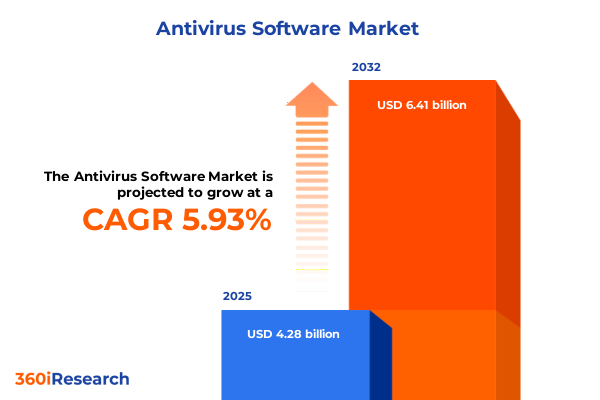

The Antivirus Software Market size was estimated at USD 4.28 billion in 2025 and expected to reach USD 4.53 billion in 2026, at a CAGR of 5.93% to reach USD 6.41 billion by 2032.

Comprehensive Contextual Introduction to the Antivirus Software Landscape Underscoring Evolving Threat Vectors Market Drivers Innovations and Opportunities

In today’s hyperconnected world, the antivirus software market sits at the epicenter of organizational resilience and individual digital safety. Cyberattacks have grown in both frequency and sophistication, exploiting vulnerabilities across endpoints, mobile devices, and cloud environments. As ransomware, fileless malware, and polymorphic threats continue to evolve, cybersecurity stakeholders are compelled to reassess traditional defenses and adopt solutions that offer advanced detection capabilities, streamlined deployment, and comprehensive coverage. From small business networks to enterprise IT infrastructures, the need for robust antivirus software has never been more pressing.

This landscape has shifted dramatically over the past decade. Initial antivirus tools focused primarily on signature-based detection, scanning files for known threat patterns. However, the rapid proliferation of zero-day exploits and advanced persistent threats has rendered signature-based approaches insufficient on their own. The market has responded with integrated endpoint protection platforms, artificial intelligence–driven threat intelligence, and extended detection and response frameworks that combine real-time analytics, behavioral monitoring, and automated remediation. Against this backdrop, understanding foundational technology trends, regulatory drivers, and evolving consumer behaviors is essential for any organization aiming to safeguard digital assets.

In-Depth Exploration of Transformative Technological Shifts Reshaping the Antivirus Software Ecosystem in a Rapidly Evolving Digital Era

The antivirus software ecosystem is undergoing transformative shifts that are redefining how organizations approach cybersecurity. Foremost among these is the integration of artificial intelligence and machine learning into threat detection engines. By leveraging supervised and unsupervised learning models, modern solutions can identify complex behavioral anomalies and previously unseen attack patterns in real time, significantly reducing dwell time and minimizing potential damage. As a result, cybersecurity teams can proactively hunt threats and automate response workflows, enabling a proactive rather than reactive security posture.

Concurrently, cloud-native architectures and platform-as-a-service deployments are reshaping delivery models. Security vendors now offer unified dashboards that monitor endpoints, across both private and public clouds, and automate updates without disrupting business continuity. This shift is complemented by the rise of managed detection and response (MDR) services, which provide continuous oversight and expert intervention for organizations lacking in-house cybersecurity resources. Moreover, the convergence of endpoint detection and response with extended detection and response has elevated cross-channel visibility, uniting endpoint, network, email, and cloud security under a single pane of glass.

Another critical trend is the proliferation of remote and mobile workforces, driven by increasingly flexible work arrangements. The resulting expansion of bring-your-own-device scenarios and Internet of Things ecosystems has widened the attack surface, compelling vendors to fortify mobile operating systems and integrate zero-trust principles. At the same time, evolving data privacy regulations across jurisdictions have placed new compliance demands on security solutions, ensuring that antivirus tools not only detect and mitigate threats but also adhere to stringent data handling and reporting requirements.

Rigorous Examination of the Cumulative Impact of United States Tariffs on Antivirus Software Procurement Deployment and Cost Structures in 2025

United States tariffs implemented in 2025 have introduced notable complexities into the procurement and deployment of antivirus software solutions. While software itself is generally intangible, many advanced security offerings rely on integrated hardware appliances for on-premises deployment-ranging from network gateways and endpoint management consoles to secure local data storage devices. Tariffs on imported hardware components have driven up capital expenditures for corporate network infrastructure and localized data centers, prompting organizations to re-evaluate their deployment strategies.

