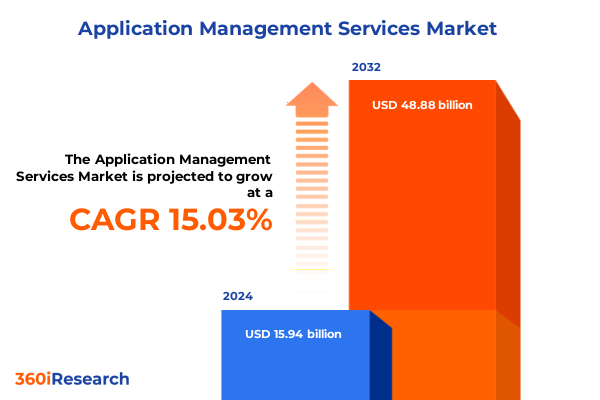

The Application Management Services Market size was estimated at USD 18.13 billion in 2025 and expected to reach USD 20.62 billion in 2026, at a CAGR of 15.22% to reach USD 48.88 billion by 2032.

Understanding the Pivotal Role of Application Management Services in Accelerating Digital Initiatives and Operational Excellence

Application management services have become integral to organizations striving to maintain competitive advantage while navigating increasingly complex digital environments. These services encompass a broad range of activities, from routine maintenance and support to the strategic modernization of legacy applications and continuous optimization of enterprise portfolios. As businesses undertake digital transformation initiatives, they require reliable partners who can deliver seamless operations, rapid incident resolution, and ongoing enhancements that ensure applications remain aligned with evolving business goals without disruption.

In today’s landscape of hybrid infrastructures and dynamic user expectations, the ability to manage applications with agility and foresight is paramount. Companies expect service providers to not only resolve technical issues swiftly but also anticipate future needs through proactive monitoring and predictive analytics. Consequently, application management has shifted from being perceived as a back-office function to a critical driver of efficiency and innovation, enabling organizations to redirect internal resources toward core competencies and strategic endeavors while relying on specialized expertise to safeguard application performance.

Analyzing the Rapid Evolution of Application Management Services Shaped by Agile Practices, DevOps Adoption, and Intelligent Automation

The application management services sector is undergoing a transformative evolution propelled by the widespread adoption of agile methodologies and DevOps principles. In this environment, continuous integration and continuous delivery pipelines have become non-negotiable, requiring service providers to embed automation at every stage of development and operations. Moreover, intelligent automation and AI-driven monitoring are being integrated to deliver real-time insights, accelerate root-cause analysis, and facilitate self-healing capabilities within critical systems.

Furthermore, the shift toward microservices architectures and containerization has introduced new opportunities and challenges for application management. Cloud-native designs demand expertise in orchestrating distributed environments, while emerging low-code platforms are enabling faster development cycles. As a result, security integration and compliance automation have moved front and center, forcing providers to deliver holistic solutions that embed vulnerability scanning, policy enforcement, and audit-ready reporting directly into the application lifecycle.

Assessing the Far-Reaching Effects of 2025 United States Tariff Adjustments on Software Supply Chains and Service Delivery Models

In 2025, sweeping United States tariff adjustments targeting imported software components and cloud infrastructure hardware have begun to reverberate across service delivery ecosystems. The increased duties on critical semiconductor products have driven hardware providers to reevaluate supply contracts, introducing longer lead times and higher procurement costs for data center equipment. Software vendors are likewise experiencing margin pressures as licensing fees and maintenance agreements are recalibrated to account for elevated import duties.

Consequently, application management service providers are reassessing their delivery models to mitigate the cumulative impact of these tariffs. Many organizations are diversifying their sourcing strategies by leveraging nearshore and onshore centers to maintain cost stability and regulatory compliance. Simultaneously, long-term service contracts are being renegotiated, and providers are exploring bundled offerings that offset tariff-driven increases through multi-year commitments and outcome-based pricing. As a result, clients and vendors alike are adapting to a new paradigm of cost predictability and supply chain resilience.

