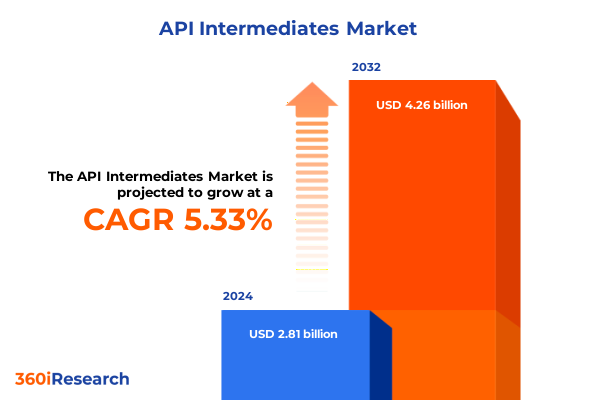

The API Intermediates Market size was estimated at USD 2.95 billion in 2025 and expected to reach USD 3.10 billion in 2026, at a CAGR of 5.37% to reach USD 4.26 billion by 2032.

Unveiling the Dynamics of Modern Enterprise Technology Adoption Under Evolving Regulatory, Economic, and Geopolitical Conditions

Modern enterprises are navigating a convergence of technological innovation, economic realignments, and regulatory shifts that are redefining how organizations deploy and manage critical business applications. Digitization initiatives are increasingly prioritized as businesses seek to enhance agility, reduce operational complexity, and deliver superior customer experiences. The pressure to modernize legacy infrastructure has driven a growing emphasis on cloud-native architectures and the optimization of on-premises systems to work in harmony with distributed resources.

As supply chain dynamics evolve in response to United States tariff policies enacted in 2025, cost considerations have become paramount. Leadership teams are evaluating the balance between public cloud scalability, private cloud security, and hybrid models that blend both environments. In parallel, enterprise decision-makers are assessing application portfolios that span customer relationship management, enterprise resource planning, human resource management, marketing automation, and supply chain management. These priorities vary significantly across banking, financial services, insurance, government, healthcare, retail, telecommunications, and other sectors.

This executive summary distills the transformative shifts shaping the competitive landscape. It provides strategic segmentation insights along multiple dimensions including product type, application use cases, end-user verticals, organization size, deployment models, distribution channels, and pricing structures. Additionally, it presents regional perspectives across the Americas, Europe, Middle East and Africa, and Asia-Pacific, followed by a synthesis of leading companies’ approaches. Finally, actionable recommendations and a transparent research methodology are outlined to support informed decision-making.

Examining the Rapid Evolution of Cloud, On-Premises Infrastructure, and Digital Transformation Fueled by Emerging Technologies and Remote Workforce Trends

Organizations are experiencing rapid transformation as digital technologies permeate every facet of operations. The adoption of cloud infrastructure has accelerated beyond traditional public and private paradigms, giving rise to hybrid environments that combine the elasticity of public cloud with the control of on-premises deployments. Meanwhile, enterprises continue to invest in on-premises systems designed for both large-scale corporate datacenters and smaller installations tailored for midsized businesses. This dual emphasis has led to a more nuanced understanding of infrastructure strategies, where performance, security, and cost optimization coexist as critical drivers.

Concurrently, the workforce has become more distributed, fueling the need for remote collaboration tools and robust platform reliability. Regulatory frameworks and trade policies have also shifted, compelling organizations to reassess vendor relationships and data sovereignty requirements. In response, CIOs are leveraging advanced analytics and artificial intelligence capabilities to forecast demand, automate routine processes, and enhance customer engagement, all while maintaining compliance with evolving data protection standards.

Emerging technologies such as edge computing and real-time processing are pushing the boundaries of what on-premises and hybrid models can deliver. By integrating these capabilities with established enterprise applications, companies are unlocking new pathways for innovation, driving operational resilience, and positioning themselves to thrive amid ongoing uncertainties.

Assessing the Broad Impact of United States Tariffs in 2025 on Supply Chains, Cost Structures, and Strategic Sourcing Decisions Across Key Industry Verticals

In 2025, a series of United States tariff adjustments targeted a broad range of imported goods, with particular emphasis on technology components, manufacturing equipment, and select raw materials. These measures, introduced to protect domestic industries and address trade imbalances, have triggered a recalibration of global supply chains. Companies reliant on imported semiconductors, storage hardware, and networking equipment have encountered increased cost pressures, driving a reassessment of procurement strategies and supplier portfolios.

