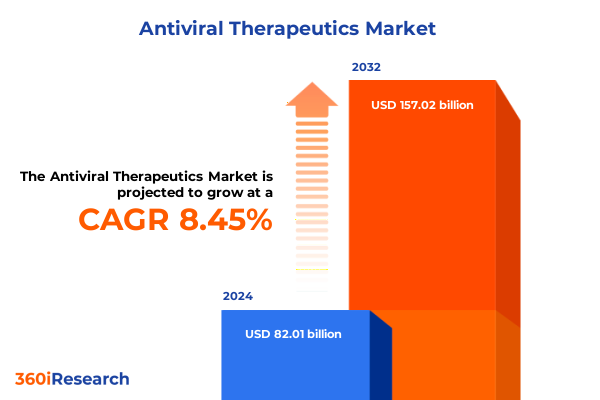

The Antiviral Therapeutics Market size was estimated at USD 88.29 billion in 2025 and expected to reach USD 95.06 billion in 2026, at a CAGR of 8.57% to reach USD 157.02 billion by 2032.

Discover How Advances in Antiviral Therapeutics Are Revolutionizing Treatment Paradigms and Addressing Global Health Challenges

The past decade has underscored the pivotal role of antiviral therapeutics in safeguarding global health, prompting a renaissance in research, development, and commercialization strategies. Scientific breakthroughs in molecular biology and virology have expanded the therapeutic arsenal beyond traditional small-molecule inhibitors to include monoclonal antibodies, polymerase blockers, and emerging RNA-based modalities. This evolution arrives at a time when viral threats continue to challenge public health systems, compelling stakeholders to adopt agile, data-driven approaches that accelerate product development while ensuring equitable patient access.

In parallel, shifting demographics and heightened awareness of zoonotic spillovers have amplified the imperative for broad-spectrum antivirals capable of tackling both endemic and pandemic agents. Consequently, investors and policymakers alike are prioritizing platforms that enable rapid response to novel pathogens while sustaining momentum against long-standing infections such as hepatitis C and HIV. By framing antiviral therapeutics within this dynamic context, this executive summary illuminates the forces driving innovation, outlines critical market trends, and sets the stage for informed decision-making across the research, manufacturing, and distribution continuum.

Exploring the Major Technological and Regulatory Transitions Reshaping the Antiviral Therapeutics Landscape Worldwide and Driving Future Therapeutic Opportunities

Innovation in antiviral therapeutics has accelerated as technology and regulation converge to reshape the development paradigm. Cutting-edge drug platforms, including mRNA vectors and structure-guided monoclonal antibodies, are redefining efficacy benchmarks and enabling precisely targeted interventions. Meanwhile, artificial intelligence and machine learning tools have entered the R&D workflow, optimizing lead identification and predicting viral resistance profiles long before clinical evaluation.

On the regulatory front, agencies have adopted expedited pathways and harmonized guidelines to balance rapid access with patient safety. Emergency use authorizations and adaptive trial designs have become integral to streamlining approval for high-impact treatments, while ongoing dialogues around patent frameworks and data exclusivity are fostering a more transparent intellectual property environment. Together, these technological and regulatory shifts are not only accelerating time to market but also fostering collaboration between biotech innovators, academic institutions, and government entities to anticipate and address future viral threats.

Analyzing the Complex Consequences of 2025 United States Tariffs on Supply Chains, Pricing Strategies, and Innovation in Antiviral Therapeutics

The introduction of new tariff measures in the United States during early 2025 has introduced both headwinds and strategic recalibrations within the antiviral therapeutics supply chain. Increased duties on imported active pharmaceutical ingredients and intermediates have placed upward pressure on manufacturing costs, prompting producers to seek localized sourcing solutions and to diversify supplier networks. These adjustments, while initially constraining margins, have encouraged domestic investments in API production and contract manufacturing capabilities.

Moreover, price sensitivity in the wake of these tariffs has heightened scrutiny around cost containment, leading companies to reexamine pricing strategies and to explore value-based contracting models with payers. In parallel, supply chain constraints have underscored the importance of inventory optimization and near-real-time demand forecasting, compelling stakeholders to leverage digital tracking and inventory management systems. Although the short-term impacts have presented logistical challenges, the cumulative effect is fostering a more resilient and vertically integrated manufacturing ecosystem within the antiviral therapeutics sector.

