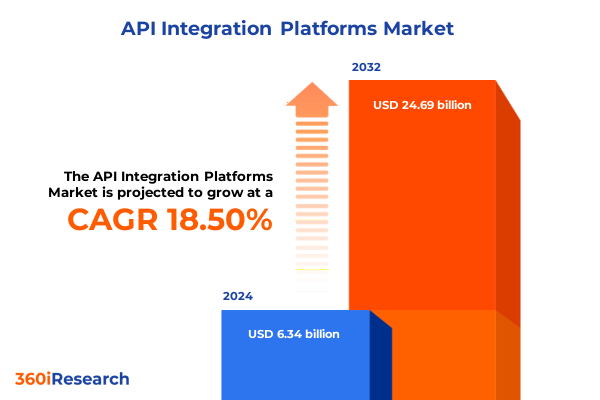

The API Integration Platforms Market size was estimated at USD 7.48 billion in 2025 and expected to reach USD 8.82 billion in 2026, at a CAGR of 18.60% to reach USD 24.69 billion by 2032.

Explore how API integration platforms unify disparate enterprise systems to streamline data flows, enhance connectivity, and power digital initiatives

In today’s digital-first environment, API integration platforms stand at the forefront of enterprise architectures, enabling organizations to seamlessly connect disparate systems, applications, and data sources. By acting as a centralized hub for orchestrating interactions across hybrid infrastructures, these platforms reduce complexity, eliminate silos, and accelerate the delivery of customer-facing services. Moreover, they facilitate real-time data exchange between legacy applications and cloud-native services, ensuring that decision-makers have timely, accurate insights at their fingertips.

As businesses pursue aggressive digital transformation agendas, API integration platforms have become indispensable for unlocking operational efficiency and fostering innovation. They support a wide range of use cases-from automating business processes and managing partner ecosystems to powering developer portals and enabling secure data sharing. Consequently, technology leaders are prioritizing investments in integration capabilities that offer scalability, flexibility, and robust governance, laying the foundation for a composable enterprise architecture.

Looking ahead, the role of API integration platforms will continue to evolve as organizations embrace microservices, event-driven architectures, and low-code development. These trends underscore the imperative to adopt integration solutions that not only deliver high performance and reliability but also enable rapid iteration in response to changing market demands. Accordingly, understanding the strategic value of API integration platforms is vital for executives seeking to drive digital resilience and competitive differentiation.

Hybrid cloud expansion, microservices prevalence, event-driven workloads, and robust security mandates are reshaping API integration platforms for enterprises

The landscape of API integration platforms is undergoing significant transformation driven by several converging trends. Hybrid cloud expansion is compelling enterprises to manage workloads across on-premises datacenters and public cloud environments, creating demand for integration tools that bridge these environments with minimal friction. Simultaneously, microservices adoption is fueling the need for lightweight, decoupled integration patterns that can dynamically scale to accommodate fluctuating transaction volumes.

Alongside infrastructure shifts, event-driven integration models are gaining traction as organizations seek to process and respond to real-time data streams. This development underscores the importance of integration platforms that provide robust event mesh capabilities and support for streaming protocols. At the same time, data privacy regulations and industry-specific compliance mandates are elevating security requirements, prompting vendors to embed advanced authentication, encryption, and access-control features natively within their solutions.

With the proliferation of APIs across B2B partnerships, IoT ecosystems, and omnichannel customer experiences, integration platforms must also offer comprehensive management capabilities. API lifecycle governance, developer self-service tooling, and analytics-driven performance monitoring are now table stakes. As a result, the market is witnessing intense competition among providers to deliver unified suites that balance ease of use with enterprise-grade controls. These transformative shifts signal a new era in which integration platforms will serve not just as middleware but as strategic enablers of business innovation.

Exploring how US tariff shifts in 2025 are affecting API integration platform pricing, supply chains, vendor partnerships, and compliance strategies

Recent adjustments to United States tariff policies in 2025 have introduced new variables into the cost equation for API integration platform deployments. Import duties on hardware components, network appliances, and specialized servers have incrementally raised the expense of on-premises infrastructure, prompting organizations to reevaluate total cost of ownership considerations. As a consequence, many enterprises are accelerating shifts toward cloud-based deployment models to mitigate exposure to import-related cost fluctuations.

From a vendor perspective, tariff-induced supply chain complexities have led platform providers to diversify manufacturing and distribution strategies. Companies are negotiating flexible sourcing arrangements, leveraging regional hubs, and forging partnerships with local integrators to ensure continuity of service and maintain competitive pricing. This strategic pivot is also reflected in go-to-market approaches, where bundling software subscription models with managed services helps smooth out cost variability.

Compliance functions are likewise recalibrating in response to tariff measures, as organizations navigate evolving regulatory reporting requirements tied to cross-border transactions. By embedding compliance workflows and tariff classification engines within integration platforms, enterprises can automate duty calculations and documentation, thereby reducing manual effort and exposure to regulatory risk. Overall, the 2025 tariff landscape is catalyzing a redefinition of deployment economics, vendor relationships, and operational processes within the API integration domain.

