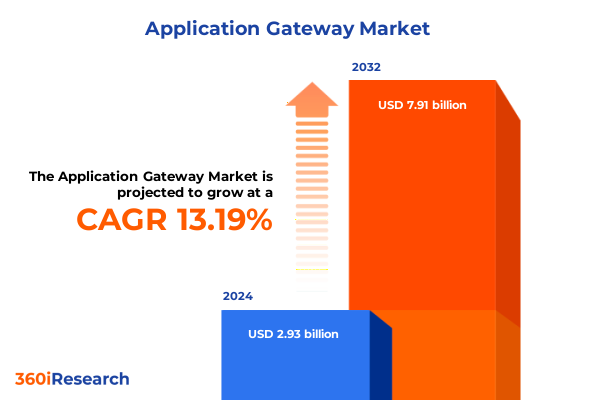

The Application Gateway Market size was estimated at USD 3.31 billion in 2025 and expected to reach USD 3.73 billion in 2026, at a CAGR of 13.22% to reach USD 7.91 billion by 2032.

Unveiling the Critical Role of Application Gateways in Fortifying Modern Digital Infrastructure Through Enhanced Security and Traffic Management

In an era marked by relentless digital transformation, application gateways have emerged as indispensable components of modern network architectures. By providing a critical intermediary that inspects, filters, and optimizes traffic between web servers and clients, these gateways ensure both performance and security for mission-critical applications. As organizations migrate workloads across hybrid and multi-cloud environments, the ability to apply granular controls at the application layer becomes essential for preserving data integrity and user experience. This necessity has elevated application gateways from optional security appliances to core pillars of resilient digital infrastructure.

The surge in remote work, propelled by the need for business continuity and employee flexibility, has further intensified the demand for robust application-level security solutions that can enforce consistent policies regardless of user location or device. Threat actors are rapidly evolving their tactics to exploit vulnerabilities in web applications, making real-time traffic inspection and anomaly detection non-negotiable for enterprises. At the same time, stringent regulatory regimes-spanning GDPR, HIPAA, and PCI-DSS-require precise control over data flows and access privileges, which only application gateways can deliver with the necessary depth and accuracy.

Against this backdrop, the application gateway market is witnessing an accelerated adoption curve fueled by converging digital trends. Enterprises are seeking unified platforms that combine load balancing, SSL offloading, API security, and web application firewalling capabilities in a single solution. Consequently, vendors are innovating at pace, integrating AI-driven threat intelligence, zero-trust enforcement, and cloud-native orchestration to meet the dual imperatives of agility and security. As a result, application gateways now occupy a strategic position in both enterprise security postures and network architectures, poised to address the evolving threat landscape and performance demands of tomorrow’s digital services.

Navigating Paradigm-Altering Forces Shaping the Application Gateway Domain Amidst Cloud Surge Zero Trust Adoption and AI-Driven Security Evolutions

The application gateway landscape is undergoing a paradigm shift driven by the convergence of cloud-native architectures, AI-powered security, and zero trust principles. Enterprises are increasingly migrating from traditional perimeter defenses to hybrid and multi-cloud deployments, prompting gateway vendors to deliver solutions that natively integrate with hyperscaler ecosystems. This shift enables seamless policy enforcement across on-premises data centers and cloud environments, ensuring business-critical applications maintain consistent security and performance standards regardless of their deployment location.

Simultaneously, AI and machine learning are being embedded deep within gateway platforms to automate threat detection and response. By leveraging behavioral analytics, these platforms can identify anomalies in real time, mitigating advanced attacks such as zero-day exploits and sophisticated botnets. Security teams benefit from actionable insights that prioritize high-risk events, reducing alert fatigue and accelerating incident resolution. Major vendors are racing to enhance their AI capabilities, offering pre-trained models and customizable threat profiles tailored to specific industry verticals.

Another transformative trend is the rise of zero trust network access (ZTNA) and microsegmentation. As organizations embrace remote work and distributed applications, the traditional trust boundaries have dissolved. Application gateways are adapting by acting as policy enforcement points that authenticate and authorize every transaction, regardless of origin. This architecture shift diminishes lateral movement within networks and tightly controls access at the application layer. The integration of ZTNA with gateway solutions is rapidly becoming a cornerstone of modern security frameworks, ensuring that only verified entities can interact with sensitive applications.

