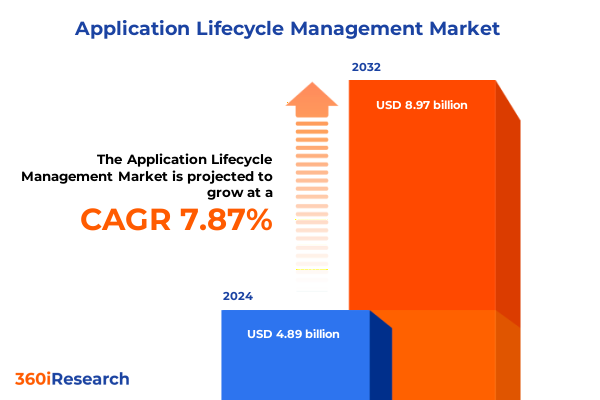

The Application Lifecycle Management Market size was estimated at USD 5.25 billion in 2025 and expected to reach USD 5.65 billion in 2026, at a CAGR of 7.93% to reach USD 8.97 billion by 2032.

Understanding the Strategic Imperatives and Holistic Importance of Application Lifecycle Management in Driving Agile Transformation

Application Lifecycle Management (ALM) has emerged as a cornerstone for organizations seeking to orchestrate end-to-end software development processes with precision and agility. By integrating planning, development, testing, deployment, and maintenance into a cohesive framework, ALM platforms empower stakeholders to align business objectives with technical execution. In an era defined by digital transformation, the capacity to manage the entire application lifecycle efficiently has become critical for enterprises striving to outpace competition and deliver high-quality solutions at scale.

As enterprises grapple with rapidly evolving customer expectations and increasingly complex technology ecosystems, ALM’s role expands beyond toolsets to encompass collaborative methodologies and governance best practices. This holistic approach ensures traceability, accountability, and compliance across distributed teams and multivendor environments. Moreover, shifting regulatory landscapes and heightened cybersecurity requirements underscore the necessity for robust lifecycle traceability and integrated risk management mechanisms within ALM workflows.

Simultaneously, the convergence of software development and operational paradigms through Agile and DevOps philosophies has propelled ALM into a transformative space. Organizations are adopting automated pipelines, continuous integration, and continuous delivery (CI/CD) to accelerate time-to-market without compromising quality. By embedding AI-driven analytics and intelligent automation into ALM platforms, teams can identify bottlenecks, predict failures, and optimize release cycles more effectively than ever before.

Revolutionary Advances in AI, Automation, and DevOps Integration Are Redefining Application Lifecycle Management Practices

The landscape of Application Lifecycle Management is undergoing a fundamental transformation driven by advanced automation and artificial intelligence. Intelligent automation capabilities are now seamlessly integrated into ALM platforms to automate repetitive tasks such as code integration, test case execution, and defect tracking. By leveraging AI and machine learning algorithms, modern ALM solutions can analyze historical project data to forecast potential risks, identify quality gaps, and recommend optimizations, enabling teams to focus on high-value activities and accelerate delivery cycles.

Concurrently, the pervasive adoption of DevOps and CI/CD methodologies has reshaped how development and operations collaborate within the ALM ecosystem. Continuous testing, real-time feedback loops, and automated release orchestration have become standard practices, supported by cloud-native architectures that provide on-demand scalability and resilience. The seamless integration of container orchestration, API lifecycle management, and microservices governance further solidifies ALM’s role as the backbone of modern software delivery pipelines.

Furthermore, organizations are increasingly seeking unified solutions that bridge ALM with product lifecycle management (PLM) and IT service management (ITSM) systems. This convergence addresses the need for end-to-end visibility across software, hardware, and service lifecycles, fostering a holistic view of product performance and compliance. As a result, ALM platforms with robust integration capabilities are gaining traction, enabling cross-functional collaboration, centralized governance, and streamlined release management in complex enterprise environments.

