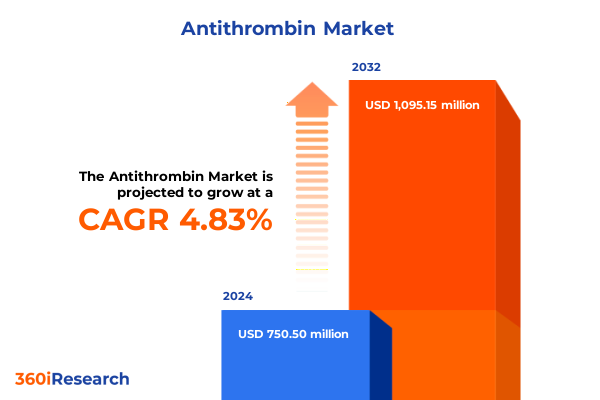

The Antithrombin Market size was estimated at USD 780.32 million in 2025 and expected to reach USD 818.65 million in 2026, at a CAGR of 4.96% to reach USD 1,095.15 million by 2032.

Setting the Foundation for Comprehensive Insights into Antithrombin’s Pivotal Mechanisms, Therapeutic Importance, and Emerging Industry Considerations

Antithrombin functions as a crucial serine protease inhibitor, orchestrating the fine balance between coagulation and anticoagulation within the human circulatory system. By binding to key clotting factors such as thrombin and factor Xa, antithrombin mitigates excessive fibrin generation, thereby averting pathological thrombosis. This endogenous controller of hemostasis plays an indispensable role in maintaining vascular integrity, especially under conditions of physiological stress or inflammatory challenge.

Inherited deficiencies of antithrombin manifest in increased susceptibility to thromboembolic events, while acquired insufficiencies frequently arise in the context of liver dysfunction, sepsis, or disseminated intravascular coagulation. Such imbalances compel clinicians to deploy exogenous antithrombin replacement therapies to restore homeostasis and reduce the risk of life-threatening clot formation. In recent years, the therapeutic landscape has expanded to accommodate both plasma-derived preparations and recombinant analogs, reflecting a concerted effort to enhance safety and supply reliability.

Amid growing clinical demand and evolving regulatory expectations, stakeholders are prioritizing refined manufacturing methods and advanced formulation strategies to optimize antithrombin stability and bioavailability. As we embark on an in-depth exploration of emerging innovations, tariff-driven market dynamics, and segmentation-based insights, this introduction frames the critical context for understanding antithrombin’s multifaceted significance across health systems and biopharmaceutical value chains.

Unveiling the Game-Changing Technological Innovations, Regulatory Milestones, and Clinical Advances Shaping the Evolution of Antithrombin Therapeutics

The antithrombin landscape is undergoing a period of transformative evolution driven by breakthroughs in molecular engineering, regulatory harmonization, and clinical validation. Next-generation recombinant production platforms now leverage transgenic expression systems and advanced cell-culture bioreactors to achieve higher yields and enhanced glycosylation profiles. These technological strides not only reduce reliance on limited human plasma pools but also support batch-to-batch consistency, which is critical for mitigating immunogenicity risks and ensuring predictable pharmacokinetic performance.

Concurrently, regulatory agencies across key markets have aligned quality standards for viral safety, protein characterization, and post-market surveillance. Harmonized guidelines now emphasize comprehensive viral inactivation validation and point-of-care traceability, reinforcing patient safety while streamlining global product registrations. This regulatory clarity has emboldened manufacturers to pursue accelerated pathway designations and conditional approvals, fostering a climate of innovation that aligns scientific excellence with expedited patient access.

Meanwhile, clinical research has validated antithrombin’s expanding role beyond congenital and acquired deficiency syndromes. Emerging evidence underscores its therapeutic potential in sepsis-associated coagulopathy and acute pancreatitis, where modulating inflammatory cascades can attenuate organ dysfunction. As ongoing trials evaluate novel formulations and dosing regimens, the cumulative impact of these shifts heralds a new era of antithrombin applications, reshaping both treatment paradigms and commercialization strategies.

