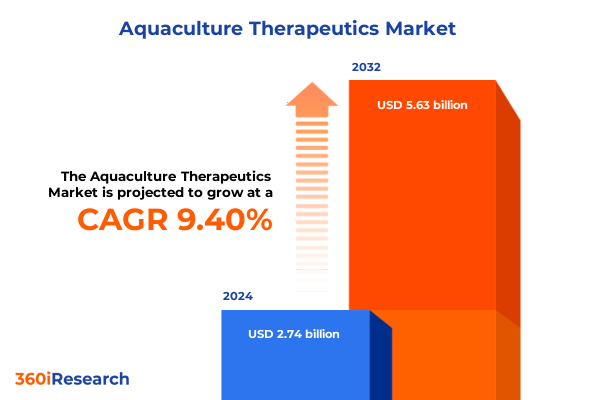

The Aquaculture Therapeutics Market size was estimated at USD 3.00 billion in 2025 and expected to reach USD 3.26 billion in 2026, at a CAGR of 9.37% to reach USD 5.63 billion by 2032.

Exploring the Critical Intersection of Aquaculture Health and Sustainable Seafood Production Amid Rising Disease Pressures and Environmental Challenges

Global seafood demand is rising faster than ever, with aquaculture now surpassing wild-catch fisheries to become the leading source of aquatic animal production. The United Nations Food and Agriculture Organization recently reported that cultured fish, crustaceans, and mollusks accounted for over half of total aquatic animal output, marking a historic shift in food production strategies. This transformation underscores both the promise and the peril facing the industry: while farmed seafood brings opportunities to meet protein needs, it also amplifies disease risks in intensive rearing systems.

As production intensifies, outbreaks of bacterial, viral, and parasitic diseases have imposed significant operational and financial burdens. In response, aquaculture operators have historically relied on broad-spectrum antibiotics to contain epidemics, but growing concerns over antimicrobial resistance have prompted regulatory crackdowns and consumer pushback. Pharmaceutical and biotech firms are thus racing to develop next-generation vaccines, probiotics, and immunostimulants tailored to species-specific pathogens, seeking to balance animal health with environmental stewardship and food safety.

At the same time, sustainability imperatives and evolving regulatory frameworks are converging to reshape industry priorities. Governments and retailers are setting ambitious targets to reduce antibiotic residues and promote eco-friendly practices. Major retailers have pledged to source antibiotic-free seafood by 2025, catalyzing investments in organic therapeutics and residue-free production protocols. Against this backdrop, the aquaculture therapeutics sector is poised at a critical juncture where innovation, regulation, and market dynamics intersect to define the future of sustainable seafood.

Unveiling the Biotech Revolution and Digital Transformation Redefining Disease Prevention and Treatment in Modern Aquaculture Operations

The aquaculture therapeutics landscape is undergoing a profound transformation driven by breakthroughs in biotechnology and digitalization. Advances in recombinant DNA and RNA-based vaccine platforms are enabling the development of highly targeted immunizations against pathogens such as Vibrio in shrimp and Streptococcus in tilapia, offering precise protection without the environmental drawbacks of conventional antibiotics. Parallel innovations in probiotic formulations and immunostimulants harness the gut microbiome and innate immune pathways, creating synergistic defenses that reduce disease incidence while promoting overall health.

Meanwhile, precision aquaculture tools are revolutionizing disease management by integrating IoT sensors, AI-driven analytics, and real-time water quality monitoring. Automated diagnostic kits employing molecular assays enable early detection of outbreaks, empowering producers to intervene swiftly and minimize losses. These digital solutions not only enhance biosecurity protocols but also generate rich data streams that inform continuous improvement cycles for feed formulations and therapeutic regimens.

Concurrently, a shift toward preventive health strategies is increasingly evident. Cultured species are now receiving tailored vaccination programs and functional feed additives from the juvenile stage, aligning with broader sustainability commitments and regulatory mandates to curtail antibiotic use. This proactive approach is fostering deeper collaboration among feed manufacturers, biotech startups, and integrators, accelerating the commercialization of eco-friendly therapeutics and positioning aquaculture as a model of responsible food production.

