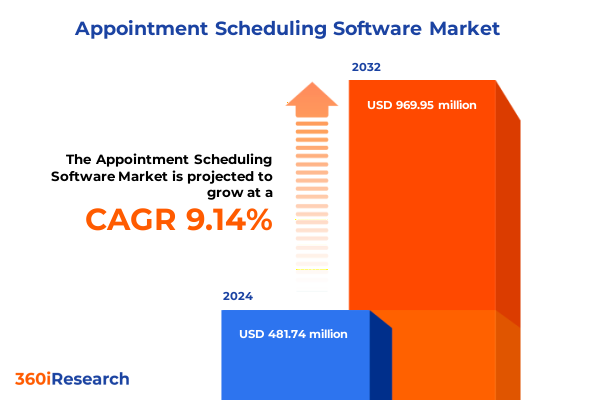

The Appointment Scheduling Software Market size was estimated at USD 524.93 million in 2025 and expected to reach USD 574.01 million in 2026, at a CAGR of 9.16% to reach USD 969.95 million by 2032.

Unveiling the Strategic Imperatives of Modern Appointment Scheduling Software Solutions to Drive Operational Excellence and Stakeholder Satisfaction

Unveiling the Strategic Imperatives of Modern Appointment Scheduling Software Solutions to Drive Operational Excellence and Stakeholder Satisfaction

In an era defined by accelerated digital transformation, appointment scheduling software has emerged as a cornerstone technology that redefines how organizations of all sizes orchestrate interactions with clientele and internal stakeholders alike. The traditional calendar and phone-based approach no longer meets the expectations of today’s digitally savvy consumers, who demand real-time confirmations, self-service flexibility, and frictionless integrations with their preferred communication channels. This executive summary embarks on a journey to articulate the strategic value of deploying advanced scheduling platforms equipped with AI-powered recommendations, seamless calendar synchronization, and automated reminder capabilities.

Through a convergence of customer experience imperatives and operational efficiency goals, appointment scheduling solutions not only streamline administrative workflows but also contribute to boosting revenue through improved utilization of available resources. As organizations navigate evolving regulatory requirements and heightened data privacy concerns, these platforms offer robust security frameworks and compliance-driven architectures, ensuring peace of mind for decision-makers across industries. The sections that follow will dissect the transformative dynamics reshaping this segment, analyze the cumulative impact of recent policy changes, and unveil actionable insights to guide strategic investments in this rapidly maturing market.

Embracing Disruptive Technological and Market Shifts Reshaping the Appointment Scheduling Landscape for Enhanced Competitiveness

Embracing Disruptive Technological and Market Shifts Reshaping the Appointment Scheduling Landscape for Enhanced Competitiveness

The appointment scheduling landscape is experiencing unprecedented disruption driven by evolving customer expectations and breakthroughs in artificial intelligence. Organizations are rapidly integrating machine learning algorithms that predict optimal time slots, adapt to no-show patterns, and offer real-time rescheduling suggestions. Meanwhile, natural language processing enables conversational appointment booking through chatbots and voice assistants, creating dynamic user experiences that extend beyond static web portals. These innovations have collectively raised the bar for software providers, compelling them to embed intelligent automation and user-centric design into every facet of their solutions.

Simultaneously, the proliferation of remote and hybrid work models has intensified demand for scheduling tools that can handle complex time zone calculations and multi-user resource allocation. Service providers are now focusing on enhancing interoperability with video conferencing platforms, CRM suites, and enterprise resource planning systems to deliver end-to-end journey visibility. As the digital touchpoints between businesses and consumers multiply, omnichannel scheduling capabilities are no longer optional but essential. By aligning with these transformative shifts, stakeholders can unlock new pathways to customer engagement while fortifying operational resilience in an increasingly competitive market.

Assessing the Far Reaching Implications of 2025 United States Tariffs on Software Tools Service Delivery Models and Market Pricing Structures

Assessing the Far Reaching Implications of 2025 United States Tariffs on Software Tools Service Delivery Models and Market Pricing Structures

The introduction of United States tariffs on select software imports and service components in early 2025 has introduced a complex layer of cost considerations for both developers and end users of appointment scheduling platforms. Although the majority of cloud-native software is intangible and exempt from traditional customs duties, the tariffs target ancillary hardware components and professional services delivered by non-US entities. As a result, organizations are facing incremental expenses when procuring SaaS integrations that rely on hardware tokens, proprietary scheduling kiosks, and managed service configurations sourced from overseas providers.

In response to these changes, many solution vendors have restructured their pricing tiers to soften the burden on subscribers. Strategic adjustments include transitioning hardware-dependent offerings toward fully virtualized modules and sourcing professional services through US-based partners. Additionally, software providers are renegotiating reseller agreements and expanding local support teams to mitigate delivery delays caused by customs inspections. While these measures have tempered immediate price increases, forward-looking enterprises must remain vigilant regarding ongoing trade policy debates and evolving levy classifications that may influence total cost of ownership for advanced scheduling ecosystems.

