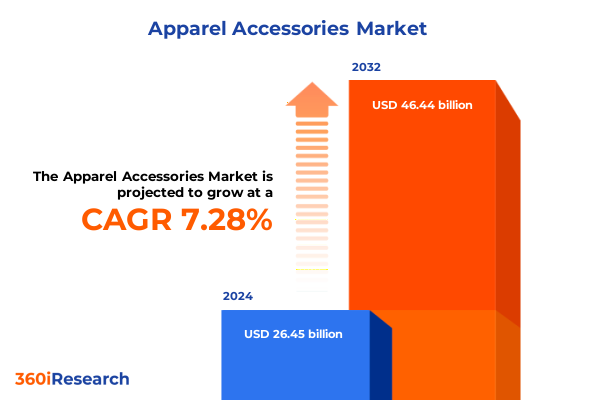

The Apparel Accessories Market size was estimated at USD 28.39 billion in 2025 and expected to reach USD 30.25 billion in 2026, at a CAGR of 7.28% to reach USD 46.44 billion by 2032.

Discover the dynamic evolution and critical growth drivers shaping the global apparel accessories market, unlocking strategic opportunities for stakeholders

In a rapidly evolving global marketplace the role of apparel accessories has transcended traditional fashion boundaries to become a bellwether for consumer sentiment lifestyle aspirations and macroeconomic shifts. Today’s accessories ecosystem encompasses an intricate tapestry of product categories ranging from practical everyday essentials to high-end luxury statements. By illuminating how these categories intersect with distribution channels end-user demographics and regional demand patterns this executive summary sets the stage for a deeper strategic understanding.

Drawing on a blend of qualitative interviews expert analyses and secondary research this report provides a panoramic view of the industry’s current state and its future trajectory. Stakeholders across brands retailers suppliers and investors will benefit from the clarity offered in identifying critical growth drivers and potential disruptive forces. As industry participants position themselves to navigate an era defined by digital acceleration heightened sustainability expectations and shifting trade regimes this introduction underscores the imperative to adopt an integrated and forward-looking perspective.

Uncover how digital innovation sustainability and shifting consumer behaviors are redefining the apparel accessories landscape with unprecedented speed

Digital transformation has emerged as the most consequential shift redefining how consumers interact with apparel accessories. Brands are leveraging cloud-based infrastructures artificial intelligence powered recommendation engines and augmented reality-driven virtual try-on experiences to create seamless omnichannel journeys that marry the convenience of e-commerce with the immersive appeal of brick-and-mortar environments. Advanced analytics have unlocked unprecedented insights into consumer behavior enabling personalized marketing strategies grounded in real-time data. Moreover integration of traceability software is fostering transparency in supply chains while meeting rising regulatory and investor demands for environmental accountability.

Simultaneously sustainability and ethical production have become non-negotiable priorities for consumers and brands alike. Demand for responsibly sourced materials and circular business models is accelerating innovation in eco-friendly fabrics recycled components and resale platforms. This drive toward circularity not only addresses environmental concerns but also offers competitive differentiation as eco-conscious consumers increasingly reward brands that demonstrate genuine commitment beyond token initiatives. Together these digital and sustainability imperatives are shaping an accessory market where agility and purpose-driven innovation are essential for capturing and retaining consumer loyalty.

Examine the broad cumulative effects of newly imposed United States tariff measures in 2025 on consumer prices supply chains and industry dynamics

The United States’ 2025 tariff agenda has imposed sweeping levies on a broad spectrum of accessory imports, reshaping pricing structures and supply chain dynamics. New duties raise China’s base rate to 54 percent with additional 34 percent levies on top of existing tariffs, while Vietnam faces rates up to 46 percent, Bangladesh 37 percent and Cambodia 49 percent. These measures apply universally across finished goods and many raw materials, marking a significant departure from traditional most-favored-nation rates and prompting a strategic reevaluation of sourcing partners.

Immediate consumer impacts are apparent in price upticks for everyday essentials. Analysis from leading economists suggests that average apparel costs may surge as much as 36 percent in the short term, while footwear could see increases near 40 percent. Lower-income households are expected to bear the brunt as price-sensitive items such as cotton T-shirts and children’s shoes become markedly more expensive. Even when policy exclusions are granted for certain electronics, the accessory segment remains largely unshielded.

Importers and retailers are grappling with cost absorption versus pass-through dilemmas. Major players like Puma have experienced inventory backlogs after accelerating shipments to circumvent impending duties, only to face weak demand and deeper discounting pressures. Puma projects an €80 million hit to annual gross profit and is reassessing future purchase orders in response to the tariff-driven margin squeeze.

Differential impacts are also emerging between mass-market and luxury segments. Items produced in Europe such as leather handbags and premium watches generally carry higher markup cushions, enabling brands to moderate price hikes more effectively. In contrast, mass-market accessories sourced from Asia experience sharper margin erosion, threatening the viability of low-margin business models and underscoring the need for diversified sourcing strategies.

