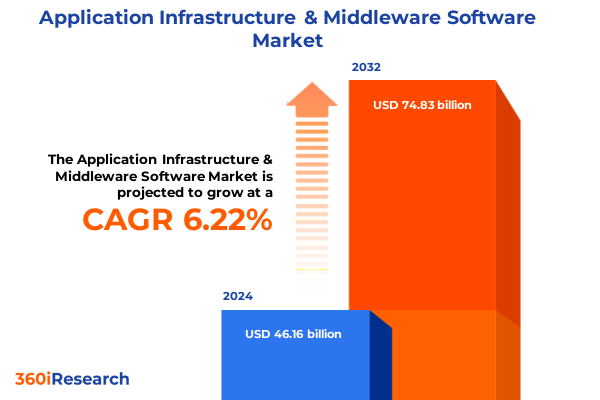

The Application Infrastructure & Middleware Software Market size was estimated at USD 49.00 billion in 2025 and expected to reach USD 52.01 billion in 2026, at a CAGR of 6.23% to reach USD 74.83 billion by 2032.

Navigating the Future of Application Infrastructure and Middleware Software Amid Accelerating Digital Transformation Demands in a Rapidly Evolving Technological Landscape

In today’s digital-first era, enterprises are under increasing pressure to modernize their application stacks and streamline middleware to achieve greater agility, resilience, and scalability. This introduction frames the critical role that middleware software and application infrastructure play as the backbone of digital ecosystems, enabling seamless connectivity between on-premises systems, hybrid environments, and cloud-native architectures. As organizations embark on ambitious digital transformation programs, they require an infrastructure that can support microservices, containerization, API-led integration, and event-driven processing without compromising performance or security.

Against this backdrop, middleware solutions have evolved from simple message brokers and transaction monitors into sophisticated platforms that offer real-time streaming, intelligent routing, and unified orchestration capabilities. This section lays the foundation for understanding why middleware has become a strategic priority for both IT and line-of-business leaders, emphasizing the convergence of integration, process management, and data flow control under a single architectural umbrella. It sets the stage for a deeper examination of how recent shifts in technology paradigms and regulatory landscapes are reshaping enterprises’ infrastructure strategies, ultimately serving as the connective tissue that drives innovation and competitiveness in an increasingly dynamic market.

Unveiling the Transformative Technological Shifts Redefining Application Infrastructure and Middleware Strategies Across Industries Driven by Cloud Native, API Centric Architectures, and AI Enabled Intelligence

The landscape of application infrastructure and middleware has been transformed by a convergence of powerful trends that collectively redefine how enterprises architect and deploy their solutions. Cloud-native adoption, for instance, has graduated from an experimental stage to a dominant model, spurred by emerging capabilities in container orchestration and serverless frameworks. Concurrently, API-first strategies have become the cornerstone of modern integration, with organizations embracing microservices and event-driven architectures to achieve modular, scalable, and maintainable systems.

Moreover, the infusion of artificial intelligence and machine learning into middleware platforms is enabling predictive analytics for performance optimization, automated anomaly detection, and self-healing operations. This intelligence layer amplifies the value of messaging middleware, business process management, and transaction monitors by injecting insights that fuel proactive decision-making. Equally significant is the rise of low-code and no-code integration tools that democratize access to sophisticated middleware capabilities, empowering business users to automate workflows without deep programming expertise.

As enterprises grapple with mounting data volumes and increasingly complex supply chains, the imperative to streamline integration across disparate endpoints has never been stronger. These transformative shifts enable organizations to break down silos, accelerate development lifecycles, and deliver seamless digital experiences, underscoring middleware’s evolving role from a niche connector to the strategic linchpin of enterprise architecture.

Assessing the Cumulative Impact of United States Section 301 and Section 232 Tariffs on Application Infrastructure and Middleware in 2025

In 2025, new United States trade policies, notably under Section 301 and Section 232, have introduced tariffs on a range of imported technology components, exerting cumulative pressures on enterprises reliant on globally sourced hardware and software. While these measures primarily target tangible goods, the ripple effects extend into the application infrastructure and middleware domain, where hardware-accelerated appliances and imported network equipment face elevated costs. Organizations are responding by re-evaluating their vendor contracts, negotiating localized support agreements, and accelerating shifts toward cloud-based services that decouple software consumption from physical supply chains.

These tariffs have also compelled vendors of middleware appliances to revisit their manufacturing footprints, with some accelerating domestic production and others redesigning products to minimize reliance on tariff-impacted components. As a result, service providers are increasingly bundling software and managed orchestration services to offset the higher upfront costs of hardware integration. Moreover, the heightened import expenses have sharpened enterprises’ focus on total cost of ownership, driving a preference for subscription-based licensing models over perpetual on-premises deployments.

The consolidated impact of these trade measures advocates for a more resilient, cloud-first posture in which middleware runtimes and integration layers can be instantiated on demand across global data centers. This shift not only buffers organizations against future tariff fluctuations but also enhances their ability to dynamically scale digital services in response to evolving market needs.

