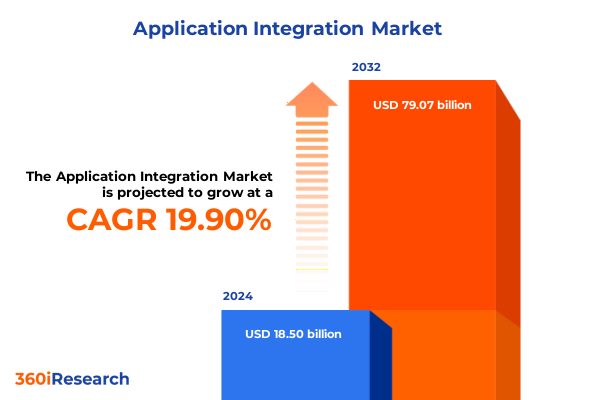

The Application Integration Market size was estimated at USD 22.23 billion in 2025 and expected to reach USD 26.07 billion in 2026, at a CAGR of 19.86% to reach USD 79.07 billion by 2032.

Understanding the critical role of application integration in driving operational efficiency and enabling seamless digital transformation across enterprises

As enterprises navigate ever-intensifying demands for agility and resilience, application integration has emerged as the linchpin of digital transformation initiatives. Modern organizations confront a complex constellation of on-premises systems, cloud services, and partner ecosystems that must interoperate seamlessly to support real-time decision making and deliver exceptional customer experiences. This executive summary introduces key themes driving investment in integration platforms, middleware solutions, and professional services as stakeholders seek to connect disparate data sources, business processes, and user interfaces with both speed and security.

In recent years, the proliferation of APIs and microservices has disrupted traditional point-to-point architectures. Companies now prioritize integration platforms that provide reusable connectors, prebuilt templates, and visual design tools to accelerate development lifecycles. As a result, integration practices are shifting from bespoke, hard-coded projects toward standardized frameworks that can scale across lines of business. Throughout this document, you will find a structured analysis of the transformative forces reshaping the landscape, the impacts of global trade policies, segmentation nuances, regional dynamics, competitive strategies, and actionable recommendations to guide your path forward.

By grounding this summary in the latest industry trends and neutral third-party research, decision makers can cut through market noise and focus on strategic priorities. Whether you represent a large enterprise embarking on a hybrid cloud journey or a midsize company optimizing on-premises deployments, these insights deliver clarity on where to allocate resources and how to navigate evolving vendor ecosystems.

Embracing cloud first integration and the API economy reshapes enterprise connectivity through low code, event driven architectures and AI powered workflows

Across the integration landscape, fundamental shifts are redefining how organizations connect applications, data, and devices. The consolidation of legacy middleware tools into unified platforms has accelerated, driven by the need for consistent governance, single panes of glass for management, and a unified security posture. Meanwhile, the rapid ascent of low-code and no-code integration studios offers citizen integrators the means to compose workflows without deep technical expertise, significantly reducing time-to-market for essential business processes.

Concurrently, event-driven architectures have gained traction as enterprises move toward real-time responsiveness. Streaming integration patterns enable immediate data exchange between operational systems, IoT devices, and analytics engines, fostering heightened operational insight and proactive issue resolution. In parallel, the API economy continues to mature, incentivizing companies to monetize data assets and expose capabilities to external partners. This proliferation of public and private APIs underscores the need for robust API management, lifecycle governance, and security by design.

Moreover, the infusion of artificial intelligence and machine learning into integration platforms is ushering in a new era of intelligent automation. Predictive data mapping, anomaly detection in data flows, and autonomous error resolution are transforming integration from a reactive enabler into a proactive driver of innovation. These transformative shifts collectively herald a future where integration is not merely a technical necessity but a strategic differentiator for forward-thinking enterprises.

Evaluating the far reaching consequences of 2025 United States tariffs on technology supply chains, cost structures and the economics of integration solutions

In 2025, the implementation of new United States tariffs has introduced a notable layer of complexity and cost pressure across technology supply chains. Core components such as semiconductors, network switches, and specialized integration hardware now attract higher duty rates, driving up the total cost of ownership for on-premises and hybrid deployments. Providers of integration platforms and middleware have had to adjust pricing structures, absorb certain cost increases, and, in many cases, renegotiate vendor agreements to maintain competitive offerings.

These shifts have prompted organizations to reevaluate sourcing strategies for both hardware and software licenses. A growing number of enterprises are diversifying supplier portfolios and exploring alternative manufacturing regions to mitigate tariffs and logistical delays. Concurrently, some solution providers have accelerated development of cloud-native integration offerings to sidestep import duties on physical infrastructure altogether. The result is a stronger emphasis on subscription and consumption-based models that transfer capital expenditure to operational expense frameworks, reducing upfront investment risks.

Alongside cost considerations, compliance with new import regulations has become a critical operational requirement. Integration projects now involve additional layers of customs documentation, classification reviews, and lifecycle audits to ensure that hardware refresh cycles and software upgrades adhere to regulatory mandates. In response, professional services teams and middleware vendors have expanded their consultative portfolios to include tariff impact assessments and supply chain optimization advisory, reinforcing the strategic imperative to balance cost, performance, and compliance in an era of shifting trade policies.

