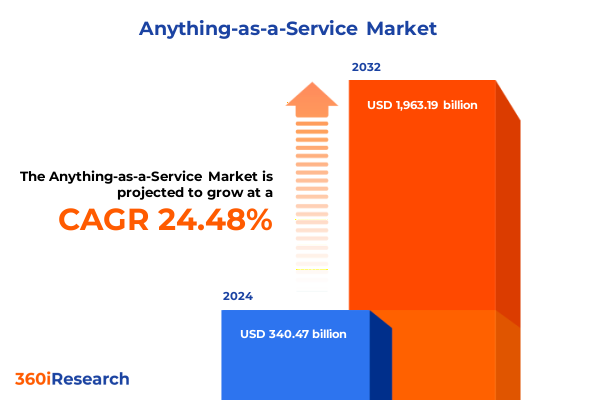

The Anything-as-a-Service Market size was estimated at USD 424.83 billion in 2025 and expected to reach USD 530.11 billion in 2026, at a CAGR of 24.44% to reach USD 1,963.19 billion by 2032.

Unveiling the Dawn of Anything-as-a-Service: A Strategic Prelude to Understanding the Paradigm Shift Reshaping Digital Service Delivery Globally

In an era defined by accelerated digital transformation and shifting consumer expectations, the concept of Anything-as-a-Service has emerged as a pivotal force rewriting the rules of technology delivery. This dynamic model transcends traditional boundaries by offering on-demand access to computing power, applications, and collaborative platforms without the overhead of capital expenditure or long-term commitments. As organizations face continuous pressure to innovate while maintaining operational agility, the XaaS approach provides a flexible blueprint that aligns service consumption directly with evolving business needs.

This introduction sets the stage for a thorough exploration of the trends, regulatory considerations, and market dynamics influencing XaaS adoption today. From the roots of Infrastructure-as-a-Service and Platform-as-a-Service to the expansive reach of Software-as-a-Service, stakeholders are reimagining how resources are provisioned and scaled. The ability to tailor solutions rapidly in response to competitive pressures has elevated XaaS from a disruptive concept to an essential component of modern enterprise strategy.

As we embark on this executive summary, key themes will unfold around transformative technological shifts, the impact of new tariff policies, granular segmentation analysis, and regional patterns of uptake. Together, these insights converge to illuminate the pathways through which anything delivered as a service can drive resilience, foster innovation, and unlock sustainable growth in a world where adaptability is paramount.

Charting the Evolution of Service Provision: How Cloud Native Innovations Artificial Intelligence and Sustainability Are Redefining the XaaS Landscape

The landscape of anything delivered as a service is undergoing profound transformation driven by the convergence of cloud-native architectures, edge computing, and artificial intelligence. Organizations that once relied on monolithic deployments are now embracing microservices to accelerate feature releases and enhance resilience. Simultaneously, advances in edge computing enable low-latency processing closer to data sources, unlocking new possibilities in industries ranging from manufacturing to autonomous transportation.

Artificial intelligence and machine learning are embedded at every layer of the XaaS stack, empowering predictive maintenance, dynamic resource allocation, and intelligent security controls. These capabilities are not merely add-ons but foundational elements that amplify the value proposition of on-demand services. As sustainability and carbon footprint reduction gain prominence, service providers are integrating green energy solutions and optimizing workloads to minimize environmental impact.

Moreover, strategic alliances between hyperscale cloud platforms and niche technology specialists are reshaping competition. Partnerships focused on open standards and interoperability facilitate seamless integration across hybrid and multi-cloud environments. Through these collaborative efforts, ecosystems of specialized services emerge, offering tailored solutions to complex challenges. This section highlights the core technological and strategic shifts that are redefining how services are architected, delivered, and monetized in today’s dynamic marketplace.

