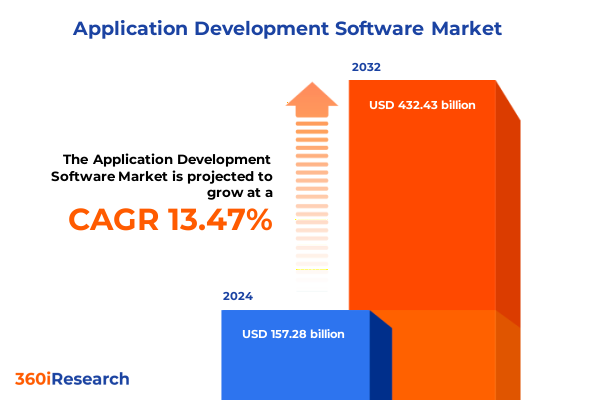

The Application Development Software Market size was estimated at USD 178.53 billion in 2025 and expected to reach USD 202.62 billion in 2026, at a CAGR of 13.47% to reach USD 432.43 billion by 2032.

Unveiling the strategic imperative of application development software in driving innovation, efficiency, and digital transformation across enterprises globally

The rapid integration of digital workflows has placed application development software at the core of modern business strategies. Organizations are under relentless pressure to deliver high-quality, scalable, and secure applications at unprecedented speeds. As the technology landscape evolves, development platforms and tools have become key enablers of innovation, offering capabilities that extend far beyond traditional coding environments. From collaborative code repositories to intelligent performance analytics, these solutions form the backbone of end-to-end software delivery pipelines.

Transitioning into a digital-first era, enterprises face a dual imperative: accelerating feature delivery while maintaining operational resilience. Continuous integration and continuous delivery practices have redefined team workflows, requiring sophisticated tooling for version control, automated testing, and real-time monitoring. Meanwhile, low-code and no-code frameworks have democratized development, empowering business analysts and citizen developers to contribute to application lifecycles.

This executive summary distills the critical shifts shaping the application development software landscape. By synthesizing transformative trends, tariff impacts, segmentation nuances, regional dynamics, and vendor landscapes, this report equips decision-makers with a holistic understanding of the market. The insights presented here lay the groundwork for strategic planning, ensuring that organizations can navigate complexity and seize emerging opportunities with confidence.

Navigating the pivotal shifts redefining the application development software landscape amid evolving architectural paradigms and user expectations

As organizations embrace cloud-native architectures, traditional monolithic development approaches are giving way to microservices, containerization, and serverless computing. This shift enables teams to deploy applications in modular increments, significantly reducing time to market and enhancing system resilience. Concurrently, the rise of DevOps culture has blurred the lines between development and operations, fostering cross-functional collaboration and continuous feedback loops. Platform-as-a-Service offerings now integrate seamlessly with infrastructure provisioning, allowing developers to focus on code rather than environment configuration.

In parallel, the incorporation of artificial intelligence and machine learning into development tooling is transforming how software is designed, tested, and optimized. Intelligent code completion, predictive analytics for performance bottlenecks, and automated anomaly detection have become integral to modern integrated development environments. Moreover, the convergence of observability platforms has brought analytics and monitoring into a unified view, giving engineering teams deeper insights into application behavior and user experience.

Together, these trends represent a fundamental redefinition of how software is built and maintained. As the demand for rapid innovation intensifies, organizations must adapt to this new paradigm by adopting flexible, AI-driven, and cloud-native toolchains that align with evolving architectural and operational requirements.

Assessing the cumulative impact of the latest United States tariffs on application development software supply chains and vendor cost structures in 2025

The cumulative effect of United States tariffs in 2025 has reverberated throughout the application development software ecosystem, primarily by influencing the cost and availability of underlying hardware infrastructure. Hardware procurement delays and elevated import duties have prompted vendors to reevaluate pricing strategies, often passing increased expenses onto software customers. As a result, organizations reliant on tariff-affected servers and networking equipment have experienced project timeline shifts and higher total cost of ownership for on-premises deployments.

In response, many providers have accelerated their migration to cloud-hosted solutions, where the capital expenditure risks associated with hardware tariffs are mitigated. Cloud platforms, investing heavily in amortized infrastructure, have leveraged economies of scale and global data center footprints to absorb cost fluctuations, offering more predictable pricing models. This shift has further reinforced the broader industry transition toward hybrid and fully managed environments, as enterprises seek to minimize exposure to geopolitical trade tensions.

Looking ahead, supply chain diversification remains a critical strategic imperative. By establishing partnerships with multiple hardware suppliers and exploring alternate manufacturing regions, stakeholders can insulate their development workflows from future tariff-induced disruptions. Ultimately, resilience will depend on a balanced mix of cloud adoption, edge deployments, and selective on-premises investments fine-tuned to each organization’s risk tolerance and performance requirements.

