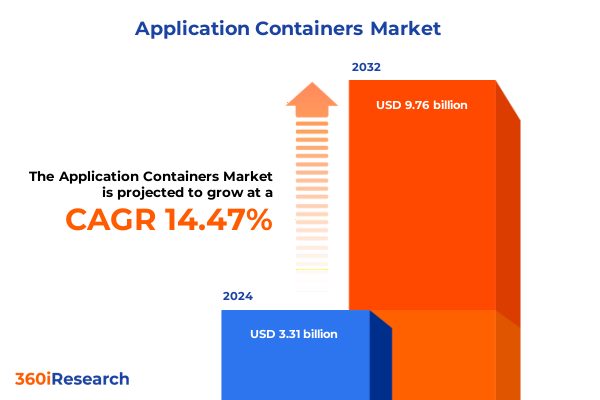

The Application Containers Market size was estimated at USD 3.78 billion in 2025 and expected to reach USD 4.33 billion in 2026, at a CAGR of 14.48% to reach USD 9.76 billion by 2032.

Setting the Stage for Unprecedented Transformation in Application Container Adoption and Enterprise Modernization Across Multiple Environments

In an era where digital transformation dictates competitive advantage, application containers have emerged as the cornerstone of modern software delivery. With enterprises striving to accelerate time to market, enhance operational efficiency, and reduce infrastructure overhead, containerization is redefining how development teams build, package, and deploy applications. This introduction frames the critical role of containers in bridging traditional IT constraints and the demands of cloud-native architectures, offering a foundation for understanding subsequent insights.

As development teams transition from virtual machines to lightweight, portable containers, a new paradigm of resource optimization and portability has taken hold. This shift is underpinned by a cultural change toward DevOps practices and continuous integration and delivery pipelines, which rely on consistent environments from development through production. Consequently, containerization is not merely a technical innovation but a strategic enabler of organizational agility and resilience in the face of evolving market pressures.

Looking ahead, this report explores transformative shifts across technology, policy, and business models that are accelerating the adoption of containers. By examining current trends and emerging paradigms, readers will gain clarity on how to harness the full potential of application containers to drive digital initiatives. The insights offered here aim to guide decision-makers in prioritizing investments, aligning teams, and architecting solutions that deliver both immediate value and long-term growth.

Unveiling the Rapid Evolution of Container Technologies Reshaping Development, Deployment, and Operational Paradigms in Modern IT Environments

Rapid innovation in container orchestration, security, and networking has reshaped the IT landscape, enabling organizations to scale microservices-based applications with unprecedented control. Kubernetes’ maturation as the de facto orchestration layer has catalyzed a proliferation of open-source tools and commercial distributions. Its extensible framework supports diverse workloads, integrates seamlessly with service mesh architectures, and empowers teams to automate complex deployment topologies across clusters.

Meanwhile, developers are leveraging container-native security measures from build to runtime, embedding vulnerability scanning into continuous integration pipelines and adopting zero-trust models. As a result, security is no longer an afterthought but an integral component of the DevOps lifecycle. Moreover, service mesh technologies have emerged to manage interservice communication, providing observability, traffic management, and resilience without requiring application code changes.

Edge computing and serverless paradigms are extending container use cases beyond centralized data centers to distributed environments. Enterprises can now run containers on IoT gateways, telecom edge nodes, and remote branch offices, unlocking low-latency processing for critical workloads. This convergence of edge, serverless, and containerization is setting the stage for highly distributed, autonomous applications that respond in real time to user demands and data insights.

Assessing the Far-Reaching Consequences of 2025 United States Tariff Measures on Infrastructure Costs and Container Platform Economics

In 2025, United States tariff policies targeting semiconductor imports and hardware components have exerted pressure on the cost structure of on-premises infrastructure, indirectly influencing container adoption strategies. As tariffs raise the price of servers, networking gear, and storage appliances, enterprises are reevaluating capital expenditures and exploring consumption-based models. Cloud providers, facing increased procurement costs, have incrementally adjusted pricing tiers, prompting organizations to optimize container workloads for cost efficiency.

Consequently, hybrid cloud architectures have gained traction as a hedge against fluctuating tariff-induced expenses. Organizations retain critical workloads on local infrastructure while bursting to multiple public cloud providers to manage peak demand and mitigate regional cost increases. This flexible approach enables teams to maintain service levels without committing to large-scale hardware purchases at uncertain price points.

Furthermore, container platform vendors have responded by decoupling software licensing from specific hardware configurations, offering subscription models aligned with usage metrics rather than host counts. This shift reduces exposure to geopolitical cost volatility and fosters broader adoption among midsize enterprises seeking predictable operating expenses. The cumulative impact of tariffs has thus accelerated networked container environments and financial models that prioritize agility over capital intensity.