Unpacking Critical Segmentation Dimensions to Illuminate Disease Profiles, Drug Classes, Administration Methods, Distribution Channels, and Therapy Types

A nuanced understanding of market segmentation sheds light on the diverse therapeutic imperatives and delivery mechanisms shaping antiviral innovation. Disease type analysis reveals sustained demand for treatments targeting COVID-19 and influenza, alongside growing investment in interventions for cytomegalovirus, respiratory syncytial virus, and hepatitis C. Equally critical is the evolution of viral prophylaxis versus treatment dynamics, as stakeholders prioritize preventive approaches for high-risk populations while maintaining robust pipelines for therapeutic interventions.

Drug class segmentation underscores a transition from traditional polymerase inhibitors and NNRTIs toward advanced modalities such as monoclonal antibodies and fusion inhibitors, reflecting a strategic pivot toward mechanism-based efficacy. This evolution aligns with patient preferences for less invasive administration, mirrored by a shift in route of administration segmentation where injectable formulations dominate emergency use scenarios and oral therapies gain traction in outpatient settings. Concurrently, the rise of specialized distribution channels-from hospital and specialty clinics to online pharmacies-highlights the need for adaptable go-to-market strategies that accommodate evolving patient access models.

This comprehensive research report categorizes the Antiviral Therapeutics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Disease Type

- Drug Class

- Route Of Administration

- Therapy Type

- Distribution Channel

Producing In-Depth Regional Analyses Highlighting Growth Patterns and Strategic Dynamics Across the Americas, Europe Middle East & Africa, and Asia-Pacific

Geographical dynamics in antiviral therapeutics reveal differentiated growth patterns and strategic considerations. In the Americas, robust R&D infrastructures and high per-capita healthcare expenditure have bolstered the rapid adoption of novel antivirals, particularly in the United States where innovative pricing models and public-private partnerships drive access. Meanwhile, Canada’s emphasis on universal healthcare has accelerated negotiations around value-based agreements, shaping competitive dynamics in the antiviral space.

In Europe Middle East & Africa, regulatory harmonization under the European Medicines Agency has streamlined approvals for pan-regional indications, fostering collaboration across member states. However, cost containment pressures and heterogeneity in reimbursement frameworks have prompted manufacturers to pursue adaptive licensing and dynamic pricing strategies. In the Asia-Pacific region, accelerating investments in local manufacturing hubs across China, India, and Southeast Asian markets are reducing dependency on imports, while expanding healthcare coverage is fueling demand for both generic and patented antivirals. These regional insights inform tailored market entry and expansion plans that account for regulatory, economic, and infrastructure variances.

This comprehensive research report examines key regions that drive the evolution of the Antiviral Therapeutics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Stakeholders Driving Innovation, Collaborations, and Competitive Dynamics that Shape the Antiviral Therapeutics Sector

A landscape of leading companies is driving competitive intensity and therapeutic progress through diversified pipelines and strategic alliances. One major player has leveraged its expertise in nucleotide polymerase inhibitors to expand indications beyond hepatitis C, while another has partnered with biotechnology firms to co-develop next-generation monoclonal antibodies targeting emerging viral strains. Meanwhile, established pharmaceutical giants with proven antiviral portfolios have accelerated acquisitions of niche biotech innovators, reinforcing their market positions and unlocking access to novel platforms.

Smaller biotechs are also carving out high-value segments by focusing on broad-spectrum antivirals and repurposing existing therapeutics, capitalizing on streamlined clinical pathways and AI-enabled candidate selection. Collaboration across the value chain-including partnerships with diagnostic companies and healthcare providers-has emerged as a key differentiator, enabling seamless integration from early detection to treatment administration. Collectively, these efforts underscore a competitive ecosystem where agility, scientific expertise, and strategic partnerships are paramount.

This comprehensive research report delivers an in-depth overview of the principal market players in the Antiviral Therapeutics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- AbbVie Inc.

- Alkem Laboratories Limited

- AstraZeneca PLC

- Atea Pharmaceuticals, Inc.

- Aurobindo Pharma Limited

- Bristol-Myers Squibb Company

- Cipla Ltd.

- Cocrystal Pharma, Inc.

- Daiichi Sankyo Company, Ltd.

- Dr. Reddy’s Laboratories Ltd.

- Eli Lilly and Company

- F. Hoffmann-La Roche Ltd.

- Gilead Sciences, Inc.

