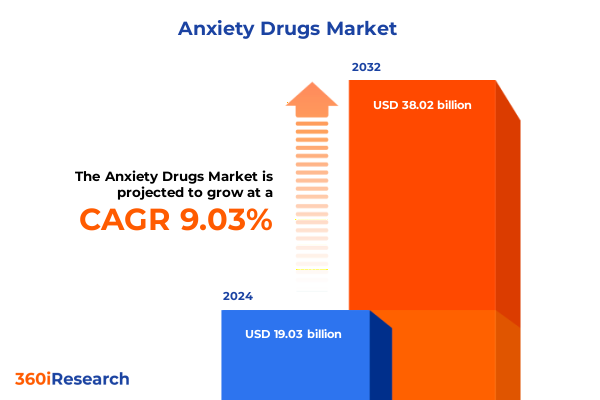

The Anxiety Drugs Market size was estimated at USD 20.72 billion in 2025 and expected to reach USD 22.50 billion in 2026, at a CAGR of 9.05% to reach USD 38.02 billion by 2032.

Setting the Stage for Innovative Anxiety Drug Dynamics Amidst Rapidly Evolving Clinical Practices Patient Preferences and Regulatory Landscapes

Anxiety disorders rank among the most prevalent mental health conditions globally, affecting over 4% of the population and representing a chronic burden on individuals and healthcare systems alike. Symptoms often manifest in childhood or adolescence and persist into adulthood, leading to significant impairments in social and occupational functioning, as well as increased risk of comorbidities such as depression and substance use. Despite the availability of effective pharmacotherapies, treatment uptake remains suboptimal, with only one in four patients receiving appropriate care in many settings.

In response to these challenges, the pharmaceutical industry has intensified efforts to innovate across a broad spectrum of anxiolytic agents. First-line therapies, including selective serotonin reuptake inhibitors and serotonin-norepinephrine reuptake inhibitors, have become mainstays of treatment guidelines, while benzodiazepines and beta blockers continue to play targeted roles in acute symptom management. Non-benzodiazepine options such as buspirone offer non-habit-forming alternatives, expanding patient choice and adherence potential.

Emerging Innovations and Clinical Paradigm Shifts in Anxiety Treatment Driven by Precision Medicine Digital Therapeutics and Novel Formulations

Over the past several years, the anxiety drug sphere has undergone dynamic transformations driven by advances in precision medicine and digital therapeutics. Pharmaceutical developers are increasingly leveraging biomarker-guided approaches to tailor treatment regimens, optimizing efficacy and minimizing adverse effects by aligning pharmacotherapy with individual genetic and phenotypic profiles. This personalized framework augments established therapies, enhancing clinical outcomes and patient satisfaction in both monotherapy and combination strategies.

Concurrently, digital health solutions have surged into prominence as complementary modalities that address adherence challenges and broaden access to evidence-based interventions. Software-as-a-medical-device applications now accompany traditional anxiolytics, employing artificial intelligence-driven coaching, mood tracking, and cognitive-behavioral modules to deliver round-the-clock support. Industry-wide momentum around integrated drug-software labels reflects this convergence, with regulatory agencies refining pathways to evaluate and reimburse digital therapeutic components alongside pharmacological treatments.

Innovations in formulation and administration have also reshaped the landscape. Novel nasal sprays and transdermal systems are under development to achieve rapid onset of action, while advanced drug-delivery platforms aim to improve tolerability and convenience. As a result, both clinicians and patients are empowered by a more diverse toolkit, enabling enhanced personalization of treatment journeys.

Assessing the Far-reaching Effects of 2025 US Pharmaceutical Tariff Policies on Anxiety Drug Supply Chains and Costs

In April 2025, the United States implemented a sweeping 10% global tariff on nearly all imported goods, explicitly encompassing active pharmaceutical ingredients and finished drug products. Simultaneously, punitive duties ranging from 20% to 25% were applied to APIs sourced from India and China under Section 301 and Section 232 investigations, reflecting intensified economic and national security considerations. These measures have reverberated across supply chains, prompting manufacturers to reassess sourcing strategies and accelerate domestic API production to mitigate exposure to escalating duties.

