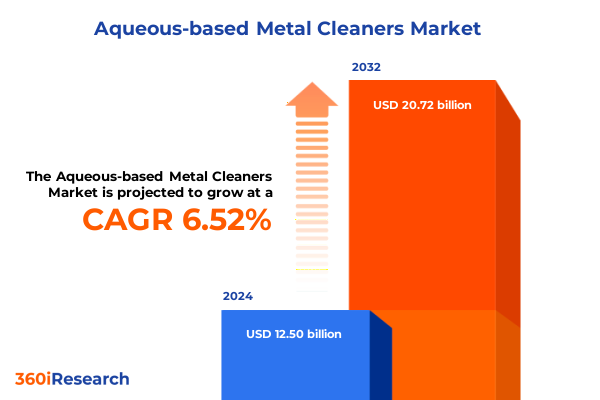

The Aqueous-based Metal Cleaners Market size was estimated at USD 13.31 billion in 2025 and expected to reach USD 14.08 billion in 2026, at a CAGR of 6.52% to reach USD 20.72 billion by 2032.

Exploring the Foundational Significance and Emerging Market Dynamics of Aqueous-based Metal Cleaners in Industrial Maintenance and Sustainability

Aqueous-based metal cleaners have emerged as essential agents in modern surface treatment, blending environmental responsibility with industrial efficacy. As traditional solvent-based processes increasingly face regulatory scrutiny due to volatile organic compound emissions and worker safety concerns, water-based formulations have gained prominence for their reduced environmental footprint and operational flexibility. Through the integration of advanced surfactants, corrosion inhibitors, and chelating agents, these cleaners deliver robust degreasing, passivation, pickling, rust removal, and surface preparation capabilities while aligning with sustainability mandates.

Moreover, industry stakeholders today demand solutions that can be seamlessly integrated into diverse cleaning rigs-from spray and immersion systems to ultrasonic baths-without compromising throughput or surface quality. This evolution has been catalyzed by tighter regulatory frameworks, particularly in North America and Europe, where emission controls and worker exposure limits are pushing manufacturers toward greener chemistries. Consequently, the market’s trajectory reflects not only technological maturation but also a collective shift toward harmonizing operational excellence with environmental stewardship and corporate social responsibility.

Uncovering the Pivotal Technological Innovations and Regulatory Transitions Driving Transformative Shifts in Aqueous-based Metal Cleaning Landscape

The landscape of aqueous-based metal cleaners is undergoing transformative shifts, primarily driven by breakthroughs in chemical formulation and digital process control. Recent innovations in biodegradable surfactants and renewable chelating systems have enhanced cleaning performance while reducing disposal burdens. Simultaneously, the incorporation of real-time process monitoring-leveraging sensor arrays and cloud-based analytics-enables dynamic adjustment of concentration, temperature, and pH, thereby optimizing resource utilization and minimizing downtime.

In parallel, regulatory convergence across major markets is shaping product development priorities. Stricter wastewater discharge limits are compelling end users to adopt closed-loop cleaning systems and invest in advanced effluent treatment. At the same time, the rise of circular economy principles is driving demand for recyclable and low-hazard formulations. As a result, leading suppliers are pursuing cross-industry collaborations to co-develop turnkey solutions that integrate chemical innovation, equipment design, and service offerings. These alliances foster faster market adoption by addressing the dual imperatives of performance and compliance while positioning system integrators and chemical providers as strategic partners rather than mere vendors.

Assessing the Broad-reaching Consequences of 2025 United States Tariffs on the Aqueous-based Metal Cleaning Supply Chain and Competitive Environment

In 2025, the United States implemented revised tariff schedules targeting imported metalworking fluids and associated chemicals, significantly impacting the cost structure of aqueous-based cleaning formulations. These duties have created a ripple effect across supply chains, elevating raw material costs for key surfactants and corrosion inhibitors sourced from Asia-Pacific producers. As domestic manufacturers contend with increased input expenses, they are exploring strategic stockpiling, dual-sourcing strategies, and localized production to mitigate supply-chain disruptions.

Furthermore, the tariff-induced price escalation has intensified competition among regional producers, prompting margin compression for smaller players lacking integrated manufacturing capabilities. In response, established chemical companies have accelerated their investments in U.S. production capacities, leveraging economies of scale to sustain competitive pricing. End users, meanwhile, are reassessing procurement strategies, favoring longer-term contracts and collaborative partnerships to secure stable pricing and supply continuity. Looking ahead, the tariff landscape will continue to reshape alliance structures, foster nearshoring initiatives, and influence pricing models throughout the cleaning ecosystem.

Delving into Detailed Application, Industry, Metal Type, Technology, Formulation, and Distribution Channel Segmentation Insights Impacting Market Dynamics

Detailed analysis reveals that application-driven segmentation highlights distinct performance requirements and process integration needs. Degreasing operations, whether conducted via immersion, spray, or ultrasonic methods, demand high-efficiency surfactant blends, whereas passivation chemistries vary between citric acid and nitric acid formulations to balance environmental considerations and corrosion resistance. Pickling processes differ in acid selection-hydrochloric, nitric, or sulfuric-to optimize cleaning intensity against substrate sensitivity. Surface preparation techniques such as chemical etching and microblasting introduce further nuance by requiring low-residue, phosphate-free rinses to ensure adhesion and coating compatibility.

