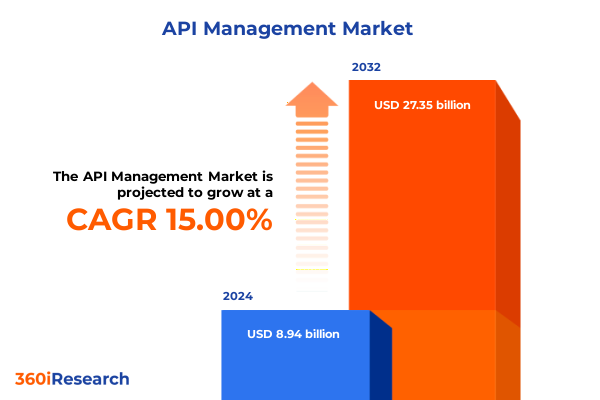

The API Management Market size was estimated at USD 10.22 billion in 2025 and expected to reach USD 11.71 billion in 2026, at a CAGR of 15.08% to reach USD 27.35 billion by 2032.

Unlocking the Power of APIs to Fuel Digital Transformation Priorities and Accelerate Business Innovation

The digital-first era has fundamentally reshaped how enterprises conceive, develop, and deploy applications. As organizations grapple with the demands of rapid innovation, seamless partner integrations, and heightened customer expectations, Application Programming Interfaces (APIs) have emerged as the backbone of modern digital transformation strategies. In this context, API management has become indispensable for ensuring security, governance, scalability, and performance across increasingly complex technology ecosystems. The advent of cloud-native architectures, the proliferation of microservices, and the surge in digital consumption have amplified the need for robust API platforms that can orchestrate access, monitor usage, and enforce policies in real time.

Against this backdrop, stakeholders across industries-from banking and retail to healthcare and government-are investing heavily in API management solutions and services. This research offers a comprehensive examination of the forces redefining the API management landscape, the strategic shifts prompted by regulatory and tariff changes, and the segmentation insights that illuminate where value is being generated. By tracing the interplay between technological advancements and market dynamics, this report equips decision-makers with the clarity needed to navigate an increasingly interconnected world with confidence.

Navigating Critical Technological and Security Shifts That Are Reshaping the Competitive Dynamics of API Management Markets

In recent years, the API management sector has witnessed pivotal transformations driven by the convergence of emerging technologies and evolving business imperatives. The rise of event-driven architectures and serverless computing has prompted vendors to augment their offerings with capabilities that support asynchronous communication patterns and dynamic scaling. Concurrently, the infusion of artificial intelligence and machine learning into API analytics has enabled predictive insights into performance bottlenecks and security threats, thereby elevating operational efficiency.

Moreover, the shift toward zero-trust security models has catalyzed a redefinition of API gateways and identity management features. Authentication and authorization mechanisms are now more tightly integrated with real-time threat detection and anomaly analysis, reflecting a broader emphasis on resilience against sophisticated cyberattacks. These developments have been further accelerated by the imperative for hybrid and multi-cloud deployments, which demand portability and consistency of policy enforcement across disparate environments.

Assessing the Consequences of Recent U.S. Tariff Policies on API Platform Deployments and Service Delivery Models

United States trade policies in 2025 have introduced new tariff measures on certain imported hardware components and network infrastructure that underpin API management platforms. These duties have increased the cost of on-premises deployments, compelling enterprises to reassess their deployment strategies. Consequently, organizations have accelerated their migration to public and private cloud environments that offer tariff-neutral advantages, thereby mitigating hardware tariff exposure.

At the same time, service and consulting providers have seen heightened demand for expertise in designing cloud-native API ecosystems that comply with evolving trade regulations. Customers are seeking guidance on leveraging local data centers and domestic hardware vendors to avoid cross-border duties. Although tariff-induced cost pressures initially disrupted project budgets, they have also spurred innovative approaches to API lifecycle management, such as containerized delivery models and edge-native gateways that rely on locally sourced appliances or infrastructure-as-code templates.