Illuminating Core Market Segments to Guide Investment Priorities Across Software Services Deployment Types Organizational Sizes Applications and Industry Verticals

Illuminating Core Market Segments to Guide Investment Priorities Across Software Services Deployment Types Organizational Sizes Applications and Industry Verticals

An in-depth segmentation analysis reveals a multifaceted market structure defined by five primary lenses. Component segmentation shows that the software platform itself commands central focus, while service-related offerings-split between managed services and professional services-provide critical ongoing support and customization. This dual-track model ensures adopters can tailor solutions to their unique operational complexities, from initial integration to continuous optimization.

Turning to deployment type, the cloud paradigm dominates new implementations, with hybrid, private, and public cloud options enabling organizations to balance security, scalability, and cost. On-premises deployments still hold relevance in ecosystems where data sovereignty and legacy system compatibility are paramount. Regarding organization size, both large enterprises and small and medium enterprises exhibit strong uptake; the latter category further subdivides into medium and small enterprises, indicating nuanced purchasing behaviors influenced by budget constraints and digital maturity.

Examining application-based segmentation underscores appointment scheduling as the foundational module, complemented by resource optimization tools that maximize equipment and facility utilization, and staff management capabilities that streamline workforce coordination. Finally, end user verticals ranging from banking, capital markets, and insurance through higher education and K-12, to clinics, hospitals, and diagnostics centers, as well as brick-and-mortar and e-commerce retailers, illustrate how industry context shapes functionality requirements and integration patterns. This layered segmentation approach equips stakeholders with a strategic roadmap for prioritizing investments and customizing go-to-market strategies.

This comprehensive research report categorizes the Appointment Scheduling Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Organization Size

- Deployment Type

- Application

- End User Industry

Deciphering Regional Dynamics to Uncover Unique Adoption Trends and Strategic Opportunities in the Americas Europe Middle East Africa and Asia Pacific

Deciphering Regional Dynamics to Uncover Unique Adoption Trends and Strategic Opportunities in the Americas Europe Middle East Africa and Asia Pacific

Regional analysis highlights distinctive growth drivers and adoption barriers across the three major geographic clusters. The Americas continue to anchor global innovation in appointment scheduling, driven by robust demand in healthcare, professional services, and retail sectors. Enterprises in North America are increasingly embedding AI-augmented scheduling into consumer-facing applications, while Latin American markets demonstrate growing appetite for cloud-based solutions that bypass costly on-premises infrastructure.

In Europe, the Middle East, and Africa, regulatory frameworks and data protection standards exert a significant influence on solution design and deployment. Organizations in the European Union prioritize GDPR-compliant platforms with strong encryption and audit capabilities. Meanwhile, Middle Eastern and African enterprises balance digital investment with sovereign data requirements, fostering partnerships with local technology providers and driving interest in hybrid cloud architectures.

Asia Pacific stands out for its rapid digitalization across sectors such as education, healthcare, and telecommunications. High population densities and competitive landscapes in markets like India, China, and Australia accelerate adoption of mobile-first scheduling experiences. Furthermore, government digital transformation initiatives and investments in smart city infrastructure are creating fertile ground for advanced scheduling modules that integrate with broader citizen engagement platforms. These regional nuances inform targeted strategies, enabling vendors and end users to align their deployment approaches with localized market realities.

This comprehensive research report examines key regions that drive the evolution of the Appointment Scheduling Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Established Players Whose Strategies and Offerings Define Competitive Differentiation in the Appointment Scheduling Arena

Profiling Leading Innovators and Established Players Whose Strategies and Offerings Define Competitive Differentiation in the Appointment Scheduling Arena

Market leadership in the appointment scheduling domain is characterized by relentless innovation, strategic partnerships, and the ability to deliver user-friendly experiences across diverse channels. Horizon players have invested heavily in enhancing their AI-driven recommendation engines, enabling automatic slot optimization and predictive analytics that reduce no-show rates. Others focus on expanding ecosystem integrations, forging collaborations with video conferencing giants and CRM titans to ensure a seamless end-to-end customer journey.

Product roadmaps reveal a common emphasis on low-code configurability, allowing business users to tailor workflows without deep technical expertise. Meanwhile, scalability and security remain non-negotiable criteria as companies target heavily regulated industries such as finance and healthcare. Several firms are differentiating through vertical-specific modules, incorporating industry-standard compliance checklists and bespoke user interfaces. Strategic acquisitions of niche providers have further consolidated market share, reinforcing the importance of M&A activity in maintaining a competitive edge. As these leading entities refine their value propositions, late-stage challengers and emerging disruptors continue to focus on niche segments and under-served geographies, injecting fresh competition into the global landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Appointment Scheduling Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 10to8 Limited

- Appointy Technologies Pvt. Ltd.

- Booksy, Inc.

- Calendly, Inc.

- Mindbody, Inc.

- Queueme Technologies Pvt. Ltd.

- Reservio, s.r.o.

- Schedulicity Inc.

