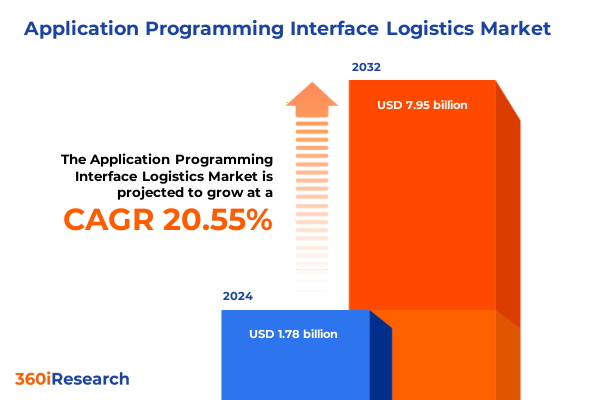

The Application Programming Interface Logistics Market size was estimated at USD 2.14 billion in 2025 and expected to reach USD 2.57 billion in 2026, at a CAGR of 20.60% to reach USD 7.95 billion by 2032.

Understanding the Critical Role of API Logistics in Modern Enterprise Data Exchange and Operational Efficiency

In today’s hyperconnected digital ecosystem, the seamless integration and management of application programming interfaces have emerged as indispensable drivers of operational excellence. Enterprises across industries are confronting the growing complexity of data exchange, system interoperability, and real-time communication demands. This report opens with an exploration of how API logistics-encompassing the design, deployment, monitoring, and governance of interfaces-has evolved into a cornerstone of modern technology infrastructures. By examining the critical intersections between developer experience, security protocols, and business agility, the introduction lays the groundwork for understanding the fundamental importance of robust API logistical frameworks.

Drawing on industry case studies, the discussion highlights the transition from monolithic integration strategies to distributed, modular approaches that leverage microservices and event-driven architectures. As organizations strive to accelerate time-to-market and enhance scalability, the ability to orchestrate APIs across cloud, hybrid, and on-premises environments becomes paramount. This introductory section establishes the context for subsequent deep dives, underscoring how API logistics not only support day-to-day operations but also serve as strategic enablers for innovation, competitive differentiation, and customer satisfaction in an era defined by digital transformation.

Examining How Cloud-Native, Hybrid Deployment, and Zero-Trust Security Are Redefining API Logistics Architectures

The landscape of API logistics has undergone transformative shifts driven by rapid technological advancements and evolving organizational priorities. Cloud-native architectures now dominate new deployments, compelling teams to adopt containerization, orchestration platforms, and serverless models. In parallel, enterprises have embraced hybrid configurations that combine public cloud elasticity with private cloud or on-premises control to meet security and compliance mandates. This dual-track evolution has forced API management solutions to support dynamic routing, multi-cloud failover, and consistent policy enforcement across disparate infrastructures.

Moreover, the proliferation of real-time analytics and machine-to-machine communications has elevated the significance of lightweight, event-driven protocols and asynchronous messaging patterns. Concurrently, security paradigms have shifted toward zero-trust frameworks, prompting organizations to embed authentication, authorization, and encryption at every touchpoint. API gateways have evolved into intelligent traffic managers, capable of load balancing, threat detection, and automated policy remediation. As a result, enterprises are now positioned to capitalize on the agility and resilience afforded by modern API logistics while navigating the complexity of integrating legacy systems, emerging technologies, and stringent regulatory landscapes.

Analyzing the Ripple Effect of 2025 Tariff Measures on API Infrastructure Costs, Vendor Strategies, and Enterprise Adoption Patterns

In response to escalating geopolitical tensions and global trade realignments, the United States implemented a new tranche of tariffs in early 2025 targeting technology components, cloud services, and enterprise software eligible into API infrastructure ecosystems. These levies have introduced upward pressures on hardware costs for data centers, increased subscription fees for cloud API gateways, and incentivized software vendors to reevaluate on-premises offerings. Enterprises reliant on imported networking gear and specialized API management appliances have encountered margin compression, prompting a strategic pivot toward open-source and domestically manufactured alternatives.

As a downstream effect, service providers have recalibrated pricing models, absorbing portions of tariff increases to maintain competitive positioning and preserve client relationships. End users, meanwhile, are accelerating the adoption of cloud solutions to minimize exposure to hardware surcharges, even as they contend with higher service charges. Through these shifts, the 2025 tariff framework has catalyzed both innovation in cost-efficient API logistics architectures and a renewed emphasis on regional supply chains for critical integration components. Ultimately, the cumulative impact underscores how external policy levers can accelerate migration to flexible, software-driven models for interface management.