Edge computing is also reshaping gateway deployments, bringing inspection and optimization closer to end users. By distributing gateway instances across edge locations, organizations can reduce latency and enhance resilience against regional outages. This edge-centric model supports emerging use cases such as real-time IoT data processing and AI inference at the network edge, where milliseconds can determine user satisfaction or operational safety. As edge computing proliferates, application gateways will evolve to provide unified visibility and control across the entire network continuum, from core data centers to the farthest edge nodes.

Assessing the Far-Reaching Ramifications of Expanded United States Trade Tariffs on Application Gateway Hardware and Software Ecosystems in 2025

In response to concerns over unfair trade practices and supply chain vulnerabilities, the United States Trade Representative (USTR) enacted significant tariff adjustments under Section 301, affecting imports of critical technology components from the People’s Republic of China. Effective January 1, 2025, tariffs on solar wafers and polysilicon rose to 50 percent, while certain tungsten products now face a 25 percent duty. These measures aim to incentivize domestic production of strategic materials and strengthen the resilience of key technology supply chains.

The semiconductor sector, vital to application gateway hardware, experienced an even more pronounced duty hike. As of January 1, 2025, USTR imposed a 50 percent tariff on a broad range of semiconductor imports to complement federal investments under the CHIPS and Science Act. The regulation explicitly targets categories where Chinese manufacturers hold 95 percent of global capacity, ensuring that domestic foundries benefit from a more level playing field. This adjustment not only increases the cost of imported gateway appliances but also accelerates the push toward onshore chip fabrication.

Despite the broad tariff increases, the USTR has extended exclusions for 164 Chinese-origin products, including certain solar manufacturing equipment, through August 31, 2025. This temporary relief provides suppliers and network operators additional time to secure compliant alternatives or qualify for further exclusions. However, companies must remain vigilant, as the extension’s expiration may lead to renewed cost pressures on gateway hardware and ancillary components. Organizations that proactively diversify their supply chains and engage with the exclusion request process will be better positioned to mitigate operational disruptions and maintain project timelines.

Illuminating Key Market Segmentation Dimensions Informing Tailored Application Gateway Strategies Across Deployment Models Organization Sizes and Industries

Market segmentation provides a structured lens through which stakeholders can understand diverse deployment preferences and usage patterns across varied organizational environments. When evaluating deployment models, it becomes clear that on-premises implementations continue to serve industries with stringent data sovereignty requirements, while cloud-based gateways have gained traction among enterprises seeking rapid scalability and managed services. Within the cloud segment, hybrid architectures balance legacy system integration with the agility of public cloud offerings, private clouds deliver controlled environments for regulated workloads, and public clouds unlock global reach for web applications. Recognizing these nuances is instrumental for vendors designing modular solutions and for users evaluating total cost of ownership across deployment scenarios.

Organization size profoundly shapes gateway requirements, as large enterprises demand comprehensive feature sets, advanced automation, and global support frameworks to manage complex, multi-regional infrastructures. Conversely, small and medium enterprises often prioritize ease of deployment, cost-effective subscription models, and streamlined management interfaces that minimize reliance on specialized IT staff. By tailoring product tiers and service bundles to these divergent needs, gateway providers can optimize value propositions and expand their addressable audience.

Understanding end-user industries further refines solution positioning. Financial services and insurance firms require high-throughput architectures with deep inspection capabilities to satisfy compliance mandates and thwart financial fraud. Government agencies place a premium on sovereign control and detailed audit trails, while healthcare organizations emphasize patient data confidentiality under HIPAA. IT and telecom sectors leverage gateways to orchestrate microservices at scale, ensuring low-latency delivery for customer applications. Retail and e-commerce enterprises depend on responsive content delivery and consistent user experience across brick-and-mortar channels and online storefronts. By dissecting these vertical dynamics, solution architects can embed vertical-specific features-such as risk scoring for banking transactions or API analytics for telecom operators-directly into gateway offerings.

