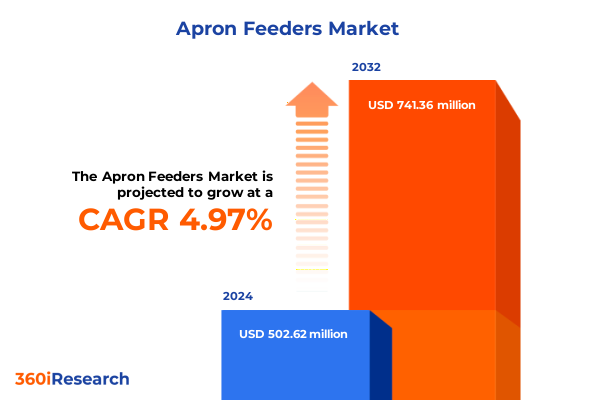

The Apron Feeders Market size was estimated at USD 525.90 million in 2025 and expected to reach USD 551.48 million in 2026, at a CAGR of 5.02% to reach USD 741.36 million by 2032.

A strategic introduction that frames how operational resilience, digital enablement, and trade policy pressures are jointly reshaping apron feeder purchasing and maintenance priorities

The apron feeder sector now sits at an inflection point where traditional heavy-mechanical requirements meet accelerating demands for digital resilience, regional supply security, and more disciplined total-cost-of-ownership thinking. Operators who once judged feeders primarily by strength and uptime are now layering requirements for predictable life-cycle costs, remote condition monitoring, and compatibility with modular retrofit packages. This shift reflects a broader industrial trajectory: plants are optimizing not only throughput but the continuity and visibility of material flow across increasingly automated value chains.

At the same time, global policy shifts and near-term trade actions have altered the economics of heavy steel consumption and international sourcing, while OEMs and aftermarket providers respond by retooling product families and service programs. These dynamics require executives to reconcile short-run procurement pressures with longer-term strategic priorities such as safety, sustainability, and integration with plant-level digital ecosystems. The introduction outlines the forces shaping procurement, engineering, and aftermarket decisions so that decision-makers can prioritize investments that preserve throughput while managing exposure to supply and tariff volatility.

Transformative industry shifts driven by automation adoption, modular engineering, and elevated trade-policy risk that are redefining product and service models in material handling

The apron feeder landscape is being transformed by three interlocking shifts: rapid adoption of automation and predictive maintenance, modular product design that reduces retrofit complexity, and heightened trade-policy volatility that changes input-cost math for heavy steel components. Automation is moving from pilot projects to mainstream operations; remote condition monitoring and predictive analytics now inform maintenance windows and spare parts strategies, forcing OEMs to reengineer controls, sensors, and service offerings to deliver measurable uptime improvements.

Concurrently, modular and hybrid feeder concepts-combining belt and apron characteristics or enabling containerized transport and on-site assembly-have lowered installation risk for greenfield and brownfield projects, shortening lead times and reducing civil-work requirements. This flexibility is especially valuable in constrained sites where excavation or transport is expensive. Finally, trade and tariff dynamics are reshaping supply chains and sourcing strategies. The re-pricing of steel and derivative inputs has prompted manufacturers to explore alternative alloys, localized supply partnerships, and revised warranty and service models to preserve margins while maintaining equipment availability. Together, these trends are accelerating a transition from pure equipment sales toward integrated solution delivery that blends hardware, software, and lifecycle services to protect plant throughput and margin.