Evaluating the Financial and Operational Ripple Effects of 2025 United States Tariffs on Global ALM Supply Chains and Service Agreements

The imposition of new United States tariffs in 2025 has introduced substantial cost pressures for organizations reliant on imported technology components and services. Import levies on critical hardware such as server infrastructure and networking devices have driven up capital expenditure for on-premise ALM deployments. In response, IT procurement teams are revisiting sourcing strategies and exploring alternative vendors to mitigate the financial impact of heightened import duties.

Beyond hardware, software licensing models have come under scrutiny as vendors adjust pricing to accommodate tariff-induced expenses. Subscription and perpetual license fees have experienced upward pressure, prompting enterprise buyers to renegotiate contracts and seek bundled offerings that offer greater cost predictability. Technical support and maintenance agreements have similarly been recalibrated, with service providers revising service level agreements to account for increased operational costs under the new tariff framework.

To navigate this evolving tariff landscape, many organizations are accelerating their shift toward software-as-a-service (SaaS) delivery models. Subscription-based ALM platforms enable predictable operating expenses and reduce dependency on imported hardware. Additionally, strategic partnerships with local system integrators and managed service providers are emerging as viable pathways to maintain service continuity and optimize total cost of ownership amidst the tariff-driven market volatility.

Unveiling In-Depth Component, Pricing, Application, Deployment, Enterprise Size, and Industry Vertical Segmentation Insights Shaping ALM Adoption Patterns

Segmenting the ALM market by component reveals distinct dynamics between services and software solutions. Implementation services and ongoing support and maintenance services cater to organizations requiring hands-on expertise for deployment, customization, and sustained operational efficiency. In contrast, ALM tools, testing suites, and quality assurance platforms represent the core software artifacts that drive standardized development and governance workflows within enterprises.

When analyzed through the prism of pricing models, the ALM landscape spans pay-per-use offerings, perpetual licenses, and subscription frameworks. Pay-per-use models attract organizations with fluctuating project demands seeking granular cost alignment, while perpetual licenses appeal to enterprises prioritizing long-term asset ownership. Subscription-based models, however, continue to gain prominence for delivering predictable expenditure patterns and rapid access to updates.

Application-driven segmentation underscores the breadth of ALM applicability across design and modeling, requirements management, software development, maintenance and support, and test management. This diversity highlights the need for modular toolchains that accommodate specialized workflows yet integrate seamlessly to ensure end-to-end traceability.

With deployment choices encompassing cloud and on-premise environments, organizations weigh the benefits of hybrid, private, and public cloud architectures against the control offered by on-premise deployments. Hybrid approaches, in particular, are capturing enterprise interest for striking a balance between data sovereignty and scalable infrastructure.

Enterprise size segmentation further differentiates market behaviors, where large enterprises leverage economies of scale to negotiate enterprise-wide agreements and invest in comprehensive ALM suites, while small and medium enterprises prioritize cost-effective, out-of-the-box solutions that accelerate time-to-value. Lastly, industry vertical segmentation spans BFSI, energy and utilities, government and public sector, healthcare, IT and telecom, manufacturing, and retail. Each vertical imposes unique regulatory, quality, and performance demands, driving specialized ALM feature sets and compliance integrations.

This comprehensive research report categorizes the Application Lifecycle Management market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Pricing Model

- Application

- Deployment

- Enterprise Size

- Industry Vertical

Analyzing Regional Variances in ALM Adoption across Mature Americas, Regulation-Driven EMEA, and Rapidly Digitizing Asia-Pacific Markets

In the Americas, the ALM market is characterized by mature adoption of Agile and DevOps methodologies, with North American enterprises leading in the integration of cloud-native CI/CD pipelines and AI-driven lifecycle analytics. Rapid cloud infrastructure expansion and an ecosystem of leading vendors have fostered an environment where early adoption of advanced ALM capabilities is the norm, driving continuous innovation across technology hubs in the United States and Canada.

Europe, the Middle East, and Africa present a heterogeneous landscape shaped by stringent data protection regulations and sector-specific compliance requirements. In Western Europe, strong emphasis on data privacy and security drives demand for on-premise and private cloud ALM deployments, particularly within financial services and public sector organizations. Meanwhile, emerging markets in the Middle East and Africa are embracing cloud-based platforms to accelerate digital transformation initiatives, leveraging ALM tools to standardize development practices amidst infrastructure modernization programs.

