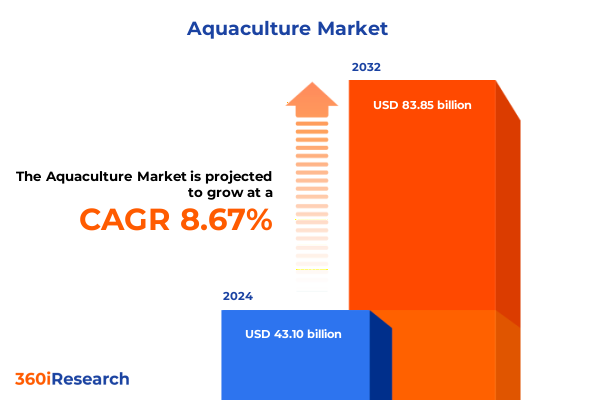

The Aquaculture Market size was estimated at USD 46.88 billion in 2025 and expected to reach USD 50.63 billion in 2026, at a CAGR of 8.65% to reach USD 83.85 billion by 2032.

Navigating the Future of Aquaculture Amid Shifting Consumer Preferences Environmental Challenges Technological Innovations and Regulatory Dynamics

Aquaculture has emerged as a pivotal component of global food systems, transcending its traditional role to become one of the fastest-growing agricultural sectors. Recent analyses reveal that aquaculture production of aquatic animals surpassed capture fisheries for the first time in 2022, underscoring its transformative potential in meeting the world’s rising demand for seafood and bolstering food security. This milestone highlights the industry’s capacity to scale sustainably, yet it also underscores the complexities inherent in balancing growth with ecological stewardship.

As environmental pressures, regulatory dynamics, and shifting consumer preferences converge, aquaculture stakeholders are challenged to innovate across every facet of production. The industry’s reliance on wild-caught fish for feed, especially for carnivorous species like salmon and trout, has come under scrutiny, with studies indicating the need for a more transparent and sustainable approach to feed sourcing. Consequently, this executive summary distills the current landscape, transformative shifts, tariff impacts, and strategic imperatives that will define aquaculture’s next phase of growth.

Identifying the Major Transformative Shifts Redefining Aquaculture with Emerging Land-Based Systems Genetic Innovation and Circular Economy Breakthroughs

Over the past decade, aquaculture has undergone a profound transformation driven by technological breakthroughs and evolving environmental imperatives. Land-based systems such as recirculating aquaculture systems (RAS) have shifted from niche experiments to cornerstone facilities, leveraging advanced water treatment, biosecurity, and waste valorization techniques. These innovations enable operations to thrive in water-scarce and urban regions while significantly reducing water usage and environmental footprints. Furthermore, the integration of sensors, automation, and IoT platforms has enhanced real-time monitoring, allowing for precise control over water quality parameters and feed efficiency.

Simultaneously, genetics and selective breeding programs are accelerating growth rates, disease resistance, and feed conversion ratios, reshaping species viability across diverse culture systems. Meanwhile, the circular economy concept is gaining momentum as producers convert RAS sludge into valuable resources such as microalgae, polychaetes, and biofertilizers, reinforcing a more sustainable operational model that minimizes waste and maximizes resource efficiency. Together, these shifts signal a new era in which innovation, sustainability, and resilience converge to redefine aquaculture’s role in global food security.

Examining How Recent Reciprocal Tariffs on Major Shrimp-Exporting Countries Are Reshaping U S Import Flows Domestic Competitiveness and Consumer Demand

In 2025 the United States enacted a series of reciprocal tariffs on imported seafood aimed at protecting domestic aquaculture producers. A 26 percent duty on shrimp from India, a 32 percent levy on shrimp from Indonesia, and a 46 percent tariff on shrimp originating in Vietnam were matched by a 10 percent blanket tariff on Ecuadorian imports, with a subsequent 90-day pause bringing rates to a uniform 10 percent across all sources. Concurrently, antidumping and countervailing duties of approximately 7.1 percent on India, 3.8 percent on Ecuador, 3.9 percent on Indonesia, and 2.8 percent on Vietnam compounded the cost structure for international suppliers, reshaping competitive dynamics within the U.S. market.

