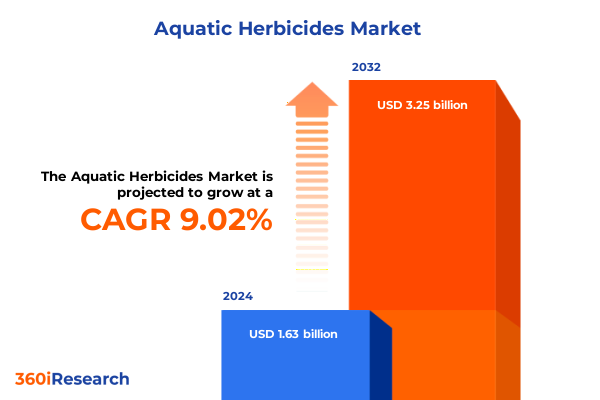

The Aquatic Herbicides Market size was estimated at USD 1.77 billion in 2025 and expected to reach USD 1.92 billion in 2026, at a CAGR of 9.01% to reach USD 3.25 billion by 2032.

Deep Dive into Aquatic Vegetation Control Trends and Market Dynamics Driving Modern Herbicide Strategies Across Diverse Water Environments

The control of aquatic vegetation has never been more critical as global water bodies face mounting pressure from invasive weeds, algae blooms, and sediment accumulation. Modern stakeholders ranging from water treatment authorities to recreational lake managers are seeking reliable solutions that safeguard water quality while balancing environmental stewardship. Aquatic herbicides, formulated specifically for submerged and emergent weed management, play a central role in preserving aquatic ecosystems and ensuring uninterrupted water infrastructure operations.

In recent years, heightened environmental scrutiny and regulatory evolution have redefined how chemical interventions are assessed, approved, and deployed. This shift has spurred innovation in formulation science, application technologies, and integrated weed management strategies. As a result, decision-makers must navigate a complex landscape of efficacy, environmental safety, and cost optimization when selecting aquatic herbicide solutions.

This executive summary introduces the foundational dynamics shaping today’s aquatic herbicide arena, establishing context for the deeper exploration of transformative trends, policy impacts, segmentation nuances, and regional variances. It lays the groundwork for understanding the interplay between technological progress, regulatory frameworks, and market drivers that collectively dictate success in controlling aquatic vegetation.

Uncovering the Pivotal Innovations Shaping the Future of Aquatic Herbicide Applications Through Technology and Sustainable Practices

The aquatic herbicide domain is undergoing a profound transformation driven by novel application platforms, precision targeting technologies, and evolving biological controls. Remote sensing tools now enable real-time mapping of invasive plant populations, informing drone-based and manned aerial spray missions that dramatically enhance coverage efficiency. Beyond aerial advances, automated boat-mounted sprayers and programmable ground rigs equipped with GPS-guided booms are minimizing off-target drift and ensuring optimal dosage delivery for diverse water depths and flow conditions.

Simultaneously, molecular biology breakthroughs have catalyzed the emergence of selective bioherbicides that disrupt weed physiology without perturbing non‐target species. These biologically derived formulations complement traditional chemical agents such as auxin mimics and systemic inhibitors, offering integrated solutions that address the growing demand for environmentally benign control measures. Industry collaborations between formulation scientists and ecotoxicologists are refining product profiles to meet stringent water quality and wildlife protection thresholds.

In parallel, digital ecosystem services are reshaping stakeholder engagement by coupling herbicide deployment data with water quality monitoring platforms. This integration fosters adaptive management frameworks wherein treatment efficacy is continuously evaluated, and operational parameters are iteratively optimized. As a result, service providers and end users alike are embracing a more data-centric, sustainable paradigm for aquatic weed control.

