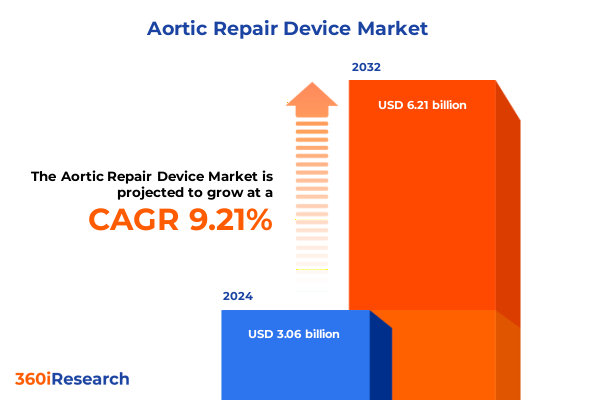

The Aortic Repair Device Market size was estimated at USD 3.32 billion in 2025 and expected to reach USD 3.60 billion in 2026, at a CAGR of 9.32% to reach USD 6.21 billion by 2032.

Introduction to the Aortic Repair Device Market Landscape Highlighting Technological Innovations and Growing Clinical Imperatives Driving Adoption

The aortic repair device market stands at the intersection of clinical necessity and technological advancement, responding to a growing prevalence of aortic pathologies among aging populations worldwide. Advances in imaging technologies, coupled with the advent of minimally invasive techniques, have transformed the way vascular surgeons approach aneurysms and dissections. As life expectancy continues to rise, the demand for durable, reliable solutions has intensified, prompting device innovators to refine endovascular and open graft designs in pursuit of superior patient outcomes.

Through this lens, the market has witnessed the maturation of stent graft technology, with developers pursuing thinner delivery systems, enhanced biocompatibility, and novel anchoring mechanisms. Concurrently, open surgical grafts have evolved with lightweight fabrics and reinforced structures to address complex anatomies. In turn, these innovations have fostered greater procedural flexibility, allowing clinicians to tailor interventions to individual patient profiles. As a result, healthcare providers are increasingly adopting hybrid treatment pathways that blend endovascular and open approaches to optimize both safety and efficacy.

Understanding the Major Forces Reshaping the Aortic Repair Device Sector Through Regulatory Advancements and Technology Disruptions

Regulatory frameworks have shifted substantially, ushering in expedited approval pathways that incentivize breakthrough aortic repair devices and digital health integrations. In response, leading manufacturers have aligned their R&D pipelines to meet evolving criteria for safety and performance, leveraging robust clinical evidence and real-world data to secure accelerated clearances. As a consequence, novel graft architectures, such as fenestrated and branched stent grafts, are emerging faster than ever, bridging treatment gaps for complex thoracoabdominal aneurysms.

Moreover, collaboration between device makers and digital health firms has yielded integrated platforms that offer intraoperative navigation, remote monitoring, and post-procedure analytics. Such synergies are progressively redefining procedural planning and long-term patient management, reducing complication rates and shortening hospital stays. Concurrently, consolidation within the supply chain-through strategic alliances and acquisitions-has enhanced distribution networks and streamlined production processes. Ultimately, these converging forces are reshaping the competitive landscape, driving a paradigm shift toward data-driven, patient-centric solutions.

Assessing the Comprehensive Effects of 2025 United States Tariffs on the Aortic Repair Device Industry Supply Chains and Price Structures

In 2025, new United States tariffs targeting imported graft materials and device components have had a profound effect on cost structures across the aortic repair device ecosystem. Manufacturers faced heightened input expenses as duties on specialized polymers and metallic alloys increased by an average of 15 percent, compelling many to reevaluate sourcing strategies. As a result, some enterprises expedited investments in regional supply bases and forged partnerships with North American and Latin American suppliers to mitigate exposure to import levies.

These tariff‐driven cost pressures have been partially transferred to hospitals and ambulatory surgical centers through revised purchasing agreements, precipitating negotiations around bundled pricing and value-based contracting. Nonetheless, the long-term impact has stimulated innovation in cost‐effective material alternatives and localized manufacturing capabilities. In parallel, policymakers have initiated dialogues with industry stakeholders to refine tariff schedules, balancing trade objectives against patient access imperatives. Looking ahead, device makers that proactively adapt their supply chains and embrace cross-border collaborations will be better positioned to sustain competitive advantage.