Assessing the Ripple Effects of New US Tariff Policies on Hardware Imports and Service Cost Structures in the Anything-as-a-Service Ecosystem

The introduction of new United States tariffs in 2025 on imported hardware components and specialized networking equipment has become a pivotal factor influencing cost structures and supply chains within the anything-as-a-service ecosystem. Service providers dependent on imported servers, storage arrays, and custom silicon for AI workloads are reassessing sourcing strategies to mitigate margin erosion. In response, many have accelerated partnerships with domestic suppliers and diversified procurement to include lower-tariff countries, balancing cost optimization with platform performance requirements.

These tariff adjustments have also prompted a recalibration of service-level agreements, as providers factor in extended lead times and potential component shortages. To uphold high availability commitments, strategic stockpiling and advanced demand forecasting have been adopted. Such measures underscore a shift from purely just-in-time inventory practices to hybrid models that combine agility with strategic reserve buffers.

Furthermore, emerging tariff-induced price pressures have incentivized investment in software-defined infrastructure, enabling providers to extract greater utilization from existing assets and delay capital outlays on hardware refresh cycles. This transition highlights the resilience of the XaaS model, where decoupling hardware dependencies through virtualization and containerization delivers both cost benefits and operational flexibility.

Illuminating User Needs through Service Type Deployment Enterprise Size and Industry Vertical Segmentation to Unlock Actionable XaaS Insights

A nuanced understanding of user requirements emerges when dissecting the market through the lens of service type, deployment model, enterprise size, and industry vertical. Starting with the foundational layer of infrastructure delivered as a service, distinct demands arise for compute, network, and storage capabilities with varying performance and security profiles. Moving up the stack, platform solutions tailored for application development, database management, and integration services reveal different pace and complexity thresholds. At the application layer, collaborative tools, customer relationship management platforms, and enterprise resource planning suites each carry unique customization and compliance considerations.

Deployment strategies further refine these preferences. Organizations that blend on-premises control with cloud scalability typically gravitate toward hybrid models to address data sovereignty concerns, while fully private environments appeal to entities with stringent security mandates. Public cloud offerings continue to attract businesses seeking rapid provisioning and global reach. These model distinctions drive differentiated strategies for interoperability, cost allocation, and governance frameworks.

Enterprise size also plays a critical role in shaping adoption patterns. Large organizations leverage extensive IT resources to negotiate bespoke agreements and optimize complex architectures. In contrast, medium and small enterprises often prioritize turnkey solutions with simplified administration and predictable expense structures. Finally, industry-specific pressures steer technology choices: financial services units require robust encryption and transaction auditing, healthcare providers emphasize data privacy and record interoperability, while manufacturing, retail, and consumer goods players focus on supply chain visibility and omnichannel engagement. Such segmentation insights guide tailored service development and go-to-market strategies that resonate with each unique cohort.

This comprehensive research report categorizes the Anything-as-a-Service market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Deployment Model

- Enterprise Size

- Industry Vertical

Spotlighting Regional Variations in XaaS Adoption Regulatory Dynamics and Infrastructure Maturity across Americas EMEA and Asia-Pacific Markets

Regional ecosystems exhibit distinct characteristics that shape the trajectory of anything-as-a-service adoption across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, a mature market with deep cloud penetration sees organizations driving next-generation use cases in AI, advanced analytics, and digital twins. Regulatory frameworks in North America emphasize data security and consumer privacy, prompting providers to integrate comprehensive compliance controls into their offerings.

Across Europe, Middle East & Africa, the landscape is heterogeneous. Western Europe’s stringent privacy regulations and carbon reduction targets influence service architectures, leading to innovations in energy-efficient data center design and privacy-by-design application deployments. In the Middle East, ambitious national initiatives aim to diversify economies through smart city and e-government projects, accelerating adoption of scalable service models. Meanwhile, parts of Africa are leapfrogging legacy infrastructure, adopting cloud services as a catalyst for financial inclusion and digital education.

