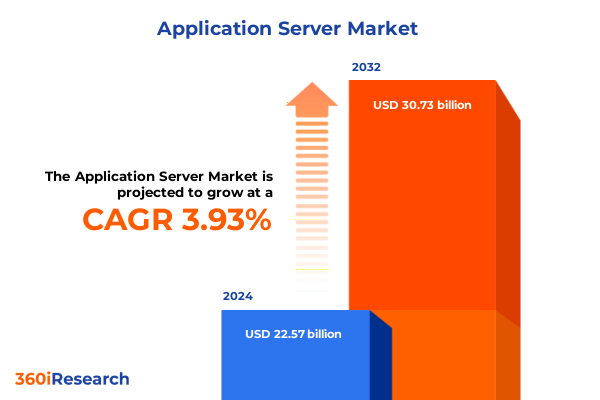

The Application Server Market size was estimated at USD 23.18 billion in 2025 and expected to reach USD 23.81 billion in 2026, at a CAGR of 4.10% to reach USD 30.73 billion by 2032.

Setting the Stage for Application Server Evolution: Navigating Market Dynamics, Technological Innovations, and Emerging Business Imperatives Impacting Today’s Enterprises

The application server domain sits at the intersection of business imperatives and technology innovation, serving as the backbone of modern digital ecosystems. As enterprises embark on ambitious digital transformation journeys, the choice and performance of application servers directly influence scalable integration, robust security postures, and the agility of software delivery pipelines. Recognizing this foundational role, today’s decision-makers are scrutinizing architectural best practices to balance legacy modernization with next-generation deployment models.

Against this backdrop, it is critical to understand how evolving customer expectations, intensified regulatory frameworks, and persistent security threats are converging to redefine success metrics for application server implementations. In particular, organizations must gauge how emerging paradigms-ranging from microservices orchestration to AI-driven workload management-are reshaping the calculus for performance, cost efficiency, and time to market. This introduction establishes the strategic context for the report, highlighting the pressing questions that executive leadership must address in an increasingly dynamic environment.

Understanding Pivotal Transformations Reshaping the Application Server Landscape Through Cloud Adoption, Microservices, Edge Computing, and AI-Driven Workloads

The application server landscape is undergoing profound transformation as cloud-native architectures, microservices frameworks, and serverless computing gain momentum. This shift is driven by the imperative to accelerate release cycles, optimize resource utilization, and foster cross-functional collaboration between development and operations teams. Furthermore, edge computing is broadening the scope of deployment scenarios, enabling real-time analytics and low-latency experiences at the network periphery. As a result, vendors and end users alike are pivoting toward platforms that can seamlessly orchestrate distributed workloads across hybrid environments.

In addition, artificial intelligence and machine learning are being embedded into application server stacks to provide proactive resource scaling, anomaly detection, and predictive maintenance capabilities. These innovations reinforce the need for platforms that not only support traditional transaction processing but also accommodate emergent, compute-intensive workloads. Consequently, stakeholders are redefining evaluation criteria to prioritize extensibility, API-driven integrations, and ecosystem collaboration over monolithic, one-size-fits-all solutions.

Evaluating the Ripple Effects of 2025 United States Tariff Policies on Application Server Ecosystems Across Supply Chain, Cost Structures, and Vendor Strategies

The landscape of global trade policies continues to dictate cost structures and supply-chain resilience for technology providers and their customers. In 2025, the United States maintained a series of tariffs targeting imported hardware components, including higher duties on server-grade CPUs and memory modules originating from key manufacturing hubs. These measures, while designed to protect domestic industries, have introduced greater volatility in procurement budgeting and vendor pricing strategies, prompting organizations to reassess their sourcing models and total cost of ownership calculations.

Moreover, the extension of Section 301 tariffs on certain software-defined networking appliances has compelled providers to adjust contractual terms and pass through incremental fees to end users. As trade negotiations remain in flux, technology leaders should anticipate potential policy shifts that could either alleviate or exacerbate cost pressures. This environment underscores the importance of flexible vendor partnerships and diversified supply-chain ecosystems that can absorb tariff-driven shocks without compromising project timelines or service quality.