Deriving key insights from multilayered segmentation analyses spanning component, deployment type, organization size, vertical, end user, and platform dimensions

A nuanced understanding of market segmentation reveals the diverse requirements across the application development journey. Component insights underscore that lifecycle management functions such as project planning, release orchestration, and requirements definition remain foundational, while performance management capabilities centered on diagnostics, analytics, and real-time monitoring have escalated in strategic value. Developers gravitate toward integrated development environments, with distinctive preferences for platforms such as Eclipse, IntelliJ IDEA, and Visual Studio. Testing is bifurcated into automated and manual approaches, each critical for ensuring quality, while version control platforms ranging from Git & GitHub to Mercurial and Subversion support collaborative workflows.

Deployment considerations further delineate the landscape. Hybrid, private, and public cloud offerings cater to varying data sovereignty and compliance mandates, contrasting with on-premises solutions that deliver direct infrastructure control. Organization size also shapes purchasing decisions: large enterprises, segmented into mid-tier and global leaders, seek enterprise-grade feature sets and vendor support, whereas small and medium businesses prioritize agility and cost efficiency. Vertical-specific requirements in industries such as banking, government, healthcare, telecommunications, and retail introduce unique compliance and integration demands. End-user roles, including analysts, DevOps engineers, operations teams, project leads, testers, and developers at all levels, each exert influence over tool selection. Platform dependencies on operating systems such as Red Hat and Ubuntu for Linux, macOS, Windows 10, and Windows 11 further refine compatibility and performance expectations.

This comprehensive research report categorizes the Application Development Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Deployment Type

- Organization Size

- Vertical

- End User

- Platform

Uncovering essential regional insights across the Americas, Europe Middle East and Africa, and Asia-Pacific markets for application development software

Regional dynamics demonstrate that the Americas maintain a leadership position in adopting advanced development practices, driven by mature technology infrastructures and substantial investments in cloud transformation. Clients in North America exhibit strong demand for integrated observability and AI-enhanced tooling, while Latin American organizations increasingly pursue cost-effective SaaS models to accelerate digital initiatives amidst budgetary constraints.

Europe, the Middle East, and Africa present a tapestry of regulatory complexities and public sector priorities. In Western Europe, stringent data privacy regulations have spurred the growth of private cloud and on-premises solutions. Meanwhile, federal and regional governments in the Middle East and Africa are embarking on digitalization drives, focusing on secure development platforms for critical services. These developments create opportunities for vendors capable of delivering compliance-ready, localized offerings.

The Asia-Pacific region exhibits the fastest rate of transformation, propelled by expanding cloud footprints, government-backed digital economies, and thriving technology hubs. Banking, telecommunications, and e-commerce verticals in this area are rapidly integrating DevOps and AI-driven development tools. Emerging markets in Southeast Asia and India, characterized by large developer populations and competitive pricing pressures, are fostering innovation ecosystems that compel global providers to adapt feature sets and pricing structures to remain competitive.

This comprehensive research report examines key regions that drive the evolution of the Application Development Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining leading application development software providers reshaping the market through innovation, strategic alliances, and competitive differentiation

Key industry participants are advancing the application development software market through strategic innovation and ecosystem partnerships. Major technology firms offering comprehensive IDE and performance management suites have increasingly focused on AI-infused capabilities, enabling predictive coding suggestions and proactive anomaly detection. Simultaneously, provider mergers and acquisitions have intensified, reshaping competitive dynamics as vendors seek to integrate security, testing, and collaboration functionalities into unified platforms.

Open source platforms have also risen in prominence, with collaborative version control and CI/CD pipelines driving broader community-driven enhancements. Cloud-native vendors, leveraging global infrastructure, continue to undercut traditional licensing models by bundling development services with managed hosting and support. Meanwhile, niche specialists in testing automation and requirements management differentiate through deep vertical expertise, catering to sectors with rigorous compliance mandates such as finance and healthcare. Altogether, the competitive landscape underscores the importance of agility, extensibility, and seamless integration for providers aiming to capture the evolving needs of enterprise and developer audiences alike.

This comprehensive research report delivers an in-depth overview of the principal market players in the Application Development Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adobe Inc

- Amazon.com Inc

- Appian Corporation

- Apple Inc

- Atlassian Corporation

- Autodesk Inc

- Capgemini SE

- Cisco Systems Inc

- Cognizant Technology Solutions Corporation

- Databricks Inc

- Google LLC

- HCL Technologies Limited

- HubSpot Inc

- IBM

- Infosys Limited

- Intuit Inc

- LTIMindtree Limited

- Meta Platforms Inc

- Microsoft Corp

- Oracle Corp

- Salesforce Inc

- SAP SE

- ServiceNow Inc

- Tata Consultancy Services Limited

- Wipro Limited

Formulating actionable recommendations for industry leaders to accelerate adoption, optimize processes, and drive sustainable growth in application development

Industry leaders can accelerate their adoption of next-generation development practices by prioritizing integrated toolchains that seamlessly connect version control, build automation, and performance analytics. This holistic approach minimizes tool fragmentation, enhances developer productivity, and streamlines release cycles. Concurrently, embedding artificial intelligence and machine learning across the development lifecycle can drive significant improvements in code quality, vulnerability detection, and incident response times.