In Asia-Pacific, rapid digital transformation is fueled by high mobile adoption rates and government-backed modernization programs. Enterprises are implementing multi-cloud strategies to balance cost, performance, and data residency concerns. Regional service providers tailor offerings to local language requirements, compliance standards, and ecosystem partnerships, resulting in innovative managed services that address diverse market needs. This regional snapshot underscores the importance of local context in designing and delivering anything-as-a-service solutions.

This comprehensive research report examines key regions that drive the evolution of the Anything-as-a-Service market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Collaborators Driving Competitive Advantage and Portfolio Diversification in the Anything-as-a-Service Arena

Leading innovators in the anything-as-a-service domain are distinguished by their ability to integrate modular architectures, foster partner ecosystems, and invest in cutting-edge research. Hyperscale cloud platforms continue to expand global footprints, deploying new microregions and edge zones to reduce latency and meet local compliance mandates. Simultaneously, specialist providers focusing on niche use cases-such as real-time analytics for manufacturing, secure collaboration for highly regulated industries, and vertical-specific AI services-are carving out competitive positions by delivering domain expertise and customizable solutions.

Strategic collaborations between technology giants and emerging startups have become a hallmark of the market. These alliances accelerate innovation cycles by combining deep domain knowledge with agile development methodologies. Open source communities also play a critical role, driving the standardization of container orchestration, service mesh implementations, and API management frameworks that underpin interoperable XaaS ecosystems.

Moreover, the maturation of managed service offerings has allowed vendors to move beyond basic provisioning toward value-added capabilities, such as continuous migration support, advanced security monitoring, and outcome-oriented service guarantees. Organizations evaluating service providers increasingly prioritize those that demonstrate a track record of measurable business impact, transparent governance practices, and the ability to co-innovate roadmaps aligned with evolving operational goals.

This comprehensive research report delivers an in-depth overview of the principal market players in the Anything-as-a-Service market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adobe Inc.

- Alibaba Cloud

- Alphabet Inc.

- Amazon Web Services

- Atlassian Corporation

- Box Inc.

- Cisco Systems

- CrowdStrike Holdings, Inc

- Datadog, Inc.

- Dropbox

- HubSpot, Inc.

- IBM Corporation

- Microsoft Azure

- Okta, Inc.

- Oracle Corporation

- Red Hat Inc.

- Salesforce

- SAP SE

- ServiceNow, Inc.

- Shopify Inc.

- Snowflake Inc.

- Splunk Inc.

- Twilio, Inc.

- VMware LLC

- Workday, Inc.

- Zoom Video Communications, Inc.

Guiding Business Transformation with Tactical Initiatives for Service Customization Risk Mitigation Supply Chain Resilience and Talent Development

Industry leaders seeking to harness the full potential of the anything-as-a-service model should embrace a multi-faceted strategy that begins with a deep understanding of customer personas and use case prioritization. By aligning service bundles with specific operational pain points, executives can accelerate adoption and demonstrate rapid value realization. Equally critical is the development of robust partnership frameworks that integrate hardware, software, and consulting expertise to deliver end-to-end solutions seamlessly.

Risk mitigation in the face of evolving tariff landscapes calls for a proactive supply chain strategy that combines supplier diversification with strategic inventory management. Organizations are advised to implement software-defined infrastructure and automated orchestration to decouple workloads from physical constraints and absorb tariff shocks through dynamic workload placement. Additionally, embedding AI-driven insights into service management processes enhances predictive capacity and drives continuous improvement across environments.

Talent development remains a cornerstone of sustainable growth in a service-centric world. Upskilling IT and line-of-business teams on cloud-native tools, DevOps practices, and security-first mindsets fosters a culture of innovation and resilience. Finally, embedding sustainability criteria into vendor selection and service design solidifies environmental stewardship as a differentiator, meeting stakeholder expectations while reducing operational risk.

