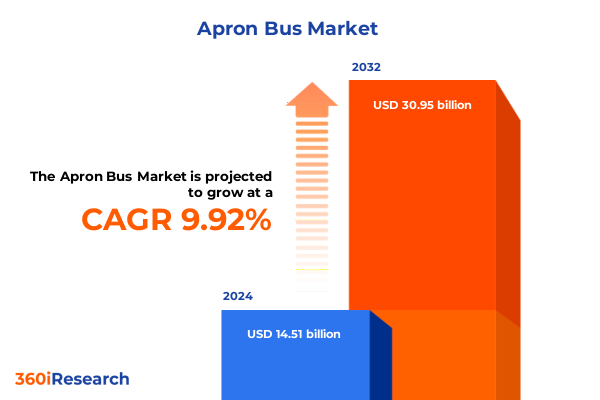

The Apron Bus Market size was estimated at USD 1.50 billion in 2025 and expected to reach USD 1.56 billion in 2026, at a CAGR of 6.06% to reach USD 2.27 billion by 2032.

Understanding the Dynamic Growth and Strategic Importance of Aircraft Apron Bus Solutions in Modern Airport Ground Transport Environments

The global airport ground transportation ecosystem is undergoing a period of profound transformation, as stakeholders seek to optimize passenger transfers, reduce operational costs, and meet sustainability imperatives. Apron buses serve as the critical link between terminal gates and aircraft parking stands, and their performance directly influences turnaround times, passenger satisfaction, and overall airport efficiency. In this context, understanding the unique value proposition of these specialized vehicles is essential for ground handlers, airport authorities, and transportation solution providers alike.

Over the last decade, increasing passenger volumes and evolving regulatory frameworks have compelled operators to reevaluate fleet composition and technology choices. Today's apron buses must not only deliver on reliability and capacity, but also align with stringent emission targets and noise reduction standards. As the industry prioritizes both environmental stewardship and operational excellence, apron bus solutions have become a focal point for investment in innovation, from advanced propulsion systems to smart fleet management. This introductory overview establishes the foundation for assessing market dynamics, competitive forces, and emerging opportunities in the apron bus segment.

Identifying Major Technological, Regulatory, and Operational Transformations Reshaping the Apron Bus Market Landscape Globally

Technological breakthroughs, shifting regulatory mandates, and evolving operational models are collectively reshaping the apron bus market at an unprecedented pace. Electrification has moved from niche pilot programs to mainstream deployment, driven by advancements in battery energy density and fast-charging infrastructure. This shift towards battery electric and fuel cell electric buses is dismantling legacy paradigms and prompting airports to integrate charging depots into facility master plans. In parallel, intelligent fleet management systems powered by telematics and IoT are enabling predictive maintenance, dynamic routing, and real-time passenger information, elevating service reliability.

Simultaneously, regulatory developments such as emissions caps in urban zones and incentives for zero-emission vehicles have accelerated the adoption of alternative propulsion types. Noise abatement policies are also influencing vehicle design, with manufacturers seeking to minimize acoustic footprints through refined chassis engineering and encapsulated drivetrains. Furthermore, operational models are shifting toward asset-light schemes in which vehicle ownership is complemented by service-based agreements, fostering greater flexibility in capacity scaling and risk sharing among airlines, ground handlers, and third-party operators. Together, these transformations underline a market in flux, characterized by rapid convergence of sustainability, digitization, and collaborative business models.

Evaluating the Compounded Effects of 2025 US Tariff Policies on the Production, Supply Chains, and Cost Structures of Apron Bus Manufacturers

In early 2025, the United States implemented a new set of tariffs on imported ground support equipment, including apron buses and related components. These levies, aimed at bolstering domestic manufacturing, have reverberated across global supply chains, raising input costs for manufacturers that rely on foreign-sourced chassis, drivetrains, and energy storage modules. As a result, procurement cycles for new fleet acquisitions have lengthened, with operators renegotiating contracts and seeking local content solutions to mitigate additional duties.

Moreover, manufacturers have responded by forging strategic alliances with domestic suppliers, investing in localized production facilities, and redesigning vehicle architectures to reduce reliance on tariff-affected parts. The cumulative effect has been a reconfiguration of cost structures across the value chain, where design engineers must balance performance requirements with tariff-induced pricing pressures. In some cases, this has led to incremental design modifications or the integration of alternative materials to maintain competitive pricing. While these adjustments require initial capital outlay, they also present opportunities for domestic innovation and resilience, as the industry recalibrates to a tariff-influenced operating environment.

