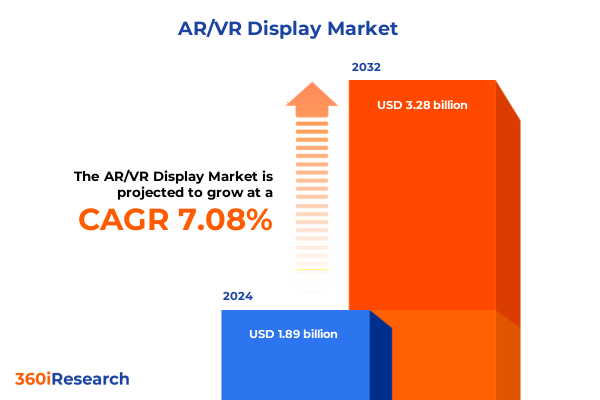

The AR/VR Display Market size was estimated at USD 2.03 billion in 2025 and expected to reach USD 2.17 billion in 2026, at a CAGR of 7.10% to reach USD 3.28 billion by 2032.

Embark on a comprehensive exploration of the immersive realities redefining visual engagement and setting the stage for AR and VR display innovation

Embark on a journey into the rapidly evolving realm of immersive visual experiences that are redefining how industries engage with technology. From consumer entertainment to enterprise solutions, augmented and virtual reality displays are at a pivotal juncture, driven by relentless innovation in optics, processing, and interface design. This introduction sets the stage for an in-depth exploration of the forces reshaping display technologies, emphasizing the convergence of hardware advancements and software capabilities that underpin next-generation user experiences.

As market dynamics accelerate in response to growing user demand, this overview will outline key themes that permeate the industry landscape. It will highlight the critical intersections of technical progress, strategic partnerships, and regulatory influences, providing a cohesive lens through which industry leaders can assess opportunities and challenges. By establishing a clear context in this opening section, readers are equipped with the foundational perspective necessary to navigate subsequent analyses and recommendations.

Revolutionary advancements and strategic alliances are propelling a paradigm shift in display technology that transcends conventional AR and VR boundaries

In recent years, the AR and VR display industry has experienced paradigm-shifting breakthroughs that extend far beyond incremental improvements. Cutting-edge developments in microLED and organic light-emitting diode technologies have delivered significant gains in brightness, contrast, and energy efficiency. Meanwhile, advances in optical waveguides and pancake lenses have led to sleeker form factors, drastically reducing the weight and bulk of head-mounted displays. This convergence of optics and materials science is complemented by next-generation processing architectures capable of delivering ultra-low latency and high-fidelity visuals, enabling more immersive and interactive experiences than ever before.

Simultaneously, the ecosystem has witnessed an uptick in strategic alliances between chipset manufacturers, display module suppliers, and system integrators. This collaborative environment fosters rapid prototyping and accelerates time-to-market for novel solutions. Additionally, the proliferation of 5G and Wi-Fi 6E connectivity frameworks has elevated remote rendering capabilities, shifting heavy computational loads to cloud infrastructures and unlocking new use cases for enterprise and consumer applications. These transformative shifts signal a departure from traditional display paradigms, setting the stage for a future defined by seamless augmentation of the physical world and fully immersive virtual environments.

Assessing the far-reaching implications of newly imposed tariffs on AR and VR display supply chains and innovation trajectories within the United States market

The imposition of United States tariffs on AR and VR display components in early 2025 has introduced significant ripple effects throughout the supply chain. Manufacturers reliant on imported optical modules and semiconductor chips have faced increased input costs, prompting a reevaluation of procurement strategies. Some industry participants have turned to domestic suppliers or diversified sourcing across Asia-Pacific markets to mitigate the impact of duty increases. In turn, these shifts have affected lead times and inventory planning, necessitating more agile manufacturing processes.

Beyond direct cost pressures, the new tariff landscape has heightened the importance of regulatory foresight and trade compliance. Companies are investing in tariff engineering-redesigning product classifications and assembly processes to qualify for reduced duty rates. At the same time, there is growing momentum toward nearshoring and onshoring of critical display assembly operations, driven by both cost considerations and supply chain resilience priorities. As businesses adapt to this altered trade environment, they are exploring long-term partnerships and flexible logistics models to safeguard innovation roadmaps and maintain competitive pricing structures.