Unveiling Critical Insights into Market Segmentation Spanning Organizational Scale, Deployment Models, Operating Systems, Components, and Industry Verticals

Insight into market segmentation reveals nuanced adoption patterns across organizational scale, deployment models, system architectures, component priorities, and vertical requirements. Enterprises range from large, multinational players seeking advanced orchestration and high-availability configurations to small and medium firms prioritizing cost-effective installations with streamlined management features. Moreover, the choice between cloud and on-premise deployments continues to bifurcate, as hybrid cloud models gain traction among organizations balancing regulatory compliance with elastic scaling. Within cloud environments, proprietary platforms coexist alongside private and public cloud offerings, each catering to distinct performance and governance needs.

Equally significant, the underlying operating system preferences-spanning Linux distributions such as Red Hat, Suse, and Ubuntu, alongside Unix and Windows implementations-shape the feature sets and support ecosystems available to decision-makers. Component-level differentiation further refines buyer requirements, as application portals, business logic engines, integration layers, and web servers each exhibit specialized performance benchmarks and security postures. Notably, the web server segment is itself divided between open-source options, championed for community-driven innovation, and proprietary solutions, valued for enterprise-grade support frameworks. Lastly, critical end-user industries, including BFSI, government, healthcare, IT and telecom, and retail, impose sector-specific SLAs, compliance regimes, and customization mandates that vendors must address with tailored roadmaps.

This comprehensive research report categorizes the Application Server market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Operating System

- Industry Vertical

- Organization Size

- Deployment

Decoding Regional Disparities and Growth Drivers Across Americas, Europe Middle East & Africa, and Asia-Pacific in the Application Server Domain

Regional dynamics exert a profound influence on technology adoption rates, regulatory expectations, and ecosystem maturity. In the Americas, robust digital-transformation initiatives among leading financial institutions and retail conglomerates are driving heightened demand for scalable, secure application server solutions. Cloud-first policies in North America are complemented by modernization efforts across Latin America, where government digitization projects are catalyzing new deployments and fostering local vendor partnerships.

Across Europe, the Middle East, and Africa, compliance with stringent data-protection frameworks and shifting energy-efficiency mandates continues to shape purchasing cycles. Organizations in Western Europe favor hybrid approaches that balance local data sovereignty with global interoperability, while emerging markets within the region explore open-source platforms to capitalize on cost advantages. Meanwhile, strategic infrastructure investments in the Gulf States and North Africa underscore the region’s ambition to develop domestic digital services and reduce reliance on external cloud providers.

In the Asia-Pacific context, rapid digitization across Southeast Asia and Oceania is converging with large-scale cloud rollouts in Japan and Australia. Technologies such as container orchestration and service meshes are being rapidly adopted by technology-intensive enterprises and government agencies alike. Concurrently, manufacturing-driven economies in East Asia emphasize high-performance computing requirements that influence application server specifications and vendor selection processes.

This comprehensive research report examines key regions that drive the evolution of the Application Server market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Application Server Vendors and Innovators: Strategic Positioning, Technological Roadmaps, and Competitive Differentiation Driving Market Momentum

Competitive dynamics in the application server market are characterized by established incumbents advancing end-to-end platform capabilities and emerging players driving specialized innovations. Major global software vendors have been expanding their portfolios through strategic acquisitions and partnerships, integrating AI-augmented management consoles and automated DevSecOps pipelines. Concurrently, open-source communities and smaller product specialists continue to disrupt with lightweight, modular server frameworks optimized for microservices and edge deployments.

These companies differentiate on a variety of dimensions, including support ecosystems, certification programs, and partner networks that facilitate rapid onboarding. For instance, some vendors emphasize cross-certification across multiple Linux distributions and container runtimes, while others focus on deep integration with popular enterprise resource planning and customer-relationship-management systems. As competition intensifies, buyers benefit from an expanding choice set, yet they must carefully evaluate vendor roadmaps against their own digital-transformation timelines and risk-mitigation strategies.

This comprehensive research report delivers an in-depth overview of the principal market players in the Application Server market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adobe Inc.

- Amazon Web Services, Inc.

- Cisco Systems, Inc.

