual prototyping and pilot line validations to accelerate time to market. Embracing digital supply chain solutions such as real time monitoring of inventory quality and automated compliance reporting will streamline operations and free up resources for strategic innovation. Finally embedding sustainability considerations into every stage of the value chain from raw material sourcing to end of life recovery will not only satisfy emerging stakeholder expectations but also unlock new revenue streams tied to circular economy initiatives.

Outlining a Rigorous Research Framework Leveraging Primary and Secondary Methodologies for Comprehensive Antistatic Agent Analysis

This analysis is underpinned by a structured research framework integrating both primary and secondary methodologies to ensure depth accuracy and relevance. Primary research was conducted through in depth interviews with senior executives process engineers and procurement specialists representing key stakeholders across major end use industries. Detailed surveys captured qualitative insights on formulation preferences market trends and strategic priorities while on site visits to manufacturing facilities provided a firsthand understanding of application challenges.

Complementing primary inputs, an extensive review of secondary sources was carried out including industry journals regulatory filings academic publications and patent databases. Market literature was triangulated with publicly available information from trade associations and government agencies to validate findings. Data synthesis employed rigorous cross referencing techniques ensuring that conclusions were corroborated by multiple independent evidence streams. This multifaceted approach guarantees a comprehensive portrayal of the antistatic agent landscape from both strategic and technical perspectives.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Antistatic Agents market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Antistatic Agents Market, by Agent Type

- Antistatic Agents Market, by Form

- Antistatic Agents Market, by Application

- Antistatic Agents Market, by End Use Industry

- Antistatic Agents Market, by Region

- Antistatic Agents Market, by Group

- Antistatic Agents Market, by Country

- United States Antistatic Agents Market

- China Antistatic Agents Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Synthesizing Key Findings to Illuminate Future Pathways and Strategic Imperatives in the Evolving Antistatic Agent Industry

The analysis presented in this executive summary underscores the critical role antistatic agents play across a diverse array of manufacturing sectors and highlights the dynamic forces driving their evolution. Technological innovations have ushered in advanced formulations that balance performance with environmental considerations while regulatory developments and trade measures have reshaped cost structures and supply chain strategies. By examining segmentation and regional nuances critical insights emerge that inform where investments in product development and infrastructure will yield the greatest returns.

Looking ahead competitive advantage will hinge on the ability to integrate cutting edge material science with sustainable business models and agile operational frameworks. Companies that anticipate end user demands collaborate closely with partners and harness data driven decision making will be best positioned to capitalize on emerging opportunities. Ultimately, a forward looking approach grounded in rigorous research methodology and strategic foresight will enable stakeholders to navigate complexities and drive growth in the ever advancing realm of antistatic agents.

Act Now to Secure Exclusive Insights and Expert Guidance by Connecting with Associate Director of Sales and Marketing for Your Custom Market Report

For organizations looking to transform insights into tangible competitive advantage, the time to act is now. Reach out directly to Ketan Rohom Associate Director Sales & Marketing to explore how this in-depth market research report can be tailored to address your specific challenges in formulation optimization regulatory compliance and supply chain resilience. By connecting with Ketan you will gain exclusive access to expert guidance detailed case studies and bespoke data visualizations that empower you to make faster confident decisions. Elevate your strategic planning and unlock growth opportunities by securing your copy of the report and scheduling a personalized briefing session with the industry’s foremost authority on antistatic agent trends and applications. Take this decisive step to ensure your organization remains at the forefront of innovation and market leadership in the rapidly evolving antistatic landscape.

- How big is the Antistatic Agents Market?

- What is the Antistatic Agents Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?