Unveiling In-Depth Market Segmentation Insights That Illuminate Where Services and Solutions Deliver the Greatest Value

The API management market is defined across two primary offerings: services and solutions. The services domain encompasses integration and consulting activities, where client engagements often begin with architecture assessments and proficiency-building workshops. Support and maintenance engagements have likewise scaled, as the complexity of API estates grows and continuous monitoring becomes critical. Training and education programs remain vital, equipping internal teams with the capabilities to innovate at speed while safeguarding compliance.

Meanwhile, solutions span a comprehensive suite of functional areas. API analytics and monitoring modules supply real-time dashboards and predictive alerts, empowering operations teams to maintain optimal performance. Gateway offerings enforce policy-driven access control while providing low-latency routing, and API lifecycle management platforms streamline design, testing, and version control workflows. As security emerges as a top priority, API security solutions integrate threat intelligence, runtime protection, and vulnerability scanning within a unified interface.

This comprehensive research report categorizes the API Management market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering

- API Types

- Deployment Type

- Organization Size

- Industry Vertical

Exploring Crucial API Type Classification Insights That Drive Tailored Governance and Performance Strategies

Across the API spectrum, the nature of the interface varies by intended audience and use case. Composite APIs, which aggregate multiple backend services, are increasingly leveraged to simplify complex orchestration scenarios in enterprise digital platforms. Internal APIs enable rapid innovation within organizational boundaries, facilitating secure data sharing between microservices and monolithic systems. Open APIs foster ecosystem growth by enabling partners, developers, and customers to build new experiences, while partner APIs ensure controlled collaboration with third parties such as payment processors and logistics providers.

The differentiation between these API types is critical for tailoring management strategies. As enterprises expand their digital footprint, they must align governance policies, security postures, and performance SLAs to the unique requirements of each API category, ensuring that internal workflows, developer communities, and partner networks operate in harmony.

This comprehensive research report examines key regions that drive the evolution of the API Management market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing How Hybrid, Private, and Public Deployment Models Drive Performance, Compliance, and Cost Efficiency

Deployment preferences in API management have steadfastly gravitated toward cloud-centric models, driven by scalability imperatives and the desire to offload infrastructure management. Public cloud adoption remains robust, underpinned by the agility of hyperscale providers to deliver on-demand capacity and global reach. Private clouds are preferred in regulated sectors such as finance and healthcare, where data residency and stringent compliance requirements necessitate dedicated environments. Hybrid cloud architectures have emerged as the bridge between performance-critical on-premises workloads and elastic public cloud resources, enabling seamless policy enforcement and unified observability.

Organizations that adopt hybrid strategies benefit from workload portability, burst scaling for peak demand, and the ability to localize sensitive transactions on-premises. This flexibility has become a cornerstone of resilient API management strategies, especially in regions affected by data sovereignty laws and variable network reliability.

This comprehensive research report delivers an in-depth overview of the principal market players in the API Management market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amazon Web Services, Inc.

- Axway, Inc.

- Boomi, LP

- Broadcom Inc.

- CData Software, Inc.

- DreamFactory Software, Inc.

- Fiorano Software, Inc.

- Google LLC by Alphabet Inc.

- Gravitee Topco Limited

- Hewlett Packard Enterprise Company

- Infosys Limited

- International Business Machines Corporation

- Kong Inc.

- Microsoft Corporation

- Moesif, Inc.

- Nevatech, Inc.

- Oracle Corporation

- Perforce Software, Inc.

- Postman, Inc.

- Rapid API

- Salesforce, Inc.

- Salt Security, Inc.

- SAP SE

- Sensedia S/A

- Snaplogic, Inc.

- TIBCO Software, Inc.

- Torry Harris Business Solutions

- Tyk Technologies Ltd.

- UiPath Inc.