- Fujitsu Limited

- Google LLC

- Hewlett Packard Enterprise Company

- Microsoft Corporation

- NEC Corporation

- Oracle Corporation

- Red Hat, Inc.

- SAP SE

- The Apache Software Foundation

- TIBCO Software Inc.

- VMware, Inc.

Action-Oriented Strategies for Industry Stakeholders to Optimize Application Server Investments, Accelerate Digital Transformation, and Mitigate Emerging Market Risks

Industry leaders should prioritize a multi-faceted approach to optimize their application server ecosystem. First, they must establish clear governance frameworks that align application portfolios with business objectives, ensuring that each deployment decision reflects cost, performance, and compliance considerations. Additionally, fostering cross-functional collaboration between development, operations, and security teams will accelerate innovation cycles and reduce time to remediation for vulnerabilities.

Moreover, organizations should engage in proactive vendor benchmarking, incorporating trials, proof-of-concepts, and performance stress tests that mirror real-world usage scenarios. By diversifying their supplier base and embracing open interfaces, they can mitigate risks associated with single-vendor lock-in and smoothly adapt to evolving tariff landscapes. Finally, investing in workforce upskilling and adopting AI-enabled automation will enhance operational resilience, enabling teams to manage hybrid and edge deployments effectively while responding swiftly to emerging market disruptions.

Outlining a Robust Research Framework Employing Mixed-Method Approaches, Expert Consultations, and Data Triangulation to Ensure Comprehensive Market Intelligence

This analysis leverages a mixed-methodology framework, synthesizing both qualitative insights and quantitative validation. Primary research comprised in-depth interviews with technology executives, system integrators, and end-user practitioners, complemented by a series of vendor briefings to capture evolving product roadmaps and innovation pipelines. These interactions were designed to elucidate strategic priorities, operational challenges, and adoption drivers across diverse organizational contexts.

Secondary research involved a rigorous review of publicly available financial reports, regulatory filings, and industry whitepapers, carefully curated to ensure the accuracy and relevance of historical trends and competitive dynamics. Data triangulation techniques were employed to cross-verify key findings, while thematic analysis facilitated the identification of emergent patterns and risk factors. This robust approach ensures that the insights presented herein are grounded in empirical evidence and reflect the latest market developments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Application Server market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Application Server Market, by Component

- Application Server Market, by Operating System

- Application Server Market, by Industry Vertical

- Application Server Market, by Organization Size

- Application Server Market, by Deployment

- Application Server Market, by Region

- Application Server Market, by Group

- Application Server Market, by Country

- United States Application Server Market

- China Application Server Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Synthesizing Key Findings to Illustrate Strategic Imperatives, Market Trajectories, and Stakeholder Opportunities in the Evolving Application Server Ecosystem

Through an integrated examination of technological shifts, policy influences, and segmented demand dynamics, this report underscores strategic imperatives for market participants. The convergence of cloud-native architectures, AI enhancements, and regional regulatory nuances underscores the need for adaptable, interoperable application server solutions that can scale with evolving business models. Leaders should harness these insights to refine their technology roadmaps and operational playbooks.

Furthermore, the nuanced understanding of organizational scale, deployment modalities, and vertical-specific requirements provides a detailed blueprint for prioritizing investments and de-risking digital initiatives. By leveraging the actionable recommendations and vendor analyses contained in this report, stakeholders are well-positioned to capitalize on the opportunities emerging in 2025 and beyond.

Engaging with Ketan Rohom to Unlock Tailored Insights and Purchase the Comprehensive 2025 Application Server Market Research Report for Competitive Advantage

To explore how this rigorous analysis can inform your strategic priorities and drive measurable business outcomes, reach out directly to Ketan Rohom. As Associate Director, Sales & Marketing at 360iResearch, Ketan brings deep expertise in aligning executive decision-making with nuanced market intelligence. By engaging with him, you can access tailored briefings, schedule private consultations, and secure your copy of the comprehensive 2025 Application Server Market Research Report. This partnership will equip your organization with the actionable insights needed to navigate complexity, capitalize on emerging opportunities, and gain a sustainable competitive advantage.

- How big is the Application Server Market?

- What is the Application Server Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?