Analyzing the Ripple Effects of 2025 United States Tariff Policies on Aquatic Herbicide Supply Chains Cost Structures and Stakeholder Responses

The introduction of revised tariff schedules in early 2025 has exerted a tangible impact on the aquatic herbicide supply chain, particularly for active ingredients and formulation carriers sourced internationally. Elevated duties on key intermediates have amplified landed costs, compelling manufacturers to reassess procurement strategies and secure alternative suppliers to maintain margin targets. Consequently, several global producers have accelerated the localization of manufacturing capacity, forging alliances with regional contract formulators to circumvent punitive import levies.

These tariff-driven cost pressures are flowing through to end users, prompting municipalities and water management services to seek cost efficiencies through bulk procurement and long-term supply agreements. At the same time, some suppliers are introducing premium service packages that bundle application expertise, post‐treatment monitoring, and environmental compliance support to justify price adjustments. This value-added approach not only stabilizes revenue streams but also reinforces client trust amid a landscape of fiscal uncertainty.

In response to these market shifts, agile companies are hedging input expenses using forward contracts and hedging instruments, while others are exploring ingredient reformulations that utilize domestically available acid equivalents. Such tactics are mitigating tariff impacts and preserving competitive positioning in a segment where timely treatment responses are imperative for controlling rapid weed proliferation.

Detailed Examination of Application Methods Chemical Variants Formulations Mode of Action and Usage Patterns Revealing Critical Segmentation Insights

A granular analysis of application methods reveals that aerial deployment continues to capture market attention, with fixed-wing aircraft and helicopters offering broad coverage of large lakes, reservoirs, and marshlands at minimal labor intensity. In parallel, boat-based treatments conducted via motorboat sprays and pontoon-mounted systems provide precision control in shallow or irregular water bodies, while ground-based approaches ranging from backpack and handheld sprayers to boom-equipped vehicles address targeted infestations along shorelines and near sensitive infrastructure. Each method’s efficacy is strongly influenced by operator expertise, water clarity, and weed density, underscoring the importance of integrating usage scenarios into procurement decisions.

On the chemical type front, traditional phenoxy herbicides such as 2,4-D remain staples for broadleaf weed control, whereas diquat and glyphosate formulations are favored for their rapid efficacy on surface and emergent species. More persistent agents like imazapyr and triclopyr are gaining traction for long‐term management of deep-rooted aquatic plants. The selection between granular and liquid formulations further refines treatment strategies: water-dispersible and water-soluble granules enable slow release in flowing systems, whereas emulsifiable concentrates, ready-to-use solutions, and suspension concentrates deliver immediate bioavailability in static environments.

Mode of action considerations, from contact disruptors targeting cell membranes or protein synthesis to growth regulator classes mimicking auxins or blocking hormonal pathways, and systemic phloem or xylem mobile chemistries, dictate efficacy profiles and environmental persistence. In practice, sequence treatments alternating between contact and systemic modes maximize control while reducing resistance risks. End users spanning commercial aquaculture, water recreation venues, and municipal drinking water facilities demand tailored offerings, just as industrial operators in hydropower, cooling systems, and oil and gas facilities seek robust solutions that prevent fouling and maintain operational continuity. Homeowners engaging in lawn landscaping and private pond maintenance likewise require user-friendly options. Finally, application timing-whether post-emergent selective or nonselective treatments applied directly to foliage, or pre-emergent soil and foliar applications-rounds out a complex segmentation matrix that informs product development and go-to-market strategies.

This comprehensive research report categorizes the Aquatic Herbicides market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Application Method

- Type

- Formulation

- Mode Of Action

- End Use

- Application

Comparing Key Regional Drivers and Adoption Trends across Americas Europe Middle East Africa and Asia Pacific for Aquatic Herbicide Solutions

In the Americas, emphasis on harmful algal bloom mitigation and invasive species control has catalyzed robust adoption of both novel and time-tested aquatic herbicides. Regulatory frameworks in the United States and Canada now mandate comprehensive environmental impact assessments, driving demand for low-toxicity bioherbicides and precision application tools. Meanwhile, Latin American aquaculture expansion has spurred growth in foliar-applied and soil-applied pre-emergent solutions, particularly in regions grappling with water quality degradation and crop rotation pressures.