Deep Dive into Market Segmentation Revealing Critical Trends Across Device Types Applications End Users and Materials

An in-depth examination of segmentation reveals distinct trends across device types, applications, end users, and materials that collectively shape market dynamics. Endovascular stent grafts continue to dominate procedural volumes, driven by growing clinician confidence in minimally invasive approaches. Within this category, bifurcated configurations account for the majority of interventions, addressing abdominal aortic aneurysms with precision, while aortomonoiliac designs offer simplified access in select anatomies and cuff grafts serve as adjuncts for vessel preservation.

Open surgical grafts maintain relevance in cases where endovascular access is contraindicated, particularly for extensive dissections and connective tissue disorders, underscoring the importance of maintaining robust open-surgery capabilities. When viewed through the lens of clinical application, abdominal aortic aneurysm treatments represent the lion’s share of utilization, yet thoracic aortic aneurysm devices are registering robust growth as manufacturers introduce branch-and-fenestrated options. Aortic dissection procedures, though fewer in number, demand grafts that balance flexibility and tensile strength.

Healthcare delivery settings are likewise evolving; hospitals remain the primary locus for complex interventions, whereas ambulatory surgical centers are capturing a growing proportion of straightforward endovascular cases, propelled by cost efficiencies and expedited patient turnover. Material innovation also plays a pivotal role, as Dacron fabrics offer proven durability in high-pressure environments, while PTFE grafts provide superior biocompatibility and reduced thrombogenic risk, motivating developers to optimize fabric blends and surface treatments.

This comprehensive research report categorizes the Aortic Repair Device market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Material

- End User

- Application

Evaluating Regional Dynamics Across Americas Europe Middle East Africa and Asia Pacific for the Aortic Repair Device Market

Regional analyses highlight the Americas as a mature and sophisticated market characterized by extensive reimbursement frameworks and advanced hospital infrastructures that support both novel and established aortic repair solutions. The United States and Canada lead in procedural volumes, while Latin American nations are progressively expanding access through public-private partnerships and targeted training initiatives, fostering incremental market growth.

In Europe, Middle East & Africa, heterogeneous regulatory landscapes and varied healthcare financing models drive differentiated adoption patterns. Western Europe boasts rapid uptake of next-generation stent grafts, underpinned by national health systems that prioritize minimally invasive care, whereas in parts of the Middle East and Africa, infrastructural constraints and budgetary pressures create demand for cost-effective, durable graft solutions. Collaboration with regional distributors and localized training programs is critical to unlocking these growth pockets.

Asia-Pacific emerges as a dynamic frontier, with China and Japan at the forefront of technology adoption and domestic manufacturing scale-up. Their regulatory bodies have fast-tracked approvals for innovative graft designs, stimulating competitive local offerings. Emerging economies in Southeast Asia and Oceania are investing in healthcare infrastructure, yet price sensitivity remains a decisive factor. Consequently, global players are forging joint ventures and licensing agreements to tailor their portfolios to meet cost and quality expectations across the region.

This comprehensive research report examines key regions that drive the evolution of the Aortic Repair Device market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Key Market Players Shaping Competitive Trajectories in Aortic Repair Device Development

Leading companies continue to vie for market leadership by leveraging innovation, strategic alliances, and targeted acquisitions. Major global players have built extensive portfolios encompassing endovascular and open grafts, while also exploring digital health integrations such as intraoperative guidance systems and remote follow-up platforms. These firms are prioritizing clinical collaborations to generate robust evidence of long-term durability and device performance, thereby strengthening their value propositions to payers and providers.

Emerging challengers are differentiating through specialized niche offerings, such as modular cuff systems and ultra-low profile delivery catheters designed for patients with challenging vascular anatomies. They also underscore agility in regulatory engagement, securing clearances for advanced graft configurations in key markets ahead of larger competitors. Partnerships between established giants and innovative startups are increasingly common, catalyzing co-development projects that blend deep clinical expertise with cutting-edge manufacturing technologies. Over the next five years, this dynamic is expected to accelerate product evolution and drive incremental improvements in patient outcomes.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aortic Repair Device market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Artivion Inc

