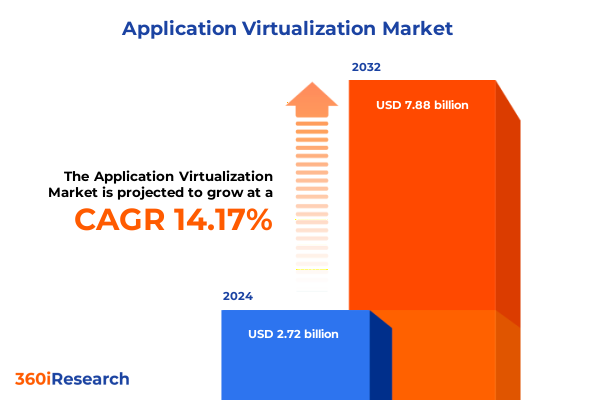

The Application Virtualization Market size was estimated at USD 3.09 billion in 2025 and expected to reach USD 3.52 billion in 2026, at a CAGR of 14.26% to reach USD 7.88 billion by 2032.

Navigating the Dynamic Frontier of Application Virtualization with Clear Insights into Drivers Opportunities and Strategic Imperatives for Enterprise Success

The advent of application virtualization has ushered in a transformative era where enterprises can decouple software from physical hardware constraints. Organizations are now empowered to deliver applications swiftly across heterogeneous environments, enabling remote work models and streamlining management complexities. As digital transformation accelerates, the need for resilient and flexible application delivery mechanisms becomes paramount. Consequently, virtualization has emerged as a cornerstone technology that underpins modern IT strategies, fostering operational efficiency and cost containment.

In recent years, strategic priorities have shifted toward maximizing resource utilization, reducing downtime, and bolstering security postures. Application virtualization addresses these imperatives by encapsulating applications in isolated containers, thereby mitigating compatibility issues and simplifying update rollouts. Moreover, it allows IT teams to enforce consistent policy controls across distributed workforces. This evolution is driven by the convergence of cloud computing trends, the proliferation of bring your own device initiatives, and an intensified focus on cybersecurity.

Looking ahead, decision-makers must understand that application virtualization extends beyond infrastructure optimization-it is a catalyst for business agility. Organizations that adopt virtualization frameworks can rapidly deploy new services, respond to customer demands, and maintain continuity in the face of disruptions. In this context, executive leaders should view virtualization not merely as a cost-saving tactic but as a strategic enabler of digital innovation and sustained competitive differentiation.

Unraveling Key Transformative Shifts Redefining Application Virtualization Ecosystems from Technological Evolution to Usage Paradigm Changes

The application virtualization landscape is undergoing profound shifts as emerging technologies redefine conventional delivery models. Edge computing, for instance, is extending virtualization capabilities to the network perimeter, enabling low-latency application access for distributed operations. In tandem, the integration of container orchestration platforms is streamlining workload management, ensuring seamless scalability and resilience. These technological inflections are reshaping how enterprises consume and deliver applications, fostering an environment where agility and performance coexist harmoniously.

Furthermore, market expectations have evolved; users demand instant application access on any device, anywhere. This shift has compelled vendors to innovate agent architectures that optimize performance without compromising security. At the same time, regulatory compliance considerations are driving adoption of robust encryption and identity management features within virtualization stacks. As a result, service providers are differentiating by offering comprehensive managed services that cover consulting, implementation, and ongoing support to navigate this increasingly complex ecosystem.

Consequently, partnerships between cloud hyperscalers and virtualization vendors are becoming more strategic, blending infrastructure-as-a-service offerings with advanced application delivery controls. These alliances facilitate hybrid deployments, allowing organizations to leverage both on-premise and cloud-based footprints. By aligning technological innovation with evolving user expectations, the application virtualization sector is charting a course toward an interconnected digital infrastructure that promises improved efficiency and robust data protection.

Analyzing the Cumulative Impact of 2025 United States Tariffs on the Application Virtualization Value Chain across Supply Technology and Operational Costs

In 2025, the United States enacted a series of tariffs targeting critical hardware components and semiconductor technologies integral to application virtualization infrastructures. These cumulative duties have elevated the cost basis for server procurement and network appliances, compressing margins for both vendors and solution integrators. Simultaneously, secondary impacts on global supply chains have introduced procurement delays, prompting enterprises to reevaluate sourcing strategies and to consider geographic diversification for resilience.

Moreover, increased import levies have motivated virtualization providers to explore alternative manufacturing partnerships and to accelerate investments in software efficiency. By optimizing resource consumption through leaner agent architectures and enhanced compression algorithms, vendors aim to offset hardware cost pressures. In parallel, some organizations are negotiating long-term agreements with regional assemblers to secure predictable pricing, thereby insulating their virtualization initiatives from tariff volatility.