When viewed through the lens of end use industries, aerospace stakeholders rely heavily on precision cleaning for aircraft manufacturing and MRO, mandating stringent particulate control and certification to aerospace standards. The automotive segment, encompassing both OEM manufacturing and aftermarket service, prioritizes throughput and cost-efficiency, driving demand for high-turnover spray wash systems. Electronics applications-battery manufacturing, PCB cleaning, and semiconductor fabrication-call for ultrapure process water and rigorous contamination control. General manufacturing, spanning discrete and process environments, values versatility, whereas oil and gas players look for heavy-duty degreasing in upstream, midstream, and downstream operations.

Metal type introduces further differentiation: ferrous substrates such as cast iron and steel often require stronger inhibitor packages, while nonferrous metals like aluminum and copper necessitate gentler chelation to preserve surface integrity. Cleaning technology segmentation distinguishes immersion washing, spray washing, and ultrasonic cleaning, each supported by tailored chemistry; ultrasonic methods, split into high and low frequency, offer fine particle removal. The physical form of the chemistry-gel, liquid concentrate or ready-to-use, and powder formats including bulk powders and granules-affects handling, storage, and dilution protocols. Finally, distribution channel insights show that direct sales through aftermarket and OEM contracts enable customized service bundles, while distributors-industrial and wholesale-provide broad market coverage and value-added logistics. Online retailing via company websites and e-commerce platforms has emerged as a rapid-response channel for urgent replenishment needs.

This comprehensive research report categorizes the Aqueous-based Metal Cleaners market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Metal Type

- Cleaning Technology

- Form

- Application

- End Use Industry

- Distribution Channel

Comparative Regional Examination Highlighting Diverse Market Drivers and Adoption Patterns across Americas, Europe Middle East Africa, and Asia-Pacific Regions

Regional dynamics display pronounced variation in demand drivers and growth trends. In the Americas, robust automotive and aerospace sectors underpin consistent investment in aqueous cleaning systems, with an emphasis on modular equipment and turnkey service contracts. North American producers have capitalized on proximity to end users, mitigating tariff impacts and delivering just-in-time supply models, while Latin American markets show emerging interest in corrosion control for infrastructure maintenance.

Within Europe, the Middle East, and Africa, stringent environmental regulations in Western Europe drive the adoption of closed-loop technologies and biodegradable chemistries. Meanwhile, Middle Eastern oil and gas operators are investing in high-capacity cleaning plants to manage heavy crude processing residues. In Africa, gradual industrialization and infrastructure projects create nascent opportunities for surface preparation and rust removal solutions. Across this vast region, distribution networks led by local chemical distributors and specialized service providers play a pivotal role in bridging supplier capabilities with on-the-ground requirements.

In the Asia-Pacific region, rapid expansion of electronics manufacturing in Southeast Asia and India is fueling demand for ultrapure cleaning systems. Simultaneously, Chinese and Japanese OEMs are implementing integrated wash-cell lines to support high-volume automotive production. Environmental authorities in countries such as South Korea and Australia are tightening wastewater standards, stimulating interest in effluent treatment modules and recycling-oriented cleaning chemistry. These regional distinctions underscore the necessity for suppliers to adapt technology portfolios and go-to-market strategies according to local regulatory landscapes and end-user preferences.

This comprehensive research report examines key regions that drive the evolution of the Aqueous-based Metal Cleaners market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Key Industry Players Shaping Innovation, Strategic Partnerships, and Competitive Approaches in the Aqueous-based Metal Cleaning Market

The competitive arena features a mix of global conglomerates and specialized niche players, each leveraging unique strengths. Major chemical manufacturers have scaled production of proprietary additive packages, enabling them to offer end-to-end cleaning solutions bundled with equipment and service. Their substantial R&D investments have yielded advanced biodegradable formulations and modular cleaning systems that integrate seamlessly with digital process controls.

In contrast, mid-tier and regional providers excel in specialized segments-such as high-purity formulations for semiconductor clients or heavy-duty degreasers for oil and gas applications-backed by deep technical service expertise. Collaborative partnerships between technology-driven start-ups and established equipment vendors are also emerging, driving co-innovation in areas like ultrasonic enhancement and real-time effluent monitoring. As competition intensifies, differentiation through value-added services-on-site training, rapid-response maintenance, and tailored chemical management programs-has become a critical mechanism for retaining high-value customers and expanding wallet share across complex industrial sites.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aqueous-based Metal Cleaners market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ashland Global Holdings Inc.

- BASF SE

- Best Technology Inc.

- Chemtex Speciality Limited

- Clariant AG

- Diversey Holdings, Ltd.

- Dow Inc.

- Eastman Chemical Company

- Ecolab Inc.