Unpacking How Deployment Models, Protocol Types, Industry Verticals, Organization Sizes, and End-Use Scenarios Drive API Logistics Choices

The API logistics market reveals distinct patterns when viewed through the lens of deployment models, protocol types, industry verticals, organizational scale, and end-use scenarios. Cloud deployments, whether private or public, dominate in organizations prioritizing rapid scalability and minimal capital outlay, whereas hybrid approaches balance control with flexibility by leveraging multi-cloud or single-cloud tiers alongside air-gapped environments. Traditional on-premises installations retain relevance in highly regulated sectors, while virtualized stacks enable enterprises to modernize without fully relinquishing legacy investments.

Protocol type segmentation shows that REST continues to underpin the majority of enterprise interfaces due to its simplicity and broad tooling support, with GraphQL gaining traction for flexible query capabilities. RPC and SOAP remain vital for transactional systems and legacy integration, respectively. Industry verticals such as finance-with its sub-segments of banking, insurance, and securities-demand rigorous security frameworks and high-availability architectures, whereas retail organizations blend brick-and-mortar, e-commerce, and omnichannel channels to deliver personalized consumer experiences. Organization size also influences choices: large enterprises invest in enterprise-grade API management platforms, while small and medium enterprises-spanning medium, micro, and small tiers-opt for cost-effective, SaaS-based solutions. Meanwhile, end-use demands across IoT, mobile, and web applications shape the preference for lightweight protocols; mobile ecosystems further distinguish between Android and iOS environments, dictating SDK compatibility and governance requirements.

Together, these segmentation insights illuminate how diverse technical, regulatory, and commercial considerations interplay to drive strategic decision-making in API logistics implementation.

This comprehensive research report categorizes the Application Programming Interface Logistics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Deployment Model

- Type

- Organization Size

- End Use

- Industry Vertical

Exploring Regional Dynamics Shaping API Logistics Adoption Across the Americas, EMEA, and Asia-Pacific Markets

Geographically, the Americas lead in the adoption of advanced API logistics solutions, propelled by a mature cloud ecosystem, progressive regulatory frameworks, and high enterprise spending on digital transformation. North American organizations are pioneering use cases that integrate AI-driven analytics and automated policy enforcement, while Latin American markets are progressively embracing cloud-based gateways to modernize legacy infrastructures.

In the Europe, Middle East & Africa region, regulatory requirements such as data residency and GDPR compliance have steered enterprises toward hybrid and private deployments, with managed service providers extending local footholds to support sensitive workloads. Multi-country operations within this region frequently adopt federated API management constructs to harmonize policies across diverse legal jurisdictions.

The Asia-Pacific market demonstrates the fastest growth trajectory, fueled by expanding digital economies in China, India, Southeast Asia, and Australia. Telecommunications, manufacturing, and financial services sectors in these markets are prioritizing scalable, containerized API platforms to enable large-scale IoT rollouts and real-time transaction processing. As vendor ecosystems mature, regional stakeholders are investing in localized support networks and partner programs to accelerate enterprise adoption. Across all territories, cultural factors and regulatory landscapes remain pivotal in shaping API logistics strategies, highlighting the necessity of region-specific go-to-market approaches.

This comprehensive research report examines key regions that drive the evolution of the Application Programming Interface Logistics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Assessing How Leading and Emerging Providers Are Advancing API Logistics Platforms Through Innovation, Partnerships, and Strategic Acquisitions

Leading innovators in the API logistics sphere are differentiating through a combination of product depth, strategic partnerships, and vertical-specific offerings. Key providers have enriched their platforms with embedded security suites, AI-based traffic analytics, and low-code integration toolkits to address the growing demand for rapid deployment and streamlined developer workflows. Collaborative alliances between gateway vendors and major cloud hyperscalers have expanded the reach of managed API services, while acquisitions of specialized startups have infused platforms with advanced policy-automation and event-stream processing capabilities.

Meanwhile, emerging challengers are carving out niches by focusing on open-source ecosystems, community-driven extensibility, and transparent pricing models that appeal to cost-conscious enterprises. These firms are capitalizing on the rising preference for self-hosted API solutions in regulated industries, offering modular architectures that can be tailored to stringent compliance standards. The competitive landscape also features consultancies and systems integrators bundling advisory services with turnkey API logistics implementations, further validating the critical role of expertise in realizing effective interface management strategies.

This comprehensive research report delivers an in-depth overview of the principal market players in the Application Programming Interface Logistics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amazon Web Services, Inc.

- Apigee Corporation

- Axway Inc.

- Celigo, Inc.

- Cleo

- Descartes Systems Group, Inc.

- FourKites, Inc.

- Google LLC

- IBM Corporation

- Jitterbit, Inc.