- Setmore Technologies, Inc.

- SimplyBook.me Ltd.

- Squarespace, Inc.

- SuperSaaS B.V.

- TimeTrade Systems, Inc.

- Vagaro, Inc.

- Valsoft SARS, Inc.

- vCita Inc.

- Zoho Corporation Pvt. Ltd.

Actionable Strategic Recommendations to Empower Industry Leaders in Maximizing Organizational Impact and ROI From Appointment Scheduling Investments

Actionable Strategic Recommendations to Empower Industry Leaders in Maximizing Organizational Impact and ROI From Appointment Scheduling Investments

Leaders seeking to capitalize on the digital appointment revolution must prioritize investments in AI-enabled functionalities that adapt in real-time to user behavior and evolving operational needs. It is imperative to adopt modular architectures that facilitate rapid integration with emerging technologies, such as voice interfaces and augmented reality scheduling kiosks, paving the way for omnichannel engagement. Enterprises should also consider forging partnerships with local systems integrators to navigate regional compliance landscapes and to mitigate risks associated with cross-border service delivery.

Moreover, embedding analytics dashboards that consolidate utilization metrics, no-show trends, and customer satisfaction scores can transform scheduling systems into strategic decision-support tools. Organizations are advised to embrace continuous feedback loops, collecting user insights through in-app surveys and monitoring API performance to drive iterative enhancements. Finally, revisiting pricing models in light of the 2025 tariff landscape can safeguard margins, ensuring that service delivery remains cost-effective while preserving superior user experiences.

Elucidating Rigorous Research Methodology and Data Collection Practices Underpinning Comprehensive Analysis of Appointment Scheduling Software Market

Elucidating Rigorous Research Methodology and Data Collection Practices Underpinning Comprehensive Analysis of Appointment Scheduling Software Market

This research synthesized insights from a robust methodological framework combining primary and secondary data sources. Primary research included in-depth interviews with C-level executives and IT architects across healthcare, financial services, education, and retail sectors, supplemented by surveys targeting end users to capture firsthand experiences with contemporary scheduling platforms. Secondary research leveraged public filings, regulatory filings, technology blogs, and a wide array of industry publications to validate trends and corroborate anecdotal evidence.

Data triangulation was achieved through the integration of quantitative usage metrics-such as average monthly scheduling volumes and API call frequencies-with qualitative feedback on feature prioritization and service quality. A bottom-up approach was employed for solution capability mapping, while a top-down perspective guided the identification of strategic themes and competitive dynamics. Throughout the process, an advisory panel of independent market analysts was engaged to challenge assumptions, test hypotheses, and ensure the objectivity and reliability of all findings.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Appointment Scheduling Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Appointment Scheduling Software Market, by Component

- Appointment Scheduling Software Market, by Organization Size

- Appointment Scheduling Software Market, by Deployment Type

- Appointment Scheduling Software Market, by Application

- Appointment Scheduling Software Market, by End User Industry

- Appointment Scheduling Software Market, by Region

- Appointment Scheduling Software Market, by Group

- Appointment Scheduling Software Market, by Country

- United States Appointment Scheduling Software Market

- China Appointment Scheduling Software Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2067 ]

Synthesizing Critical Insights and Key Findings to Offer a Cohesive Outlook on the Future Trajectory of Appointment Scheduling Technologies

Synthesizing Critical Insights and Key Findings to Offer a Cohesive Outlook on the Future Trajectory of Appointment Scheduling Technologies

The appointment scheduling software arena stands at the cusp of sustained innovation, driven by relentless advancements in artificial intelligence, growing demand for omnichannel experiences, and evolving regulatory frameworks. As organizations prioritize efficiency and user satisfaction in equal measure, the boundaries between scheduling, resource management, and workforce optimization continue to blur. Market leaders who excel at seamlessly integrating these functionalities will set new benchmarks for performance and engagement.

Looking ahead, we anticipate increased emphasis on hyper-personalization, leveraging real-time behavioral data to deliver proactive recommendations and context-aware scheduling options. The ongoing evolution of global trade policies underscores the importance of flexible deployment models and resilient supply chains. Companies that navigate these complexities through strategic partnerships, modular architectures, and continuous feedback mechanisms are poised to shape the next wave of digital scheduling innovation. This executive summary provides a holistic foundation for decision-makers to assess their current position and chart a clear course toward future growth.

Engage With Ketan Rohom to Unlock Exclusive Market Research on Appointment Scheduling Software Solutions for Strategic Growth

Engaging with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, is your gateway to unlocking unparalleled insights and capturing a competitive edge. His expertise in guiding leading organizations through the intricacies of appointment scheduling software ensures you receive tailored solutions aligned with your strategic imperatives. Reach out today to secure your full market research report, gain immediate access to in-depth analysis, and begin implementing actionable intelligence that will drive your roadmap forward. Take the next step toward informed decision-making and sustained market leadership by scheduling a consultation at your convenience

- How big is the Appointment Scheduling Software Market?

- What is the Appointment Scheduling Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?