Key Segmentation-Driven Perspectives on Container Platforms Across Types, Deployment Modes, Application Use Cases, End Users, and Operating Systems

When examining market segmentation by container type, Docker leads with its modular approach, offering a widely adopted Community Edition as well as an enterprise-grade distribution tailored to production environments. Complementing this, Linux containers (LXC) present a mature virtualization option available in both enhanced and standard variants, while Rkt provides an alternative runtime with distinct architectural philosophies through its Version 1 and Version 2 releases.

Segmentation by deployment mode reveals that cloud-based container services are diversifying into public, private, and multi-cloud offerings to meet compliance and performance requirements. Hybrid strategies are emerging as an essential bridge between fully managed services and on-premises deployments, enabling enterprises to tailor their mix of edge, data center, and cloud resources according to workload criticality.

From an application type perspective, containers are empowering big data and analytics pipelines, simplifying the orchestration of high-volume processing tasks. They are also central to DevOps initiatives, supporting continuous integration and continuous delivery workflows as well as configuration and source code management tools. In addition, IoT applications leverage container portability to distribute microservices such as API gateways, event streaming platforms, and service mesh proxies closer to the data source, enhancing responsiveness for smart devices.

End users across banking, financial services, and insurance sectors adopt containers to modernize core systems with rigorous compliance controls. Healthcare organizations deploy containerized applications in hospitals and pharmaceutical research to accelerate clinical data processing, while digital service providers and network operators in the IT and telecom space rely on containers for rapid service rollout and network function virtualization. Manufacturing and retail enterprises leverage containers to integrate shop-floor systems and omnichannel platforms, driving real-time visibility and customer engagement.

The underlying operating systems powering these container instances are predominantly Linux distributions-including Red Hat Enterprise Linux, SUSE, and Ubuntu-alongside Windows Server environments such as Windows Server 2016 and Windows Server 2019. Each platform offers tailored ecosystem integrations, security frameworks, and performance optimizations that influence enterprise selection criteria and deployment architectures.

This comprehensive research report categorizes the Application Containers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Container Type

- Deployment Mode

- Application Type

- Operating System

- End User

Analyzing Regional Dynamics Influencing Container Adoption, Infrastructure Strategies, and Enterprise Modernization Trends Across the Americas, EMEA, and Asia-Pacific Markets

In North and South America, the United States continues to dominate container adoption, driven by extensive public cloud investments, a thriving developer community, and regulatory support for digital infrastructure. Latin American organizations, meanwhile, are accelerating modernization efforts by partnering with global cloud providers to overcome legacy constraints and regulatory complexities.

Europe, the Middle East, and Africa present a mosaic of regulatory and technical environments. Stringent data sovereignty laws in the European Union have spurred private and sovereign cloud initiatives, compelling enterprises to deploy containerized workloads within regional data centers. Across Africa and the Middle East, rapid urbanization and telecom expansions are fueling interest in edge container architectures, particularly for smart city and fintech applications.

Asia-Pacific markets exhibit some of the highest container adoption rates globally, driven by national digitization agendas and robust manufacturing sectors. China’s large-scale industrial cloud deployments, Japan’s focus on advanced manufacturing automation, and Southeast Asia’s burgeoning startup ecosystems illustrate how regional nuances shape container strategies. In each case, local vendors and global hyperscalers are forging alliances to deliver integrated container services that comply with regional regulations and performance requirements.

This comprehensive research report examines key regions that drive the evolution of the Application Containers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Container Ecosystem Players and Their Strategic Approaches to Driving Innovation, Market Positioning, and Partner Integrations

Docker, as the originator of mainstream containerization, has solidified its position through open-source leadership and an extensive partner network. Its Enterprise Edition integrates advanced security features and orchestration plugins, catering to large organizations that demand governance and compliance. Red Hat’s OpenShift platform builds on Linux container technology by embedding Kubernetes orchestration, developer pipelines, and certified ecosystem integrations, appealing to enterprises seeking a turnkey hybrid cloud solution.

VMware’s Tanzu suite leverages the company’s virtualization heritage to offer container management that dovetails with existing vSphere environments, enabling customers to modernize without discarding established infrastructures. Similarly, Amazon Web Services and Microsoft Azure have each developed robust container services-ECS, EKS, and AKS, respectively-that provide deep integration with their broader cloud ecosystems, driving consumption through managed services and developer-centric tooling.

Google Cloud Platform champions its Kubernetes Engine, emphasizing automated cluster management, advanced networking, and AI-driven insights. Meanwhile, emerging players such as Rancher by SUSE deliver multi-cluster management across diverse environments, positioning themselves as flexible alternatives for customers seeking vendor neutrality. Collectively, these providers are expanding their portfolios with security, observability, and managed service add-ons, reflecting a competitive push to address the full lifecycle of container-driven applications.