Consequently, production costs for key anxiolytic classes-particularly generic benzodiazepines and SSRIs-have risen, exerting upward pressure on pricing and reimbursement negotiations. Exemptions granted during early implementation phases have proven temporary, instilling uncertainty about long-term tariff stability. Retail and hospital pharmacies now face supply constraints as companies explore reshoring and alternative supplier networks to avoid tariff-induced cost spikes. Prioritizing resilience, leading players have begun diversifying logistics across Southeast Asia and Europe, hedging against further trade disruptions and ensuring continuity of medication availability in critical therapeutic categories.

Unveiling Deep-Dive Segmentation Perspectives Across Drug Classes Administration Routes Patient Demographics Indications and Distribution Channels

A foundational lens through which the anxiety drug market can be understood is its categorization by drug class, encompassing established benzodiazepines-with agents such as alprazolam, clonazepam, diazepam, and lorazepam that deliver rapid symptom relief-and non-addictive options like buspirone that target serotonin-dopamine pathways. The selective serotonin reuptake inhibitor category spans escitalopram, fluoxetine, paroxetine, and sertraline, each differentiated by pharmacokinetics and indication profiles, while serotonin-norepinephrine reuptake inhibitors duloxetine and venlafaxine offer dual neurotransmitter modulation for broader symptom control.

Routes of administration further refine market segmentation. Traditional oral formulations-capsules, tablets, and liquids-continue to dominate due to ease of use, whereas injectable intramuscular and intravenous benzodiazepine options play critical roles in acute care settings. Emerging interest in nasal spray delivery systems promises rapid central nervous system penetration, and transdermal patches offer the prospect of sustained release, although clinical uptake hinges on future pharmacodynamic validation.

Patient demographics influence both prescribing behaviors and unmet needs. Adult populations account for the bulk of prescriptions, yet geriatric patients present unique safety considerations, especially with long-acting benzodiazepines, and pediatric usage demands cautious off-label protocols. Clinical indications bifurcate by disorder type, with generalized anxiety disorder, obsessive-compulsive disorder, panic disorder, post-traumatic stress disorder, and social anxiety disorder each driving specific treatment patterns and regulatory pathways. Distribution channels-hospital pharmacies, retail pharmacies, and rapidly expanding online platforms-shape patient access and competitive dynamics.

This comprehensive research report categorizes the Anxiety Drugs market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Drug Class

- Route Of Administration

- Patient Type

- Indication

- Distribution Channel

Analyzing Regional Nuances in Access Innovation and Growth Across the Americas Europe Middle East & Africa and Asia Pacific

Within the Americas, robust health insurance frameworks and high per-capita healthcare spend underpin leading adoption rates for both branded and generic anxiolytics. The United States remains the epicenter of clinical trial activity, digital therapeutic reimbursement frameworks, and accelerated approval programs for novel delivery platforms. Canada’s universal coverage environment sustains broad patient access, while Latin American markets are witnessing incremental growth aided by telehealth penetration and government-led mental health awareness campaigns.

In Europe, Middle East & Africa, the landscape is shaped by diverse regulatory standards and economic disparities. Western European nations combine stringent pharmacovigilance with value-based pricing to secure premium placement for innovative therapies. Concurrently, emerging markets in the Middle East and Africa grapple with fragmented distribution networks and nascent reimbursement mechanisms, although digital health initiatives and stigma-reduction efforts are catalyzing new entry opportunities in underserved regions.