As tariffs impose upward cost trajectories, many organizations have sought to diversify sourcing channels, including engaging with alternative manufacturing hubs in South America and Southeast Asia. A growing number of enterprises are exploring partial reshoring initiatives to mitigate exposure to external levies, balancing the benefits of proximity with the challenges of scaling regional operations. At the same time, businesses have engaged in price negotiations and longer-term contracting to lock in favorable terms before future tariff escalations, striving to stabilize input costs and preserve margin integrity.

From the perspective of cloud service providers and large-scale system integrators, hardware supply constraints have spurred investments in localized infrastructure to reduce cross-border dependencies. This shift has heightened the strategic importance of flexible deployment architectures, allowing workloads to migrate between regions in response to policy changes. Ultimately, the tariff landscape has underscored the critical need for dynamic sourcing models and enhanced risk management practices across the technology value chain.

Illuminating Critical Market Segmentation Insights Spanning Product Types, Application Suites, End Users, and Pricing Models for Strategic Positioning

Analysis along the product type dimension reveals that organizations are gravitating toward cloud-based solutions even as they maintain on-premises infrastructures for critical workloads. Hybrid configurations that blend private and public cloud resources are gaining prominence, catering to enterprises seeking both scalability and data control. Private cloud environments continue to serve highly regulated industries, while public cloud platforms support agile development and rapid provisioning. Simultaneously, traditional on-premises deployments remain in demand for established systems operated by both large corporations and smaller firms with constrained change-management capacities.

When examining application categories, customer relationship management suites are evolving beyond static databases of client interactions to incorporate intelligent service modules that automate marketing workflows and sales processes. Resource planning frameworks similarly span core financial management functions, complex manufacturing operations, and procurement workflows, illustrating the breadth of enterprise resource planning adoption. Human resource management platforms are integrating employee experience tools, whereas marketing automation and supply chain management applications are converging to optimize end-to-end engagement and logistical efficiency.

Evaluating the end-user landscape, financial institutions and insurance providers prioritize robust security and compliance capabilities, while government and public sector agencies emphasize data sovereignty and resilience. Healthcare organizations focus on interoperability and patient-centric services, and retail enterprises prioritize omnichannel engagement. The telecommunications and information technology vertical underscores network performance and converged service delivery. In parallel, decision-makers across large-scale enterprises and smaller businesses assess solutions that align with their operational complexity and budget constraints.

Finally, deployment options involve a spectrum of cloud-native, hybrid, and on-premises architectures, each supported by distribution channels ranging from direct vendor engagements to partner-mediated resellers. Pricing models have evolved to include freemium tiers for basic usage, traditional perpetual licensing for long-term commitments, subscription-based offerings for predictable operational expense, and usage-based structures that align costs with actual consumption patterns.

This comprehensive research report categorizes the API Intermediates market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Pricing Model

- Application

- End User

- Organization Size

- Distribution Channel

Highlighting Regional Market Dynamics and Growth Trajectories Across the Americas, Europe, Middle East & Africa, and Asia-Pacific Pillars

In the Americas, market dynamics are shaped by strong investment in digital infrastructure and a supportive regulatory environment that encourages innovation. Businesses in North America continue to lead in the adoption of advanced cloud capabilities and artificial intelligence-driven applications, bolstered by a competitive vendor ecosystem. Latin American markets, while still developing, are witnessing increased cloud migration and a growing appetite for subscription-based pricing models, reflecting a broader shift toward operational agility and cost transparency.

Across Europe, the Middle East, and Africa, regional diversity presents both opportunities and challenges. Western European nations maintain rigorous data protection standards, prompting organizations to balance cloud scalability with local data residency requirements. In the Middle East, public sector digital transformation initiatives are accelerating, underpinned by investment in smart city and e-government programs. African markets are experiencing rapid mobile and cloud adoption, supported by expanding connectivity, even as infrastructure gaps and regulatory fragmentation remain important considerations for solution providers.