As cost pressures intensified, the appeal of cloud-hosted antivirus platforms has surged. Organizations have shifted workloads to public and private clouds to bypass import duties and reduce upfront hardware investment. This transition has accelerated the adoption of subscription-based licensing, enabling predictable operating expense models that align more closely with continuous threat intelligence updates and pay-as-you-go scalability. At the same time, some enterprises maintain hybrid configurations-combining local data center resilience with cloud orchestration-to balance performance, compliance, and cost considerations.

For security vendors, the tariff environment has prompted strategic adjustments. Many have expanded partnerships with domestic hardware manufacturers to localize production and mitigate import surcharges, while others have optimized their distribution channels to offer bundled software-as-a-service models. End users are now more scrutinous of total cost of ownership, factoring in both the tangible and intangible impacts of tariffs on their overall cybersecurity budgets. Ultimately, these dynamics underscore a market-wide pivot toward cloud-native delivery, subscription licensing, and integrated, tariff-resilient deployment architectures.

Key Segmentation Insights Revealing Critical Platform Deployment Service and Security Service Preferences Across Diverse Customer Profiles

Segmentation across various dimensions reveals nuanced customer priorities and purchasing behaviors in the antivirus software market. Demand differs markedly by platform, as Windows-based endpoints remain the primary target for ransomware and phishing exploits, prompting enterprises to invest heavily in advanced threat protection for desktops and servers. Mobile platforms such as Android and iOS drive investments in light-weight endpoint security, while macOS and Linux deployments often require specialized configurations to address unique UNIX-based vulnerabilities.

Deployment mode serves as another critical axis of differentiation. Cloud environments, whether private or public, offer rapid provisioning, automated threat intelligence updates, and elastic scalability, making them popular for subscription-based models. Conversely, on-premises deployments within corporate networks and local data centers continue to appeal to organizations with strict data residency or latency requirements. As a result, leading vendors provide flexible architectures that enable hybrid configurations, allowing security teams to distribute workloads according to regulatory, technical, and financial constraints.

Service type segmentation underscores a market divided between enhanced perpetual licensing and standard perpetual models, as well as annual or monthly subscription options. The enhanced perpetual model appeals to large enterprises seeking long-term, predictable ownership, whereas subscription licensing supports smaller organizations and those requiring agility in scaling or adapting to emerging threats. Within security services, advanced threat protection is often bundled with endpoint protection platforms for high-risk environments, while standard antivirus solutions remain prevalent among individual users and budget-sensitive small and medium enterprises.

Further distinctions emerge when considering organization size and distribution channels. Individual consumers often gravitate toward direct sales or online retailers for off-the-shelf antivirus packages, while large enterprises and SMEs leverage resellers and system integrators-ranging from channel partners and value-added resellers to in-house and third-party integrators-to implement comprehensive security frameworks. Finally, end-user segmentation between corporate and individual users drives tailored feature sets, with corporate customers prioritizing centralized management and compliance reporting, while individual consumers value ease of use and automated protection.

This comprehensive research report categorizes the Antivirus Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Platform

- Service Type

- Security Service

- Organization Size

- Deployment Mode

- Distribution Channel

- End User

Strategic Analysis of Regional Market Dynamics Highlighting Unique Growth Drivers and Challenges Across the Americas EMEA and Asia-Pacific

Regional dynamics in the antivirus software sector highlight divergent growth drivers and challenges across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, strong digital infrastructure, mature cybersecurity frameworks, and heightened regulatory scrutiny have fueled robust investments in advanced threat protection and extended detection and response platforms. The United States remains a global innovation hub for AI-driven security solutions, while Canada’s emphasis on data privacy has accelerated cloud security adoption among both public and private institutions.

Across Europe, Middle East & Africa, organizations contend with stringent data protection regulations, such as the GDPR, which mandate comprehensive audit trails and incident response capabilities. This regulatory environment has elevated demand for integrated compliance reporting within antivirus platforms. In the Middle East, rapid digital transformation initiatives and government-driven cybersecurity frameworks have catalyzed increased spending on managed security services. Meanwhile, Africa’s expanding banking and telecommunications sectors are driving adoption of lightweight antivirus solutions that prioritize scalability and cost efficiency.

