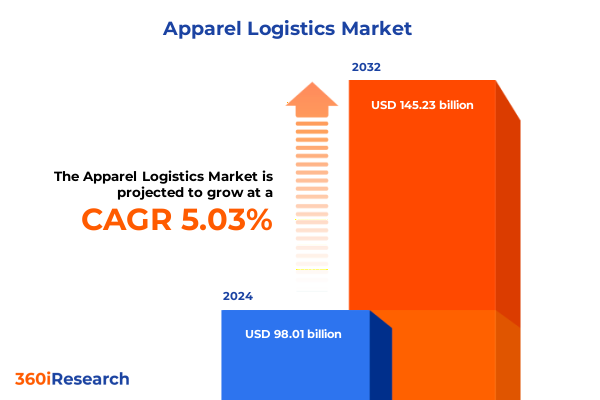

The Apparel Logistics Market size was estimated at USD 102.87 billion in 2025 and expected to reach USD 108.64 billion in 2026, at a CAGR of 5.04% to reach USD 145.23 billion by 2032.

Navigating the complex terrain of apparel logistics in an ever-evolving global market where accelerating consumption trajectories demand speed, agility, and resilience to drive competitive success

As global apparel consumption accelerates, logistics networks are under relentless pressure to keep pace with evolving consumer demands, technological advancements, and shifting trade policies. E-commerce continues to reshape purchasing behavior, with social media–driven sales forecasted to reach 8.5 trillion EUR by 2030, underscoring the urgency for scalable, tech-enabled logistics solutions that can handle surging order volumes and intricate fulfillment patterns.

Consumer expectations are also evolving beyond speed to include sustainability commitments, with 58% of shoppers expressing willingness to participate in recycling or buy-back programs as part of their shopping experience. This trend places additional emphasis on reverse logistics, circular economy strategies, and transparent supply chain practices that demonstrate environmental responsibility while maintaining cost-effectiveness.

Meanwhile, the lingering effects of pandemic-era disruptions and recent tariff shocks have led many apparel brands and retailers to reconsider global sourcing footprints. Nearshoring initiatives are gaining traction, evidenced by the opening of new cross-border logistics hubs-such as the recent facility launched in Laredo, Texas-to support expedited customs processing and reduce exposure to geopolitical trade volatility.

Against this backdrop of rapid change and mounting complexity, this executive summary provides a concise yet comprehensive overview of the transformative shifts, tariff implications, segmentation insights, regional nuances, key industry players, and actionable strategies shaping the future of apparel logistics.

Uncovering the seismic industry shifts reshaping apparel logistics through digital innovation, sustainability imperatives, omnichannel integration, and evolving consumer expectations

The apparel logistics landscape is undergoing seismic transformations driven by digital innovation, sustainability imperatives, and changing consumer behaviors. Leading logistics providers are integrating generative AI into core processes to enhance data management, accelerate response times for customer requests, and deliver more accurate, personalized proposals. For example, AI-powered tools now automate initial data cleansing and analysis, ensuring logistics engineers can design solutions more efficiently and reduce time to market by significant margins.

Sustainability has transitioned from a peripheral concern to a strategic priority, with major carriers and freight forwarders forging collaborative agreements with airlines and ocean shipping lines to accelerate the adoption of sustainable aviation fuels, optimize vessel utilization, and develop low-emission transport corridors. These initiatives not only reduce carbon footprints across air, sea, and road transport but also position participants to meet emerging regulatory requirements and customer expectations for green logistics solutions.

At the same time, the drive for operational resilience has spurred investments in warehouse automation and autonomous transport. Strategic partnerships between robotics innovators and contract logistics leaders are deploying collaborative mobile robots for flexible in-facility material handling, while pilot programs for driverless freight trucks on major intercity routes aim to alleviate labor shortages and enhance safety through advanced sensing technologies and remote monitoring systems.

These converging trends underscore a fundamental shift in apparel logistics: success now depends on an integrated approach that harmonizes digital capabilities, sustainability commitments, and adaptive operational models to navigate uncertainty and capture new growth opportunities.