Assessing the Ripple Effects of New U.S. Trade Tariffs on Aquaculture Therapeutics Supply Chains Manufacturing Costs and Market Dynamics

In 2025, the United States enacted sweeping tariffs on healthcare imports, imposing a baseline global levy of 10 percent on active pharmaceutical ingredients, medical devices, and diagnostic equipment critical to aquaculture therapeutics production. Chinese APIs, which supply a significant portion of vaccine and additive manufacturing inputs, faced additional reciprocal duties of up to 245 percent, sharply increasing the cost of raw materials and jeopardizing supply chain stability. These measures, designed to bolster domestic manufacturing, have prompted many therapeutics providers to reevaluate sourcing strategies, with some repatriating production or seeking alternative suppliers in Southeast Asia and Europe.

Simultaneously, tariffs on seafood imports have had cascading market effects. The United States Trout Farmers Association reported a 25 percent duty on salmon and other products from Canada and Mexico, alongside anticipated levies on certain European exports, which have led to elevated consumer prices and shifts in buying patterns toward domestically farmed species. For aquaculture therapeutics firms, these trade barriers translate into both cost pressures-via higher shipping and compliance expenses-and potential demand fluctuations as feed and health management costs are absorbed by producers and, ultimately, end consumers.

Within this complex environment, industry stakeholders are balancing short-term tariff impacts with long-term resilience strategies. Major players are expanding U.S.-based manufacturing capacity and investing in localized R&D hubs to mitigate import dependencies. At the same time, companies are negotiating temporary exemptions for critical inputs and optimizing logistics networks to preserve margin integrity. These adaptive measures are laying the groundwork for a more geographically diversified supply chain, reducing exposure to future trade policy volatility and safeguarding product availability.

Delving into Comprehensive Therapeutic Type Species Application and Administration Segmentation to Unlock Actionable Aquaculture Health Strategies

A nuanced understanding of market segmentation reveals the multifaceted nature of aquaculture therapeutics demand. Products based on therapeutic type encompass antibiotics, which include both broad-spectrum and narrow-spectrum formulations, disinfectants such as chlorine and quaternary ammonium compounds, immunostimulants derived from beta glucan and herbal extracts, bacterial and yeast probiotics, and a diverse array of vaccines including inactivated, live attenuated, and recombinant variants. Each therapeutic class addresses distinct disease challenges and aligns with varying regulatory expectations, influencing adoption patterns across geographies and species.

Species-focused segmentation underscores critical differences in health management needs. Crustaceans, notably prawn and shrimp, are highly susceptible to viral pathogens and require specialized immunostimulants and vaccines, while fish categories such as carp, salmon, and tilapia demand tailored solutions for bacterial and parasitic threats. Mollusk cultivation, including mussels and oysters, often relies on disinfectants and water treatment protocols rather than systemic therapeutics, reflecting the unique physiology and production methods of these species.

Further insights emerge when considering application, mode of administration, and distribution channel. Therapeutics serve both curative and preventive applications, delivered through immersion baths, targeted injections, or feed-based oral systems. Each administration route presents trade-offs in labor intensity, dosage precision, and stress management for the animals. Distribution channels range from direct sales by manufacturers to independent distributors and emerging online platforms, shaping procurement strategies and influencing pricing dynamics within the value chain.

This comprehensive research report categorizes the Aquaculture Therapeutics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Therapeutic Type

- Species

- Mode Of Administration

- Application

- Distribution Channel

Navigating Distinct Regional Dynamics and Regulatory Landscapes Shaping Aquaculture Therapeutics Adoption Across Americas EMEA and Asia Pacific

Regional dynamics play a pivotal role in aquaculture therapeutics adoption and regulatory evolution. In the Americas, robust demand for shrimp and salmon has encouraged producers to integrate vaccines and probiotic-enriched feeds, while stringent residue regulations at the federal and state levels are accelerating the shift toward antibiotic-free protocols. North American companies are also innovating in precision aquaculture and digital diagnostics to maintain competitiveness amid tariff-driven cost pressures.

In Europe, the Middle East & Africa region, historical leadership in salmon vaccine development has set a benchmark for preventive health management. The European Union’s ban on prophylactic antibiotic use in 2022 has driven rapid growth in biologics and immunostimulant sectors, with pioneering firms launching recombinant vaccines and synbiotic products to meet rigorous sustainability criteria. Meanwhile, emerging markets in the Middle East and North Africa are exploring partnerships with global technology providers to bolster local production capabilities and enhance disease resilience.