In Asia-Pacific, the market is characterized by rapid digitalization and a booming mobile-first user base. Nations like China, Japan, and South Korea are at the forefront of cloud-native security innovations, investing heavily in endpoint protection integrated with secure access service edge architectures. Emerging economies in Southeast Asia and India are experiencing heightened demand for cost-effective subscription-based antivirus solutions, as small businesses and individual users seek flexible licensing models. Moreover, regional partnerships between global vendors and local distributors are facilitating tailored offerings that address language, regulatory, and infrastructural nuances.

This comprehensive research report examines key regions that drive the evolution of the Antivirus Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Comprehensive Profiling of Leading Antivirus Software Companies Emphasizing Strategic Differentiators Partnerships and Innovation Roadmaps

Leading antivirus software companies are distinguishing themselves through specialized capabilities, strategic partnerships, and innovation roadmaps aligned with evolving security paradigms. One prominent provider has integrated machine learning models directly into its endpoint protection platform, enabling near-instantaneous identification of zero-day exploits and reducing false-positive rates. This vendor’s emphasis on API-based integrations has facilitated seamless connectivity with third-party SIEM and cloud orchestration tools, strengthening its position among enterprise clients seeking consolidated security management.

Another key player has solidified its market share through strategic acquisitions, enhancing its advanced threat protection suite with real-time threat intelligence feeds sourced from global sensor networks. Its cloud-native backend architecture supports multi-tenant deployments and continuous threat hunting, appealing to service providers and large-scale enterprises. In parallel, a technology giant has leveraged its dominant operating system install base to offer deeply embedded endpoint security modules, creating a streamlined user experience that lowers the barrier to adoption for small businesses and individual consumers.

Meanwhile, nimble disruptors are forging partnerships with telecom providers to deliver managed detection and response services optimized for 5G networks and IoT deployments. Their offerings prioritize lightweight agents, behavioral analytics, and subscription licensing models that adapt to the needs of rapidly scaling startups. Across the board, these leading firms continue to invest in threat intelligence research, collaborative industry initiatives, and developer ecosystems to ensure their solutions remain at the vanguard of cybersecurity innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Antivirus Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AO Kaspersky Lab

- Aura Sub, LLC

- Avast Software s.r.o. by Gen Digital Inc.

- Beijing Qihu Keji Co. Ltd.

- Bitdefender LLC

- Cheetah Mobile Group

- Cisco Systems, Inc.

- Comodo Security Solutions, Inc.

- ESET, spol. s r.o.

- F-Secure Oyj

- Fortinet, Inc.

- G DATA CyberDefense AG

- K7 Computing Private Limited

- Malwarebytes Inc.

- McAfee LLC

- Microsoft Corporation

- Net Protector (Biz Secure Labs Pvt Ltd)

- NortonLifeLock Inc

- Panda Security, S.L.U.

- PC Matic, Inc.

- Quick Heal Technologies Limited

- S.C. BitDefender S.R.L.

- Sophos Group plc

- Surfshark B.V.

- Total Security Limited

- Trend Micro Incorporated

Actionable Strategic Recommendations for Industry Leaders to Accelerate Innovation Enhance Security Posture Foster Collaboration to Expand Market Reach

Industry leaders must adopt a multifaceted strategy to maintain market relevance and drive future growth in the antivirus software sector. First, they should prioritize the development of AI-driven threat detection engines that integrate both supervised and unsupervised learning capabilities. This will enable more accurate behavioral analysis across diverse endpoint environments and reduce reliance on signature updates. Concurrently, building unified extended detection and response platforms that span endpoints, cloud workloads, email, and network layers will deliver the cross-channel visibility demanded by modern security teams.

At the same time, vendors should enhance cloud-native delivery models by partnering with leading hyperscalers and telecom operators. Such partnerships will enable vendors to offer localized, compliant deployments while minimizing the impact of import tariffs on on-premises hardware. Offering flexible subscription packages, with monthly and annual options, will appeal to small and medium enterprises seeking predictable operational expenses. Large organizations, in turn, will benefit from enhanced perpetual licensing with value-added services such as threat intelligence subscription feeds and dedicated incident response support.

Furthermore, expanding the partner ecosystem through both channel partners and system integrators will be critical for reaching fragmented end-user segments. By providing comprehensive training programs, certification pathways, and co-marketing initiatives, vendors can empower resellers, value-added resellers, in-house integrators, and third-party integrators to deliver tailored solutions that address sector-specific requirements. Finally, continuous investment in user experience optimization, automation of remediation workflows, and compliance reporting features will solidify the vendor’s reputation as a trusted advisor to security decision-makers.