Revealing insights across component categories, deployment modes, organizational profiles and industry vertical dynamics shaping the integration landscape

The application integration market reveals distinct patterns when examined through component categories. Integration Platform as a Service has grown to encompass specialized modules for application integration, B2B messaging, data consolidation, and IoT connectivity, offering enterprises modular flexibility with consistent governance frameworks. Meanwhile, middleware remains pivotal for API management, data integration middleware, enterprise service bus implementations, and message oriented middleware solutions that ensure reliable transaction processing and message delivery. Professional services underpin these technology layers, with consulting, implementation services, and ongoing support and maintenance essential to maximizing platform adoption and operational continuity.

Deployment mode segmentation highlights the rising influence of cloud adoption, with private cloud environments favored by enterprises prioritizing data sovereignty and security controls. Public cloud deployments continue to benefit from elastic scalability and rich ecosystems of complementary services, while hybrid models bridge legacy on-premises systems with modern cloud platforms, offering a pragmatic path for digital transformation without wholesale infrastructure replacement.

Organizational profiles further reveal that large enterprises pursue integrated suites to unify global operations and standardize processes, whereas small and medium enterprises selectively adopt point solutions that address specific integration challenges or industry-specific requirements. In parallel, industry vertical dynamics emphasize nuanced demands: financial services and insurance firms require robust B2B messaging and regulatory compliance, energy and utilities organizations prioritize SCADA system integration alongside IoT telemetry, and manufacturing sectors focus on discrete and process manufacturing workflows. Government bodies at federal and state levels implement secure data exchanges, healthcare and life sciences providers integrate patient and laboratory data to support care coordination, IT services and telecom operators develop carrier grade APIs, while retail, consumer goods and logistics companies orchestrate omnichannel experiences and supply chain visibility.

This comprehensive research report categorizes the Application Integration market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Deployment Mode

- Organization Size

- End User Industry

Analyzing distinct regional dynamics influencing integration strategies across the Americas, Europe Middle East & Africa and Asia Pacific markets

Regional dynamics play a pivotal role in shaping integration strategies and investment priorities. In the Americas, North American enterprises leverage advanced cloud infrastructures, robust telecommunications backbones and a mature regulatory environment to scale integration initiatives quickly. Canada’s emphasis on privacy regulations influences hybrid cloud preferences, while Latin American markets exhibit growing interest in cloud-native B2B integration to support cross-border trade corridors and digital commerce expansion.

In Europe, Middle East & Africa, integration architectures must balance stringent data protection regulations and diverse market requirements. Western European firms often lead in adopting API gateways and centralized integration governance, whereas emerging markets in Eastern Europe and the Gulf emphasize cost-effective middleware deployments and professional services to address talent gaps. Across the region, regulatory frameworks such as GDPR have compelled organizations to embed security and consent management into integration flows from inception.

Asia-Pacific illustrates a spectrum of maturity levels, from cutting-edge digital platforms in Japan and Australia to high-growth opportunities in India and Southeast Asia. Enterprises in advanced APAC markets prioritize event-driven integration and real-time analytics, while fast-developing economies focus on cloud migration and B2B supply chain connectivity. The diverse language and localization requirements across APAC further underscore the importance of flexible, configurable integration platforms that adapt to regional compliance and cultural nuances.

This comprehensive research report examines key regions that drive the evolution of the Application Integration market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing strategies and innovation trajectories of leading integration solution providers that drive competitive advantage and technological evolution

Leading integration solution providers have distinguished themselves through a combination of strategic partnerships, product innovation and ecosystem development. Organizations offering comprehensive integration platform as a service deliver a broad set of connectors alongside embedded AI capabilities, positioning themselves as one-stop shops for end-to-end connectivity. Middleware vendors invest heavily in API lifecycle management features and microservices frameworks to capture rising demand for agile, containerized deployments. Meanwhile, top professional services firms cultivate deep domain expertise to guide complex integrations in regulated industries and large global rollouts.

Competitive differentiation also emerges through collaborative alliances. Key players often partner with hyperscale cloud providers to co-develop managed integration services, integrate with native security services, and embed integration tools directly into cloud marketplaces. Independent software vendors align with industry-specific solution providers to deliver preconfigured templates for banking, healthcare and manufacturing, accelerating time to value. In addition, several vendors have pursued targeted acquisitions of niche specialists in IoT data orchestration, real-time analytics integration and API security to bolster their portfolios rapidly.

Financial discipline and go-to-market execution further distinguish the leading firms. By optimizing subscription and consumption pricing models, these companies align vendor incentives with customer success, driving broader platform adoption. They also continuously refine developer and citizen integrator experiences by enhancing visual design studios, low-code SDKs and comprehensive training programs. Collectively, these strategies converge to create compelling value propositions that address the full spectrum of integration challenges facing today’s enterprises.

This comprehensive research report delivers an in-depth overview of the principal market players in the Application Integration market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adeptia Inc.

- Apache Software Foundation

- Axway Inc.

- Celigo, Inc.