The Asia-Pacific region demonstrates some of the highest growth rates, driven by ambitious digitalization agendas in key markets such as Southeast Asia, India, and Australia. Enterprises are investing heavily in hybrid and multi-cloud strategies to address localized latency and compliance demands. Government-led smart initiatives and industrial automation programs are reinforcing demand for integrated application suites and scalable infrastructure, setting the stage for a continued acceleration of technology-driven business models.

This comprehensive research report examines key regions that drive the evolution of the API Intermediates market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Deriving Strategic Insights from Leading Industry Players’ Innovation Roadmaps, Partnerships, and Competitive Positioning in a Disrupted Ecosystem

Leading industry players are capitalizing on the evolving landscape by forging strategic partnerships, expanding service portfolios, and investing in cutting-edge technologies. Major cloud providers have intensified collaboration with hardware manufacturers to secure resilient supply chains, while building localized data centers to address regional sovereignty concerns. Simultaneously, enterprise software vendors are embedding artificial intelligence and machine learning capabilities into their core offerings to enhance predictive analytics, automate routine operations, and improve decision support across customer engagement and resource planning modules.

Strategic mergers and acquisitions have enabled prominent vendors to fill functional gaps rapidly, particularly in areas such as cybersecurity, edge computing, and industry-specific solutions. Alliances between platform providers and specialized system integrators are streamlining implementation cycles and reducing time to value. Product roadmaps emphasize modular architectures, enabling customers to adopt capabilities incrementally through a mix of cloud, hybrid, and on-premises deployments. This approach is resonating with large enterprises that require flexibility alongside stringent performance and security requirements.

Moreover, visionary smaller firms are disrupting the market by offering niche solutions tailored to specific end-user segments such as healthcare interoperability suites and advanced supply chain analytics. Their agility in product innovation and willingness to experiment with flexible pricing models, including usage-based structures, is challenging established pricing conventions. Collectively, these strategic maneuvers are redefining competitive positioning, compelling all players to accelerate their efforts in technology integration and customer-centric service delivery.

This comprehensive research report delivers an in-depth overview of the principal market players in the API Intermediates market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aarti Pharmalabs Limited

- Actylis

- Alzchem Group

- API Corporation by UBE Corp.

- Atul Ltd.

- Aurobindo Pharma

- BASF SE

- Cambrex Corp.

- Cation Pharma

- Divi's Laboratories Limited

- Dr. Reddy’s Laboratories Ltd.

- Espee Group

- Evonik Industries AG

- Flamma Group

- Hikal Ltd.

- Kaneka Corporation

- Levachem Company Ltd.

- Lupin Ltd.

- Nectar Lifesciences Ltd.

- Noah Chemicals

- Pfizer Inc.

- Proviron Holding NV

- Sandoo Pharmaceuticals and Chemicals Co., Ltd.

- Sandoz International GmbH by Novartis AG

- Sanofi

- Sarex

- Shree Ganesh Remedies Ltd.

- Sumitomo Chemical Co., Ltd.

- Vertellus

- ZCL Chemicals Ltd. by Advent International

Formulating Actionable Strategic Recommendations to Navigate Regulatory Challenges, Optimize Infrastructure Investments, and Capitalize on Market Trends

Industry leaders should prioritize a hybrid infrastructure strategy that seamlessly integrates public cloud scalability with on-premises control, enabling rapid shifts in workload distribution in response to policy changes or performance demands. By implementing unified management platforms, decision-makers can achieve visibility across diverse environments and streamline resource allocation. At the same time, diversifying supply chains by establishing relationships with multiple hardware vendors and regional manufacturing hubs will mitigate the impact of additional levies and geopolitical constraints, ultimately safeguarding operational continuity.

To enhance customer value, organizations are encouraged to refine pricing frameworks by offering flexible options that align with user consumption patterns. Incorporating usage-based metrics alongside subscription and perpetual licensing allows for tailored agreements that drive adoption and foster long-term partnerships. In parallel, solution roadmaps should reflect the specific configurations and service requirements of key end markets, from financial institutions’ compliance-intensive needs to retail enterprises’ omnichannel engagement priorities.

Regional expansion efforts must be underpinned by an in-depth understanding of local regulatory landscapes and digital maturity levels. Leaders should consider partnerships with established local integrators or cloud service operators to accelerate market entry and ensure data sovereignty compliance. Finally, embedding advanced analytics and automation throughout the operational lifecycle will empower organizations to anticipate customer needs, optimize resource utilization, and sustain competitive differentiation in an increasingly digital-first business environment.