- Evonik Industries AG

- Gage Products Company

- Henkel AG & Co. KGaA

- Kyzen Corporation

- Modern Chemical Inc.

- Nouryon

- Quaker Chemical Corporation

- R.K. Transonic Engineers Pvt. Ltd.

- Stepan Company

- The Chemours Company

- Zavenir Kluthe India Private Limited

Presenting Actionable Strategic Recommendations for Industry Leaders to Capitalize on Emerging Trends and Navigate Evolving Challenges in Metal Cleaning

To navigate the evolving aqueous metal cleaning market, industry leaders should prioritize holistic solution development that integrates advanced chemistry, equipment automation, and data analytics. Investing in scalable pilot facilities can accelerate customer validation cycles for new formulations and system configurations. Additionally, forging strategic alliances with wastewater treatment specialists will allow providers to offer end-to-end compliance solutions, addressing both cleaning performance and environmental discharge requirements.

Equally important is the cultivation of digital service capabilities. Implementing cloud-based dashboards and remote monitoring tools enhances customer engagement and creates recurring revenue streams through service subscriptions. On the commercial front, adopting flexible contracting models-such as performance-based agreements and volume guarantees-can strengthen long-term relationships and mitigate the impact of tariff-driven cost fluctuations. Finally, ongoing training and certification programs for end users will reinforce product efficacy while positioning suppliers as indispensable partners in achieving operational excellence and sustainability targets.

Outlining Robust Mixed-Method Research Methodology Integrating Primary Expert Interviews and Secondary Data to Ensure Comprehensive Insight Generation

This analysis synthesizes insights from a robust mixed-method research approach, beginning with extensive secondary data collection from regulatory databases, technology white papers, and environmental agency reports. Primary research included structured interviews with chemical formulators, equipment OEM executives, and end users across key industries to capture nuanced perspectives on performance requirements and procurement dynamics. Qualitative case studies of leading cleaning deployments provided real-world validation of emergent trends and tariff impact mitigation strategies.

Quantitative inputs were derived from company disclosures, trade associations, and customs records to map supply chain flows and regional trade patterns. The research team employed iterative triangulation, cross-referencing multiple data sources to ensure reliability and uncover discrepancies. Scenario modeling assessed the implications of policy shifts and tariff adjustments on cost structures and competitive positioning. The methodology adhered to stringent data quality standards, ensuring transparency, repeatability, and actionable relevance for stakeholders seeking to develop or refine their presence in the aqueous-based metal cleaning market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aqueous-based Metal Cleaners market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aqueous-based Metal Cleaners Market, by Metal Type

- Aqueous-based Metal Cleaners Market, by Cleaning Technology

- Aqueous-based Metal Cleaners Market, by Form

- Aqueous-based Metal Cleaners Market, by Application

- Aqueous-based Metal Cleaners Market, by End Use Industry

- Aqueous-based Metal Cleaners Market, by Distribution Channel

- Aqueous-based Metal Cleaners Market, by Region

- Aqueous-based Metal Cleaners Market, by Group

- Aqueous-based Metal Cleaners Market, by Country

- United States Aqueous-based Metal Cleaners Market

- China Aqueous-based Metal Cleaners Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 3498 ]

Concluding Synthesis Emphasizing Critical Insights and Strategic Imperatives Derived from Aqueous-based Metal Cleaning Market Analysis

The evolution of aqueous-based metal cleaners encapsulates a broader shift toward sustainable industrial processes and advanced surface treatment integration. Throughout this analysis, we have examined how technological breakthroughs, regulatory pressures, and tariff dynamics are collectively reshaping market structure and competitive strategies. Segmentation nuances across application, end use industry, metal type, technology, form, and distribution channels reveal a complex tapestry of requirements driving differentiated value propositions.

Regional insights underscore the importance of tailored approaches that accommodate local regulations and end-user preferences, while the competitive landscape highlights the growing significance of service-oriented business models. The recommendations presented herein offer a strategic roadmap for chemical suppliers, equipment vendors, and end users to foster innovation, optimize supply chains, and enhance customer engagement. Ultimately, stakeholders who proactively integrate these insights into their strategic planning will be best positioned to lead in the transition to cleaner, more efficient, and more sustainable metal cleaning operations.

Initiating Direct Engagement with Sales and Marketing Leadership to Secure Comprehensive Market Intelligence Report Purchase Opportunity with Expert Support

To secure an in-depth, tailored market intelligence report that provides strategic clarity and actionable data, please contact Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Ketan will guide you through the report’s key deliverables, including detailed segmentation analysis, tariff impact assessments, and regional opportunity mapping. Engage with an expert who can align the research outcomes to your organization’s strategic objectives and ensure you receive bespoke support in leveraging the market insights for optimal decision-making. Reach out today to discuss subscription options, sample extracts, and bundling possibilities that match your unique requirements and position your team at the forefront of the aqueous-based metal cleaning market.

- How big is the Aqueous-based Metal Cleaners Market?

- What is the Aqueous-based Metal Cleaners Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?