- Workato

- WSO2 LLC

Revealing How Organizational Scale Influences API Management Adoption, Governance, and Cost Structures

Enterprise size plays a pivotal role in shaping API management priorities. Large organizations grapple with sprawling API portfolios that require centralized governance, robust analytics, and comprehensive lifecycle automation. These enterprises invest in integrated suites that can span design-time collaboration, runtime security, and API monetization. In contrast, small and medium-sized enterprises (SMEs) often prioritize ease of use and cost-effective consumption, opting for modular, pay-as-you-go service models that align with lean IT teams and agile development practices.

The divergence in requirements has prompted vendors to adapt their packaging and support models. Tiered subscription plans now reflect organization size, with SMEs gaining access to self-service portals and preconfigured policy templates, while large enterprises leverage dedicated account teams, professional services, and custom SLAs. This segmentation has fostered healthy competition among vendors to address both the scale of complex integration projects and the rapid deployment needs of nimble innovators.

Examining How Sector-Specific Compliance and Integration Needs Shape API Management Strategies Across Diverse Industries

Industry verticals dictate unique API management challenges, as different sectors possess distinct regulatory, security, and operational imperatives. In banking, capital markets, and insurance, real-time transaction processing and fraud prevention demand ultra-low-latency gateways and advanced threat detection capabilities. Government agencies emphasize citizen data privacy and interdepartmental data sharing, driving investments in identity federation and compliance reporting features.

Healthcare organizations, including diagnostics labs, hospitals, clinics, and pharmaceutical firms, leverage APIs to integrate patient data, clinical workflows, and research platforms. The sensitivity of health records necessitates end-to-end encryption, audit trails, and strict adherence to standards such as HL7 and FHIR. IT and telecom providers focus on enabling developer ecosystems and partner portals, embedding API management within digital channels that support value-added services and network orchestration. The retail and e-commerce segment depends on scalable, highly available APIs to power personalized shopping experiences, inventory synchronization, and fulfillment integrations with logistics partners.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our API Management market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- API Management Market, by Offering

- API Management Market, by API Types

- API Management Market, by Deployment Type

- API Management Market, by Organization Size

- API Management Market, by Industry Vertical

- API Management Market, by Region

- API Management Market, by Group

- API Management Market, by Country

- United States API Management Market

- China API Management Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Identifying How Regional Regulations, Cloud Infrastructures, and Digital Initiatives Influence API Management Adoption Worldwide

In the Americas, demand for API management continues to be driven by large-scale digital transformation initiatives in financial services, retail, and healthcare. North American enterprises are at the forefront of adopting AI-infused analytics and zero-trust security models within API platforms. LatAm markets are increasingly embracing cloud-based offerings, with regional players focusing on integration services to support expanding fintech ecosystems.

In Europe, Middle East, and Africa, regulatory frameworks such as GDPR and national data protection laws elevate the importance of policy-centric gateways and data masking capabilities. Regional cloud providers are collaborating with global vendors to deliver localized deployments that address latency and compliance requirements. In the Asia-Pacific region, market growth is spurred by government modernization programs and digital infrastructure investments. Countries like India, Australia, and Singapore are pioneering API-first strategies to enhance public services, while Southeast Asian economies benefit from cross-border trade facilitation through standardized partner APIs.

Elevate Your API Strategy with Expert Market Intelligence Tailored to Drive Growth and Competitive Advantage

Are you ready to stay ahead in the rapidly evolving digital ecosystem and capitalize on the transformative power of APIs? Connect with Ketan Rohom, Associate Director of Sales & Marketing at our firm, to learn how this comprehensive market research report can empower your strategic decisions and help you uncover untapped growth opportunities. Discover actionable intelligence on the latest trends, technological advancements, and competitive dynamics to future-proof your API management investments. Reach out today and secure your advantage in the API economy.

- How big is the API Management Market?

- What is the API Management Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?