This comprehensive research report delivers an in-depth overview of the principal market players in the Application Containers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amazon Web Services, Inc.

- Docker, Inc.

- Google LLC

- Huawei Technologies Co., Ltd.

- IBM Corporation

- Microsoft Corporation

- Mirantis, Inc.

- Oracle Corporation

- Portainer.io Ltd.

- Red Hat, Inc.

- SUSE LLC

- VMware, Inc.

Strategic Imperatives and Actionable Initiatives for Industry Leaders Seeking to Capitalize on Containerization and Secure Competitive Advantage

To capitalize on containerization’s momentum, industry leaders must prioritize multi-cloud strategies that align workload characteristics with platform strengths. By leveraging consistent orchestration across public, private, and edge environments, organizations can mitigate vendor lock-in and optimize cost and performance metrics. It is equally critical to embed security early in the development cycle, adopting infrastructure as code and policy-as-code frameworks to enforce compliance and reduce vulnerabilities.

Moreover, enterprises should invest in developer enablement initiatives, providing self-service platforms and standardized templates that reduce friction and accelerate application delivery. Embracing service mesh architectures for interservice communication and observability will enhance resilience and simplify debugging across complex microservices landscapes. Furthermore, automating continuous integration, continuous deployment, and configuration management pipelines ensures that infrastructure and application changes propagate reliably.

Finally, forging strategic partnerships with container platform providers and ecosystem integrators can unlock additional value through specialized services such as managed hosting, professional support, and custom optimizations. By fostering a culture of experimentation and continuous learning, organizations position themselves to adapt rapidly to emerging trends and to capture new market opportunities presented by container-driven innovation.

Comprehensive Research Methodology Incorporating Primary Expert Interviews, Secondary Analysis, and Rigorous Data Validation Processes

The research methodology underpinning this report integrates multiple layers of secondary and primary investigation to deliver robust, unbiased insights. Initially, a thorough review of technical documentation, vendor white papers, and open-source forums established a foundational understanding of container technologies, orchestration frameworks, and emerging standards.

Building on this, primary research was conducted through in-depth interviews with technology leaders, enterprise architects, and vendor specialists across regions. These conversations captured firsthand perspectives on adoption drivers, operational challenges, and future roadmaps, providing qualitative depth to complement quantitative observations. Data triangulation techniques were employed to cross-validate interview findings with publicly available case studies and platform usage telemetry.

Finally, an iterative validation process involved peer reviews by industry experts and internal quality assurance protocols to ensure accuracy, relevance, and clarity. This multi-phased approach guarantees that the conclusions presented herein are grounded in real-world experience, reflect current market dynamics, and offer actionable guidance for decision-makers navigating the container ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Application Containers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Application Containers Market, by Container Type

- Application Containers Market, by Deployment Mode

- Application Containers Market, by Application Type

- Application Containers Market, by Operating System

- Application Containers Market, by End User

- Application Containers Market, by Region

- Application Containers Market, by Group

- Application Containers Market, by Country

- United States Application Containers Market

- China Application Containers Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2544 ]

Driving Forward the Container Revolution with Holistic Insights, Strategic Alignment, and the Path to Accelerated Digital Transformation Success

As the container revolution continues, organizations that embrace the principles of portability, automation, and resiliency will gain a decisive advantage in delivering digital services. By synthesizing insights across technology innovation, policy impacts, and market segmentation, this report equips leaders with a holistic understanding of where to focus investments and how to structure organizational capabilities.

The interplay between evolving tariff environments, deployment models, and regional dynamics underscores the need for flexible strategies that adapt to shifting geopolitical and economic landscapes. Enterprises that integrate multi-cloud, hybrid, and edge approaches while maintaining robust security and governance frameworks will be best positioned to capitalize on container-driven efficiencies.

In conclusion, the next phase of application container adoption will be defined by ecosystem collaboration, continuous learning, and technology integration. Organizations that act on these insights today will not only optimize existing workloads but will also lay the groundwork for next-generation architectures that deliver sustained innovation and growth.

Engage with Our Sales Leadership to Secure the Definitive Container Market Research Report and Empower Your Strategic Decision-Making Journey

To delve deeper into the transformational insights and gain unrestricted access to the full analysis of market dynamics, contact Ketan Rohom, Associate Director, Sales & Marketing. Engage with a dedicated expert to explore tailored data and strategic frameworks that align with your organizational objectives. Secure your comprehensive report today to empower your teams with actionable intelligence and maintain a decisive edge in the rapidly evolving container landscape.

- How big is the Application Containers Market?

- What is the Application Containers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?