Reveal the nuanced segmentation insights across product types distribution channels end users and price tiers that define market diversity and opportunity

The apparel accessories market is characterized by a mosaic of product offerings each with distinct demand drivers and competitive landscapes. Within the broader bags category, backpacks, clutches, crossbody bags, handbags and shoulder bags vie for attention, catering to everything from school-day practicality to evening elegance. Similarly, gloves and mittens range from utilitarian woolen models to high-end leather and touchscreen-enabled designs, reflecting both climate concerns and smart-device integration. Hair accessories encompass clips, pins, combs, hairbands and scrunchies, underscoring the interplay of aesthetics and function in personal grooming. Hats and caps cover baseball caps, beanies, bucket hats and fedoras, illustrating how weather, sport and style converge.

Jewelry spans anklets, bracelets, brooches, pins, earrings, necklaces and rings, each category influenced by cultural traditions, gifting occasions and fashion cycles. Scarves and shawls leverage the richness of materials such as pashmina, silk and wool to create statements of luxury or everyday warmth. Sunglasses adopt familiar aviator, round, square and wayfarer silhouettes that oscillate with seasonal trends. Ties and bow ties serve both corporate dress codes and formal occasions through bow ties, cravats and classic neckties. Wallets and pouches encompass card holders, coin pouches and leather wallets that combine security with style, while watches split into analog, digital and smartwatches, integrating heritage craftsmanship with wearable technology.

Distribution channels fragment into offline retail-encompassing department stores, mass market retailers and specialty boutiques-and online retail through brand-owned websites and broad marketplaces. End-user segmentation spans children, broken down by boys and girls, men including adult men and teen boys, and women covering adult women and teen girls, each cohort presenting unique preferences and purchasing behaviors. Pricing tiers range from luxury artisanal creations to premium branded lines, mid-range essentials and mass-market offerings, allowing brands to align product features, materials and exclusivity with specific consumer segments. This layered segmentation framework highlights the market’s diversity of choice and opportunity.

This comprehensive research report categorizes the Apparel Accessories market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Price Range

- Distribution Channel

- End Users

Illustrate key regional performance drivers and consumer trends shaping the Americas Europe Middle East Africa and Asia Pacific accessory markets

Regional dynamics play a pivotal role in shaping both consumption patterns and competitive strategies. In the Americas, the United States remains the central hub for brand headquarters, retail innovation and tech-enabled consumer experiences, while Mexico and Brazil offer growth avenues through rising middle-class purchasing power and expanding omnichannel infrastructure. The Americas also serve as a critical testing ground for premium and limited-edition accessory launches, reflecting high consumer appetite for both heritage luxury labels and challenger brands.

Europe, the Middle East and Africa (EMEA) present a multifaceted landscape where Western European fashion capitals set global trends and regulatory frameworks, the Gulf Cooperation Council region invests heavily in luxury retail developments and African markets exhibit early signs of e-commerce adoption among youth demographics. Sustainability regulations such as the EU’s Corporate Sustainability Reporting Directive drive transparency in supply chains and traceability initiatives, creating both compliance challenges and differentiation opportunities.

Asia-Pacific stands out as the largest manufacturing base for accessory components and finished goods, with countries like China, Vietnam and Bangladesh supplying the majority of global exports. At the same time, domestic consumption in East Asia, Southeast Asia and Australia is being fueled by digital commerce, social-media-influenced shopping and increasingly sophisticated omnichannel integration. This region’s dual role as supplier and consumer marketplace underscores its strategic importance to brand expansion and supply chain resilience.

This comprehensive research report examines key regions that drive the evolution of the Apparel Accessories market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Explore the strategic initiatives competitive positioning and innovation approaches of leading companies driving momentum in the apparel accessories sector

Leading players across the accessory sector are deploying differentiated approaches to capture market share. Puma’s recent inventory challenges underscore the risks of reactive sourcing strategies under tariff pressure, prompting the company to reevaluate its Asia-centric supply chain and focus on leaner inventory management practices. Nike and Adidas continue to leverage direct-to-consumer channels alongside their wholesale partnerships, investing in proprietary digital platforms to enhance personalization, improve margin capture and gather richer behavioral data.

Luxury conglomerates such as LVMH and Kering are reinforcing vertical integration by acquiring selective manufacturers and logistics providers to secure product quality and supply continuity, while simultaneously nurturing nascent challenger brands through targeted incubator programs. Watchmakers including Rolex and Swatch have expanded smart and hybrid collections to capture tech-influenced demographics, whereas heritage jewelry brands like Cartier and Pandora are capitalizing on brand storytelling and social commerce activations. Across the board, investments in Tier-1 e-commerce solutions, blockchain-enabled traceability and AI-driven design platforms are emblematic of an industry in transition, balancing traditional craftsmanship with forward-leaning innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Apparel Accessories market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adidas AG

- Burberry Group plc

- Burlington Stores Inc.