Assessing the Far-Reaching Consequences of 2025 U.S. Tariff Adjustments on the Supply Chain, Cost Structures, and Market Accessibility of Antithrombin Products

In early 2025, the United States introduced revised tariff schedules targeting select biologic imports, a measure that has reverberated across the antithrombin supply chain. Raw materials derived from international suppliers now face elevated duties, prompting manufacturers to reevaluate procurement strategies and consider onshore production of critical intermediates. The result has been a marked recalibration of cost structures and a heightened emphasis on supply security to mitigate exposure to cross-border policy shifts.

These tariff adjustments have translated into incremental price pressures on both plasma-derived and recombinant antithrombin products. Companies reliant on foreign upstream inputs have absorbed part of the increased financial burden, while others have adjusted list pricing to preserve margin integrity. However, payers and health systems have responded cautiously to any wholesale price escalation, underscoring the importance of efficiency gains and value-based contracting models in preserving market accessibility.

As a consequence of these dynamics, forward-looking organizations have adopted multi-pronged strategies to navigate the new landscape. Some have deepened partnerships with domestic plasma centers to secure local sourcing, while others are investing in modular bioreactor systems to decentralize manufacturing. By blending strategic stockpiling, flexible supply agreements, and continuous process optimization, industry players are forging resilient pathways that balance cost containment with uninterrupted patient access.

Deriving Actionable Perspectives from Diverse Antithrombin Segmentation Dimensions Spanning Molecular Types, Sources, Forms, and Clinical Applications

A closer examination of antithrombin market segmentation unveils nuanced insights that can guide strategic decision-making. The distinction between alpha and beta antithrombin isoforms, defined by their glycosylation patterns and heparin-binding affinities, informs development priorities for high-efficacy recombinant constructs and tailored clinical applications. Parallel to this, the source dimension differentiates human plasma-derived antithrombin, prized for its established safety profile, from recombinant alternatives that promise scalable production and minimized contamination risk.

Likewise, the physical form segmentation underscores the trade-offs between liquid formulations, which afford ready-to-use convenience in acute care settings, and lyophilized powder presentations that enhance storage stability and simplify global distribution. From the vantage point of dosage form, the injectable preparations remain the mainstay for intravenous administration, while the emergence of oral suspensions points to future directions in outpatient management and self-administration models.

Therapeutic application classifications map demand drivers across acquired deficiency associated with surgical interventions and liver disorders, acute pancreatitis requiring anti-inflammatory modulation, congenital deficiency cases necessitating lifelong replacement, as well as coagulation dysregulation in disseminated intravascular coagulation, liver disease, and sepsis-associated coagulopathy. Finally, end-user segmentation highlights the diverse care settings from ambulatory surgical centers and diagnostic laboratories to hospitals, clinics, and research institutes, each with distinct procurement cycles, handling capabilities, and patient-centric requirements.

This comprehensive research report categorizes the Antithrombin market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Source

- Form

- Dosage Form

- Therapeutic Application

- End User

Illuminating Regional Variations in Antithrombin Adoption and Infrastructure Across the Americas, Europe Middle East & Africa, and Asia-Pacific Markets

Regional dynamics play a pivotal role in shaping antithrombin utilization and market maturity. In the Americas, robust reimbursement frameworks and well-established plasma donation networks underpin a high baseline adoption of both plasma-derived and recombinant antithrombin therapies. North American health systems prioritize rapid product availability for acute thrombotic interventions, while Canada’s regulatory environment has fostered cross-border collaborations that enhance regional supply resilience.

Across Europe, stringent pharmacovigilance requirements and centralized approval pathways have cultivated a highly standardized antithrombin ecosystem. The European Union’s emphasis on safety testing and traceability has raised the bar for product licensure, with member states leveraging shared assessment procedures to harmonize patient access. In the Middle East and Africa, pockets of investment in medical infrastructure-particularly within Gulf Cooperation Council countries-have begun to bridge longstanding gaps, although logistical hurdles in remote regions continue to challenge wide-scale deployment.