Unveiling Critical Insights Across Service Types, Deployment Models, Application Domains, and Industry Verticals Driving Market Dynamics

The landscape of application management services is delineated by four primary service categories. First, application maintenance and support remain foundational, ensuring that mission-critical systems operate without interruption. Second, application managed services provide an end-to-end outsourcing framework, encompassing everything from incident management to performance optimization. Third, application modernization initiatives are designed to reengineer legacy systems, migrate workloads to the cloud, and leverage microservices architectures. Finally, application portfolio assessment engagements enable organizations to rationalize their technology investments by evaluating performance, cost, and alignment with business objectives.

Deployment models serve as a second axis of differentiation. Cloud-only engagements harness the scalability and elasticity of public hyperscale platforms, while hybrid deployments blend on-premise systems with cloud resources to meet performance and security requirements. Meanwhile, traditional on-premise installations continue to play a role in regulated industries where data sovereignty remains critical. Across these environments, applications span business intelligence domains-encompassing both data mining and data visualization capabilities-alongside customer relationship management suites that feature marketing automation and sales automation modules, and comprehensive enterprise resource planning solutions that integrate project management and supply chain management functions. Underlying these service and deployment dimensions are industry-specific considerations, with verticals ranging from commercial and retail banking to healthcare providers, hospitals, pharmaceuticals, brick-and-mortar retailers, and e-commerce operators.

This comprehensive research report categorizes the Application Management Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Services

- Deployment Model

- Application

- End-User Industry

Revealing Regional Nuances Influencing Application Management Services Adoption Across the Americas, EMEA, and Asia-Pacific Regions

Regional dynamics continue to shape application management service strategies, beginning with the Americas where a cloud-first mindset prevails. Organizations in North and Latin America prioritize managed services to streamline operations and capitalize on advanced analytics capabilities. Regulatory shifts in data privacy have also prompted service providers to enhance compliance offerings and localize data processing to meet evolving requirements.

Across Europe, the Middle East, and Africa, hybrid implementations dominate the landscape as enterprises balance stringent data residency mandates with the drive for digital transformation. Service firms in EMEA are expanding their consulting teams to offer advisory services that navigate the complexities of cross-border data flows and multi-cloud integration. Meanwhile, Asia-Pacific markets continue to demonstrate rapid growth, fueled by digital government initiatives, increased infrastructure investments, and a burgeoning startup ecosystem. Countries such as India, China, and those in Southeast Asia are increasingly adopting modern application architectures and engaging managed service partners to accelerate time-to-market and operationalize AI-infused solutions.

This comprehensive research report examines key regions that drive the evolution of the Application Management Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Prominent Industry Players Steering Innovation, Strategic Alliances, and Comprehensive Service Portfolios in Application Management

Leading global consultancies and technology services companies are setting the pace for innovation in application management. Accenture has expanded its application services portfolio through strategic acquisitions that strengthen its cloud-native capabilities and AI-powered monitoring tools. IBM continues to integrate automated testing and security compliance into its managed services, while Infosys leverages its proprietary platforms to deliver real-time analytics and predictive maintenance for mission-critical applications.

Similarly, Cognizant and Tata Consultancy Services have forged alliances with hyperscale cloud providers to co-innovate edge-to-cloud solutions tailored to industry-specific requirements. Wipro and Capgemini are emphasizing sector-focused practices, with specialized offerings for banking, healthcare, and retail customers. HCL Technologies and DXC Technology are differentiating through comprehensive delivery networks and outcome-based commercial models that align service costs with client performance metrics. These competitive dynamics underscore the strategic importance of partnerships, platform investments, and value-driven service designs.

This comprehensive research report delivers an in-depth overview of the principal market players in the Application Management Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accenture PLC

- Atos SE

- Birlasoft Limited

- Capgemini SE

- CGI Inc.

- Cognizant Technology Solutions Corp.

- Damco Group by Maersk Group

- Deloitte Touche Tohmatsu LLC

- DXC Technology Company

- Endava plc

- EPAM Systems, Inc.

- Fujitsu Limited

- HCL Technologies Limited

- Hexaware Technologies Limited

- Infosys Ltd.