How the 2025 United States tariff changes on steel and aluminum are altering sourcing choices, input-cost structures, and procurement timing for heavy equipment manufacturers

Policy actions in 2025 that raise ad valorem duties on steel and aluminum imports to higher levels have an immediate and observable impact on heavy-equipment manufacturing economics, given the material intensity of apron feeder constructions. In March and June 2025 the U.S. administration modified prior trade arrangements and then adjusted tariff rates on steel and aluminum, respectively, increasing measures that influence upstream input costs for feeders and related components. These proclamations changed the baseline import duty treatment and expanded the range of articles subject to additional tariffs, which in turn prompted many OEMs and fabricators to reassess sourcing strategies, revise supplier contracts, and accelerate local supply development where practical. The legal and administrative modifications to tariff treatment also created timing uncertainty for planned capital projects, as procurement teams evaluated whether to accelerate orders before new rates took effect or to redesign equipment to reduce exposed content.

The broader commercial effects include faster pass-through of higher raw-material costs into quotations, a heightened focus on parts standardization to reduce inventory exposure, and increased interest in retrofit and refurbishment as alternatives to full replacement. Trade partners and trading blocs signaled potential retaliatory measures and negotiation pathways, creating near-term demand disruptions for some imported components while incentivizing manufacturers to expand domestic capacity or shift production footprints to lower-tariff jurisdictions. These developments mean that procurement leaders must include tariff scenario planning as a core input to CAPEX approval workflows and supplier risk assessments to avoid margin erosion and schedule slippage. The White House proclamations and international responses provide the legal milestones and geopolitical context that underpin these operational impacts, and they should be incorporated into supplier contracts, lead‑time assumptions, and financial modeling for the remainder of the planning horizon for heavy-material handling equipment.

Key segmentation insights revealing how product type, application requirements, capacity tiers, and sales channels shape procurement and aftermarket strategies

Segment-level insight shows the apron feeder market is not homogeneous: product-type differentiation is a meaningful determinant of engineering choices, service models, and purchasing horizons. Electromagnetic, hydraulic, mechanical, and vibratory apron feeders each imply different wear characteristics, control architectures, and spare‑parts profiles, which influence the mix of upfront CAPEX and ongoing OPEX in plant budgets. Likewise, application-driven requirements-ranging across chemical processing, construction, food processing, metal processing, mining, and recycling-create distinct specification matrices. Within construction, for example, the demands of building construction differ materially from road construction in terms of feed rates, portability, and dust-control needs; within metal processing, foundries present hotter, slag-prone environments while steel mills require exceptionally robust impact resistance; and within mining, coal extraction, metal ore operations, and nonmetal mineral mining each place different priorities on abrasion resistance, throughput, and pan design. Recycling applications further bifurcate into metal and plastic recycling streams with different cleanliness, contamination, and sizing constraints.

Capacity remains a practical axis of segmentation: high-, medium- and low-capacity feeders steer material selection, drive gearbox and drive-train specification, and determine installation footprints. Sales-channel dynamics also matter; distributors regularly serve retrofit and aftermarket lubrication, spare-parts and emergency replacement needs, whereas OEMs typically secure greenfield projects and package integration work that bundles process control and long-term service agreements. For procurement and product strategy, combining product-type preferences, application-specific specifications, capacity requirements, and channel expectations yields a granular roadmap for prioritizing SKUs, service offerings, and digital feature-sets that will resonate with customers in each end-market.

This comprehensive research report categorizes the Apron Feeders market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Capacity

- Application

- Sales Channel

Regional demand and supply-chain contrasts across the Americas, Europe Middle East & Africa, and Asia-Pacific that determine go-to-market and production footprint decisions

Regional demand drivers and supply-chain constraints diverge sharply across the Americas, Europe Middle East & Africa, and Asia-Pacific, and these differences are central to strategic planning for manufacturers and buyers. In the Americas, a mix of infrastructure renewals, aggregates production, and energy‑sector projects creates steady demand for heavy-duty feeders and retrofit services, while the U.S. tariff measures have pushed some OEMs to accelerate local sourcing and parts inventories to avoid unpredictable lead times and landed-cost increases. This region therefore favors suppliers that can offer quick-response service networks and localized fabrication capabilities.