Unveiling nuanced perspectives by dissecting AR and VR display markets through type, device form factors, underlying technologies, and application spectra

Gaining a holistic understanding of the AR and VR display market requires a multilayered segmentation approach that transcends simplistic categorizations. When analyzing by type, one observes distinct product development cycles and software requirements between augmented reality devices, which overlay digital content onto real-world views, and virtual reality headsets, which completely immerse users in synthetic environments. This duality shapes ecosystem dynamics, as developers and OEMs tailor their hardware platforms and content pipelines to the specific interactivity and transparency capabilities of each category.

Examining segmentation by device type illuminates further nuance: head-mounted displays prioritize compact, integrated optics and sensor arrays, whereas heads-up displays focus on windshield or visor projections for enterprise and automotive use cases. Holographic systems, utilizing diffractive waveguides, present unique opportunities for spatial computing, while projector-based solutions serve applications that benefit from large-scale, room-based immersive experiences. Underlying display technologies also differentiate market segments: liquid crystal displays remain prevalent for cost-sensitive deployments, while microLED solutions deliver unparalleled brightness and power efficiency for premium devices, and organic light-emitting diodes continue to enable flexible, high-contrast form factors. Finally, applications span from education and training simulations to gaming and entertainment, from medical imaging in healthcare to precision tooling in manufacturing and immersive retail experiences that bridge physical and digital commerce.

This comprehensive research report categorizes the AR/VR Display market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Device Type

- Display Technology

- Application

Highlighting regional dynamics shaping the adoption and innovation of AR and VR displays across the Americas, EMEA, and Asia-Pacific landscapes

Regional dynamics play a decisive role in shaping the trajectory of immersive display adoption and innovation. In the Americas, a robust ecosystem of startups, established technology firms, and academic research centers fosters rapid prototyping and commercialization. Investment in R&D, coupled with a mature venture capital landscape, underpins initiatives in consumer gaming, enterprise training, and medical simulation, creating a diverse array of pilot programs and early deployments.

Across Europe, the Middle East, and Africa, government-backed digital transformation agendas and stringent regulatory standards influence product certification processes and drive emphasis on data privacy and security. Local manufacturers benefit from skilled engineering talent and access to collaborative research consortia, particularly in automotive heads-up displays and industrial maintenance applications. Meanwhile, Asia-Pacific markets exhibit vibrant manufacturing hubs, supported by economies of scale and cost-effective supply chain networks. Partnerships among regional component suppliers and global technology leaders have accelerated the diffusion of microLED and OLED displays into both consumer and enterprise segments throughout this diverse region.

This comprehensive research report examines key regions that drive the evolution of the AR/VR Display market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying market frontrunners and emerging innovators catalyzing breakthroughs in AR and VR display solutions through strategic investments and collaborations

A handful of technology pioneers and innovative challengers are at the forefront of AR and VR display evolution. These companies leverage vertically integrated operations, combining expertise in optical waveguides, display fabrication, and software ecosystems to deliver end-to-end solutions. Strategic investments and high-profile partnerships have fueled product roadmaps, enabling rapid scale-up of manufacturing capacities and aftermarket support networks.

Conversely, emerging entrants are carving niches by focusing on specialized applications, such as ultra-lightweight optics for medical wearables or immersive retail kiosks that blend projection systems with AI-driven customer analytics. These nimble organizations often collaborate with academic institutions and pilot program partners to validate novel form factors, forging pathways to commercialization. The interplay between established leaders and agile innovators creates a competitive environment that accelerates development cycles, enhances feature differentiation, and drives user-centric advancements in display clarity, ergonomics, and content integration.

This comprehensive research report delivers an in-depth overview of the principal market players in the AR/VR Display market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Apple Inc.

- Augmedics, Inc.

- AUO Corporation

- Barco N.V.

- BOE Technology Group Co., Ltd.

- Google LLC by Alphabet Inc.