- Becton Dickinson and Company

- Bentley InnoMed GmbH

- Biotronik SE & Co KG

- Boston Scientific Corporation

- Cardinal Health Inc

- Cook Group Incorporated

- CryoLife Inc

- Edwards Lifesciences Corporation

- Endologix LLC

- Getinge AB

- Johnson & Johnson

- JOTEC GmbH

- LeMaitre Vascular Inc

- Lombard Medical Technologies plc

- Medtronic plc

- Merit Medical Systems Inc

- MicroPort Scientific Corporation

- Penumbra Inc

- Shanghai MicroPort Endovascular MedTech Co., Ltd

- Straub Medical AG

- Stryker Corporation

- Terumo Corporation

- W. L. Gore & Associates Inc

Strategic Recommendations to Empower Industry Leaders to Navigate Market Volatility and Drive Sustainable Growth in Aortic Repair Devices

Industry leaders should prioritize diversification of their supply chains by establishing multiple sourcing agreements and regional manufacturing hubs to mitigate future tariff and geopolitical risks. In parallel, investing in next-generation materials-such as bioactive and heparin-coated fabrics-can enhance graft performance and provide a clear clinical differentiation. To further solidify market positioning, companies must deepen collaborations with key opinion leaders and clinical centers to conduct post-market studies that validate real-world effectiveness.

Moreover, expanding the adoption of integrated digital health ecosystems-encompassing advanced imaging, procedural navigation, and remote patient monitoring-will strengthen the continuum of care and open new revenue streams through software and service offerings. Engaging proactively with payers to develop value-based contracting models can ensure sustainable reimbursement and align pricing with demonstrated outcomes. Finally, companies should maintain active participation in policy dialogues to shape favorable regulatory environments and advocate for balanced tariff frameworks that safeguard both domestic manufacturing and patient access.

Transparent Research Methodology Detailing Data Collection Analytical Frameworks and Validation Processes Underpinning Insights

This report synthesizes qualitative and quantitative insights derived from a multi-tiered research methodology. Primary data was gathered through in-depth interviews with vascular surgeons, procurement directors, and senior executives across leading healthcare institutions, ensuring firsthand perspectives on clinical needs and purchasing drivers. Complementing this, secondary research encompassed peer-reviewed journals, regulatory databases, patent filings, and company financial disclosures, facilitating triangulation and validation of core trends.

Analytical frameworks applied include SWOT analyses, competitive benchmarking, and segmentation modeling to dissect market dynamics across device types, applications, end users, and materials. Robust data verification protocols were employed, involving cross-checking with multiple sources and expert review panels, to uphold the highest standards of accuracy and relevance. The result is a rigorous, transparent foundation that underpins the insights and recommendations presented throughout this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aortic Repair Device market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aortic Repair Device Market, by Type

- Aortic Repair Device Market, by Material

- Aortic Repair Device Market, by End User

- Aortic Repair Device Market, by Application

- Aortic Repair Device Market, by Region

- Aortic Repair Device Market, by Group

- Aortic Repair Device Market, by Country

- United States Aortic Repair Device Market

- China Aortic Repair Device Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Concluding Perspectives Emphasizing Market Opportunities Challenges and the Path Forward for Aortic Repair Device Stakeholders

The aortic repair device market is poised for continued evolution as demographic shifts, technological breakthroughs, and regulatory reforms reshape the landscape. Opportunities abound in emerging indications, digital health integrations, and regional expansions, yet challenges persist in the form of cost pressures, tariff uncertainties, and competitive intensity. As manufacturers refine device architectures and material compositions, they must concurrently demonstrate value through clinical evidence and stakeholder engagement.

In conclusion, success will hinge on agility and collaboration: the ability to adapt supply chains, co-innovate with clinical partners, and engage payers in outcome-driven dialogue. By embracing a holistic approach that spans device development, digital ecosystems, and policy advocacy, companies can unlock new avenues for growth and deliver improved care for patients with aortic disease. Stakeholders who internalize these imperatives will be best positioned to navigate risks and harness the full potential of this dynamic market.

Take Action Today to Engage with Insights on the Aortic Repair Device Market Contact Our Associate Director Sales Marketing to Secure Your Report

To gain a comprehensive and actionable understanding of the dynamics shaping the aortic repair device market, reach out to Ketan Rohom, Associate Director, Sales & Marketing, to secure your detailed market research report. Engaging with his expertise will grant you direct access to in-depth analyses, competitive benchmarks, and strategic recommendations that can inform critical decisions and accelerate growth. Contact Ketan today to obtain customized insights and ensure you stay ahead of emerging trends and regulatory changes in this evolving sector.

- How big is the Aortic Repair Device Market?

- What is the Aortic Repair Device Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?