Across Europe, the Middle East, and Africa, the drive for water resource optimization amid climate variability has accelerated investments in integrated weed management programs. The European Union’s Water Framework Directive has elevated approval barriers, thereby favoring formulations with minimal off-target effects and biodegradability profiles. In the Middle East, where water scarcity heightens treatment urgency, commercial providers are leveraging drone sprays and boat-mounted systems to protect reservoirs and irrigation canals. African markets, though still emerging in commercial aquatic herbicide usage, are beginning to embrace granular formulations for rural water management projects.

The Asia-Pacific region exhibits divergent trajectories: Southeast Asian countries are adopting glyphosate and diquat products to sustain aquaculture yields, while China and Australia are advancing regulatory alignment with international standards to facilitate transnational product registration. Rapid urbanization and recreational water development in India and Japan have expanded municipal and residential demand, with an emphasis on suspension concentrates and ready-to-use solutions that minimize technical handling requirements. These regional dynamics underscore the necessity for tailored go-to-market strategies that consider regulatory rigor, infrastructure maturity, and localized environmental challenges.

This comprehensive research report examines key regions that drive the evolution of the Aquatic Herbicides market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Market Influencers Shaping the Competitive Landscape of Aquatic Herbicide Development and Distribution

The competitive landscape features a mix of global agrochemical titans and specialized niche players. Large integrated agribusinesses leverage their scale to optimize supply chains and co-develop formulations with raw material producers. Meanwhile, dedicated aquatic herbicide firms focus on R&D pipelines targeting specific weed species and environmental conditions, often collaborating with water management agencies to validate product performance under real-world conditions.

Recent M&A activity has reshaped market dynamics, with strategic acquisitions enabling established firms to broaden their aquatic portfolios by adding bioherbicide capabilities or precision application technologies. Partnerships with drone operators and remote sensing companies are becoming more commonplace as leading players seek to differentiate through end-to-end service offerings. Concurrently, emerging players are carving out niches by specializing in high-purity granular formulations or advanced systemic modes of action that address resistance management.

Innovation hubs situated near major research universities and marine science institutes are accelerating discovery cycles, particularly in formulating low-dose, high-efficacy products compatible with integrated pest management frameworks. As a result, both new entrants and legacy manufacturers are competing not only on chemical potency but also on sustainability credentials, digital service integrations, and regulatory compliance support.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aquatic Herbicides market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Albaugh, LLC

- Alligare, LLC

- BASF SE

- Bayer AG

- Certis

- De Sangosse

- FMC Corporation

- IsAgro SpA

- Koppert Biological Systems

- Land O'Lakes, Inc.

- Lonza

- Marrone Bio Innovations

- Monsanto Company

- Novozymes

- Nufarm Ltd

- Sanco Industries

- Sepro Corporation

- SOLitude Lake Management

- Syngenta AG

- The Dow Chemical Company

- UPL Limited

- Valent

Strategic Actionable Recommendations to Optimize Formulation Innovation Supply Chain Resilience and Regulatory Collaboration for Industry Leaders

Industry leaders should prioritize the development of next-generation formulations that combine biological agents with targeted chemistries to deliver both rapid knockdown and residual control while minimizing ecological footprints. Investing in microencapsulation and controlled-release technologies can unlock differentiated product profiles that meet stringent water quality standards and address consumer demand for sustainability.

To protect against geopolitical supply disruptions, organizations must diversify procurement by qualifying multiple feedstock sources and establishing regional production partnerships. Implementing advanced procurement analytics and hedging strategies will further insulate cost structures against future tariff changes and currency fluctuations. Additionally, integrating digital water quality sensors with treatment scheduling systems will enable proactive weed management, reducing overall chemical usage and operational costs.