Across Asia-Pacific, where over two-thirds of global aquaculture production originates, a convergence of government-led vaccination campaigns and private-sector R&D is spearheading next-generation therapeutics. National initiatives in countries like Vietnam and India focus on reducing losses from white spot syndrome and streptococcosis, respectively, by deploying integrated health management programs. Simultaneously, increased consumer awareness of antibiotic residues is spurring demand for certified organic and residue-free seafood products.

This comprehensive research report examines key regions that drive the evolution of the Aquaculture Therapeutics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Leaders and Emerging Innovators Steering Aquaculture Therapeutics Through Competitive Pressures and Technological Advancements

Leading pharmaceutical and biotech firms are shaping the competitive contours of the aquaculture therapeutics market. Zoetis Inc. and Merck Animal Health, leveraging their global R&D networks, are advancing vaccine platforms for high-value species such as salmon and shrimp, while Elanco Animal Health is expanding its immunostimulant and probiotic pipelines through strategic acquisitions and collaborations. Phibro Animal Health has intensified its focus on specialized feed additives and disinfectant chemistries that promise fast-acting pathogen control.

Benchmark Holdings and INVE Aquaculture exemplify vertically integrated companies that combine hatchery operations with in-house health management solutions, enabling end-to-end control of biosecurity and therapeutics application. Nutreco’s Skretting division and specialty producers like HIPRA are pioneering novel delivery systems for oral vaccines, reducing stress on stock and labor requirements, while Virbac Animal Health continues to diversify its portfolio with recombinant and autogenous vaccine offerings tailored to regional disease profiles.

Beyond established players, a dynamic ecosystem of startups and academic spin-offs is emerging around microbial therapies, phage-based antivirals, and CRISPR-enabled genetic resistance programs. This infusion of innovation is attracting venture capital and corporate investment, signaling a new wave of competition centered on sustainable, antibiotic-free disease prevention strategies. As these companies scale their technologies, partnerships with feed integrators and farm operators will be critical to driving broad adoption and achieving measurable impact in global aquaculture systems.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aquaculture Therapeutics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alltech, Inc.

- Archer-Daniels-Midland Company

- Benchmark Holdings plc

- Biomar Group

- Cermaq Group AS

- Ceva Santé Animale

- CP Foods

- DSM Nutritional Products AG

- Elanco Animal Health Incorporated

- Evonik Industries AG

- HIPRA

- Kemin Industries, Inc.

- Merck & Co., Inc.

- Neovia (part of ADM)

- Novartis AG

- NUTRECO N.V.

- Pharmaq AS

- Phibro Animal Health Corporation

- Ridley Corporation Limited

- Skretting

- Veterquimica S.A.

- Virbac S.A.

- Zoetis Inc.

Strategic Imperatives for Industry Leaders to Enhance Resilience Optimize Supply Chains and Drive Sustainable Aquaculture Health Interventions

Industry leaders should prioritize diversification of their supply chains to mitigate the risks posed by evolving trade policies. By establishing regional manufacturing hubs and securing local sourcing agreements, companies can reduce exposure to tariff volatility and ensure consistent access to critical inputs. Incentivizing near-shore production of vaccines, diagnostics, and probiotics will not only enhance supply resilience but also align with sustainability targets and bolster stakeholder confidence.

Leveraging digital health platforms can further elevate operational efficiency and disease control. Implementing sensor-based monitoring systems and AI-driven predictive analytics allows for early intervention and optimized therapeutic dosing, minimizing animal stress and reducing resource consumption. In parallel, organizations should pursue strategic alliances with biotech innovators to co-develop next-generation immunostimulants and vaccine adjuvants, accelerating time-to-market and broadening their product portfolios with evidence-backed solutions.

Finally, transparent engagement with regulators and industry associations is imperative to shape favorable policy frameworks and ensure compliance. Proactive participation in standard-setting processes for antibiotic residue limits and vaccine approval pathways enables companies to anticipate regulatory changes and adapt product development pipelines accordingly. These multi-pronged strategies will position industry leaders to capture emerging opportunities, reinforce competitive differentiation, and support the sustainable growth of aquaculture therapeutics.

