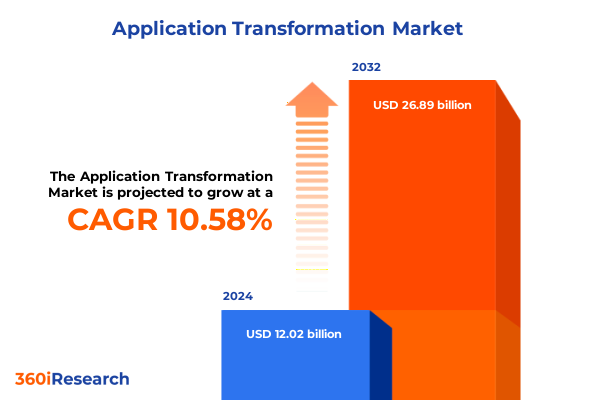

The Application Transformation Market size was estimated at USD 13.23 billion in 2025 and expected to reach USD 14.56 billion in 2026, at a CAGR of 10.66% to reach USD 26.89 billion by 2032.

Unveiling the Strategic Imperative of Application Transformation for Driving Agile Innovation and Operational Excellence Across Modern Enterprises

Application transformation has rapidly evolved from a technical playbook to a strategic imperative that underpins the agility and resilience of modern enterprises. Organizations across industries recognize that legacy monolithic systems, once the foundation of critical business operations, now constrain speed, innovation, and cost efficiencies. The growing demands of digital-native competitors, coupled with shifting customer expectations for real-time experiences, have propelled application modernization to the forefront of executive agendas.

Furthermore, technological advancements in cloud computing, microservices, and automation have unlocked new pathways for rearchitecting core applications. Businesses are no longer limited to point upgrades; instead, they can embrace comprehensive transformations that drive process optimization, accelerated time to market, and enhanced operational visibility. This shift underscores the importance of viewing application transformation not merely as an IT project, but as a holistic business initiative that delivers measurable outcomes and fosters a culture of continuous improvement.

To meet these imperatives, organizations are increasingly integrating cross-functional teams, leveraging agile methodologies, and forging deeper partnerships with technology providers. These collaborative models enable faster prototyping, iterative enhancements, and risk mitigation through pilot programs. As enterprises navigate competitive pressures and technological disruptions, a well-defined transformation roadmap becomes essential for aligning strategic goals with technology investments and unlocking sustainable growth.

Mapping the Transformative Shifts Shaping the Application Transformation Landscape from Legacy Constraints to Future-Proof Digital Architectures

The application transformation landscape has undergone profound shifts that extend well beyond simple cloud migration and code refactoring. Initially characterized by siloed modernization efforts, the market has matured toward integrated ecosystems where interoperability, API-led connectivity, and container orchestration form the backbone of digital architectures. This evolution has been fueled by the convergence of cloud-native principles, DevOps pipelines, and platform engineering practices that prioritize modularity and scalability.

In parallel, the rise of artificial intelligence and machine learning has infused new intelligence into application frameworks, enabling predictive analytics, automated decision-making, and self-healing infrastructures. Organizations are now embedding AI-driven workflows within both front-end user experiences and back-end processes to achieve end-to-end optimization. Moreover, the advent of edge computing and 5G connectivity is extending transformation strategies to distributed environments, driving the need for lightweight, resilient microservices that can operate with intermittent connectivity.

Ultimately, the market’s trajectory reflects a departure from one-size-fits-all modernization approaches toward bespoke, outcome-focused solutions. Enterprises are calibrating their strategies based on domain-specific requirements, regulatory constraints, and risk appetites. As these transformative shifts continue to accelerate, businesses that harness holistic, data-driven frameworks will be best positioned to capitalize on emerging opportunities and maintain a competitive edge.

Analyzing the Cumulative Impact of Newly Imposed United States Tariffs in 2025 on Global Application Transformation Strategies and Supply Chains

In 2025, a series of new tariffs implemented by the United States government on imported servers, semiconductor components, and network infrastructure have created a ripple effect across global application transformation initiatives. Organizations heavily reliant on cost-effective hardware imports now face elevated procurement expenses, prompting them to reassess their supply chain strategies and consider regional sourcing alternatives to mitigate financial impacts.

Moreover, these tariffs have catalyzed an acceleration in onshore manufacturing investments, as enterprises seek to insulate critical application environments from geopolitical fluctuations. While this shift enhances control and compliance, it also introduces complexities in vendor management and infrastructure lifecycle costs. For technology service providers, the tariffs underscore the importance of localized deployment models and strategic partnerships with domestic hardware vendors to maintain competitive pricing and delivery timelines.