Assessing how the latest U.S. tariff measures introduced in 2025 are compounding complexity across sourcing strategies, cost structures, and supply chain agility for apparel logistics

In 2025, the U.S. government implemented sweeping tariff measures affecting key apparel manufacturing hubs, imposing duties that range from 38% to 65% on imports from countries such as China, Vietnam, India, and Bangladesh-up from previous rates of approximately 11–12%-in an effort to bolster domestic industries and address trade imbalances. These abrupt rate increases have introduced significant cost pressures for apparel importers, compelling rapid adjustments in sourcing strategies and supply chain configurations.

Trade data reveal the immediate impact: imports of clothing from China to the United States plunged to a 22-year low in May, with values tumbling from $796 million in April to $556 million in May as buyers pivot toward alternative suppliers in Mexico, Vietnam, and Bangladesh. While this shift alleviates some tariff burdens, it also exposes brands to capacity constraints and varying quality standards in emerging sourcing locations.

Retailers and brands are grappling with the aftermath as well. Notably, a leading sportswear manufacturer reported an 18.3% year-on-year inventory buildup in North America after accelerating shipments to beat tariff deadlines, triggering elevated discounting and profit compression estimated to approach a €80 million hit to gross profit. These challenges underscore the complex interplay between trade policy and inventory management, where misaligned timing and demand forecasts can translate directly into margin erosion.

Looking ahead, industry stakeholders are exploring hedging strategies that combine diversified sourcing, nearshoring partnerships, and dynamic pricing models. The goal is to strike a balance between cost containment and service levels, ensuring supply chain agility while adapting to evolving tariff frameworks and consumer price sensitivities.

Revealing how diverse end-use channels, organizational scales, service model variations, and transport mode preferences uniquely influence operational strategies in apparel logistics networks

Apparel logistics providers must tailor their solutions to the distinct requirements of end-use channels, ranging from direct-to-consumer e-commerce operations to traditional brick-and-mortar retail environments. E-commerce platforms benefit from flexible, responsive fulfillment capabilities that can seamlessly route orders from brand websites and third-party online marketplaces, while retail outlets demand predictable inbound shipments and store replenishment schedules optimized for both standalone apparel boutiques and multi-department department store footprints.

Organizational scale further informs service expectations. Large enterprises often require integrated global logistics frameworks capable of managing high shipment volumes across multiple regions with stringent service level agreements and advanced visibility tools. Meanwhile, small and medium-sized businesses prioritizing cost efficiency may favor modular, scalable solutions that balance performance with lean operational models.

From a service perspective, the logistics spectrum encompasses fourth-party orchestration models that deliver end-to-end supply chain oversight, specialized freight forwarding expertise for multimodal consignment management, and third-party logistics options that range from fully asset-based warehousing and transport to non-asset-based brokerage and carrier management services. These layers of service complexity enable brands to align their logistics investments with network design considerations and desired control levels.

Transport mode selection adds another layer of segmentation, as providers configure air express and standard cargo lanes for time-sensitive fashion drops, leverage bulk and intermodal rail solutions for inland long-haul moves, deploy full truckload and less-than-truckload road services for flexible pallet movements, and utilize full and less-than-container load ocean shipments to optimize cost-to-transit trade-off decisions. This rich tapestry of segmentation options underscores the importance of tailored logistics strategies that reflect channel demands, organizational objectives, service capabilities, and modal efficiencies.

This comprehensive research report categorizes the Apparel Logistics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- End Use Industry

- Organization Size

- Service Type

- Mode Of Transport

Exploring distinct regional dynamics driving performance in apparel logistics across the Americas, Europe Middle East and Africa, and Asia Pacific markets with unique infrastructure and demand patterns

Regional landscapes in apparel logistics differ markedly based on infrastructure maturity, regulatory environments, and consumer spending patterns. In the Americas, logistics hubs are increasingly concentrated near cross-border corridors, with new facilities dedicated to streamlined customs brokerage and cross-docking operations emerging to support nearshoring trends. These developments enhance delivery speed and reliability for U.S. markets while mitigating exposure to rising import tariffs through closer proximity to production zones.