- GlaxoSmithKline plc

- Hetero Labs Limited

- Johnson & Johnson Services Inc.

- Merck & Co., Inc.

- Novartis AG

- Pfizer Inc.

- Sanofi S.A.

- Sun Pharmaceutical Industries Limited

- Syngene International Limited

- Takeda Pharmaceutical Company Limited

- Themis Medicare Ltd.

- Venatorx Pharmaceuticals, Inc.

- Viatris Inc.

- Zydus Lifesciences Limited

Strategic Imperatives and Tactical Frameworks for Industry Leaders to Optimize Innovation, Collaboration, and Market Position in Antiviral Therapeutics

Industry leaders must adopt multifaceted strategies to thrive amid rapid innovation and market complexity. Prioritizing supply chain resilience through diversified sourcing and agile manufacturing platforms ensures continuity during geopolitical or regulatory disruptions. Investing in broad-spectrum antiviral research, alongside adaptive clinical trial designs, will accelerate response capabilities against both known and emerging pathogens.

Furthermore, integrating real-world evidence and digital health tools enhances patient stratification and outcome measurement, supporting more compelling value propositions for payers and providers. Engaging proactively with regulatory agencies to shape guidelines and expedite approvals will reduce time-to-market for breakthrough therapies. Finally, forging public-private partnerships and academic collaborations can amplify resource pools, share risk, and foster a holistic ecosystem that advances scientific discovery and maximizes patient impact.

Transparent Overview of Research Methodology Incorporating Robust Data Collection, Rigorous Analysis, and Expert Validation Processes

This report’s insights derive from a rigorous research methodology designed to ensure accuracy, transparency, and relevance. Primary research encompassed in-depth interviews with leading virologists, regulatory experts, and commercial strategists, providing first-hand perspectives on pipeline developments and market access challenges. Secondary research integrated data from peer-reviewed journals, regulatory filings, and corporate disclosures to map emerging trends and benchmark company performance.

Data validation employed triangulation techniques, cross-referencing quantitative findings with qualitative insights to mitigate bias and confirm consistency. Analytical models were calibrated using historical market behavior and scenario analyses, enabling robust segmentation and regional comparisons. Finally, an expert review board conducted iterative peer reviews to refine conclusions and recommendations, ensuring that the methodology meets the highest standards of academic and industry rigor.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Antiviral Therapeutics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Antiviral Therapeutics Market, by Disease Type

- Antiviral Therapeutics Market, by Drug Class

- Antiviral Therapeutics Market, by Route Of Administration

- Antiviral Therapeutics Market, by Therapy Type

- Antiviral Therapeutics Market, by Distribution Channel

- Antiviral Therapeutics Market, by Region

- Antiviral Therapeutics Market, by Group

- Antiviral Therapeutics Market, by Country

- United States Antiviral Therapeutics Market

- China Antiviral Therapeutics Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesizing Insights and Future Outlook to Reinforce the Strategic Value of Antiviral Therapeutics Intelligence for Decision Making

In summary, the antiviral therapeutics landscape is characterized by dynamic innovation, evolving regulatory frameworks, and strategic realignments driven by external forces such as tariffs and shifting patient needs. Stakeholders who understand these converging factors and anticipate future developments will be best positioned to capture emerging opportunities and mitigate risks.

Looking ahead, the integration of advanced modalities, digital health solutions, and resilient manufacturing practices will define the next wave of therapeutic breakthroughs. Continuous monitoring of pipeline advancements, regulatory shifts, and regional market dynamics remains essential for informed decision-making. By synthesizing these insights, industry participants can craft strategies that not only respond to present challenges but also proactively shape the future of antiviral therapeutics.

Act Now to Secure Comprehensive Market Intelligence from Expert Guidance and Empower Strategic Planning with Insights from Ketan Rohom

To gain a definitive competitive advantage, we invite you to connect with Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch) for a personalized briefing and to secure your copy of this in-depth antiviral therapeutics market research report. Through direct engagement, you’ll access tailored insights, actionable intelligence, and ongoing support designed to accelerate your strategic planning and commercial execution.

Act now to leverage expert analysis and comprehensive data that will empower your organization to navigate emerging challenges, identify untapped opportunities, and optimize your footprint across every segment of the antiviral therapeutics landscape. Reach out to Ketan Rohom today to unlock the full value of this authoritative resource.

- How big is the Antiviral Therapeutics Market?

- What is the Antiviral Therapeutics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?