Asia-Pacific stands out as the fastest-growing region, driven by rapid urbanization, rising mental health awareness, and expanding digital infrastructure. China and India are key volume markets for cost-sensitive generics, while Japan and Australia demonstrate strong uptake of prescription digital therapeutics and advanced formulation platforms. Employer wellness programs and government investments in mental health services further accelerate demand, making the region a strategic priority for late-stage pipeline launches and commercial partnerships.

This comprehensive research report examines key regions that drive the evolution of the Anxiety Drugs market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Collaborators Driving the Anxiety Drug Industry Through Innovation and Partnerships

Several pharmaceutical incumbents continue to shape the anxiolytic domain through deep pipelines and strategic repositioning of existing compounds. Eli Lilly’s focus on novel small molecules and Johnson & Johnson’s exploration of biophysical modalities underscore the commitment to address treatment-resistant populations, while Pfizer’s divestiture of previously shelved generalized anxiety disorder candidates paves the way for leaner, more targeted portfolios. Sanofi and AstraZeneca have contributed to collaborative R&D frameworks, particularly in biosimilar development and advanced drug-delivery platforms, reflecting a collaborative approach to sustaining innovation in mature therapeutic classes.

At the intersection of pharmacology and technology, digital therapeutics providers have emerged as critical partners. Akili Interactive, Happify Health, Kaia Health, Big Health, and Omada Health are among the frontrunners securing regulatory clearances and insurance coverage for software-based cognitive behavioral interventions. Investment activity remains robust, with 41% of funding rounds in 2023 targeting anxiety and depression applications, validating the commercial and clinical potential of unified drug-software solutions.

Collaborative licensing deals similarly define the competitive landscape. Axsome Therapeutics’ exclusive agreement with Pfizer for reboxetine clinical data illustrates how agile biotechs can accelerate late-stage development, while large-scale licensing partnerships between multinational firms and regional manufacturers optimize global supply chains and extend market reach. These alliances not only de-risk R&D investments but also facilitate rapid geographic expansion, aligning stakeholder incentives with patient access goals.

This comprehensive research report delivers an in-depth overview of the principal market players in the Anxiety Drugs market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AbbVie Inc.

- Addex Therapeutics Ltd.

- Amorsa Therapeutics Inc.

- Apotex Inc.

- AstraZeneca PLC

- Avineuro Pharmaceuticals, Inc.

- Azevan Pharmaceuticals, Inc.

- Bausch Health Companies Inc.

- Bionomics Limited

- Chengdu Kanghong Pharmaceutical Group Co., Ltd.

- Eli Lilly and Company

- F. Hoffmann-La Roche Ltd.

- GlaxoSmithKline PLC

- H. Lundbeck A/S

- Huahai Pharmaceutical Co. Ltd.

- Intra-Cellular Therapies Inc.

- Johnson & Johnson Services Inc.

- Merck & Co., Inc.

- Novartis AG

- Olainfarm

- Otsuka Pharmaceutical Co., Ltd.

- Pfizer Inc.

- Sanofi S.A.

- Sun Pharmaceutical Industries Limited

- Swisschem Healthcare

- Teva Pharmaceutical Industries Ltd.

Strategic Imperatives and Tactical Roadmaps for Industry Leaders to Navigate Volatile Anxiety Drug Market Conditions and Policy Shifts

Industry leaders should prioritize supply chain diversification to mitigate the impact of ongoing tariff volatility and API concentration risks. Establishing dual-sourcing agreements across multiple geographies-particularly India and Southeast Asia-can preserve cost competitiveness while reducing exposure to potential trade escalations. Simultaneously, investments in onshore API and formulation capacity will bolster national security postures and safeguard continuity of care during future policy shifts.

Embracing digital therapeutics integration represents a critical frontier for differentiation. Drug manufacturers should explore co-development or licensing arrangements with software-focused entities, leveraging FDA’s expanding digital health frameworks to include adjunctive AI-driven adherence tools in product value propositions. Early engagement with payers and regulatory authorities will help secure reimbursement pathways that reward combined efficacy outcomes over traditional volume-based models.

