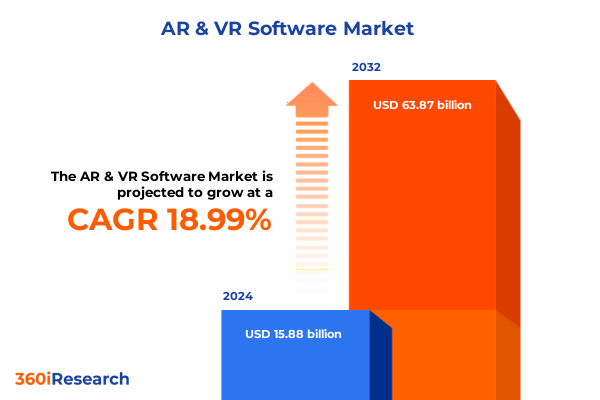

The AR & VR Software Market size was estimated at USD 18.91 billion in 2025 and expected to reach USD 22.51 billion in 2026, at a CAGR of 19.25% to reach USD 64.87 billion by 2032.

Unlocking the Dynamic World of Augmented Reality and Virtual Reality Software Solutions: A Foundational Overview of Industry Drivers and Scope

Augmented reality and virtual reality software technologies are transforming the way individuals and organizations experience digital content, blending immersive visual engagement with interactive environments. This introduction elucidates the current state of AR and VR software, highlighting how waves of technological innovation have expanded utility beyond gaming and entertainment into enterprise operations and consumer applications. Building on rapid enhancements in hardware capabilities and software frameworks, the AR and VR landscape now offers applications that streamline workflows, elevate training effectiveness, and redefine customer engagement.

Moreover, this section underscores the convergence of mobile proliferation and edge computing, which together have accelerated access to immersive experiences, making AR and VR software solutions more accessible and scalable across diverse devices. The evolution of intuitive development platforms has further lowered the barrier to entry, fostering an ecosystem where start-ups and established technology firms can collaborate and compete effectively. As we navigate deeper into a digital era defined by interactivity and personalization, the reader gains clarity on the drivers propelling market interest and the strategic relevance of adopting AR and VR software solutions.

Setting the stage for subsequent analysis, this introduction frames the executive summary by outlining critical themes such as transformative market shifts, regulatory and tariff impacts, and the segmentation insights that reveal emerging opportunities. By offering a cohesive foundation, this opening cultivates a comprehensive understanding of the intricate dynamics influencing adoption and investment decisions in the AR and VR software domain.

Charting the Transformative Shifts in AR and VR Software as Market Boundaries Expand and Immersive Experiences Redefine Engagement

The AR and VR software market has undergone transformative shifts that have redefined boundaries between physical and digital realms. In recent years, immersive experiences have transcended novelty to become strategic tools in sectors such as healthcare, education, and enterprise collaboration. Advances in computer vision, machine learning, and spatial computing have enhanced the precision and interactivity of software platforms, enabling real-time object recognition and context-aware augmentation. This shift toward intelligent immersion underscores how AR and VR have evolved from standalone applications into integrated solutions that streamline processes, facilitate remote assistance, and create engaging learning modules.

Simultaneously, developments in hardware such as lightweight head-mounted displays, standalone VR headsets, and smartphone-based AR capabilities have broadened user accessibility. Consumer expectations have pivoted toward seamless, high-fidelity experiences, prompting software vendors to optimize graphics rendering and latency management while simplifying deployment pipelines. Equally, enterprises have adopted AR for maintenance support, guided workflows, and virtual prototyping, recognizing its potential to minimize error rates and training costs. Together, these technological and user-driven transformations are reshaping adoption patterns, driving software providers to innovate at pace and address nuanced use-case requirements across diverse operational environments.

Through these converging trends, the AR and VR software industry is witnessing a maturation stage marked by strategic partnerships, cross-industry collaborations, and open-source initiatives that further democratize development. These collaborative ecosystems invigorate product roadmaps, accelerate feature releases, and foster community-driven enhancements, establishing a new paradigm where continuous innovation and user feedback sustain growth and relevance.

Assessing the Cumulative Impact of 2025 United States Tariffs on AR and VR Software Supply Chains Cost Structures and Competitive Landscape

In 2025, the imposition of United States tariffs on electronic components and display modules has imparted notable consequences for the AR and VR software sector, affecting both cost structures and supply chain resilience. The additional duties have elevated component prices, compelling hardware manufacturers to reassess sourcing strategies and renegotiate contracts. As software providers rely on tight integration with optimized hardware, these cost pressures ripple through development budgets and product release timelines, necessitating greater vigilance in managing total cost of ownership for end users.

Consequently, procurement teams are exploring alternative supply hubs and re-evaluating vendor partnerships to mitigate exposure to tariff volatility. Some leading providers have shifted a portion of display module manufacturing to offshore facilities in the Asia-Pacific region, while others have invested in regional assembly operations within Europe and the Middle East to circumvent increased duties. This dynamic has introduced a new complexity to forecasting and pricing strategies, compelling software vendors to balance feature innovation with cost containment in a tightening margin environment.