Consequently, these tariff-driven dynamics have underscored the importance of fiscal agility in budgeting virtualization projects. IT leaders are prioritizing modular deployment models that allow incremental capacity expansion and shifting workloads to cloud-based platforms where local data centers are less exposed to import levies. This strategic recalibration ensures that application delivery remains both cost-effective and scalable, even in a landscape marked by trade policy uncertainty.

Unlocking Deep Segmentation Insights across Components Deployment Modes Application Use Cases Industry Verticals and Organization Sizes

Delving into the market through a component lens reveals that services and solution offerings are evolving in concert. Within services, managed services deliver turnkey virtualization management while professional services encompass consulting, implementation and integration, alongside support and maintenance to ensure ongoing performance optimization. The solution segment bifurcates into agent-based deployments that offer granular control, and agent-less approaches that minimize footprint complexities. This duality enables organizations to align with both high-control use cases and lightweight, rapid-deployment scenarios.

Transitioning to deployment modes, the dichotomy of cloud-based and on-premise architectures remains central. Cloud-based environments grant elastic scalability and ease of updates, whereas on-premise deployments address stringent data sovereignty and compliance demands. This tension drives hybrid frameworks where workloads can shift dynamically based on performance requirements and governance considerations. As such, IT leaders must evaluate operational priorities to determine the optimal mix of centralized cloud services and localized infrastructure investments.

When examining application use cases, organizations leverage virtualization for compatibility testing, bring-your-own-device initiatives, remote access enablement, security and compliance enforcement, as well as software testing and development pipelines. Each of these scenarios demands tailored performance profiles, dashboarding capabilities, and security controls. Finally, industry verticals ranging from financial services and education to healthcare and logistics each impose unique regulatory, performance and support requirements, while organization sizes from global enterprises to nimble SMEs seek solutions that match their scale and resource constraints.

This comprehensive research report categorizes the Application Virtualization market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Deployment Mode

- Application

- Industry Vertical

- Organization Size

Revealing Key Regional Dynamics Shaping Application Virtualization Adoption Patterns across Americas EMEA and AsiaPacific Markets

Regional dynamics exert a profound influence on application virtualization adoption patterns. In the Americas, advanced network infrastructures and progressive work-from-anywhere policies have spurred rapid virtualization uptake among large enterprises and innovative SMEs. This environment fosters robust partnerships between local integrators and global virtualization vendors, enabling tailored managed service offerings that cater to diverse organizational needs.

Conversely, the Europe Middle East and Africa region presents a mosaic of regulatory regimes and infrastructure maturity levels. While Western European markets benefit from high-speed connectivity and unified GDPR-driven data privacy standards, public sector initiatives in the Middle East are propelling virtualization as part of smart city visions. North African and sub-Saharan markets are meanwhile at earlier stages of digital transformation, where on-premise deployments coexist with nascent cloud engagements.

In the AsiaPacific domain, the convergence of high-growth economies and technology-driven policy frameworks has accelerated cloud-native virtualization adoption. Rapid digitization in sectors such as manufacturing, telecommunications and retail underscores a demand for scalable, low-latency solutions. This momentum is reinforced by government incentives for cloud infrastructure development and by partnerships that localize support capabilities for mission-critical applications.

This comprehensive research report examines key regions that drive the evolution of the Application Virtualization market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating Critical Company Strategies Product Innovations and Partnerships Steering the Competitive Landscape of Application Virtualization

Leading providers continue to refine their virtualization portfolios through strategic product enhancements and ecosystem integrations. One vendor has introduced AI-driven performance analytics that forecast resource bottlenecks before they impact end users, while another has expanded its global managed service footprint to include 24/7 multilingual support. Meanwhile, cloud giants are embedding virtualization controls directly into their infrastructure-as-a-service offerings, enabling seamless interoperability between traditional virtual desktops and containerized microservices.

Partnerships are also reshaping competitive positioning. Hardware manufacturers are collaborating with virtualization specialists to preconfigure hyper-converged appliances, delivering turnkey solutions optimized for both agent-based and agent-less models. At the same time, independent software vendors are integrating virtualization capabilities into their application stacks to simplify delivery and licensing for enterprise clients. This wave of alliances is fostering a more cohesive ecosystem, where end-to-end service delivery is underpinned by joint roadmaps and shared support frameworks.

Ultimately, these strategic maneuvers showcase how companies are differentiating through innovation and collaboration. By aligning product roadmaps with emerging deployment paradigms and by forging complementary partnerships, these players are positioning themselves to meet evolving customer demands for agility, security and cost-efficient operations.

This comprehensive research report delivers an in-depth overview of the principal market players in the Application Virtualization market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accops Systems Private Limited.

- Adobe Inc.

- Alibaba Group

- Amazon Web Services, Inc.

- Broadcom Inc.

- Calsoft Inc.

- Cisco Systems, Inc.

- Cloud Software Group, Inc.

- Cognizant Technology Solutions Corporation

- Dell Technologies Inc.

- Google LLC by Alphabet Inc.