Meanwhile, the Asia-Pacific region is characterized by divergent trajectories. In markets such as Japan, regulatory rigor mirrors Western standards, supporting a growing appetite for recombinant innovations. China and India are rapidly expanding domestic bioprocessing capabilities to reduce import dependence, while emerging Southeast Asian markets are bolstering cold-chain networks to ensure reliable delivery of antithrombin products. Together, these regional insights illuminate the importance of tailored market entry strategies and localized stakeholder engagement.

This comprehensive research report examines key regions that drive the evolution of the Antithrombin market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Antithrombin Industry Stakeholders Highlighting Their Strategic Initiatives, Partnerships, and Innovative Pipeline Developments

A review of leading companies in the antithrombin arena reveals a blend of established biopharma incumbents and specialized plasma therapy organizations driving sector momentum. Key players have fortified their pipelines through strategic alliances, acquisitions, and internal R&D investments aimed at next-generation recombinant antithrombin analogs. High-profile partnerships between bioreactor technology providers and contract development manufacturers have accelerated scale-up timelines for novel constructs.

Notably, some manufacturers are pioneering modular production approaches that deploy single-use bioreactors in decentralized networks to mitigate supply chain disruption. Others are leveraging advanced purification platforms and chromatographic techniques to elevate product purity and yield. Meanwhile, select stakeholders are expanding their geographic footprints by establishing plasma collection centers in under-served regions, thereby enhancing raw material availability and fostering community engagement.

In parallel, a subset of industry leaders is augmenting their market portfolios through collaborative research with academic centers to explore antithrombin’s potential in inflammatory and cardiovascular indications. By integrating real-world evidence and health economics analyses into launch strategies, these organizations are building compelling value propositions that align therapeutic benefits with payer expectations. Collectively, these corporate initiatives underscore a vibrant ecosystem poised for continued evolution.

This comprehensive research report delivers an in-depth overview of the principal market players in the Antithrombin market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Baxter International Inc.

- Bio-Techne Corporation

- Biocon Ltd.

- Boehringer Ingelheim Pharma GmbH & Co. KG

- China Biologic Products, Inc.

- Diapharma Group, Inc.

- European Medicines Agency

- F. Hoffmann-La Roche Ltd

- Genesis BioPharma Services

- Grifols, S.A.

- Jiangsu Hengrui Medicine Co., Ltd.

- Lee Biosolutions, Inc.

- LFB USA, Inc.

- Merck KGaA

- Novartis AG

- Octapharma AG

- Pfizer Inc.

Translating Insights into Strategic Pathways for Industry Leaders to Strengthen Their Market Position and Drive Sustainable Growth in Antithrombin Therapeutics

To capitalize on emerging opportunities and navigate the evolving antithrombin landscape, industry leaders should prioritize a multi-pronged strategic agenda. First, investing in proprietary recombinant platforms can mitigate reliance on human plasma, while also creating differentiation through tailored glyco-engineering that enhances therapeutic performance. By channeling R&D resources into next-generation molecular designs, organizations can secure a first-mover advantage in high-value clinical segments.

Second, fostering partnerships with domestic plasma centers and biotechnology service providers will reinforce supply chain resilience. Integrating flexible manufacturing capacities-such as modular single-use bioreactors-can accommodate demand fluctuations and regional regulatory requirements without incurring prohibitive capital expenditures. In parallel, engaging early with regulatory authorities through scientific advice mechanisms fosters alignment on data expectations, accelerating approval timelines and market entry.

Third, companies should leverage holistic evidence generation frameworks that blend clinical trial outcomes with real-world data and health economics modeling. By articulating a compelling value narrative to payers and providers, stakeholders can negotiate value-based contracting arrangements that sustain favorable reimbursement terms. Finally, exploring patient-centric innovations-such as self-administered oral suspensions or long-acting formulations-can unlock new care pathways, driving broader adoption across outpatient settings and improving patient adherence.