Across Europe, the Middle East, and Africa, the intricate patchwork of trade agreements and customs unions has fostered sophisticated distribution networks that leverage rail and road connectivity to bridge Western European consumption centers, Gulf Cooperation Council transshipment points, and emerging African markets. Investments in green corridors and digital customs platforms are also accelerating, reducing dwell times and supporting sustainability goals through optimized load factors and intermodal transitions.

In Asia Pacific, rapid e-commerce adoption coupled with diverse manufacturing hubs has intensified competition for logistics capacity. Regional players are scaling up advanced warehouse automation, last-mile density solutions, and cross-border express lanes to serve dynamic consumer segments. Insights from global e-commerce surveys highlight the region’s appetite for sustainable delivery options and personalized fulfillment experiences, reinforcing the need for logistics networks that can flexibly accommodate varying urbanization and regulatory contexts.

These regional nuances demand that apparel brands and logistics partners develop differentiated strategies that leverage local strengths, address infrastructure constraints, and align with regulatory and customer expectations to achieve consistent service excellence worldwide.

This comprehensive research report examines key regions that drive the evolution of the Apparel Logistics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing leading logistics and supply chain providers investing in technology, sustainability partnerships, and strategic collaborations to drive differentiation in the apparel logistics ecosystem

Leading players in the apparel logistics space are distinguishing themselves through targeted investments in technology, sustainability, and collaborative partnerships. Contract logistics giants are embedding generative AI platforms into their service portfolios, automating proposal development and data analytics to drive rapid solution design and real-time customer insights.

Freight forwarders are reinforcing their global networks with specialized customs clearance hubs, exemplified by the establishment of new facilities at strategic border points to facilitate expedited cross-border shipments and robust brokerage services. By doing so, they enable brands to navigate complex trade regulations with greater ease and reduced transit times.

Sustainability collaborations are also on the rise, as industry leaders sign memoranda of understanding with airline carriers to pilot sustainable aviation fuel programs and track emissions data across air freight lanes. These initiatives not only demonstrate environmental stewardship but also prepare logistics providers and their customers for imminent regulatory requirements around carbon reporting.

Moreover, pioneering warehouse automation alliances are delivering flexible, scalable robotics solutions that adapt to fluctuating seasonal volumes and diverse product assortments. Autonomous vehicle trials on key freight corridors are further augmenting capacity resilience by addressing driver shortages and safety considerations. Together, these strategic moves highlight the competitive imperatives of innovation, collaboration, and sustainability in securing leadership positions within the apparel logistics ecosystem.

This comprehensive research report delivers an in-depth overview of the principal market players in the Apparel Logistics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A.P. Moller - Maersk AS

- Amazon.com Inc

- Apparel Logistics Group Inc

- Bleckmann Logistics

- C.H. Robinson Worldwide

- CEVA Logistics SA

- CJ Logistics

- Dachser

- DB Schenker

- Deutsche Post DHL Group

- DSV AS

- Expeditors International of Washington Inc

- FedEx Corp

- GEODIS

- GXO Logistics

- Hellmann Worldwide Logistics

- J.B. Hunt Transport Services

- Kintetsu World Express

- Kuehne + Nagel International AG

- Logwin AG

- Nippon Express

- OIA Global

- Ryder Supply Chain Solutions

- Sinotrans

- UPS Supply Chain Solutions

Delivering targeted strategic initiatives and operational best practices to help industry leaders optimize efficiency, resilience, and sustainability across apparel logistics operations

Industry leaders should prioritize the integration of advanced data and AI capabilities to enhance decision-making across transportation planning, demand forecasting, and network optimization. By deploying generative AI tools that automate data cleansing and proposal analysis, organizations can accelerate response times and reduce planning errors, ultimately improving service reliability and cost efficiency.

Next, forging multi-stakeholder sustainability alliances across carriers, shippers, and technology providers is essential to advance decarbonization goals. Implementing collaborative fuel programs, optimizing modal shifts toward low-emission transport corridors, and investing in circular packaging solutions will not only reduce environmental impact but also strengthen brand reputation and regulatory compliance.

Embracing nearshoring and dual-sourcing strategies can mitigate tariff risks and enhance supply chain agility. By establishing cross-border logistics hubs and cultivating partnerships with regional manufacturers, companies can balance cost advantages with shorter transit times, enabling more responsive inventory replenishment and risk dispersion in volatile trade environments.