Asia-Pacific markets exhibit robust growth trajectories, fueled by rapid digitization in countries such as China and India and increasing investments in software R&D across Australia, Japan, and Southeast Asia. The region’s expanding ecosystem of local system integrators and managed service providers is amplifying ALM adoption by tailoring solutions to address language diversity, local regulatory frameworks, and evolving enterprise IT strategies. Public cloud adoption continues to rise, with hybrid deployments gaining favor for their flexibility in balancing performance, compliance, and cost efficiency.

This comprehensive research report examines key regions that drive the evolution of the Application Lifecycle Management market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading ALM Vendors and Emerging Innovators Driving Competitive Differentiation and Platform Evolution

Atlassian has solidified its leadership position with Jira and Bitbucket, offering flexible, cloud-first ALM capabilities that blend issue tracking, code repository management, and team collaboration into a unified platform. By continuously enhancing AI-driven insights and expanding integration ecosystems, Atlassian is enabling distributed teams to streamline workflows and accelerate time-to-market.

International Business Machines Corporation and Microsoft are anchoring enterprise-grade ALM strategies with IBM’s Rational Team Concert and Microsoft Azure DevOps. These vendors leverage extensive enterprise infrastructure portfolios and global support channels to deliver scalable, secure ALM solutions embedded within broader platform ecosystems, catering to highly regulated and mission-critical development environments.

Broadcom, through its CA Agile Central and CA DevOps offerings, and SAP, with Solution Manager and SAP ALM, are driving value for large enterprises by embedding robust governance, compliance, and portfolio management features into their ALM suites. These platforms emphasize end-to-end traceability and enterprise risk management to support complex, cross-functional development initiatives across global organizations.

Innovative challengers such as Intland Software, Visure Solutions, and NimbleWork are differentiating through specialized capabilities in requirements traceability, quality management, and lightweight ALM workflows. By focusing on niche use cases and flexible deployment options, these vendors are capturing attention among mid-market and specialized industry verticals that demand tailored ALM experiences.

This comprehensive research report delivers an in-depth overview of the principal market players in the Application Lifecycle Management market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Atlassian Corporation

- Atos SE

- ATQOR Technologies Private Limited

- Birlasoft Limited

- Broadcom Inc.

- CGI Inc.

- Digité, Inc.

- DXC Technology

- EPAM SYSTEMS, INC..

- Foundant Technologies, Inc.

- Gartner, Inc.

- HCL Technologies Limited

- Inflectra Corporation

- International Business Machines Corporation

- Jama Software, Inc.

- Liferay Inc.

- LTIMindtree Limited

- Micro Focus International PLC

- MicroGenesis Tech Soft Pvt. Ltd.

- Microsoft Corporation

- Parasoft Corporation

- Perforce Software, Inc.

- Persistent Systems Limited

- PTC Inc.

- SAP SE

- Siemens AG

- TECH MAHINDRA LIMITED

- VIRTUSA CORPORATION

- Xoriant Corporation

- Zensar Technologies Limited

Actionable Strategic Pillars for Executives Incorporating AI Automation, Flexible Pricing, and Hybrid Deployment to Fortify ALM Programs

Industry leaders should prioritize the adoption of AI-driven automation within their ALM toolchains to enhance predictive analytics, accelerate testing cycles, and mitigate quality risks. By integrating machine learning algorithms that learn from historical delivery data, organizations can proactively address bottlenecks and improve release reliability.

To optimize cost structures and align consumption with project demands, enterprises are encouraged to evaluate flexible pricing models such as pay-per-use and subscription frameworks. This approach supports agile budgeting and reduces financial exposure in volatile market conditions, particularly when navigating tariff-driven cost fluctuations.

Leaders should also bolster supply chain resilience by fostering strategic partnerships with local system integrators and managed service providers. These alliances can offset the impact of import levies on hardware procurement, ensure regional compliance, and maintain uninterrupted service delivery in diverse markets.