- Cleo Communications Inc.

- IBM Corporation

- InterSystems Corporation

- Jitterbit, Inc.

- Microsoft Corporation

- Oracle Corporation

- SAG Software AG

- Salesforce, Inc.

- SAP SE

- SEEBURGER AG

- SnapLogic Inc.

- Software AG

- Talend Inc.

- TIBCO Software Inc.

- Workato Inc.

- WSO2, Inc.

- Zapier Inc.

Empowering industry leaders with strategic recommendations to maximize integration impact, drive innovation and alignment across evolving digital ecosystems

Industry leaders seeking to capitalize on integration opportunities should first establish clear governance frameworks that align integration goals with strategic business objectives. By defining standards for API versioning, security protocols and data quality checks up front, organizations can avoid costly rework and ensure consistent performance. Simultaneously, investment in centralized integration centers of excellence equipped with skilled architects and citizen integrator champions fosters cross-functional collaboration and accelerates solution delivery.

Next, organizations should prioritize a hybrid integration approach that harmonizes on-premises investments with cloud agility. Rather than migrating entire estates at once, a phased model that targets high-value use cases for cloud-native integration yields quick wins and builds organizational confidence. In parallel, adopting event-driven patterns and real-time data streaming can unlock proactive insights for operational teams in manufacturing, logistics and customer support.

Furthermore, industry leaders must leverage emerging technologies, including AI-driven mapping, automated error remediation and predictive analytics, to elevate integration from a reactive conduit to an intelligent engine of innovation. Cultivating a robust partner ecosystem with specialized service providers ensures access to niche expertise in regulatory compliance and vertical applications. Finally, continuous monitoring, feedback loops and iterative optimization of integration workflows will sustain performance gains and adapt to evolving business requirements, thereby securing long-term returns on integration investments.

Outlining a rigorous research methodology blending primary interviews, secondary data analysis and data triangulation for robust insights

This research employs a structured methodology that begins with primary interviews involving technology executives, integration architects and domain experts across multiple industries. These in-depth discussions yielded qualitative insights into adoption drivers, implementation challenges and emerging best practices. They were complemented by online surveys targeting IT decision makers and citizen integrators, providing quantitative validation of priorities, budgets and preferred deployment models.

Secondary research encompassed a thorough review of vendor whitepapers, industry alliance publications, analyst reports and regulatory documents. Publicly available financial statements, corporate press releases and patent filings offered additional context on vendor strategies, investment trends and innovation pipelines. All data sources underwent rigorous cross-verification to ensure accuracy and relevance.

Data triangulation served as a core pillar of this methodology, synthesizing primary and secondary findings to identify convergent themes and reconcile discrepancies. The research team applied both qualitative coding techniques and quantitative statistical analyses to uncover correlations between market dynamics and adoption patterns. This blended approach ensures that the insights presented are both empirically grounded and enriched by practitioner perspectives, delivering high confidence in the strategic guidance offered.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Application Integration market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Application Integration Market, by Component

- Application Integration Market, by Deployment Mode

- Application Integration Market, by Organization Size

- Application Integration Market, by End User Industry

- Application Integration Market, by Region

- Application Integration Market, by Group

- Application Integration Market, by Country

- United States Application Integration Market

- China Application Integration Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2703 ]

Drawing together critical insights to underscore the pivotal role of application integration strategies in empowering resilient and agile digital ecosystems

The evolving integration landscape demands a strategic mindset that embraces both technological innovation and disciplined governance. As cloud native architectures, API centric models and AI infused capabilities converge, organizations must adapt their integration frameworks to meet rising performance expectations and compliance requirements. By understanding the transformative shifts, regulatory headwinds and segmentation nuances detailed in this summary, decision makers can craft a roadmap that aligns with their unique business imperatives.

Ultimately, success in application integration hinges on balancing agility with control. Enterprises that cultivate centralized governance, foster collaborative centers of excellence and leverage hybrid deployment strategies will be best positioned to deliver seamless experiences across complex digital ecosystems. Moreover, adopting an iterative approach to integration development, underpinned by real-time monitoring and continuous optimization, enables sustained value creation in dynamic market conditions.

These comprehensive insights and strategic recommendations serve as a blueprint for navigating the integration challenge. Organizations that internalize these findings will gain the clarity and confidence needed to accelerate digital transformation, enhance operational resilience and unlock new opportunities for innovation.

Accelerate strategic decision making by reaching out to Ketan Rohom to access the comprehensive application integration market research report today

Accelerate your strategic decision making by connecting with Ketan Rohom, Associate Director, Sales & Marketing, to secure the definitive application integration market research report. This tailored research empowers you with the in-depth insights needed to shape resilient integration strategies and maintain a competitive edge in an ever-evolving technological landscape.

By engaging directly with Ketan Rohom, you gain access to a comprehensive package that includes executive briefings, customizable data sets, and bespoke consultation sessions aligned to your specific business objectives. Seize the opportunity to translate these critical findings into actionable initiatives that drive growth, optimize investments, and ensure seamless digital transformation across your enterprise.

- How big is the Application Integration Market?

- What is the Application Integration Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?