The immediate effects of these measures have been multifaceted. Importers accelerated purchases in early 2025 to hedge against tariff uncertainties, resulting in a 38 percent year-on-year increase in U.S. shrimp imports in April alone and a doubling of shipments from Ecuador, which benefited from comparatively lower duties. While domestic producers welcomed relief from predatory pricing practices, economists caution that higher consumer prices may temper demand and drive substitution toward alternative proteins. Moreover, the structural challenges of processing capacity and industry consolidation underscore the need for complementary policy measures to ensure that tariff protections translate into sustained domestic growth rather than transient price distortion.

Analyzing the Multifaceted Market Segmentation to Reveal Species-Specific Dynamics Culture System Variations Farming Methodologies and Product Form Nuances

The aquaculture market’s complexity is illuminated through a nuanced analysis of its segmentation parameters, beginning with species composition. Within the crustaceans category, sub-segments of crab, prawns, and shrimp have each exhibited distinct growth trajectories shaped by consumer preference and production cost dynamics. Finfish producers, operating across carp, salmon, and tilapia, face divergent challenges related to feed formulation and disease management, while mollusc cultivators of clams, mussels, and oysters navigate habitat requirements and certification standards.

Culture system segmentation reveals that traditional freshwater ponds continue to dominate in regions with abundant land resources, whereas marine cages deliver proximity to natural feed inputs but contend with environmental exposure. Raceway systems offer controlled flow-through water conditions, and innovative recirculating aquaculture systems provide land-based alternatives optimized for biosecurity and resource efficiency. Farming methods ranging from aquaponics integration to monoculture and polyculture approaches reflect varying priorities of yield maximization, resource sharing, and ecosystem symbiosis. Meanwhile, product form preferences-fresh, frozen, and processed-underscore logistical considerations and consumer expectations around convenience, shelf life, and value-added offerings. Farm size, spanning large commercial enterprises to medium and small producers, shapes capital intensity, access to finance, and scalability. Finally, water type differentiation into freshwater and marine operations delineates species suitability, infrastructure requirements, and regulatory frameworks.

This comprehensive research report categorizes the Aquaculture market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Species

- Culture System

- Farming Method

- Product Form

- Water Type

- Farm Size

Contrasting Regional Aquaculture Landscapes in the Americas EMEA and Asia Pacific Highlighting Technology Adoption Resource Constraints and Sustainability Priorities

Regional dynamics in the aquaculture industry diverge significantly between the Americas, Europe–Middle East–Africa, and Asia-Pacific, each influenced by resource availability, regulatory frameworks, and consumption patterns. In the Americas, robust aquaculture clusters in the United States, Canada, and Chile benefit from advanced technology adoption and strong market linkages to seafood processors and retailers. However, constraints such as water rights, environmental permitting, and processing capacity bottlenecks necessitate targeted investments in infrastructure and policy support to unlock latent growth.

Across Europe, the Middle East, and Africa, stringent environmental regulations and certification requirements drive a focus on sustainability, with countries like Norway and the UK leading in salmon and shellfish production under Aquaculture Stewardship Council standards. Meanwhile, emerging markets in the Middle East and North Africa leverage desalination and RAS technologies to address water scarcity, and sub-Saharan African initiatives prioritize small-scale pond systems to bolster local food security. The Asia-Pacific region, home to more than 70 percent of global aquaculture output, demonstrates vast scale in China, Vietnam, and Indonesia, while rapidly growing markets in India and Southeast Asia pursue modernization of feed supply chains and disease control protocols.

This comprehensive research report examines key regions that drive the evolution of the Aquaculture market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Showcasing the Strategic Approaches of Global Aquaculture Leaders from Large-Scale Salmon Producers to Innovative Feed and Technology Developers

Leading aquaculture companies exhibit diverse strategic priorities that underscore the sector’s breadth. Mowi ASA, the world’s largest producer of Atlantic salmon, focuses on integrating advanced imaging, smart feeding systems, and traceability technologies to maintain premium margins and meet stringent regulatory standards. Cooke Inc., the largest privately held seafood company, has pursued growth through targeted acquisitions in North America, Chile, and Scotland, while expanding its feed, hatchery, and processing capabilities to enhance operational resilience and geographic diversification.

Among feed and service providers, firms such as Cargill, BioMar AS, and CP Foods drive innovation in sustainable feed formulations and nutrition research, responding to pressure for reduced fishmeal inclusion and greater use of alternative proteins. Meanwhile, specialized RAS technology developers and engineering firms are forging partnerships with large-scale producers and government bodies to deploy modular systems in urban and water-scarce environments. Collectively, these companies set benchmarks in operational excellence, sustainability certification, and value chain integration.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aquaculture market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AKVA group ASA

- Alltech Inc

- Apex Frozen Foods Ltd

- Austevoll Seafood ASA

- Avanti Feeds Limited

- Cermaq Group AS

- Charoen Pokphand Foods PCL

- Cooke Aquaculture Inc

- Dongwon Industries

- Empresas AquaChile S.A.