Offering type segmentation illuminates how content delivery, load balancing, SSL offloading, and web application firewall functions intersect to form holistic gateway platforms. Software distribution and video delivery sub-functions within content delivery address specialized traffic profiles, while distinct load balancers optimize resource utilization across varied microservice topologies. SSL offloaders reduce cryptographic overhead on backend servers, and web application firewalls perform real-time threat mitigation against application-layer exploits. Similarly, application type differentiation-ranging from API endpoints to native mobile and web applications-dictates protocol support, session management, and threat signature requirements. Mobile environments, subdivided into Android and iOS, introduce distinct device characteristics and operating system nuances that gateway policies must accommodate to ensure seamless and secure mobile user experiences.

This comprehensive research report categorizes the Application Gateway market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Deployment Model

- Organization Size

- End User Industry

- Offering Type

Decoding Regional Divergences and Synergies Impacting Application Gateway Adoption Patterns Across the Americas EMEA and Asia-Pacific Markets

Regional dynamics play a pivotal role in shaping the adoption trajectory of application gateway technologies. In the Americas, digital transformation initiatives are accelerated by strong cloud adoption, comprehensive regulatory frameworks such as CCPA, and significant investments in cybersecurity infrastructure. North American enterprises, facing escalating cyberthreat frequencies, prioritize integrated gateway platforms that unify load balancing, SSL inspection, and web application firewalling within hyperscaler environments. Central and South American markets are gradually following suit, driven by the need for secure e-commerce channels and regional data privacy regulations.

Within Europe, Middle East, and Africa (EMEA), a mosaic of regulatory regimes-from GDPR in Europe to evolving data protection laws across the Middle East-demands solution flexibility for sovereign deployments and granular policy enforcement. Public sector modernization projects in the Gulf Cooperation Council are fueling demand for gateways capable of hybrid cloud orchestration, while European financial institutions emphasize detailed audit capabilities. In emerging African markets, constrained network infrastructures and accelerating mobile penetration have created opportunities for edge-deployed gateways that deliver low-latency experiences over cost-effective broadband and cellular networks.

Asia-Pacific (APAC) is witnessing the fastest growth, underpinned by large-scale digitalization efforts across China, India, Japan, and Southeast Asia. Government-led smart city and e-governance programs are integrating application gateways into critical infrastructure, ensuring secure citizen-facing portals and IoT frameworks. Meanwhile, regional hyperscalers and telecom operators are embedding gateway services within their cloud portfolios to serve a burgeoning base of cloud-native startups and enterprises. The fragmentation of regulatory landscapes-ranging from China’s data localization mandates to India’s emerging digital personal data protection law-has heightened the appeal of hybrid gateway solutions that can be tailored to divergent compliance requirements.

This comprehensive research report examines key regions that drive the evolution of the Application Gateway market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Dominant Application Gateway Vendors Unveiling Strategic Alliances Acquisitions and Technological Innovations Shaping Competitive Dynamics

Dominance in the application gateway arena is shared by hyperscale cloud providers and specialized network security vendors, each leveraging distinct strengths. Microsoft Azure Application Gateway and AWS Application Load Balancer collectively command a majority of cloud-native gateway deployments, benefiting from seamless integration with their broader cloud ecosystems and advanced API orchestration capabilities. These platforms offer auto-scaling environments that adapt to dynamic traffic loads, making them the go-to choice for enterprises migrating microservices and container-based applications to the cloud.

Among dedicated appliance and software providers, F5 Networks has solidified its position through strategic acquisitions and deep domain expertise. The recent integration of AI-driven penetration testing capabilities from Heyhack and LeakSignal into the F5 Distributed Cloud Services platform demonstrates an emphasis on preemptive security intelligence and data governance. F5’s BIG-IP series continues to lead in enterprise-grade application delivery, offering customizable traffic steering and hardware-accelerated SSL offloading to meet the performance demands of global financial institutions and telecommunications operators.