Delving into Propulsion, Bus Type, Capacity, Application, and Sales Channel Segments to Reveal Critical Market Behavior Patterns

The propulsion type dimension reveals divergent adoption rates, with compressed natural gas models retaining appeal for operators seeking cleaner alternatives to conventional diesel, while the diesel segment itself bifurcates between traditional diesel and ultra-low sulfur diesel platforms to meet emission standards. Electric propulsion is accelerating, encompassing both battery systems-lithium-ion and emerging solid-state chemistries-and fuel cell configurations distinguished by proton exchange membrane and solid oxide fuel cell variants. Meanwhile, hybrid designs leveraging parallel and series hybrid architectures offer transitional solutions, blending internal combustion and electric drives to optimize fuel efficiency.

Bus type segmentation illuminates clear preferences: low-floor configurations are gaining traction for rapid passenger boarding, while articulated units serve high-volume airport hubs requiring large transfer capacity. Double-deckers provide a balance of footprint efficiency and seating, and high-floor models persist in legacy fleets. Capacity-oriented distinctions categorize vehicles according to seating ranges, from sub-25-seat shuttles for remote stands to above-60-seat giants for peak-flow management, with the mid-range tiers commanding significant share in medium-size airports.

Application-focused insights highlight the nuanced requirements across operational contexts. Airport shuttles operate on fixed-route circulators or on-demand services tailored to irregular gate allocations. City transit use cases demand express or standard scheduling to integrate airport operations with municipal networks, while intercity and tourism segments prioritize comfort amenities and extended range. Finally, sales channel analysis underscores the dual pathways of aftermarket parts and services-spanning inspections, refurbishments, and component upgrades-and original equipment manufacturer channels for turnkey fleet expansions, each shaping vendor relationships and revenue models.

This comprehensive research report categorizes the Apron Bus market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Propulsion Type

- Bus Type

- Capacity

- Application

Comparative Examination of Regional Dynamics Across the Americas, Europe Middle East & Africa, and Asia-Pacific in the Apron Bus Industry

The Americas region is characterized by a strong emphasis on sustainability mandates and fleet modernization initiatives, driven by municipal and federal incentives. In North America, leading airports are piloting zero-emission apron buses alongside investments in charging infrastructure, while Latin American hubs are gradually upgrading older diesel fleets to compressed natural gas alternatives as they balance cost and emissions targets. This regional context fosters collaboration between equipment suppliers and government bodies to de-risk large-scale deployments.

Across Europe, Middle East & Africa, legislative frameworks such as the European Green Deal and national clean-air zones are significant catalysts for zero-emission bus adoption. Western European airports often integrate battery electric and fuel cell vehicles, whereas Middle Eastern operators leverage hybrid and gas-powered fleets to navigate extreme temperature conditions. African markets, while nascent, show growing demand for resilient, cost-effective solutions that can operate reliably under varied infrastructure constraints.

In Asia-Pacific, the dynamic mix of mature and emerging economies creates a layered landscape. East Asian airports are at the forefront of deploying solid-state battery prototypes and next-generation fuel cells, supported by government R&D subsidies. Southeast Asian operators focus on hybrid and liquefied natural gas variants to address air quality challenges, while Australia and New Zealand emphasize asset-management agreements to optimize lifecycle costs. Each subregion reflects a distinct interplay of regulatory impetus, infrastructure readiness, and strategic partnerships.

This comprehensive research report examines key regions that drive the evolution of the Apron Bus market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Global and Regional Manufacturers Highlighted by Their Innovation Strategies and Competitive Positioning in the Apron Bus Market

Leading manufacturers have differentiated themselves through sustained investments in alternative propulsion research and strategic expansion of service networks. Cobus Industries leverages decades of airport equipment experience to refine electric drivetrains and fast-charging solutions tailored for high-frequency shuttle operations. At the same time, Mallaghan has deepened its expertise in durable diesel and CNG platforms, taking advantage of modular design approaches to simplify maintenance across diverse climatic zones.

Smith Electric continues to pioneer battery electric architectures, integrating lithium-ion systems with predictive energy management software to extend operational hours without compromising charge cycles. Similarly, CaetanoBus is collaborating with energy storage innovators to explore solid-state battery applications for robust performance in extreme temperatures. Meanwhile, regional players in Asia-Pacific, such as BYD and EV Dynamics, are utilizing scale advantages to offer competitively priced battery electric models, underpinned by government-supported manufacturing incentives.

In parallel, service providers like TECO and Marquette have elevated their aftermarket capabilities, offering end-to-end fleet management solutions that combine remote diagnostics, component refurbishment, and driver training programs. These companies exemplify a holistic approach, integrating hardware innovations with value-added services to strengthen customer retention and drive recurring revenue streams.

This comprehensive research report delivers an in-depth overview of the principal market players in the Apron Bus market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alexander Dennis Limited

- Ashok Leyland Limited

- Blue Bird Corporation

- BMC Otomotiv Sanayi ve Ticaret A.Ş.

- Bucher Municipal AG

- BusTech Ventures Pty Ltd

- CIMC Tianda Holdings Co., Ltd.

- Cobus Industries GmbH

- Göppel Bus GmbH

- Iveco Group N.V.