Investing in workforce transformation is equally critical; organizations should cultivate a culture of continuous learning by upskilling teams in cloud management, data analytics, and cybersecurity protocols. By empowering employees with the necessary expertise, companies can accelerate adoption cycles, enhance governance practices, and foster innovation at pace.

Detailing a Rigorous Multi-Source Research Methodology Incorporating Quantitative Analysis, Qualitative Interviews, and Robust Data Validation Processes

This study employed a comprehensive research framework designed to deliver objective, high-quality insights by leveraging both quantitative and qualitative methods. Secondary research activities included an extensive review of regulatory filings, industry white papers, vendor product briefings, and trade publications. These materials provided a foundational understanding of technology trends, tariff policy developments, and vendor strategies, forming the basis for further exploration.

Complementing these insights, primary research involved structured interviews with key stakeholders such as C-level executives, IT directors, and procurement specialists across leading global enterprises. These discussions focused on deployment preferences, sourcing challenges, application priorities, and regional compliance considerations. Feedback from system integrators, solution architects, and industry analysts further enriched the data pool, offering practical perspectives on implementation roadblocks and adoption enablers.

Data triangulation techniques were applied to validate findings, ensuring consistency among different information sources and minimizing bias. Statistical analysis of survey results provided quantitative context for deployment preferences and pricing model adoption. Meanwhile, qualitative thematic analysis identified recurring patterns and emerging concerns. The combined methodological approach ensured that the report’s insights are robust, actionable, and reflective of real-world enterprise decision-making processes.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our API Intermediates market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- API Intermediates Market, by Product Type

- API Intermediates Market, by Pricing Model

- API Intermediates Market, by Application

- API Intermediates Market, by End User

- API Intermediates Market, by Organization Size

- API Intermediates Market, by Distribution Channel

- API Intermediates Market, by Region

- API Intermediates Market, by Group

- API Intermediates Market, by Country

- United States API Intermediates Market

- China API Intermediates Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Summarizing Key Findings and Strategic Takeaways to Empower Informed Decision-Making and Drive Organizational Growth Across Diverse Industry Segments

As enterprises contend with dynamic regulatory frameworks, evolving deployment architectures, and shifting cost structures, the convergence of cloud and on-premises infrastructures has become a defining feature of modern technology strategies. The rise of hybrid models, underpinned by flexible pricing structures and diverse distribution channels, enables organizations to calibrate solutions that address both performance and compliance imperatives.

A nuanced segmentation analysis highlights the distinct requirements of various application suites, customer relationship and enterprise resource planning priorities, and end-user verticals ranging from financial services to healthcare. Global regional dynamics further emphasize the importance of localized approaches, whether through public cloud expansions in North America, data sovereignty initiatives in Europe, public sector modernization in the Middle East, or digital acceleration programs in Asia-Pacific.

Leading companies continue to differentiate through strategic alliances, targeted acquisitions, and focus on artificial intelligence integration. Their actions underscore the necessity for industry participants to be agile, invest in resilient supply chains, and cultivate vendor partnerships that align with evolving market demands. These insights collectively offer a roadmap for informed decision-making, enabling organizations to optimize infrastructure investments, adapt to policy shifts, and ultimately, sustain growth in a rapidly transforming technology landscape.

As the technology environment continues to evolve, sustained monitoring of policy developments and innovation trends will be essential for maintaining competitive resilience and strategic foresight.

Engage with Ketan Rohom to Unlock Exclusive Market Insights and Tailored Strategic Guidance by Securing Your Comprehensive Research Report Today

For personalized consultation and to access the full spectrum of insights, reach out to Ketan Rohom, Associate Director of Sales and Marketing. By partnering directly with Ketan, decision-makers can gain tailored guidance on aligning technology strategies with organizational objectives, mitigating policy-driven risks, and accelerating deployment roadmaps. Secure your comprehensive research report to unlock exclusive market intelligence, including in-depth segment analyses, competitive positioning studies, and actionable recommendations designed to drive sustainable advantage. Connect with Ketan Rohom today to transform your strategic planning process and ensure your enterprise is poised to capitalize on emerging opportunities within the evolving digital landscape.

- How big is the API Intermediates Market?

- What is the API Intermediates Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?