Detailed Account of Research Methodology Employed to Generate Robust Insights Ensuring Data Integrity Analytical Rigor and Sector Relevance

To generate these insights, a rigorous research methodology was employed that combined both secondary and primary research approaches. Initially, a comprehensive review of publicly available documentation-including regulatory filings, industry publications, technical white papers, and vendor press releases-established a baseline understanding of market trends and technological advancements. This phase also incorporated analysis of financial statements from leading antivirus software companies to identify strategic investments, M&A activity, and potential shifts in service models.

Subsequently, primary research was conducted through in-depth interviews with cybersecurity executives, IT decision-makers, and managed services providers. These discussions illuminated real-world deployment challenges, procurement criteria, and evaluation processes across different organization sizes and geographies. Concurrently, a structured survey of end users-from individual consumers to enterprise CISOs-was administered to quantify preferences around platform coverage, deployment modes, licensing models, and security services. Survey findings were triangulated with insights from threat intelligence databases to ensure alignment with the latest attack patterns and defensive innovations.

Finally, all collected data underwent a rigorous validation process that included cross-referencing vendor roadmaps, third-party technical assessments, and anonymized feedback from channel partners and system integrators. This multi-layered methodology ensured not only the reliability and accuracy of the findings but also the contextual relevance necessary for practical strategic planning.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Antivirus Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Antivirus Software Market, by Platform

- Antivirus Software Market, by Service Type

- Antivirus Software Market, by Security Service

- Antivirus Software Market, by Organization Size

- Antivirus Software Market, by Deployment Mode

- Antivirus Software Market, by Distribution Channel

- Antivirus Software Market, by End User

- Antivirus Software Market, by Region

- Antivirus Software Market, by Group

- Antivirus Software Market, by Country

- United States Antivirus Software Market

- China Antivirus Software Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2226 ]

Conclusive Synthesis of Market Drivers Challenges and Strategic Imperatives Characterizing the Antivirus Software Sector in 2025

The antivirus software market in 2025 is characterized by the convergence of advanced threat protection, cloud-native architectures, and AI-driven detection mechanisms. Traditional signature-based approaches have ceded ground to behavioral analytics and extended detection frameworks, while tariff pressures have accelerated the shift toward subscription-based, cloud-hosted platforms. Segmentation analysis reveals that platform diversity, deployment preferences, and service-type flexibility are key determinants of solution adoption, with varying emphasis across individual consumers, SMEs, and large enterprises.

Regionally, the Americas lead in innovation adoption, driven by mature infrastructures and regulatory imperatives, whereas EMEA’s strict data privacy regimes underscore integrated compliance features. Asia-Pacific’s rapid digital transformation and mobile-first orientation have created fertile ground for automated, scalable antivirus solutions. Meanwhile, leading vendors stand out through strategic partnerships, localized production strategies, and continuous investment in AI and threat intelligence research. To capitalize on these dynamics, industry participants must pursue integrated XDR architectures, diversified licensing models, and expansive partner ecosystems.

Ultimately, the most successful organizations will be those that leverage comprehensive market intelligence to align product roadmaps with emerging threat vectors, regulatory developments, and end-user expectations. By combining data-driven decision-making with agile innovation and robust collaboration frameworks, security vendors can both anticipate and neutralize the evolving threat landscape while delivering measurable business value.

Engaging Call-To-Action to Connect with Associate Director Sales Marketing to Gain Exclusive Access to a Comprehensive Antivirus Software Market Research Report

If you’re ready to delve deeper into the strategic implications of these findings and secure a competitive edge in the fast-evolving antivirus software market, you can connect directly with Ketan Rohom, Associate Director of Sales & Marketing. By leveraging his expertise and insights, your organization will gain early access to an in-depth market research report that unpacks detailed competitive analyses, granular regional trends, and actionable growth strategies.

This exclusive report is designed to empower decision-makers with the intelligence needed to navigate tariff challenges, capitalize on emerging technological shifts, and optimize segmentation across platforms, deployment models, service types, and distribution channels. Engaging with our associate director will ensure that you receive tailored guidance on how to integrate the latest innovations in AI-enabled threat detection, cloud-native security architectures, and subscription-based licensing models into your product and go-to-market roadmaps.

Don’t miss this opportunity to transform your cybersecurity strategy. Contact Ketan Rohom today to secure your copy of the comprehensive market research report and position your organization at the forefront of the antivirus software industry.

- How big is the Antivirus Software Market?

- What is the Antivirus Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?