Gaining segmentation perspectives spanning service and solution offerings, deployment models, enterprise sizes, application types, and end-user sectors

Deep insights emerge when examining the market through the lens of service and solution offerings. The services segment divides into managed services, where third parties handle integration operations on behalf of clients, and professional services, which provide specialized consulting, customization, and implementation expertise. On the solutions side, API management platforms focus on design, security, and governance; integration and orchestration tools enable complex workflow automation across heterogeneous systems; and security and compliance modules ensure data protection, auditability, and adherence to regulations.

Deployment model segmentation reveals a clear delineation between cloud-based offerings-favored for their scalability, rapid provisioning, and lower capital expenditure-and on-premises implementations, which deliver granular control over data residency and infrastructure configurations. Meanwhile, organizational size influences solution requirements: large enterprises demand high-throughput architectures, extensive departmental governance, and global support networks, whereas small and medium enterprises often prioritize ease of use, self-service capabilities, and predictable subscription pricing.

Functional application drives further differentiation, spanning application integration scenarios that link CRM and ERP systems, B2B integration use cases mobilizing supplier and partner networks, cloud integration initiatives unifying SaaS and PaaS offerings, and data integration projects consolidating analytical data warehouses. Finally, industry verticals ranging from banking, financial services, and insurance through energy, healthcare, IT, manufacturing, media, and retail impose unique performance, compliance, and customization requirements that integration providers must address.

This comprehensive research report categorizes the API Integration Platforms market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering

- Deployment Model

- Organizational Size

- Application

- End-User Industry

Revealing regional dynamics driving API integration platform adoption across the Americas, Europe Middle East and Africa, and Asia-Pacific markets

Regional dynamics play a pivotal role in shaping API integration adoption patterns. In the Americas, enterprises leverage sophisticated digital infrastructures and mature cloud ecosystems to pursue aggressively automated supply chains, omnichannel customer engagements, and data-driven insights. This environment fosters demand for advanced integration features such as event-triggered automation, AI-driven mapping, and embedded analytics that translate operational data into strategic action.

Europe, Middle East, and Africa present a more heterogeneous landscape, where data sovereignty regulations and cross-border transaction complexities require integration platforms to offer localized deployment options and granular compliance controls. Organizations in this region often operate in multi-country federations, necessitating connectivity solutions that can reconcile divergent privacy frameworks, multilingual interfaces, and varying levels of IT maturity among stakeholders.

In Asia-Pacific, rapid digitalization across emerging markets intersects with large-scale manufacturing, government-led smart city initiatives, and a burgeoning digital services sector. Integration platforms in this region must cater to high-volume transactional environments, support lightweight edge integrations for IoT deployments, and accommodate multilingual support structures. Consequently, scalability, low-latency processing, and adaptable licensing models are key differentiators that drive platform selection across Asia-Pacific economies.

This comprehensive research report examines key regions that drive the evolution of the API Integration Platforms market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting strategic initiatives and competitive positioning of leading API integration platform providers shaping industry innovation and market expansion

Competitive dynamics within the API integration platform space are marked by strategic investments in cloud-native architectures, partner ecosystems, and advanced security frameworks. Industry incumbents are unveiling modular offerings that enable customers to adopt core API management capabilities initially and layer on orchestration, monitoring, or compliance features as needed. This composable approach allows enterprises to align integration capabilities with evolving digital roadmaps and budget constraints.

Simultaneously, emerging challengers are gaining traction by focusing on low-code and citizen integration experiences, enabling business analysts and power users to construct integrations without deep coding expertise. These platforms emphasize visual mapping, template-driven workflows, and marketplace-driven connector libraries, addressing the shortage of skilled integration developers and accelerating time to value.

In response, legacy vendors are forging strategic partnerships, acquiring niche specialists, and enhancing developer portals to cultivate vibrant collaboration communities. Security and compliance remain central themes, with enhancements in threat detection, anomaly monitoring, and policy automation. The result is a competitive landscape where platform differentiation stems from balance between enterprise-grade controls and consumer-grade usability, with ongoing innovation in AI-assisted mapping, predictive performance tuning, and multi-cloud orchestration.

This comprehensive research report delivers an in-depth overview of the principal market players in the API Integration Platforms market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amazon Web Services, Inc.

- Axway Inc.

- Boomi, LP.

- Celigo, Inc.

- Celonis, Inc.

- Cisco Systems, Inc.

- Dell Technologies Inc.

- Elastic.io GmbH

- International Business Machines Corporation

- Jitterbit, Inc.

- Microsoft Corporation

- Moesif, Inc.

- MuleSoft, Inc.

- Oracle Corporation

- Red Hat, Inc.

- SAP SE

- SnapLogic, Inc.

- Solo.io, inc.

- Tata Consultancy Services Limited

- Tyk Technologies Ltd.

- Wipro Ltd.

- Workato, Inc.

Actionable strategies for industry leaders to optimize API integration platform adoption, drive agility, and secure competitive advantage in evolving digital ecosystems

To capitalize on the momentum of API integration, industry leaders should begin by establishing a clear governance framework that defines ownership, security policies, and performance benchmarks. By aligning integration objectives with business outcomes-such as accelerated time to market, enhanced partner collaboration, and reduced operational risk-organizations can prioritize use cases that deliver the highest return on investment and foster stakeholder buy-in.