- Kiitokori Oy

- Mascott International

- MAZ-SPORTavto

- Mercedes-Benz Group AG

- Nigehban Gostar Parsian Co.

- Optare plc

- Oshkosh Corporation

- Rosenbauer International AG

- TAM-Europe S.A.S.

- TATRA TRUCKS a.s.

- Terberg Special Vehicles

- Volvo Group

- Zhengzhou Yutong Bus Co., Ltd.

Strategic Recommendations Empowering Industry Leaders to Capitalize on Emerging Apron Bus Market Opportunities and Navigate Upcoming Challenges

To capitalize on the accelerating shift toward zero-emission apron buses, industry leaders should proactively forge partnerships with electric utility providers to secure access to high-capacity charging infrastructure. By aligning procurement schedules with regional renewable energy capacity expansions, operators can ensure vehicles recharge during off-peak hours, minimizing energy costs and reducing carbon footprints. Simultaneously, investing in standardized charging interfaces will future-proof fleets against rapid technological changes in connector designs and power delivery rates.

Furthermore, companies should build modular platform architectures that allow seamless swapping of propulsion modules-whether battery packs, fuel cell stacks, or CNG tanks-to adapt quickly to evolving regulatory mandates and customer preferences. This approach will reduce redesign costs and accelerate time-to-market for new variants. Alongside these technical measures, establishing service-based contracts that tie maintenance revenues to vehicle availability metrics can strengthen customer loyalty while incentivizing predictive maintenance practices.

Finally, engaging in collaborative pilots with airport authorities and regulatory agencies will help shape practical policy frameworks and secure early access to new funding programs. By participating in demonstrator projects, original equipment manufacturers and ground handlers can validate emerging technologies under real-world conditions, building confidence among stakeholders and refining operational protocols ahead of broader rollouts.

Transparent Overview of Research Approach Integrating Primary Consultations, Secondary Data Analysis, and Rigorous Validation for Reliable Insights

The research methodology underpinning this analysis integrates multi-tiered data collection and validation processes. Primary insights were gathered through structured interviews with airport operations managers, ground handling service providers, and vehicle manufacturers across key regions. These discussions explored adoption drivers, fleet deployment strategies, and maintenance practices, ensuring a direct line of sight into on-the-ground realities.

Secondary data were sourced from government transportation agencies, environmental regulatory bodies, and industry consortium publications. This information was meticulously cross-verified through third-party technical papers, trade association reports, and recognized journals specializing in sustainable mobility. Quantitative data points such as fleet composition, technology adoption rates, and regulatory timelines were triangulated to confirm consistency across sources.

Finally, all findings underwent rigorous validation via expert panel reviews, where seasoned practitioners evaluated assumptions, tested scenario frameworks, and provided feedback on market narratives. This iterative process ensured that the conclusions drawn reflect both the current marketplace nuances and credible projections of technology and policy evolution.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Apron Bus market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Apron Bus Market, by Propulsion Type

- Apron Bus Market, by Bus Type

- Apron Bus Market, by Capacity

- Apron Bus Market, by Application

- Apron Bus Market, by Region

- Apron Bus Market, by Group

- Apron Bus Market, by Country

- United States Apron Bus Market

- China Apron Bus Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2067 ]

Synthesizing Core Market Insights and Future Outlook to Guide Stakeholders in Making Well-Informed Decisions in the Apron Bus Sector

This comprehensive overview of the apron bus market underscores the convergence of sustainability, technology innovation, and evolving business models. From alternative propulsion shifts to tariff-driven supply chain recalibrations, the landscape is being defined by a need for agility and collaborative problem-solving. Market participants that embrace modular design philosophies, strategic alliances, and data-driven operational practices are best positioned to thrive amid these changes.

As airport authorities and service providers refine their ground transport strategies, the prioritization of zero-emission platforms and intelligent fleet management will become increasingly non-negotiable. By synthesizing regulatory developments, regional dynamics, and competitive positioning insights, this research equips stakeholders with a holistic view to guide investment decisions. Ultimately, the capacity to adapt swiftly to technological advancements and policy shifts will determine the competitive edge for both equipment manufacturers and airport operators in the coming years.

Engage with Ketan Rohom to Secure Comprehensive Apron Bus Market Research Deliverables and Unlock Data-Driven Decision-Making Potential

For an in-depth exploration of emerging trends, detailed competitive landscapes, and actionable strategies within the apron bus market, engaging directly with Ketan Rohom will provide you with tailored insights and personalized support. As Associate Director of Sales & Marketing, he can guide you through the comprehensive report components, arrange a walkthrough of the data sets, and customize findings to your organization’s unique needs. Reach out to discuss your specific research requirements and secure access to proprietary analysis that will empower your decision-making and accelerate your competitive advantage.

- How big is the Apron Bus Market?

- What is the Apron Bus Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?