The broader consequence of the tariff landscape has been an increased emphasis on virtualization and containerization, as organizations strive to decouple application performance from physical hardware constraints. By increasing their reliance on cloud-based IaaS and PaaS offerings, enterprises can sidestep some direct tariff exposures while gaining elasticity and cost predictability. These strategic pivots demonstrate how fiscal policies can reshape transformation roadmaps and reinforce the need for adaptive, cost-sensitive planning.

Deriving Key Segmentation Insights to Decode Diverse Stakeholder Requirements Across Solution Types Deployment Modes Organization Sizes and Industry Verticals

A nuanced understanding of end-user requirements emerges when examining solution type segmentation, deployment modes, organizational scale, and industry verticals. Enterprises seeking to automate repetitive tasks often gravitate toward robotic process automation for high-volume, rules-based operations while leveraging workflow automation to integrate human decision points. Meanwhile, integration initiatives harness API management platforms to enable secure, real-time data exchanges and deploy enterprise service bus solutions to maintain legacy interoperability.

In migration scenarios, rearchitecting core systems offers long-term agility gains, whereas rebuilding and refactoring are favored for preserving business logic while modernizing codebases. Rehosting remains a rapid lift-and-shift option for organizations prioritizing immediate cloud adoption. Separately, modernization strategies employ containerization to standardize deployment artifacts and replatforming to optimize runtime environments without extensive code changes. Deployment preferences span cloud-first architectures utilizing IaaS, PaaS, and SaaS, through hybrid models that balance flexibility and compliance, to on-premises implementations where data sovereignty remains paramount.

Organizational size and industry context further drive nuanced preferences. Large enterprises often adopt a mix of modernization pathways to align with diverse portfolio requirements and stringent governance frameworks, while small and medium enterprises prioritize turnkey SaaS solutions and managed services for resource efficiency. Verticals such as financial services and healthcare emphasize security and regulatory compliance, whereas manufacturing and retail focus on real-time analytics and shop-floor integration. These segmentation insights guide providers in tailoring offerings that meet unique business objectives and operational constraints.

This comprehensive research report categorizes the Application Transformation market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Solution Type

- Deployment Mode

- Organization Size

- Industry Vertical

Unveiling Regional Dynamics Influencing Application Transformation Adoption Patterns and Emerging Opportunities Across Major Global Markets

Regional dynamics play a pivotal role in shaping transformation strategies across the Americas, Europe Middle East and Africa, and Asia-Pacific. In the Americas, organizations benefit from mature cloud ecosystems and established digital talent pools, leading to a surge in advanced automation and microservices adoption. The presence of hyperscale cloud providers and a favorable regulatory climate further accelerates time-to-value for large-scale modernization programs.

Conversely, Europe Middle East and Africa markets contend with complex data protection regulations and varying infrastructure maturity levels. Enterprises in this region prioritize hybrid cloud architectures to navigate jurisdictional requirements, while also investing in container security and compliance tooling. Countries with robust manufacturing bases are increasingly piloting edge-native solutions to support Industry 4.0 initiatives, reflecting a balance between innovation and governance needs.

In Asia-Pacific, rapid digitization across emerging economies is driving widespread demand for cost-effective, scalable transformation solutions. Cloud-native migration is particularly prominent in sectors like telecommunications and financial services, where low-latency architectures and real-time processing are critical. Strategic partnerships with global technology vendors, coupled with localized delivery centers, enable organizations in this region to leverage global best practices while adapting to local market nuances.

This comprehensive research report examines key regions that drive the evolution of the Application Transformation market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Key Companies Driving Innovation and Competitive Differentiation in the Application Transformation Ecosystem Through Strategic Initiatives

Competition in the application transformation ecosystem is fueled by a mix of established technology giants and specialized service providers. Cloud platform leaders are expanding their managed modernization services to integrate migration accelerators, AI-driven code analysis, and automated testing frameworks. Consulting firms, on the other hand, are deepening their industry domain expertise, launching vertical-specific transformation blueprints for sectors such as banking, healthcare, and telecommunications.

Technology-driven service providers are carving differentiation by developing proprietary marketplaces for prebuilt connectors, microservices libraries, and deployment templates. These offerings reduce implementation timelines and minimize custom development risks. Collaborative alliances between cloud providers and systems integrators are also emerging, enabling joint Go-To-Market programs that bundle infrastructure, consulting, and application support under unified SLAs.

Startup innovation remains a critical catalyst for ecosystem dynamism, with emerging players introducing low-code platforms, cloud costs optimization tools, and intelligent observability solutions. By partnering with these niche vendors, enterprise clients can augment their transformation roadmaps with specialized capabilities that address unique operational challenges. This confluence of scale and specialization underscores the competitive intensity and collaborative potential within the application transformation landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Application Transformation market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accenture plc

- Atos SE

- Capgemini SE

- Cognizant Technology Solutions Corporation

- DXC Technology Company

- HCL Technologies Limited

- Infosys Limited

- International Business Machines Corporation

- Tata Consultancy Services Limited

- TEKsystems Global Services, LLC

- Wipro Limited

Actionable Recommendations Empowering Industry Leaders to Accelerate Transformation Efforts Mitigate Risks and Capitalize on Emerging Technology Trends

Industry leaders can accelerate their transformation journeys by prioritizing modular, API-first architectures that facilitate rapid integration and future scalability. It is advisable to conduct detailed portfolio assessments to identify high-impact modernization candidates and develop phased implementation roadmaps that align with business priorities. By adopting well-defined governance frameworks, organizations can ensure consistency in development practices, reduce technical debt, and maintain quality standards throughout the transformation lifecycle.