To further strengthen resilience, organizations should embrace hybrid and multi-cloud deployment strategies that distribute workloads according to performance requirements and compliance objectives. Investing in vendor-neutral integration frameworks will facilitate interoperability and reduce lock-in risks. Moreover, tailoring offerings to distinct vertical needs-whether financial services, government operations, healthcare, telecommunications, or retail-can unlock new revenue streams by addressing domain-specific challenges and regulatory landscapes.

Finally, fostering a culture of continuous learning and experimentation will be vital. By enabling cross-functional teams to iterate rapidly, measure outcomes, and incorporate user feedback, leaders can maintain a competitive edge. Incentivizing collaboration between development, operations, security, and business units will ensure that strategic objectives remain aligned with technological capabilities, driving sustained growth in the dynamic application development software market.

Detailing rigorous research methodology that integrates qualitative and quantitative approaches to ensure robust, verifiable findings and transparent insights

The research underpinning this summary employs a hybrid methodology that integrates structured qualitative interviews with senior development and IT leaders alongside quantitative surveys of software practitioners. Primary insights were gathered through in-depth discussions with product managers, architects, and DevOps engineers across a range of industry verticals, providing firsthand perspectives on tool adoption drivers, pain points, and future priorities.

Secondary research involved comprehensive analysis of publicly available technical white papers, academic journals, and vendor documentation to contextualize primary findings within broader market trends. Proprietary data sources were leveraged to track technology maturity curves and measure the diffusion of innovations such as container orchestration, AI-assisted coding, and continuous testing frameworks.

Data triangulation and validation processes ensured the robustness of conclusions. Cross-referencing qualitative narratives with quantitative survey results and secondary benchmarks enabled a multi-dimensional view of the market. The resulting insights offer a transparent, replicable foundation for strategic decision-making, ensuring that stakeholders can rely on this report for deep, actionable intelligence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Application Development Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Application Development Software Market, by Component

- Application Development Software Market, by Deployment Type

- Application Development Software Market, by Organization Size

- Application Development Software Market, by Vertical

- Application Development Software Market, by End User

- Application Development Software Market, by Platform

- Application Development Software Market, by Region

- Application Development Software Market, by Group

- Application Development Software Market, by Country

- United States Application Development Software Market

- China Application Development Software Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 3657 ]

Summarizing critical takeaways and future imperatives for stakeholders navigating the evolving application development software ecosystem

In summary, the application development software landscape is undergoing a profound transformation driven by cloud-native architectures, AI/ML integration, and an expanding emphasis on observability and automation. The cumulative impact of 2025 tariffs has accelerated the pivot toward managed cloud services, reinforcing the imperative for flexible deployment strategies. Detailed segmentation analysis highlights distinct requirements across components, deployment models, organization sizes, verticals, end users, and platforms, underscoring the need for tailored solutions.

Regional variations further illustrate how regulatory frameworks, economic priorities, and digital maturity shape adoption patterns. North America leads in cloud-first strategies, EMEA balances compliance with innovation, and Asia-Pacific drives volume and price-sensitive expansion. Competitive dynamics reveal an ecosystem of established technology incumbents, agile open source communities, and specialized vendors, all vying to deliver integrated, AI-enhanced toolsets.

Looking ahead, stakeholders must embrace continuous innovation, diversify supply chains, and invest in interoperability to maintain momentum. By aligning technology roadmaps with evolving user expectations and market forces, organizations can harness the full potential of application development software to drive differentiation and long-term success.

Request a comprehensive application development software market research report directly from Ketan Rohom to empower strategic decision-making and drive growth

Engaging directly with Ketan Rohom, Associate Director of Sales & Marketing, invites you to secure in-depth analysis and actionable insights to inform your strategic roadmap. Discussions with Ketan will unveil how the findings align with your organizational objectives, unlocking pathways to drive innovation, optimize processes, and capture emerging opportunities in application development software.

By collaborating with Ketan, stakeholders gain access to a tailored exploration of trends, competitive intelligence, and regional dynamics, all synthesized into a comprehensive report. Contacting him ensures a seamless procurement experience and equips your team with the authoritative data needed to make confident investment and technology adoption decisions.

Take the next step to empower your enterprise’s digital transformation journey by reaching out to Ketan Rohom. His expertise in sales and market engagement will guide you through customizing the report to your specific requirements, enabling you to leverage insights that accelerate growth and enhance your competitive stance.

- How big is the Application Development Software Market?

- What is the Application Development Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?