Despite these headwinds, the sector’s agility in adapting to shifting trade policies underscores its resilience. Forward-looking companies are fortifying their logistics frameworks through diversified supplier networks and leveraging emerging trade agreements to optimize cross-border movements. By integrating scenario planning into procurement models, industry stakeholders can anticipate future regulatory shifts, enhancing their capacity to preserve competitiveness amid an evolving tariff landscape.

Deriving Actionable Key Segmentation Insights from Diverse End User Technologies Applications Device Types and Industry Verticals

A nuanced understanding of market segmentation reveals critical insights into how end-user needs, technology choices, application use cases, device preferences, and industry vertical dynamics shape demand for AR and VR software solutions. From the perspective of end users, consumer applications continue to drive engagement in gaming and entertainment, whereas enterprise deployments across banking and financial services, education, healthcare, manufacturing, and retail increasingly showcase productivity gains and operational efficiency. Within enterprise, banking and financial services leverage AR for risk visualization and fraud detection simulations, while education institutions harness VR to deliver immersive learning experiences that augment classroom curricula.

When viewed through the lens of technology, augmented reality remains the primary choice for smartphone-based interactions and head-mounted visual overlays, supporting real-time translations, maintenance guides, and contextual marketing. Virtual reality, whether delivered via standalone headsets or tethered systems, offers fully immersive simulations ideal for training, design reviews, and virtual events. These distinct technology paths have led software vendors to develop modular platforms that accommodate both AR and VR modes, enabling cross-device compatibility and seamless transition between mixed reality environments.

Exploration of application segments underscores the relevance of digital collaboration tools, where enterprise teams connect in virtual workspaces for planning and project reviews, while the gaming sector sustains high engagement through interactive storytelling and social integration. Healthcare providers deploy AR for surgical planning and patient education, and retail brands implement virtual try-on experiences to bridge online and in-store channels. Device type considerations differentiate smartphone-based solutions, offering lower-cost entry points, from standalone headsets that deliver complete immersion and tethered systems that guarantee high-performance graphics for demanding enterprises.

Across industry verticals spanning automotive, banking and financial services, education, healthcare, manufacturing, and retail, demand patterns vary according to regulatory requirements, technology maturity levels, and ROI expectations. For example, automotive leverages VR for design prototyping and digital showrooms, while manufacturing focuses on AR-enabled maintenance instructions to reduce downtime. These segmentation insights inform product roadmaps and go-to-market strategies, ensuring that software features align with the specific performance, compliance, and integration needs of each segment.

This comprehensive research report categorizes the AR & VR Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Device Type

- End User

- Application

Unveiling Critical Regional Insights Highlighting Growth Drivers Adoption Patterns and Strategic Trends across Americas EMEA and Asia Pacific Markets

Regional nuances play a pivotal role in shaping AR and VR software adoption, as economic conditions, regulatory frameworks, and technology infrastructure diverge across the Americas, Europe Middle East and Africa, and Asia-Pacific. In the Americas, market leadership is driven by robust investment ecosystems, strong consumer appetite for immersive entertainment, and enterprise initiatives targeting digital transformation. Leading software providers are capitalizing on partnerships with telecom operators to enhance 5G-enabled use cases, as well as collaborating with academic institutions to pilot educational and healthcare applications.

Meanwhile, in the Europe Middle East and Africa region, regulatory considerations around data privacy and content localization influence technology adoption. Governments are promoting smart city and industrial metaverse initiatives, creating demand for AR and VR solutions that support urban planning, energy management, and workforce reskilling. Localization efforts have prompted software firms to integrate multilingual interfaces and region-specific compliance modules, enhancing appeal to public sector and enterprise customers.

In Asia-Pacific, rapid digitalization and government-backed innovation programs have accelerated AR and VR deployments across manufacturing hubs and educational institutions. Local hardware manufacturing strengths in display technologies have facilitated close collaboration between software vendors and component suppliers, optimizing performance parameters and reducing latency. Moreover, mobile-first populations in this region have embraced smartphone-based AR experiences for retail and gaming, driving software developers to prioritize lightweight mobile SDKs and cloud-based content delivery networks.

Collectively, these regional insights underscore the importance of tailored go-to-market approaches, strategic alliances, and compliance alignment to effectively address the divergent adoption drivers that characterize each geographical market.

This comprehensive research report examines key regions that drive the evolution of the AR & VR Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Spotlighting Prominent Companies Shaping the AR and VR Software Ecosystem through Innovation Partnerships and Strategic Expansions

The AR and VR software ecosystem features a range of prominent companies that are advancing the industry through innovation, strategic partnerships, and targeted expansions. Established technology giants have expanded their portfolios by integrating machine learning and spatial computing capabilities, thereby enhancing realism and interactivity in enterprise applications. These companies have also forged alliances with hardware manufacturers to ensure seamless interoperability between software platforms and head-worn devices, reinforcing their market leadership positions.