- Capri Holdings Limited

- Chanel S.A.

- Christian Dior SE

- Fast Retailing Co. Ltd.

- H & M Hennes & Mauritz AB

- Hermès International S.A.

- JD Sports Fashion plc

- Kering SA

- Lululemon Athletica Inc.

- LVMH Moët Hennessy Louis Vuitton

- NIKE Inc.

- Prada S.p.A.

- PUMA SE

- PVH Corp.

- Ralph Lauren Corporation

- Ross Stores Inc.

- Tapestry Inc.

- The Gap Inc.

- The TJX Companies Inc.

- VF Corporation

- Zalando SE

Provide actionable recommendations for industry leaders to navigate market complexities optimize operations and drive sustainable growth

To thrive amidst evolving trade policies and shifting consumer expectations industry leaders should prioritize a dual-pronged strategy that accelerates digital and sustainability agendas. Investing in advanced AI-enabled merchandising tools and augmented reality experiences can deepen customer engagement, optimize inventory turns and fortify brand loyalty in omnichannel environments. Embedding traceability solutions across the supply chain not only enhances regulatory compliance but also resonates with increasingly eco-conscious consumers.

Simultaneously, diversification of sourcing geographies is essential to mitigate tariff-induced risks. Establishing flexible manufacturing partnerships in regions with stable trade agreements, such as Central America or Eastern Europe, can provide buffer capacity while preserving cost competitiveness. Brands must also adopt scenario-planning frameworks to stress-test pricing strategies and inventory models against potential policy shifts. Finally, fostering a culture of continuous innovation-combining heritage craftsmanship with agile product development cycles-will empower organizations to respond swiftly to emerging trends and maintain relevance in a rapidly changing marketplace.

Detail the rigorous research methodology incorporating primary interviews data triangulation and expert validation ensuring robust analysis

This report’s findings are underpinned by a rigorous multi-method research framework designed to ensure analytical depth and actionable relevance. Primary data inputs were gathered through structured interviews with senior executives representing leading brands, retailers and supply chain partners. Secondary research encompassed comprehensive reviews of trade publications, industry white papers and financial filings to validate market observations and emerging trends.

Quantitative insights were triangulated using import-export databases, custom surveys and proprietary technology adoption metrics. This approach was complemented by expert panels comprising academic authorities, policy analysts and technology innovators to stress-test preliminary conclusions and refine strategic implications. Throughout the research process, strict data governance protocols were maintained to uphold integrity and reproducibility. The resulting insights reflect a balanced synthesis of qualitative perspectives and quantitative evidence, equipping decision-makers with a robust intelligence foundation.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Apparel Accessories market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Apparel Accessories Market, by Product Type

- Apparel Accessories Market, by Price Range

- Apparel Accessories Market, by Distribution Channel

- Apparel Accessories Market, by End Users

- Apparel Accessories Market, by Region

- Apparel Accessories Market, by Group

- Apparel Accessories Market, by Country

- United States Apparel Accessories Market

- China Apparel Accessories Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 3180 ]

Summarize the overarching findings reinforcing strategic imperatives and highlighting key takeaways that empower stakeholders to make informed decisions

In conclusion the apparel accessories market stands at a crossroads defined by technological acceleration, sustainability imperatives and evolving trade landscapes. The interplay of digital innovation and ethical production is reshaping both consumer expectations and competitive benchmarks, requiring industry participants to adopt integrated strategies that bridge e-commerce, physical retail and supply chain transparency.

As regional dynamics continue to evolve from the Americas through EMEA to Asia-Pacific, brands and retailers must cultivate agility in sourcing, channel management and product development. Leading companies demonstrate that aligning heritage craftsmanship with data-driven personalization and circular economy principles creates durable competitive advantage. The strategic recommendations outlined herein offer a blueprint for stakeholders to navigate these complexities, prioritize investment imperatives and ultimately drive sustainable growth across the accessory sector.

Engage with Ketan Rohom Associate Director Sales Marketing to secure your comprehensive market research report and unlock actionable insights for growth

Engaging with Ketan Rohom provides you direct access to an in-depth overview of emerging trends competitive dynamics and strategic frameworks that underpin the ever-changing apparel accessories landscape. By partnering with an experienced Associate Director in sales and marketing you gain tailored guidance on how to leverage the comprehensive findings presented in this report for maximum impact. Reach out today to secure a copy that will equip your organization with the clarity and confidence needed to capitalize on market opportunities and drive long-term value.

- How big is the Apparel Accessories Market?

- What is the Apparel Accessories Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?