In Europe, the Middle East & Africa, regulatory scrutiny, energy-transition projects, and higher labor costs make modularity, energy efficiency, and serviceability important differentiators. European buyers often prize engineering sophistication and integration with plant control systems, but they are also sensitive to supply-chain disruption when trade measures alter availability or price of critical steel components. The Asia-Pacific region continues to lead in volume demand driven by large mining projects, cement production, and rapid infrastructure expansion; here, price competition and short replacement cycles favor scalable manufacturing footprints and hybrid feeder designs that combine robustness with transportability. Understanding these regional archetypes enables suppliers to map product portfolios and commercial models-whether to lean into high-touch OEM project work in one region or to scale distributor-led aftermarket operations in another-so that regional investments in inventory, service, and local assembly yield predictable returns.

This comprehensive research report examines key regions that drive the evolution of the Apron Feeders market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive company dynamics and supplier responses that prioritize hybrid designs, digital-enabled services, and localized production to protect margins and uptime

Leading suppliers and equipment integrators are responding to the confluence of higher material costs, automation expectations, and the need for modular solutions by expanding product variants and service lines. Major engineering brands are emphasizing hybrid feeder concepts that reduce civil and transport costs and are embedding digital interfaces that make predictive maintenance and condition-based servicing a standard part of the offering. These vendors also invest in regional manufacturing partnerships and component localization to protect margins against tariff-driven input-cost volatility.

At the same time, specialist fabricators and regional OEMs are exploiting retrofit opportunities by offering wear‑resistant pan technologies, quick-change wear kits, and on-site refurbishment programs that extend component life and delay full-replacement decisions. Channel partners are repositioning around inventory-as-a-service models and emergency response commitments to capture aftermarket share. For buyers, this competitive landscape means evaluating suppliers not just on capex price but on their ability to deliver integrated lifecycle value: spare‑parts velocity, embedded condition monitoring, documented reliability in comparable applications, and the capacity to reconfigure solutions for changing tariff or site constraints.

This comprehensive research report delivers an in-depth overview of the principal market players in the Apron Feeders market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Astec Industries, Inc.

- FLSmidth & Co. A/S

- Haver & Boecker OHG

- KPI-JCI, LLC

- McLanahan Corporation

- Metso Outotec Corporation

- Schenck Process Holding GmbH

- Superior Industries International, Inc.

- ThyssenKrupp Industrial Solutions AG

- Weir Group PLC

Actionable recommendations for procurement, engineering, and commercial leaders to mitigate tariff exposure, reduce downtime, and accelerate retrofit economics

To protect operations and commercial margins, industry leaders should act on three pragmatic priorities. First, integrate tariff scenario planning directly into procurement and CAPEX approvals so that contract clauses, delivery windows, and contingency inventory are visible to finance and operations stakeholders early in project cycles; short lead sourcing and option clauses reduce exposure to sudden tariff-driven cost increases. Second, accelerate the adoption of digital monitoring and condition-based maintenance programs to convert reactive servicing into predictable, data-driven maintenance windows that lower unplanned downtime and spare-parts carrying costs. Third, pursue modularization and hybrid-feeder architectures for brownfield work to reduce civil and logistics costs while improving retrofit economics and shortening commissioning timelines.

Operationally, executives should require supplier proposals to include lifecycle cost analyses, spare-parts availability metrics, and clear retrofit upgrade paths so that procurement decisions internalize serviceability and time-to-return rather than focusing solely on initial price. At the portfolio level, consider shifting some sourcing to qualified local fabricators for critical steel subassemblies while maintaining a strategic supplier base for core engineered components and control systems. These actions will balance short-run cost shocks with long-run resilience and create clearer pathways to protect throughput and profitability in an uncertain trade and operating environment.