Akamai and Cloudflare differentiate with extensive edge networks, delivering distributed denial of service protection and content optimization close to end users. Their focus on a global footprint ensures minimal latency for video streaming, software updates, and mobile application traffic. Citrix and Fortinet cater to hybrid and on-premises scenarios, offering feature-rich ADCs and web application firewalls that integrate with zero trust frameworks. Meanwhile, emerging players like Radware, Imperva, and Juniper Networks are carving niches by specializing in AI-driven bot management and API security, addressing the growing complexity of machine-to-machine communication and automated threats.

Competitive dynamics are increasingly defined by strategic partnerships and ecosystem integrations. Collaborations between gateway vendors and SIEM or SOAR platforms enable comprehensive threat monitoring and incident response, while alliances with container orchestration providers streamline the deployment of gateways within Kubernetes environments. This interconnected landscape underscores the importance of open APIs, modular architectures, and flexible licensing models as factors that differentiate leading suppliers in the evolving application gateway market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Application Gateway market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A10 Networks, Inc.

- Akamai Technologies, Inc.

- Amazon Web Services

- Array Networks, Inc.

- Barracuda Networks, Inc.

- Cisco Systems, Inc.

- Citrix Systems, Inc.

- Cloudflare, Inc.

- F5 Networks, Inc.

- Fastly, Inc.

- Fortinet, Inc.

- Google LLC

- HAProxy Technologies

- Imperva, Inc.

- Juniper Networks

- Kemp Technologies

- Kong Inc.

- Microsoft Corporation

- Palo Alto Networks, Inc.

- Radware Ltd.

Actionable Strategic Recommendations Empowering Industry Leaders to Leverage Application Gateway Solutions for Robust Security Scalability and Operational Efficiency

Industry leaders should prioritize the integration of AI-driven threat analytics into gateway platforms, ensuring that security teams are equipped to detect and respond to novel attack vectors swiftly. By adopting adaptive machine learning models that evolve with emerging threats, organizations can minimize manual rule-set maintenance and refocus resources on proactive defense strategies. Moreover, embedding these capabilities into unified observability dashboards creates a single pane of glass for both network performance and application security monitoring.

Detailed Research Methodology Underpinning the Analysis of Application Gateway Trends Leveraging Rigorous Primary and Secondary Data Collection Techniques

This analysis synthesizes data collected through a combination of primary and secondary research methodologies. Primary data was obtained via in-depth interviews with CIOs, network architects, and security practitioners across key industries, supplemented by structured surveys to capture deployment preferences and future requirements. Secondary research encompassed a comprehensive review of government publications, industry whitepapers, and publicly available press releases from major gateway vendors.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Application Gateway market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Application Gateway Market, by Deployment Model

- Application Gateway Market, by Organization Size

- Application Gateway Market, by End User Industry

- Application Gateway Market, by Offering Type

- Application Gateway Market, by Region

- Application Gateway Market, by Group

- Application Gateway Market, by Country

- United States Application Gateway Market

- China Application Gateway Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Synthesizing Insights from Application Gateway Research to Illuminate Strategic Pathways and Prepare Organizations for Future Technological Challenges

As digital architectures continue to evolve, application gateways will remain critical to balancing security, performance, and compliance demands. The convergence of cloud-native deployments, AI-driven threat intelligence, zero trust principles, and edge computing will dictate the next phase of gateway innovation. Organizations must stay ahead by selecting flexible, modular platforms that can adapt to multi-cloud environments and emerging regulatory landscapes. By implementing the strategic recommendations outlined, enterprises can ensure that their gateways are not merely reactive defenses but proactive enablers of digital transformation.

Connect with Ketan Rohom to Secure Your Comprehensive Application Gateway Market Research Report and Accelerate Informed Decision-Making Today

To obtain an in-depth understanding of the application gateway market, its evolving dynamics, and strategic imperatives, purchase the comprehensive market research report by contacting Ketan Rohom, Associate Director of Sales & Marketing. His expertise will guide you through tailored insights, ensuring your organization gains a competitive edge. Reach out today to secure this invaluable resource and drive informed decision-making that aligns with your growth objectives.

- How big is the Application Gateway Market?

- What is the Application Gateway Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?