Deriving Strategic Insights from Product Type Deployment Model Industry and Organization Size Segmentation in Application Infrastructure and Middleware

Understanding the application infrastructure and middleware market requires a nuanced view of how diverse product categories interrelate and serve different organizational needs. Product offerings range from traditional application servers to advanced business process management suites, while integration middleware spans API management, robust data integration platforms, and enterprise service bus implementations. In parallel, message oriented middleware solutions encompass both queuing middleware for discrete messaging and streaming middleware for real-time data flows, complemented by transaction processing monitors that ensure reliability in mission-critical operations.

Deployment preferences simultaneously reflect a spectrum of on-premises installations, fully managed public and private cloud environments, and hybrid architectures that bridge legacy systems with agile cloud capabilities. This fluid deployment landscape allows organizations to adopt new middleware services in the cloud while retaining control over sensitive workloads in private environments. Industry verticals further influence middleware adoption patterns; heavily regulated sectors such as banking, insurance, healthcare, and government demand stringent security and compliance features, whereas manufacturing and retail emphasize agility and data throughput for supply chain optimization and omnichannel experiences. In financial services, dedicated banking, financial services, and insurance frameworks drive specialized middleware requirements, while the IT and telecom sectors leverage integration platforms to support complex service orchestration. Across enterprises of varying size-from large global corporations to micro-focused small enterprises-middleware strategies are tailored to resource availability, operational complexity, and growth aspirations, ensuring that organizations can select solutions commensurate with their digital maturity and scalability demands.

This comprehensive research report categorizes the Application Infrastructure & Middleware Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Deployment Model

- Organization Size

- End User

Illuminating Key Regional Dynamics Shaping Application Infrastructure and Middleware Adoption in the Americas Europe Middle East Africa and Asia Pacific

Regional nuances profoundly shape enterprises’ middleware adoption journeys, influenced by regulatory environments, infrastructure maturity, and cultural factors. In the Americas, organizations are characterized by sophisticated cloud ecosystems and an appetite for cutting-edge integration services, with North American enterprises leading the charge in API economy strategies and real-time analytics implementations. These markets also benefit from strong service provider ecosystems delivering specialized middleware offerings optimized for both horizontal and vertical use cases.

Across Europe, the Middle East, and Africa, compliance imperatives such as data sovereignty and stringent privacy regulations have driven a balanced embrace of hybrid architectures, where sensitive workloads often reside in private clouds or on-premises datacenters, while public cloud services handle less-critical processes. This region’s growing innovation hubs are investing in AI-enhanced integration platforms to support cross-border data exchanges, although adoption is tempered by the need to align solutions with evolving legislative frameworks.

Asia-Pacific markets exhibit the highest intensity of digital infrastructure growth, powered by governmental initiatives focused on smart manufacturing, retail modernization, and digital government services. Enterprises in China, India, and Southeast Asia prioritize scalable, streaming-capable middleware to manage massive data inflows and distributed architectures. Consequently, cloud-native integration and lightweight API gateways are central to enabling rapid service rollout and fostering vibrant developer ecosystems across the region’s dynamic economic landscapes.

This comprehensive research report examines key regions that drive the evolution of the Application Infrastructure & Middleware Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Discerning Competitive Landscape and Key Vendor Strategies Driving Innovation and Differentiation in Application Infrastructure and Middleware Software

The competitive landscape for application infrastructure and middleware is defined by both established technology giants and emerging disruptors offering specialized platforms. Longstanding incumbents deliver comprehensive suites encompassing integration, API management, and messaging capabilities, leveraging their global footprints to provide enterprise-grade support and service level assurances. These legacy players continue to innovate by incorporating low-code tooling, hybrid deployment frameworks, and AI-driven orchestration to stay relevant against nimble upstarts.

Conversely, a new breed of pure-play middleware vendors is capitalizing on the shift toward microservices and event-driven designs by offering lightweight, developer-centric tools that accelerate time to market. These innovators often differentiate through container-native architectures, Kubernetes integration, and transparent pricing models that cater to both technical and business stakeholders. Strategic partnerships between cloud hyperscalers and middleware providers have also become commonplace, enabling seamless bundling of integration services with underlying infrastructure, and reducing friction for organizations adopting managed cloud integration offerings.

Moreover, vendor strategies increasingly emphasize open-source communities as catalysts for platform extensibility and ecosystem growth. This community-driven approach fosters broader adoption of API gateways, streaming engines, and integration frameworks, while enabling customers to tailor solutions to unique operational requirements. As a result, the market is witnessing a dynamic interplay between comprehensive platform vendors and focused specialists, each driving innovations that expand the boundaries of what modern middleware can achieve.

This comprehensive research report delivers an in-depth overview of the principal market players in the Application Infrastructure & Middleware Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amazon Web Services, Inc.

- Cisco Systems, Inc.

- Dynatrace LLC

- Fujitsu Limited

- Informatica LLC

- International Business Machines Corporation

- Microsoft Corporation

- NGINX by F5, Inc.

- Oracle Corporation

- Salesforce, Inc.

- SAP SE

- Software AG

- Splunk Inc.

- TIBCO Software Inc.