- Holoeye Photonics AG

- Innolux Corporation

- Kopin Corporation

- Kura Technologies

- Lenovo Group Limited

- LG Display Co., Ltd.

- Magic Leap, Inc.

- Meta Platforms, Inc.

- Mojo Vision

- Raontech

- Samsung Electronics Co., Ltd.

- Seiko Epson Corporation

- Sony Group Corporation

- STMicroelectronics N.V.

- TCL Technology Group Corporation

- TeamViewer SE

- Virtual Realities, LLC

- Vuzix Corporation

- Wave Optics Limited by Snap

Empowering executives with targeted strategies to navigate evolving AR and VR display markets and capitalize on emerging opportunities for sustained growth

For industry executives seeking to maintain a competitive edge, there are several strategic imperatives. First, diversifying supplier networks and exploring nearshore manufacturing options can mitigate tariff risks while ensuring supply chain continuity. At the same time, investing in modular product architectures and firmware-updatable platforms enables rapid feature rollouts and customization for vertical market demands.

Additionally, cultivating partnerships across software and hardware ecosystems will drive richer content libraries and more seamless user experiences. By aligning with cloud service providers, AI specialists, and industry-specific solution integrators, organizations can offer end-to-end value propositions that extend beyond hardware. Finally, prioritizing user ergonomics and accessibility will broaden addressable audiences; conducting structured user testing and human factors research ensures that display solutions meet rigorous comfort and usability standards, fostering higher adoption rates and sustained user engagement.

Detailing the rigorous research framework employed to ensure comprehensive analysis and actionable intelligence across the AR and VR display ecosystem

The insights presented in this report are underpinned by a rigorous research framework designed to capture the multifaceted nature of AR and VR display markets. Primary research included in-depth interviews with key stakeholders across device manufacturers, component suppliers, system integrators, and end users. These interviews provided firsthand perspectives on technology roadmaps, procurement strategies, and regional regulatory considerations.

Complementing primary inputs, comprehensive secondary research involved a systematic review of industry white papers, patent filings, and trade association publications. Quantitative analysis of trade flow data and shipment statistics offered additional context on supply chain shifts and component sourcing. Expert advisory panels, comprising engineers, product designers, and market strategists, validated emerging trends and testing methodologies, ensuring that conclusions reflect both technical feasibility and commercial viability across global markets.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our AR/VR Display market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- AR/VR Display Market, by Type

- AR/VR Display Market, by Device Type

- AR/VR Display Market, by Display Technology

- AR/VR Display Market, by Application

- AR/VR Display Market, by Region

- AR/VR Display Market, by Group

- AR/VR Display Market, by Country

- United States AR/VR Display Market

- China AR/VR Display Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Summarizing insights and reinforcing the strategic imperatives driving the future trajectory of immersive display technologies in global markets

The convergence of advanced display technologies, strategic alliances, and evolving regulatory landscapes has established a fertile environment for innovation in augmented and virtual reality. As manufacturers adapt to tariff-induced supply chain complexities and refine their technological capabilities, a new class of immersive experiences is emerging. These developments promise to redefine training methodologies, entertainment ecosystems, healthcare diagnostics, and beyond.

Looking ahead, the interplay of regional market dynamics and global competitive pressures will shape the pace and direction of AR and VR display adoption. Stakeholders that proactively address procurement diversification, user-centric design, and ecosystem integration will be best positioned to capitalize on growth opportunities. By harnessing the insights and recommendations outlined in this report, decision-makers can navigate uncertainty with confidence and accelerate the realization of immersive display potential.

Connect with Ketan Rohom to secure unparalleled insights and empower your AR and VR display strategy through a comprehensive market intelligence report purchase

Elevate your strategic initiatives by partnering with Ketan Rohom, whose expertise bridges market intelligence with tangible business outcomes. By securing this market research report, you gain a roadmap of actionable insights tailored to the complexities of AR and VR display ecosystems and dynamic regulatory environments. Let expert guidance inform your product roadmaps, investment decisions, and competitive positioning, driving accelerated innovation and market penetration. Reach out today to transform data into decisive action and unlock the full potential of immersive display technologies.

- How big is the AR/VR Display Market?

- What is the AR/VR Display Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?