Detailing a Rigorous Research Framework Integrating Systematic Review, Data Triangulation, and Expert Validation for Unbiased Antithrombin Market Insights

Our research deployed a comprehensive methodology integrating rigorous secondary data review, primary stakeholder engagement, and multi-angle validation to ensure robust insights into the antithrombin landscape. Initially, extensive literature and regulatory database scans provided foundational context on molecular mechanisms, approved therapies, and pipeline candidates. Supplementing this desk research, we conducted in-depth interviews with key opinion leaders, including hematologists, pharmacologists, and procurement directors, to capture nuanced perspectives on clinical demand and commercial dynamics.

Subsequently, data triangulation techniques were employed to reconcile information from corporate filings, clinical trial registries, and academic publications, enhancing the credibility of segmentation analyses and regional assessments. Quantitative cross-checks with publicly available healthcare utilization statistics further validated end-user consumption patterns, while direct consultations with manufacturing experts clarified emerging production innovations and cost considerations.

Finally, an expert validation workshop convened senior advisors from regulatory affairs, supply chain management, and patient advocacy groups to critique preliminary findings and refine strategic recommendations. This iterative framework-spanning systematic review, primary qualitative inquiry, and collaborative validation-ensures that our insights are both actionable and reflective of real-world market dynamics.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Antithrombin market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Antithrombin Market, by Type

- Antithrombin Market, by Source

- Antithrombin Market, by Form

- Antithrombin Market, by Dosage Form

- Antithrombin Market, by Therapeutic Application

- Antithrombin Market, by End User

- Antithrombin Market, by Region

- Antithrombin Market, by Group

- Antithrombin Market, by Country

- United States Antithrombin Market

- China Antithrombin Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Synthesis of Key Findings Underscoring the Strategic Imperatives and Future Directions for Stakeholders in the Antithrombin Therapeutic Arena

This executive summary has underscored antithrombin’s enduring importance as a cornerstone of hemostatic regulation and its expanding therapeutic horizons. From the accelerating pace of recombinant innovations and regulatory advancements to the tangible effects of U.S. tariff revisions on supply chains and cost structures, the landscape is being continually reshaped by scientific breakthroughs and policy shifts. Segmentation insights reveal the nuanced interplay of molecular types, sources, formulations, and clinical applications, while regional analyses highlight the differentiated trajectories across the Americas, EMEA, and Asia-Pacific.

Leading companies are navigating these dynamics through strategic alliances, modular manufacturing investments, and evidence-driven value propositions that align with payer priorities. To stay ahead, industry stakeholders must adopt a holistic approach encompassing advanced production platforms, diversified sourcing, proactive regulatory engagement, and patient-centric formulation development. By harnessing a rigorous research framework that integrates stakeholder insights and data validation, organizations can chart resilient pathways that balance innovation, access, and economic sustainability.

Looking forward, the antithrombin sector is poised for continued transformation as new modalities emerge, cross-border collaborations deepen, and digital health solutions complement traditional therapeutic models. For decision-makers seeking to translate these trends into competitive advantage, the insights contained within this report offer a strategic compass for navigating the intricate tapestry of antithrombin therapeutics.

Seize the Opportunity to Partner with Ketan Rohom and Gain Exclusive Access to the Comprehensive Antithrombin Market Research Report Tailored for Your Success

To explore the depth and breadth of these insights firsthand and equip your organization with a competitive advantage, reach out to Ketan Rohom. He stands ready to provide you with a tailored overview of the research report, discuss how its findings can inform your specific strategic priorities, and arrange seamless access to the comprehensive antithrombin market study. Engage today to transform insights into impact and position your team at the vanguard of antithrombin therapeutics innovation.

- How big is the Antithrombin Market?

- What is the Antithrombin Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?