- Grieg Seafood ASA

- High Liner Foods

- Huon Aquaculture Group Limited

- Lerøy Seafood Group ASA

- Maruha Nichiro Corporation

- Mitsubishi Corporation

- Mowi ASA

- Multiexport Foods S.A.

- Nippon Suisan Kaisha Ltd

- Nutreco N.V.

- Pacific Seafood

- Tassal Group Limited

- Thai Union Group

- The Waterbase Limited

- Trident Seafoods

Prioritize Strategic Investments in Circular Production Systems Feed Innovation and Policy Engagement to Build Resilience and Sustainable Growth

Industry leaders should prioritize investments in next-generation production systems, particularly recirculating aquaculture systems, to enhance resource efficiency and mitigate environmental risk. By adopting circular economy principles-such as converting waste streams into biogas or biofertilizers-organizations can reduce operational costs while meeting rising consumer demand for sustainably sourced seafood. Equally critical is the acceleration of feed innovation, leveraging alternative protein sources and precision formulation to decrease reliance on wild fish stocks and align with evolving sustainability standards.

In parallel, engaging proactively with policymakers to shape balanced trade and tariff frameworks will help ensure that tariff protections translate into long-term domestic capacity rather than short-lived price distortions. Establishing cross-sector collaborations among producers, technology providers, feed companies, and research institutions will foster a cohesive innovation ecosystem capable of responding swiftly to disease outbreaks, climate extremes, and market fluctuations. Ultimately, agile strategic planning that integrates digital monitoring, genetic improvement, and policy advocacy will distinguish the industry’s most resilient performers.

Detailing a Robust Two-Phase Methodology Integrating Secondary Analysis Proprietary Data and Primary Expert Interviews to Ensure Rigorous Findings

This analysis integrates a rigorous two-phase research methodology combining comprehensive secondary data review and primary stakeholder engagement. In the first phase, global standards and regulatory documents, specialized databases, and peer-reviewed journals were examined to map current trends, technological advancements, and tariff regulations. Proprietary datasets capturing trade flows, import volumes, and duty structures were cross-referenced with publicly available sources to validate accuracy and currency.

In the second phase, structured interviews with aquaculture executives, technology providers, and policy experts provided qualitative insights into strategic priorities and operational challenges. Findings were synthesized through triangulation to minimize bias and ensure robustness. Each insight was subjected to peer review by domain specialists before finalization, ensuring that the conclusions and recommendations rest on a solid evidence base and reflect the latest industry developments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aquaculture market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aquaculture Market, by Species

- Aquaculture Market, by Culture System

- Aquaculture Market, by Farming Method

- Aquaculture Market, by Product Form

- Aquaculture Market, by Water Type

- Aquaculture Market, by Farm Size

- Aquaculture Market, by Region

- Aquaculture Market, by Group

- Aquaculture Market, by Country

- United States Aquaculture Market

- China Aquaculture Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Synthesizing Key Findings to Illustrate How Innovation Sustainability and Strategic Policy Engagement Will Shape Aquaculture’s Next Chapter

Aquaculture stands at the threshold of unprecedented growth, propelled by technological innovation, shifting consumer expectations, and evolving policy landscapes. The industry’s ability to harness land-based systems, improve feed sustainability, and navigate tariff environments will determine its trajectory in the coming years. While tariff measures offer short-term relief for domestic producers, sustainable advantage will stem from strategic investments in resource efficiency, circular practices, and collaborative innovation.

As global demand for aquatic foods intensifies, industry stakeholders who combine agility with long-term vision will capture emerging opportunities across diverse segments and regions. This report’s insights serve as a roadmap for aquaculture leaders to chart a course toward profitable, resilient, and environmentally responsible growth.

Don’t Miss the Opportunity to Engage with Our Associate Director to Acquire the Definitive Aquaculture Report

To unlock comprehensive insights and actionable intelligence tailored to your strategic objectives, contact Ketan Rohom, Associate Director of Sales & Marketing. Secure your copy of this in-depth aquaculture market research report and empower your organization with the knowledge to lead in a rapidly evolving industry.

- How big is the Aquaculture Market?

- What is the Aquaculture Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?