- International Business Machines Corporation

- Larsen & Toubro Infotech Limited

- Mphasis Limited

- NTT DATA Corporation

- Oracle Corporation

- PERSISTENT SYSTEMS LIMITED

- SAP SE

- ScienceSoft USA Corporation

- Sopra Steria Group S.A.

- Tata Consultancy Services Ltd.

- TECH MAHINDRA LIMITED

- Unisys Corporation

- UST Global

- Wipro Limited

- Zensar Technologies Limited

Presenting Actionable Strategies for Industry Leaders to Enhance Service Differentiation, Optimize Delivery, and Ignite Customer Value

To secure a competitive edge, industry leaders should prioritize investments in AI-driven automation that streamline routine operations and elevate proactive issue resolution. By integrating machine learning models into monitoring platforms, organizations can shift from reactive to predictive service delivery, reducing downtime and enhancing user experiences. In addition, forging deeper partnerships with hyperscaler providers can unlock access to advanced managed Kubernetes services, specialized cloud-native toolchains, and co-development pipelines that accelerate feature releases.

Furthermore, organizations should adopt outcome-based pricing models that align costs with measurable business results. Bundled engagements encompassing modernization, managed services, and strategic assessments incentivize service providers to deliver continuous value while providing clients with transparent ROI frameworks. Investing in cybersecurity as a core component of application management will also reassure stakeholders and ensure regulatory compliance. To this end, tailored offerings that address specific vertical requirements can differentiate portfolios and drive deeper customer engagement.

Outlining Robust Research Methodologies Employed to Ensure Data Integrity, Rigorous Analysis, and Actionable Insights for Stakeholders

This research leverages a blend of primary and secondary methodologies to ensure the accuracy and relevance of its insights. Primary research involved structured interviews with C-level executives, IT directors, and architecture leads across diverse industries, capturing first-hand perspectives on strategic priorities, pain points, and investment drivers. Concurrently, a broad survey of decision-makers provided quantitative data on adoption rates, service preferences, and budgetary allocations.

Secondary research included a comprehensive review of industry publications, regulatory filings, service provider white papers, and technology vendor documentation. Data triangulation techniques were applied throughout the analysis to cross-verify findings and eliminate bias. Validation workshops with expert panels further refined the conclusions, and rigorous quality assurance processes were employed to maintain data integrity. The segmentation framework was developed iteratively, reflecting the dynamic interplay of service types, deployment models, application domains, and vertical requirements.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Application Management Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Application Management Services Market, by Services

- Application Management Services Market, by Deployment Model

- Application Management Services Market, by Application

- Application Management Services Market, by End-User Industry

- Application Management Services Market, by Region

- Application Management Services Market, by Group

- Application Management Services Market, by Country

- United States Application Management Services Market

- China Application Management Services Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Synthesizing Core Findings and Implications to Offer a Cohesive Perspective on the Future Trajectory of Application Management Services

The convergence of agile frameworks, cloud-native architectures, and intelligent automation is reshaping application management services into value-centric engagements rather than mere cost centers. As service providers adapt to shifting regulatory landscapes, tariff pressures, and regional market dynamics, they must embrace innovation across service delivery, technology integration, and commercial models. The resulting competitive environment rewards those who can demonstrate tangible improvements in system performance, security posture, and user satisfaction.

Looking ahead, the imperative for continuous modernization will only intensify. Organizations will seek partners capable of orchestrating complex application landscapes, harnessing AI for predictive operations, and navigating evolving trade policies. Success will hinge on aligning services with strategic business outcomes, fostering co-innovation with hyperscalers, and sustaining a relentless focus on quality. By synthesizing these core themes, stakeholders can chart a clear path forward, leveraging application management as a catalyst for digital transformation and long-term resilience.

Engaging Directly with Ketan Rohom to Secure Tailored Insights and Comprehensive Reports That Empower Strategic Decision-Making

To obtain in-depth perspectives and comprehensive data that align precisely with your strategic objectives, reach out to Ketan Rohom. He will guide you through the customized features of our market research report, ensure that you gain access to exclusive insights on emerging trends, and facilitate arrangements for a detailed briefing. Act now to empower your organization with the competitive intelligence needed to accelerate governance and technological excellence.

- How big is the Application Management Services Market?

- What is the Application Management Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?