Finally, leaders must cultivate modular, scalable service offerings that address the varied needs of enterprise and small business customers. Leveraging a mix of asset-based warehousing, non-asset brokerage, freight forwarding, and specialized fourth-party orchestration services will enable logistics providers to deliver customized solutions aligned with channel-specific requirements and growth objectives.

Detailing a rigorous multi-phase research approach combining primary stakeholder interviews, comprehensive secondary data analysis, and expert validation for robust apparel logistics insights

This research employs a structured, multi-phase methodology designed to capture comprehensive insights into the apparel logistics landscape. The first phase involved in-depth interviews with senior executives and supply chain practitioners across leading logistics providers, apparel brands, and retail organizations to gather qualitative perspectives on emerging trends, strategic priorities, and operational challenges.

The second phase comprised an extensive review of secondary data sources, including trade publications, corporate press releases, government trade statistics, and industry association reports. This triangulation of data enabled the validation of observed shifts in trade flows, tariff policies, and technology adoption rates across key regions and market segments.

To ensure the robustness of findings, the third phase incorporated granular segmentation analyses, examining variations in end-use channels, organizational scales, service models, and transport modes. This approach facilitated the identification of nuanced requirements and performance differentials within the broader market.

Finally, expert validation workshops were convened with third-party logistics specialists, freight forwarders, and transport technology innovators to review preliminary conclusions, refine strategic recommendations, and align on future outlook implications. This iterative validation process ensures that the insights and recommendations presented are not only factually accurate but also pragmatically relevant for industry decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Apparel Logistics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Apparel Logistics Market, by End Use Industry

- Apparel Logistics Market, by Organization Size

- Apparel Logistics Market, by Service Type

- Apparel Logistics Market, by Mode Of Transport

- Apparel Logistics Market, by Region

- Apparel Logistics Market, by Group

- Apparel Logistics Market, by Country

- United States Apparel Logistics Market

- China Apparel Logistics Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2067 ]

Synthesizing critical findings on market transformations, tariff impacts, segmentation dynamics, and regional nuances to chart a strategic path forward in apparel logistics excellence

This executive summary has distilled the critical dynamics reshaping the apparel logistics sector, from the accelerating influence of digital technologies and sustainability imperatives to the material impacts of U.S. tariff policies and the nuanced demands of diverse market segments. Through curated segmentation frameworks and regional analyses, it underscores the necessity of tailored logistics strategies that align operational design with channel-specific and geographic considerations.

The highlighted case studies of industry leaders demonstrate how targeted investments in AI, automation, and green initiatives are driving competitive differentiation. At the same time, the tariff-driven disruptions of 2025 have illustrated the profound linkages between trade policy and supply chain resilience, reinforcing the value of flexible sourcing strategies and nearshoring options.

By synthesizing these insights and actionable recommendations, industry stakeholders can chart a path forward that balances efficiency, agility, and sustainability. The integration of advanced data analytics, collaborative sustainability programs, and scalable service models provides a robust blueprint for navigating future uncertainties and capturing emergent opportunities.

As apparel consumption patterns continue to evolve alongside geopolitical and technological shifts, the capacity to adapt logistics networks with precision and foresight will remain the defining factor in securing enduring competitive advantage within the global apparel ecosystem.

Unlock unparalleled apparel logistics intelligence by connecting directly with Ketan Rohom Associate Director Sales and Marketing to secure your comprehensive market research report

To gain a competitive edge and access the full depth of our apparel logistics research, reach out to Ketan Rohom Associate Director Sales and Marketing. His expertise will guide you through the comprehensive insights and strategic recommendations contained in the full market research report. By partnering with Ketan, you can secure a tailored analysis of your specific supply chain challenges, receive customized data interpretations, and explore advanced solutions to elevate your logistics operations. Don’t miss the opportunity to leverage this critical intelligence to drive cost efficiencies, enhance resilience, and accelerate sustainable growth in your apparel logistics network.

- How big is the Apparel Logistics Market?

- What is the Apparel Logistics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?