Finally, adopting a hybrid deployment strategy that balances the agility of public cloud with the control of private infrastructure will enable organizations to scale dynamically while meeting stringent data sovereignty and security requirements. This balanced approach underpins robust governance frameworks and empowers global teams to collaborate seamlessly.

Employing a Rigorous Mixed-Method Research Framework with Primary Interviews, Quantitative Analysis, and Expert Validation

This analysis leverages a mixed-method research framework combining primary interviews with industry practitioners, secondary data from reputable technology journals, and vendor documentation. Primary insights were gathered through in-depth discussions with CIOs, DevOps leads, and ALM solution architects to capture emerging requirements and deployment experiences. Secondary research included peer-reviewed articles, white papers, and public filings to triangulate market-wide trends.

Quantitative data was sourced from technology adoption surveys, software usage analytics, and tariff schedule bulletins to assess the economic impact of 2025 United States trade policies on ALM procurement. Expert validation sessions were conducted with ALM strategists and compliance officers to ensure procedural accuracy and contextual relevance.

Data synthesis employed statistical analysis techniques, including regression modeling and scenario planning, to identify correlations between tariff fluctuations and license cost variability. Qualitative insights were coded and thematically analyzed to surface critical success factors and innovation patterns within ALM ecosystems.

The final report underwent rigorous peer review and editorial validation to uphold methodological integrity and factual precision. All findings adhere to industry research standards, ensuring that recommendations and insights are underpinned by robust evidence and actionable clarity.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Application Lifecycle Management market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Application Lifecycle Management Market, by Component

- Application Lifecycle Management Market, by Pricing Model

- Application Lifecycle Management Market, by Application

- Application Lifecycle Management Market, by Deployment

- Application Lifecycle Management Market, by Enterprise Size

- Application Lifecycle Management Market, by Industry Vertical

- Application Lifecycle Management Market, by Region

- Application Lifecycle Management Market, by Group

- Application Lifecycle Management Market, by Country

- United States Application Lifecycle Management Market

- China Application Lifecycle Management Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Integrating Segmentation Insights, Regional Dynamics, and Innovation Pathways to Empower Holistic ALM Decision Making and Drive Competitive Edge

The evolving Application Lifecycle Management landscape underscores the critical intersection of technology innovation, strategic governance, and operational agility. As organizations navigate heightened tariff complexities, integration demands, and regional variances, a nuanced understanding of market segmentation and vendor capabilities becomes indispensable.

By synthesizing insights across component, pricing, application, deployment, enterprise size, and industry vertical dimensions, decision makers can tailor ALM strategies that align with organizational priorities and regulatory obligations. Regional analysis further illuminates the diverse adoption patterns across Americas, EMEA, and Asia-Pacific, guiding targeted investment decisions and partnership models.

The competitive landscape, shaped by industry titans and agile challengers, highlights the importance of selecting ALM platforms that balance enterprise-grade governance with modular flexibility. Embracing AI-powered automation and hybrid cloud architectures will be pivotal in achieving scalable, secure, and cost-effective software delivery lifecycles.

Ultimately, informed by a robust research methodology and actionable recommendations, stakeholders are equipped to harness the full potential of ALM to drive continuous innovation, resilient supply chains, and enduring competitive advantage.

Secure Expert Guidance and Unmatched ALM Market Intelligence by Reaching Out to Ketan Rohom for Your Definitive Research Report

Ready to transform your software development strategy with unparalleled insights and actionable intelligence? Engage now with Ketan Rohom, Associate Director of Sales & Marketing, to secure your comprehensive market research report on Application Lifecycle Management. This definitive resource equips you with in-depth analysis of transformative trends, tariff impacts, granular segmentation, regional dynamics, and competitive landscapes necessary to drive strategic growth.

Don’t miss your chance to gain a competitive edge. Connect with Ketan today to discuss tailored research solutions, exclusive data packages, and personalized briefings designed to support your decision-making process. Unlock the full potential of your organization’s ALM initiatives and chart a clear path toward innovation and operational excellence.

- How big is the Application Lifecycle Management Market?

- What is the Application Lifecycle Management Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?