Additionally, targeted patient engagement strategies are essential. Companies should implement precision marketing campaigns informed by patient-segmentation analytics, tailoring messaging to adult, geriatric, and pediatric cohorts across indication landscapes. Strengthening partnerships with key opinion leaders and leveraging real-world evidence registries will enhance formulary positioning and foster prescriber confidence in both existing and emerging anxiolytic offerings.

Robust Multi-Source Research Framework Employing Quantitative and Qualitative Methods to Ensure Comprehensive Anxiety Drug Market Intelligence

This report leverages a rigorous multi-stage methodology combining exhaustive secondary research and primary interviews to ensure robust market intelligence. Initial data collection encompassed peer-reviewed publications, regulatory filings, and clinical trial registries to map pharmacological and digital therapeutic pipelines comprehensively. Subsequently, expert consultations with neurologists, psychiatrists, and market access leaders validated emerging trends and refined segment definitions.

Quantitative analyses deployed triangulation frameworks to reconcile divergent data points, while qualitative assessments-drawn from stakeholder workshops and advisory boards-provided context on regional nuances and patient behavior. Segmentation matrices were developed based on drug class dynamics, administration routes, patient demographics, clinical indications, and distribution channels, ensuring granular visibility across the value chain.

Quality assurance was maintained through cross-verification of sources and iterative peer reviews, ensuring the findings reflect real-time market conditions as of mid-2025. The integration of tariff scenario modeling and competitive intelligence rounds out a holistic perspective, empowering decision-makers with actionable, evidence-based insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Anxiety Drugs market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Anxiety Drugs Market, by Drug Class

- Anxiety Drugs Market, by Route Of Administration

- Anxiety Drugs Market, by Patient Type

- Anxiety Drugs Market, by Indication

- Anxiety Drugs Market, by Distribution Channel

- Anxiety Drugs Market, by Region

- Anxiety Drugs Market, by Group

- Anxiety Drugs Market, by Country

- United States Anxiety Drugs Market

- China Anxiety Drugs Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Synthesizing Key Findings and Forward-Looking Highlights on the Transformative Outlook of the Global Anxiety Drug Domain

In conclusion, the anxiolytic therapeutic landscape is poised at an inflection point-sustained by foundational treatment classes yet energized by precision medicine advances, digital therapeutic synergies, and responsive supply chain strategies. While U.S. tariff policies have introduced cost and logistics complexities, they simultaneously catalyze opportunities for onshoring and strategic realignment that will define competitive advantage over the coming decade.

Segmentation insights underscore the necessity of tailored approaches-from drug-class specificity and administration route optimization to indication-focused patient engagement and distribution channel innovation. Regional variation highlights priority markets for late-stage pipeline launches, with Asia-Pacific’s rapid growth trajectory offering fertile ground for next-generation formulations and integrated care solutions.

As major pharmaceutical firms collaborate with nimble biotechs and software developers to deliver unified drug-software offerings, the industry’s capacity to address unmet clinical needs will hinge on evidence generation, regulatory alignment, and value-based partnerships. This evolving ecosystem presents both challenges and unprecedented avenues for differentiation, ultimately serving the shared goal of improving patient outcomes in anxiety disorders.

Empowering Strategic Decisions Today With an Exclusive Premium Anxiety Drug Market Report Accessible Through Ketan Rohom

I invite you to take the next step toward securing unparalleled market insights on the anxiety drug landscape by engaging directly with Ketan Rohom, Associate Director, Sales & Marketing. With deep expertise in pharmaceutical market intelligence and a track record of guiding decision-makers, Ketan can tailor the research deliverables to address your organization’s unique priorities. By connecting with him, you will gain immediate access to comprehensive data, break-through analysis, and actionable intelligence that will drive your strategic initiatives forward and position you ahead of the competitive curve.

- How big is the Anxiety Drugs Market?

- What is the Anxiety Drugs Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?