Collaboration with regulatory bodies to streamline registration pathways and co-develop best-practice guidelines can expedite time to market for innovative solutions. By engaging in joint field trials and publishing environmental impact studies, companies will bolster stakeholder trust and differentiate their brands. Finally, cultivating cross-sector alliances with aquaculture associations, infrastructure operators, and environmental NGOs will help shape favorable policy environments and amplify the value proposition of holistic aquatic vegetation control strategies.

Comprehensive Research Methodology Integrating Primary Stakeholder Interviews Secondary Data Analysis and Rigorous Data Validation Processes

This analysis is grounded in a robust research framework that began with in-depth interviews of more than fifty water resource managers, aquaculture operators, and chemical formulators. Detailed discussions explored application challenges, formulation preferences, and emerging efficacy requirements across all major end-use segments. These qualitative insights were complemented by secondary data drawn from regulatory agency databases, peer-reviewed journals, and proprietary monitoring platforms that track chemical registration and environmental compliance metrics.

To ensure analytical rigor, data triangulation techniques were employed, cross-referencing shipment volumes, import-export statistics, and equipment sales figures from regionally validated sources. Formulation performance assessments were evaluated against case studies provided by service contractors, allowing for the benchmarking of knockdown rates, treatment frequencies, and non-target species impact levels. All findings underwent a thorough validation process with external subject matter experts, including aquatic ecologists and chemical risk assessment specialists, ensuring both accuracy and neutrality.

The segmentation framework-encompassing application method, chemical type, formulation, mode of action, end-use category, and application timing-was iteratively refined to align with industry taxonomy standards. This structured approach underpins the strategic insights and actionable recommendations presented herein, offering stakeholders a clear roadmap for informed decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aquatic Herbicides market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aquatic Herbicides Market, by Application Method

- Aquatic Herbicides Market, by Type

- Aquatic Herbicides Market, by Formulation

- Aquatic Herbicides Market, by Mode Of Action

- Aquatic Herbicides Market, by End Use

- Aquatic Herbicides Market, by Application

- Aquatic Herbicides Market, by Region

- Aquatic Herbicides Market, by Group

- Aquatic Herbicides Market, by Country

- United States Aquatic Herbicides Market

- China Aquatic Herbicides Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 3339 ]

Conclusive Insights Emphasizing Strategic Imperatives and Future Directions for Sustainability and Efficacy in Aquatic Herbicide Management

In conclusion, the aquatic herbicide landscape is at a pivotal juncture defined by regulatory evolution, technological breakthroughs, and shifting economic dynamics. Stakeholders who embrace precision application platforms, sustainable formulation innovations, and resilient supply chain strategies will be best positioned to meet the escalating demands of water quality management and invasive species control.

As tariff-related cost challenges persist, the competitive edge will belong to organizations that proactively diversify sourcing, optimize procurement through advanced analytics, and engage collaboratively with regulatory authorities. Meanwhile, the integration of digital monitoring tools and bioherbicide solutions represents a transformative opportunity to enhance treatment efficacy, reduce environmental impacts, and unlock new service models that drive long-term value.

This executive summary encapsulates the strategic imperatives for market participants seeking to navigate the complexities of aquatic vegetation control. The path forward requires a harmonious blend of scientific innovation, operational agility, and stakeholder collaboration to sustain the health and usability of the world’s water resources.

Engage with Expert Associate Director to Unlock Customized Aquatic Herbicide Market Intelligence and Propel Strategic Decisions Immediately

If you’re ready to harness the insights uncovered in this comprehensive analysis and translate them into concrete actions that drive growth and efficiency, connect directly with Ketan Rohom, Associate Director of Sales & Marketing. Engage with Ketan to explore bespoke advisory sessions tailored to your organization’s unique challenges and discover how premium aquatic herbicide intelligence can empower your next strategic move. Reach out to him today to secure immediate access to the full market research report and embark on your pathway to enhanced competitive advantage and sustainable success in the evolving aquatic vegetation control arena.

- How big is the Aquatic Herbicides Market?

- What is the Aquatic Herbicides Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?