Additionally, continuous investment in workforce upskilling is crucial for building internal capabilities around cloud-native development, DevSecOps, and data engineering. Collaborative partnerships with technology vendors and educational institutions can expand talent pipelines and deliver targeted training programs. Risk mitigation strategies, such as pilot deployments and canary releases, enable teams to validate architectural decisions under real-world conditions before broader rollouts.

Finally, it is essential to maintain a robust feedback loop across business and IT stakeholders. Ongoing performance monitoring, coupled with user experience assessments, provides tangible metrics to refine strategic roadmaps. By embedding continuous delivery practices and leveraging analytics-driven insights, organizations can adapt swiftly to changing market conditions, ensuring their transformation efforts yield sustained value.

Elucidating a Robust Research Methodology Integrating Primary Qualitative Engagements and Secondary Data Validation Protocols for Comprehensive Analysis

This research integrates a multi-layered methodology combining primary qualitative engagements with secondary data validation to deliver comprehensive and reliable insights. Primary research involved in-depth interviews with C-level executives, transformation leads, and IT architects across a representative cross-section of industries, ensuring that diverse perspectives on challenges and success factors were captured.

Secondary research encompassed a thorough review of publicly available corporate filings, regulatory publications, industry journals, and thought leadership reports to contextualize quantitative trends and validate anecdotal findings. Data triangulation techniques were employed to reconcile discrepancies between sources and establish a robust foundation for strategic analysis. Where applicable, vendor white papers and analyst presentations were used to supplement understanding of emerging technological capabilities and solution roadmaps.

Analytical frameworks such as SWOT analysis, Porter’s Five Forces, and scenario planning were applied to derive actionable insights and identify potential disruption vectors. Rigorous review processes, including peer validation and expert panel sessions, ensured that conclusions reflect both current industry realities and forward-looking considerations. This methodology guarantees that the research deliverables are grounded in empirical evidence and are relevant for decision-makers seeking to navigate complex transformation landscapes.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Application Transformation market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Application Transformation Market, by Solution Type

- Application Transformation Market, by Deployment Mode

- Application Transformation Market, by Organization Size

- Application Transformation Market, by Industry Vertical

- Application Transformation Market, by Region

- Application Transformation Market, by Group

- Application Transformation Market, by Country

- United States Application Transformation Market

- China Application Transformation Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Summarizing Critical Insights Synthesized from the Application Transformation Landscape to Guide Strategic Decision-Making and Future Readiness

The synthesis of industry perspectives, technology trends, and regulatory influences underscores the multifaceted nature of application transformation in today’s global economy. Key insights reveal that success hinges on aligning modernization strategies with overarching business objectives, leveraging flexible architectures, and fostering collaborative ecosystems that bridge internal and external stakeholders.

Enterprises must remain vigilant to external variables such as evolving fiscal policies, regional compliance requirements, and emergent technology paradigms. Strategic agility, enabled by iterative development models and continuous feedback loops, will be central to adapting transformation roadmaps in real time. Moreover, segmentation-based precision in solution design ensures that organizations address the specific needs of their operational context-be it through targeted automation, seamless integration, or container-driven scalability.

In conclusion, application transformation is not a one-off effort but an ongoing journey that demands sustained investment, strategic foresight, and a willingness to embrace change. Organizations that cultivate a culture aligned around innovation, risk-informed decision-making, and data-driven optimization will be best equipped to harness the full potential of their digital architectures and maintain a competitive advantage.

Engage Directly with Ketan Rohom to Secure Your Customized Application Transformation Analysis and Accelerate Strategic Growth Trajectories

We invite you to engage directly with Ketan Rohom, Associate Director, Sales & Marketing, to discuss how this deep-dive analysis can be customized to address the unique challenges and opportunities within your organization. Ketan brings extensive expertise in aligning application transformation strategies with strategic business imperatives and can guide you through the nuances of deploying automation, integration, migration, and modernization initiatives to accelerate growth.

Reach out today to explore tailored insights, expert recommendations, and bespoke data that can support boardroom decisions, investment planning, and operational roadmaps. Seize this opportunity to secure your organization’s competitive edge and navigate the complexities of the digital economy with confidence.

- How big is the Application Transformation Market?

- What is the Application Transformation Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?