Detailing a Robust Mixed-Methodological Approach Integrating Expert Interviews Data Triangulation and Framework-Driven Analysis to Ensure Research Integrity

The research underpinning this executive summary follows a rigorous mixed-methodology designed to ensure depth and accuracy. Initial secondary research involved a systematic review of publicly available sources, including industry white papers, regulatory publications, and case studies that illuminate both historical trends and emerging best practices. This foundation was complemented by primary qualitative interviews with senior technology executives, solution architects, and industry analysts to capture firsthand perspectives on strategic priorities and operational challenges.

Data triangulation was achieved by cross-verifying interview insights with quantifiable evidence from reputable open data repositories and proprietary data partners. A framework-driven analysis segmented findings across service types, deployment models, enterprise sizes, and industry verticals, enabling comparative assessment and thematic clustering. Throughout the process, an iterative validation cycle engaged domain experts to review preliminary findings, refine assumptions, and endorse conclusions.

This methodological rigor ensures that the insights presented are not only reflective of current market dynamics but also resilient to rapid change. Ethical data collection practices, confidentiality safeguards, and standardized coding protocols underpin every phase of the study, delivering a robust intelligence platform from which stakeholders can confidently derive strategic direction.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Anything-as-a-Service market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Anything-as-a-Service Market, by Service Type

- Anything-as-a-Service Market, by Deployment Model

- Anything-as-a-Service Market, by Enterprise Size

- Anything-as-a-Service Market, by Industry Vertical

- Anything-as-a-Service Market, by Region

- Anything-as-a-Service Market, by Group

- Anything-as-a-Service Market, by Country

- United States Anything-as-a-Service Market

- China Anything-as-a-Service Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Concluding Strategic Reflections on the Imperatives of Agility Collaboration and Technological Foresight in Sustaining XaaS Leadership and Growth Trajectories

As the anything-as-a-service paradigm continues to evolve, the strategic imperative for organizations is clear: agility, collaboration, and foresight are non-negotiable. By embracing modular service architectures and open interoperability standards, enterprises can pivot rapidly in response to competitive pressures and customer demands. Collaboration across ecosystems-whether through strategic alliances, open source communities, or industry consortia-drives innovation velocity and dilutes the risk of vendor lock-in.

Dynamic risk management, informed by real-time analytics and predictive intelligence, becomes a cornerstone for maintaining continuity in the face of regulatory shifts or supply chain disruptions. Leaders who invest in talent development and cultivate a culture that prizes experimentation and learning position their organizations to extract maximum value from anything-as-a-service offerings.

Ultimately, the true measure of success lies not in technological adoption alone, but in the ability to translate capabilities into tangible outcomes-whether that be streamlined operations, differentiated customer experiences, or accelerated time to market. This conclusion underscores the convergent themes of this analysis and serves as a call to action for decision makers to chart their own path forward with confidence.

Encouraging Direct Engagement with Ketan Rohom to Leverage Comprehensive Insights and Elevate Strategic Decision Making through the Full Market Research Report

Elevate your strategic perspective by exploring the complete market research report on Anything-as-a-Service, guided by the expertise of Ketan Rohom (Associate Director, Sales & Marketing). This comprehensive resource delivers in-depth analysis of emerging service trends, regulatory impacts, and regional dynamics that shape decision making in the XaaS ecosystem. By partnering directly with Ketan Rohom, you gain exclusive access to tailored insights that align with your organization’s objectives, enabling you to anticipate industry shifts and capitalize on new revenue streams.

Secure immediate access to proprietary intelligence covering tariff scenarios, segmentation nuances across service types, deployment models, enterprise sizes, and verticals, as well as critical benchmarks for competitive positioning. This engagement provides a platform for one-on-one consultations to discuss customized strategies for risk mitigation, supply chain resilience, and go-to-market planning. Reach out to Ketan Rohom to arrange a personalized briefing session, ensuring your team is equipped with actionable recommendations drawn from a meticulously validated research framework. Don’t miss the opportunity to transform this knowledge into tangible business outcomes and elevate your leadership in the Anything-as-a-Service landscape.

- How big is the Anything-as-a-Service Market?

- What is the Anything-as-a-Service Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?