Leaders must also invest in skill development, cultivating a cross-functional integration center of excellence that brings together architects, security experts, and business analysts. This collaborative model accelerates integration design, standardizes best practices, and builds internal expertise in API lifecycle management, event-driven orchestration, and compliance automation. Concurrently, executive sponsors should champion a culture of continuous improvement, leveraging analytics from integration platforms to identify bottlenecks, optimize workflows, and drive proactive performance tuning.

Finally, organizations should cultivate strategic partnerships with leading vendors and system integrators to access emerging capabilities such as AI-enabled mapping, hybrid connectivity adapters, and embedded compliance engines. By piloting new features in less-critical domains and scaling successful proofs of concept, leaders can iteratively enhance integration maturity, mitigate risk, and ensure that their API ecosystem remains agile, secure, and ready to support future digital imperatives.

Transparency into the comprehensive research methodology leveraging multi-faceted data sources, expert insights, and rigorous analysis to ensure robust API integration market intelligence

The foundation of this research rests on a comprehensive secondary analysis of publicly available industry literature, vendor whitepapers, technical documentation, and regulatory guidelines. This initial phase established a baseline understanding of market definitions, technology trends, and competitive landscapes, serving as a framework for deeper investigation. Building on these insights, we conducted extensive primary interviews with senior IT leaders, integration architects, and solution providers to capture firsthand perspectives on deployment challenges, vendor evaluation criteria, and emerging use cases.

To ensure rigor and impartiality, we employed data triangulation techniques, corroborating qualitative interview findings with quantitative indicators such as technology adoption rates, platform usage metrics, and industry survey results. Our methodology also incorporated ongoing validation cycles, wherein draft findings were reviewed by an editorial advisory panel of domain experts who provided critical feedback on analytical assumptions, thematic categorizations, and strategic recommendations.

Finally, a structured synthesis process distilled complex datasets into actionable insights, organized around market dynamics, segmentation impacts, regional variations, and vendor strategies. This multi-step approach guarantees that the report delivers a balanced, evidence-based view of the API integration platform landscape, empowering decision-makers with the clarity needed to navigate a rapidly evolving technology environment.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our API Integration Platforms market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- API Integration Platforms Market, by Offering

- API Integration Platforms Market, by Deployment Model

- API Integration Platforms Market, by Organizational Size

- API Integration Platforms Market, by Application

- API Integration Platforms Market, by End-User Industry

- API Integration Platforms Market, by Region

- API Integration Platforms Market, by Group

- API Integration Platforms Market, by Country

- United States API Integration Platforms Market

- China API Integration Platforms Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesizing key findings underscores the critical role of API integration platforms in enabling digital resilience, efficiency, and strategic growth across industries

The insights presented throughout this executive summary coalesce to demonstrate that API integration platforms are no longer ancillary components but essential pillars of modern enterprise architectures. By unifying disparate systems, enabling event-driven processes, and embedding security at every layer, these platforms empower organizations to respond to market shifts with speed and resilience. The segmentation analysis highlights that whether an organization selects managed services or a standalone solution, opts for cloud-based or on-premises deployments, or targets specific application scenarios, the core imperative remains the same: integration must be agile, secure, and aligned with business objectives.

Regional and tariff-driven considerations underscore that successful platform adoption hinges on flexibility-both in deployment models and cost structures. North American enterprises leverage mature ecosystems to experiment with advanced automation, while EMEA organizations prioritize data sovereignty and compliance. In Asia-Pacific, high-volume transactional demands and diverse regulatory environments drive preferences for scalable, low-latency integrations. Meanwhile, competitive positioning among vendors continues to evolve through cloud-native innovations, low-code capabilities, and AI-assisted features.

As enterprises chart their integration journeys, the actionable recommendations outlined here offer a strategic roadmap: establish governance, develop in-house expertise, and partner selectively to pilot cutting-edge capabilities. Ultimately, the synthesis of market trends, segmentation insights, regional dynamics, and vendor strategies confirms that investing in the right API integration platform is a strategic differentiator that fuels digital transformation and long-term growth.

Engage with Ketan Rohom to secure your comprehensive API integration platform market research report for strategic decision-making and growth acceleration

To obtain a detailed and actionable market research report on API integration platforms, we invite you to connect with Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch). By discussing your organization’s specific integration challenges and strategic objectives, Ketan can help you tailor the report’s insights to your unique requirements. Whether you are evaluating deployment models, refining vendor selection criteria, or preparing for regulatory compliance shifts, this report will equip you with the intelligence needed to make informed decisions and accelerate your digital transformation roadmap.

Reach out to Ketan Rohom to unlock in-depth analyses, expert perspectives, and strategic recommendations that will empower your team to advance integration initiatives with confidence. Secure your copy today and position your organization to leverage API integration platforms as a catalyst for innovation, agility, and sustainable growth in an increasingly interconnected business landscape.

- How big is the API Integration Platforms Market?

- What is the API Integration Platforms Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?