- Unisys Corporation

Implementing Actionable Recommendations to Enhance Integration Agility and Operational Resilience in Modern Application Infrastructure and Middleware Environments

To extract maximum value from evolving middleware capabilities, industry leaders should prioritize a set of strategic actions designed to enhance integration agility and operational resilience. First, migrating to cloud-native middleware platforms allows for elastic scalability as demands fluctuate, reducing reliance on fixed-capacity hardware and insulating organizations from future tariff shocks. Simultaneously, embracing API management best practices-such as standardized governance, version control, and developer self-service portals-can significantly accelerate time to market and improve cross-functional collaboration.

Another critical step is fostering a culture of continuous integration and continuous delivery, whereby integration components are versioned, tested, and deployed alongside application code. This practice minimizes integration bottlenecks and promotes rapid iteration. Leaders should also invest in upskilling their teams on emerging paradigms like event-driven architectures and streaming analytics to unlock real-time business insights from high-velocity data. Partnering with managed service providers can further alleviate operational burdens, granting internal teams the latitude to focus on strategic initiatives rather than routine maintenance.

Lastly, adopting a phased approach to modernization-where legacy middleware applications are containerized and gradually transitioned to hybrid or cloud environments-enables organizations to de-risk transformation projects and realize incremental benefits. By combining these recommendations, executives can build a robust integration foundation that is both adaptable and future-proof, ensuring that digital initiatives deliver sustained competitive advantage.

Outlining a Rigorous Mixed Methodology Leveraging Primary Interviews Secondary Research and Data Triangulation to Ensure Research Integrity and Depth

The research underpinning this report harnesses a rigorous mixed methodology to ensure depth, validity, and actionable insights. Secondary research involved scouring public sources, technical documentation, and industry whitepapers to map the current technology landscape and regulatory context. Concurrently, primary research was conducted through structured interviews and interactive workshops with more than fifty senior IT architects, integration specialists, and line-of-business executives across diverse verticals and regions.

Following data collection, the information underwent a comprehensive triangulation process, reconciling qualitative feedback with observed market behaviors and vendor performance indicators. This approach enabled the identification of patterns in product adoption, deployment preferences, and regional disparities. Segmentation frameworks were then applied to delineate the market along product type, deployment model, industry vertical, and organizational size, ensuring that insights accurately reflect the nuanced needs of different customer cohorts.

Finally, all findings were peer-reviewed by an external panel of middleware experts to validate interpretations and challenge assumptions. This collaborative validation step ensures that the report’s conclusions and recommendations are not only empirically grounded but also resonate with real-world enterprise decision-making processes.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Application Infrastructure & Middleware Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Application Infrastructure & Middleware Software Market, by Product Type

- Application Infrastructure & Middleware Software Market, by Deployment Model

- Application Infrastructure & Middleware Software Market, by Organization Size

- Application Infrastructure & Middleware Software Market, by End User

- Application Infrastructure & Middleware Software Market, by Region

- Application Infrastructure & Middleware Software Market, by Group

- Application Infrastructure & Middleware Software Market, by Country

- United States Application Infrastructure & Middleware Software Market

- China Application Infrastructure & Middleware Software Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Concluding Strategic Imperatives for Stakeholders to Harness Middleware and Infrastructure Platforms for Sustainable Competitive Advantage

In summary, the application infrastructure and middleware landscape is undergoing a profound transformation driven by cloud-native innovations, API-centric integration, and intelligence-infused automation. Trade policies in 2025 have accelerated the shift toward subscription-based and managed offerings, while segmentation insights reveal that deployment preferences, industry requirements, and organizational scale critically shape solution selection. Regional dynamics further underscore the necessity for flexible architectures that can adapt to varied regulatory and infrastructure conditions across the Americas, Europe Middle East Africa, and Asia Pacific.

Competitive pressures are intensifying as established vendors bolster their portfolios with low-code tooling and AI-driven orchestration, and specialized entrants disrupt with container-native, developer-friendly platforms. To stay ahead, enterprises must adopt a hybrid modernization strategy, invest in robust API governance, and cultivate integration expertise across their technology and business teams. By synthesizing strategic recommendations and adhering to a phased transformation roadmap, organizations can harness middleware’s full potential to optimize operations, drive innovation, and sustain competitive differentiation.

Contact Ketan Rohom Associate Director Sales and Marketing to Secure the Comprehensive Application Infrastructure and Middleware Market Research Report Today

To explore deeper insights into application infrastructure and middleware software market dynamics and to empower your organization with actionable intelligence, reach out directly to Ketan Rohom, Associate Director of Sales and Marketing. Ketan brings a wealth of expertise in translating complex research findings into strategic business outcomes and will guide you through the comprehensive report’s rich analysis of technology trends, segmentation insights, regional dynamics, and competitive landscapes. Engage with Ketan to discuss tailored solutions, unlock exclusive data visualizations, and secure your full report today to stay ahead in an increasingly interconnected and innovation-driven environment.

- How big is the Application Infrastructure & Middleware Software Market?

- What is the Application Infrastructure & Middleware Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?