- Kong Inc.

- Microsoft Corporation

- MuleSoft, LLC

- Oracle Corporation

- Postman, Inc.

- project44, Inc.

- Salesforce, Inc.

- SAP SE

- SnapLogic Inc.

- Software AG

- TIBCO Software Inc.

- Trimble Inc.

- Twilio Inc.

- WiseTech Global Limited

- Zapier Inc.

Implementing Integrated Security, Hybrid Infrastructure, and AI-Driven Analytics to Future-Proof API Logistics Strategies

Industry leaders must adopt a proactive stance to capitalize on the evolving API logistics paradigm. To start, integrating policy enforcement and security capabilities natively within API gateways will streamline compliance and reduce operational overhead. Concurrently, creating a developer portal that supports participatory governance and self-service onboarding will accelerate time-to-market and foster deeper collaboration between business and IT teams.

In light of the tariff-driven cost pressures, organizations should diversify procurement strategies by evaluating domestic hardware alternatives and embracing open-source middleware to mitigate supply chain risks. Establishing a hybrid infrastructure blueprint that leverages both on-premises control and cloud elasticity will future-proof API deployments against regulatory shifts. Furthermore, investing in AI-powered analytics for traffic optimization and anomaly detection can yield actionable insights that elevate performance and security postures. By embedding these recommendations within a holistic digital integration roadmap, enterprises can enhance agility, reduce total cost of ownership, and unlock new revenue streams through scalable API ecosystems.

Detailing a Rigorous Mixed-Method Research Framework Combining Primary Interviews, Surveys, and Expert Peer-Review Validation

This research harnessed a mixed-method approach combining primary interviews with senior IT executives, API architects, and security specialists alongside secondary data from regulatory filings, patent databases, and industry publications. Quantitative analysis of enterprise adoption patterns was conducted via surveys administered across multiple regions and verticals, ensuring representation of varied organization sizes and deployment preferences. Qualitative insights were derived from in-depth case studies that examined real-world implementations of API logistics platforms, elucidating best practices and common challenges.

To validate the findings, a peer-review process was employed involving external subject-matter experts who assessed methodological rigor and data integrity. Statistical sampling techniques were applied to ensure the reliability of trend extrapolations, while thematic coding of interview transcripts facilitated the extraction of actionable recommendations. The combination of robust empirical evidence, expert testimony, and systematic validation underpins the credibility of the strategic insights presented in this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Application Programming Interface Logistics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Application Programming Interface Logistics Market, by Deployment Model

- Application Programming Interface Logistics Market, by Type

- Application Programming Interface Logistics Market, by Organization Size

- Application Programming Interface Logistics Market, by End Use

- Application Programming Interface Logistics Market, by Industry Vertical

- Application Programming Interface Logistics Market, by Region

- Application Programming Interface Logistics Market, by Group

- Application Programming Interface Logistics Market, by Country

- United States Application Programming Interface Logistics Market

- China Application Programming Interface Logistics Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2067 ]

Synthesizing Market Dynamics to Reveal How API Logistics Are Transforming Enterprise Integration, Security, and Strategic Growth

In conclusion, API logistics have transcended their traditional role as back-end technical enablers to become strategic assets that drive innovation, operational resilience, and competitive advantage. The convergence of cloud-native, hybrid, and on-premises deployments, coupled with zero-trust security and AI-powered analytics, is reshaping how enterprises orchestrate data exchange at scale. The 2025 tariff adjustments have further underscored the importance of cost-efficient, software-driven models and localized supply chains in sustaining API management capabilities.

Segmentation insights highlight the diversity of deployment and protocol preferences across industries, organization sizes, and application use cases, while regional analyses reveal that tailored market approaches are essential for success. Competitive dynamics indicate that leading providers must continuously evolve through innovation, ecosystem alliances, and strategic acquisitions, whereas challengers can disrupt by embracing open-source and modular architectures. By implementing the actionable recommendations outlined herein, decision-makers can craft resilient API logistics strategies that anticipate policy shifts, technological trends, and evolving business requirements, positioning their enterprises for sustained growth in the digital era.

Secure tailored market research and expert guidance from our Associate Director to empower your API logistics strategy with precise insights

To explore this comprehensive analysis in greater depth and unlock strategic intelligence tailored to your organization’s needs, reach out to Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch) to purchase the full market research report. With a personalized consultation, you can gain access to detailed data, expert forecasts, and actionable insights designed to accelerate your development and deployment of API logistics solutions. Engage today to position your enterprise at the forefront of innovation in API management and integration.

- How big is the Application Programming Interface Logistics Market?

- What is the Application Programming Interface Logistics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?