Research methodology that combines primary interviews, manufacturer technical documentation, and authoritative policy texts to produce actionable procurement scenarios and supplier analysis

This research synthesizes a mixed-methods approach combining primary interviews with OEM product managers, aftermarket service leads, and plant engineering decision-makers together with a targeted review of policy proclamations, manufacturer technical literature, and trade‑press coverage to map how tariffs, technology, and region-specific demand intersect. Primary inputs included structured interviews focused on procurement lead times, spare‑parts strategies, and digital service adoption; these interviews were supplemented with technical product documentation, manufacturer datasheets, and case studies of retrofit projects.

Secondary sources included public policy texts and proclamations that define tariff timing and scope, reputable trade reporting on geopolitical reactions and plant-level impacts, and supplier product pages and white papers that document engineering responses such as hybrid feeder adaptations and new control integrations. Quantitative triangulation used lead‑time and cost inputs drawn from supplier datasheets and public tariff schedules to build scenario matrices that inform recommended procurement actions. The methodology prioritizes verifiable primary inputs and authoritative public documents to ground practical recommendations in the legal and operational realities that procurement and engineering teams face today.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Apron Feeders market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Apron Feeders Market, by Product Type

- Apron Feeders Market, by Capacity

- Apron Feeders Market, by Application

- Apron Feeders Market, by Sales Channel

- Apron Feeders Market, by Region

- Apron Feeders Market, by Group

- Apron Feeders Market, by Country

- United States Apron Feeders Market

- China Apron Feeders Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Concluding synthesis emphasizing lifecycle transparency, regional supply resilience, and integrated digital capabilities as the new determinants of competitive advantage for apron feeders

In conclusion, the apron feeder market is evolving from a commodity-equipment mindset into a layered solutions market where mechanical robustness, digital visibility, and supply-chain resilience matter in equal measure. Tariff developments in 2025 have crystallized the importance of localized sourcing and contractual flexibility, while technology trends-especially automation and predictive maintenance-are changing the value equation for buyers and OEMs alike. Suppliers that can rapidly combine hybrid mechanical designs, embedded monitoring, and responsive regional service networks will capture a disproportionate share of new project and retrofit spend.

For buyers, the strategic imperative is to move beyond single-point price negotiations and to demand lifecycle transparency from suppliers, including clear spare-parts commitments and documented retrofit paths. Taking these steps will preserve throughput, stabilize costs in a volatile trade environment, and create measurable operational improvements that support both short-term performance and long-term resilience.

Clear next steps to acquire the complete apron feeder market report and arrange a tailored briefing with the associate director for sales and marketing

To act on the strategic intelligence in this executive summary and secure a comprehensive, evidence-based market research report, contact Ketan Rohom, Associate Director, Sales & Marketing, to initiate the purchase process and arrange a tailored briefing for your leadership team. The report provides detailed supplier profiles, technology benchmarking, tariff-scenario analysis, parts and retrofit opportunity mapping, and buy/partner decision frameworks that help capital equipment buyers and OEM executives move from insight to contract negotiations within a compressed planning cycle.

A short commissioning conversation with Ketan Rohom can clarify which report modules are most relevant to your business, scope a custom addendum (for example, a deep dive on construction segment retrofit needs or a tariff-pass-through model), and organize expedited delivery of the dataset and slide-deck suitable for executive briefings. Following that call, buyers typically receive a formal proposal with options for custom country appendices, implementation workshops, and a follow-up analyst Q&A session to ensure quick operationalization of the research findings. This direct path from inquiry to procurement reduces time-to-action and ensures the right combination of off-the-shelf intelligence and tailored analysis to support commercial decisions.

If you are prioritizing procurement or strategic partnerships in the near term, contact Ketan Rohom to request an immediate sample excerpt, confirm licensing terms, and schedule a demonstration of the data dashboards. The report is structured to support tender evaluations, CAPEX approvals, and supplier negotiations, and the sales team can coordinate a clear timeline for delivery, invoicing, and any bespoke advisory support needed to deploy findings into your 90- to 180-day planning horizons.

- How big is the Apron Feeders Market?

- What is the Apron Feeders Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?