Understanding the Rigorous Research Framework Combining Primary Expert Interviews Secondary Data Analysis and Triangulation Techniques for Robust Insights

Our research methodology integrates a rigorous blend of primary and secondary data collection with robust validation processes. We conducted in-depth interviews with key stakeholders, including aquaculture producers, veterinary health experts, feed mill operators, and regulatory authorities, to capture first-hand insights on operational challenges and emerging solutions. These qualitative inputs were complemented by detailed surveys targeting therapeutic manufacturers and distribution channel partners, providing a comprehensive view of market dynamics and investment priorities.

Secondary research encompassed an extensive review of peer-reviewed journals, industry publications, trade association reports, and regulatory filings. Particular attention was given to technical white papers on vaccine efficacy, peer-reviewed studies on probiotic–vaccine synergy, and government publications on antibiotic stewardship policies. Data triangulation was employed to reconcile conflicting information and ensure the accuracy of thematic insights. Proprietary databases were leveraged to track technology adoption rates, patent filings, and M&A activities within the aquaculture health sector.

Quantitative analysis was supported by advanced statistical techniques to identify trend trajectories, correlation patterns between disease incidence and therapeutic uptake, and scenario modeling to project the impact of policy shifts and trade barriers. All findings underwent an internal peer review process to validate methodologies and interpretations. This multi-layered approach ensures that our report delivers actionable, evidence-based insights that reflect the latest industry developments and equip decision-makers to navigate a complex, evolving landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aquaculture Therapeutics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aquaculture Therapeutics Market, by Therapeutic Type

- Aquaculture Therapeutics Market, by Species

- Aquaculture Therapeutics Market, by Mode Of Administration

- Aquaculture Therapeutics Market, by Application

- Aquaculture Therapeutics Market, by Distribution Channel

- Aquaculture Therapeutics Market, by Region

- Aquaculture Therapeutics Market, by Group

- Aquaculture Therapeutics Market, by Country

- United States Aquaculture Therapeutics Market

- China Aquaculture Therapeutics Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Bringing Together Insights on Market Shifts Regulatory Impacts and Innovation Trajectories to Guide Future Aquaculture Therapeutics Initiatives

The aquaculture therapeutics sector stands at the confluence of technological innovation, regulatory reform, and evolving market demands. Breakthroughs in vaccine platforms, immunostimulants, and digital diagnostics are transforming disease management from reactive to preventive paradigms, reducing reliance on antibiotics and fostering greater sustainability. Concurrently, escalating trade tensions and tariff policies have underscored the importance of resilient supply chain architectures and adaptive sourcing strategies.

Segmentation analysis reveals the diverse requirements across therapeutic types, species, applications, and distribution channels, highlighting the need for tailored approaches that match product attributes with end-user needs. Regional insights further emphasize that markets in the Americas, EMEA, and Asia-Pacific are on distinct evolutionary paths shaped by regulatory mandates, consumer preferences, and production intensities. Leading companies and agile startups alike are leveraging these nuances to carve out competitive niches and drive collaborative innovation.

As the industry advances, proactive engagement with policymakers, continuous investment in localized manufacturing, and adoption of integrated health management systems will be critical to sustaining growth. By harnessing a combination of strategic partnerships, cutting-edge research, and data-driven decision-making, stakeholders can navigate the complexities of the current environment and position themselves for long-term success. The insights contained within this report serve as a roadmap for capitalizing on emerging opportunities and addressing the challenges that will define the future of aquaculture therapeutics.

Connect with Ketan Rohom to Secure Exclusive Aquaculture Therapeutics Research Insights and Drive Your Strategic Growth Initiatives

Ready to unlock unrivaled insights into the evolving aquaculture therapeutics market and fortify your strategic initiatives? Connect with Ketan Rohom, Associate Director of Sales & Marketing, to arrange a personalized demonstration of our comprehensive market research report. Discover how our in-depth analysis can support your decision-making, identify emerging growth opportunities, and navigate regulatory complexities with confidence. Reach out today to secure your copy and empower your organization with actionable intelligence tailored to drive sustainable growth and competitive advantage in this rapidly changing industry.

- How big is the Aquaculture Therapeutics Market?

- What is the Aquaculture Therapeutics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?