- Gotham Technology Group, LLC

- Hewlett Packard Enterprise Company

- Infosys Limited

- International Business Machines Corporation

- Microsoft Corporation

- Millennium Technology Services Holding LTD

- NComputing Co. LTD

- NextAxiom Technology, Inc.

- Open Text Corporation

- Oracle Corporation

- SA SYSTANCIA

- Salesforce, Inc.

- Sangfor Technologies Inc.

- SAP SE

Actionable Strategic Recommendations Empowering Industry Leaders to Capitalize on Application Virtualization Trends Strengthen Differentiation and Drive Growth

Industry leaders must prioritize the orchestration of hybrid infrastructures that blend cloud-native virtualization with on-premise control, thereby ensuring both agility and compliance. By investing in interoperable platforms, organizations can unlock workload mobility and resilience. Furthermore, adopting a service-centric approach that leverages managed services can relieve in-house teams of routine maintenance tasks, allowing them to focus on strategic initiatives that drive digital innovation.

To bolster security postures, it is essential to integrate zero-trust principles within virtualization frameworks. Embedding continuous authentication, microsegmentation and real-time threat analytics ensures that virtual applications remain protected against an expanding threat landscape. Concurrently, industry leaders should cultivate vendor alliances that reinforce supply chain agility, mitigating the impact of future tariff fluctuations and component shortages.

Lastly, tailoring solutions to the distinct needs of large enterprises and SMEs will unlock new growth avenues. Large organizations benefit from enterprise-grade integrations and global support networks, while smaller entities often prioritize ease of adoption and cost predictability. By structuring flexible pricing models and modular service bundles, vendors can address this spectrum of requirements and drive broader virtualization adoption across diverse market segments.

Comprehensive Research Methodology Detailing Rigorous Data Collection Expert Validation and MultiLayered Analysis for Market Intelligence Integrity

This report’s findings are grounded in a multi-stage research methodology incorporating extensive secondary research and rigorous primary engagements. Initially, industry literature, technical whitepapers and vendor documentation were reviewed to frame the technological evolution and market context. Subsequently, structured interviews with CIOs, virtualization architects and channel partners provided firsthand insights into deployment challenges and strategic priorities.

To validate qualitative inputs, the methodology included hands-on product evaluations and comparative analyses of leading virtualization platforms. Performance benchmarks, security assessments and compatibility tests were conducted under controlled conditions, ensuring that solution capabilities aligned with real-world workloads. In addition, data triangulation techniques were applied to cross-verify trends identified across disparate sources and to enhance the accuracy of thematic conclusions.

This layered approach-combining secondary data mining, expert interviews, empirical testing and triangulation-ensures that the insights within this report reflect a balanced, holistic view of the application virtualization landscape. The methodology underpins the integrity and actionability of the recommendations, providing executives with a trustworthy foundation for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Application Virtualization market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Application Virtualization Market, by Component

- Application Virtualization Market, by Deployment Mode

- Application Virtualization Market, by Application

- Application Virtualization Market, by Industry Vertical

- Application Virtualization Market, by Organization Size

- Application Virtualization Market, by Region

- Application Virtualization Market, by Group

- Application Virtualization Market, by Country

- United States Application Virtualization Market

- China Application Virtualization Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Concluding Perspectives Emphasizing Strategic Imperatives and Future Foresight to Navigate Application Virtualization Challenges and Opportunities

In conclusion, application virtualization stands at the nexus of digital resilience and strategic innovation. Organizations that harness its capabilities can achieve unparalleled flexibility in provisioning applications, simplify change management, and enhance their security posture. However, realizing these benefits requires deliberate alignment of technology, processes and governance frameworks.

The cumulative pressures of evolving tariff regimes, shifting user expectations and regional compliance mandates underscore the need for agile virtualization architectures. By incorporating hybrid deployment models, optimizing agent footprints and embedding robust security controls, enterprises can navigate these complexities with confidence. Furthermore, the industry’s competitive landscape-shaped by strategic partnerships and product innovation-offers a breadth of options to meet diverse organizational needs.

Ultimately, the next wave of application virtualization will be defined by intelligent orchestration across distributed environments, underpinned by data-driven performance insights and proactive threat mitigation. Leaders who act decisively to integrate these capabilities will secure a strategic edge, positioning their organizations to thrive in an increasingly digital world.

Engage with Ketan Rohom Associate Director Sales Marketing for a Tailored Consultation and Secure Your Comprehensive Application Virtualization Report Today

To explore how your organization can leverage these insights for tangible benefits, reach out to Ketan Rohom, Associate Director, Sales & Marketing, to arrange a personalized consultation. He will guide you through the report’s comprehensive findings and demonstrate how you can apply actionable intelligence to optimize your virtualization initiatives. Secure full access today and gain a decisive advantage in harnessing application virtualization for enhanced agility, security, and operational excellence.

- How big is the Application Virtualization Market?

- What is the Application Virtualization Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?