Mid-tier firms and specialized software developers are distinguishing themselves through niche offerings, such as developer toolkits for rapid prototyping and industry-specific modules for healthcare training or virtual collaboration. By focusing on modular architectures and API-driven integrations, these companies empower partners and customers to customize solutions to unique operational requirements. Their agility in delivering timely updates and embracing feedback loops has helped them gain traction among early adopters seeking specialized functionality.

Collaborations between software providers and academic institutions have generated open-source initiatives and developer communities that accelerate innovation cycles. These engagements foster knowledge sharing, enable joint research projects, and facilitate the co-creation of proof-of-concepts that demonstrate real-world value. Furthermore, several emerging entrants are leveraging cloud-native architectures and edge computing to reduce latency and scale deployments on demand, challenging incumbents to evolve their offerings to maintain competitive differentiation.

Taken together, the strategies and capabilities of these key companies illuminate the competitive landscape’s complexity and the multifaceted pathways through which vendors can achieve market penetration, customer retention, and sustained growth.

This comprehensive research report delivers an in-depth overview of the principal market players in the AR & VR Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Apple Inc.

- Baidu, Inc.

- Carl Zeiss AG

- CitrusBits Inc.

- Goertek Inc.

- Google LLC by Alphabet Inc.

- HiSilicon (Shanghai) Technologies Co., Ltd.

- HP Inc.

- HTC Corporation

- Immersion Corporation

- Lenovo Group Limited

- Magic Leap, Inc.

- Meta Platforms, Inc.

- Microsoft Corporation

- Niantic, Inc.

- Nvidia Corporation

- PICO Immersive Pte.ltd.

- Qualcomm Technologies, Inc.

- Samsung Electronics Co., Ltd.

- Seiko Epson Corporation

- Sharp Corporation

- Snap Inc.

- Sony Group Corporation

- Ultraleap Limited

- Unity Software Inc.

- Valve Corporation

- VR Owl BV and Owl VR Solutions GmbH

- Vrgineers, Inc.

- Vuzix Corporation

- Xiaomi Corporation

Empowering Industry Leaders with Actionable Recommendations to Accelerate AR and VR Software Adoption Monetization and Sustainable Growth Trajectories

To harness the vast potential of AR and VR software, industry leaders should adopt a strategic posture that aligns innovation with operational rigor. First, organizations must prioritize immersive pilot programs that validate use cases in controlled environments, enabling stakeholders to quantify benefits in areas such as safety, efficiency, and user engagement. By deploying proofs-of-concept that connect cross-functional teams, leaders can foster organizational buy-in and accelerate enterprise-wide rollouts.

Next, companies should cultivate ecosystems of technology and content partners to broaden solution offerings and mitigate integration challenges. Leveraging consortiums and developer networks facilitates access to complementary tools and accelerates feature development. As part of this collaborative approach, decision makers must also invest in upskilling programs that equip IT and operations teams with the expertise to manage deployments, optimize performance metrics, and troubleshoot edge cases.

Additionally, aligning deployment plans with emerging standards and regulatory frameworks is essential for minimizing compliance risks and ensuring data security. Industry leaders need to monitor policy developments in data privacy, intellectual property, and digital accessibility, adapting deployment architectures to address jurisdictional variations. Finally, establishing metrics-driven governance structures will enable continuous evaluation of ROI, user adoption rates, and system reliability, fostering an iterative improvement cycle that sustains competitive advantage in a rapidly evolving marketplace.

Detailing Robust Research Methodology Leveraging Primary and Secondary Data Collection Comprehensive Analysis and Validation Techniques for AR VR Insights

This market research report is grounded in a robust methodology that integrates primary and secondary data collection, rigorous analysis, and validation protocols to ensure the highest levels of accuracy and relevance. Primary research involved structured interviews and surveys with senior technology executives, software developers, and end users across consumer and enterprise segments. These qualitative insights were complemented by detailed discussions with industry analysts, hardware manufacturers, and system integrators to triangulate perspectives on emerging trends and pain points.

Secondary research consisted of an exhaustive review of proprietary databases, white papers, patent filings, technical documentation, and public-sector publications. Through systematic content analysis and cross-referencing, the study validated thematic patterns in technology adoption, regulatory implications, and competitive dynamics. Quantitative data was subjected to consistency checks and outlier analysis, ensuring coherent interpretation across multiple data sources.

Analytical techniques employed include segmentation analyses based on end user, technology, application, device type, and industry vertical parameters. Each segment was interrogated for performance indicators and growth drivers. Regional assessments incorporated macroeconomic factors, infrastructure readiness, and policy frameworks. The research also applied scenario planning to evaluate the impact of regulatory changes and trade developments on market trajectories.

Finally, a comprehensive validation workshop with internal domain experts and external advisory board members was conducted to review findings, challenge assumptions, and refine conclusions. This iterative validation process has resulted in a comprehensive and reliable portrait of the AR and VR software landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our AR & VR Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- AR & VR Software Market, by Technology

- AR & VR Software Market, by Device Type

- AR & VR Software Market, by End User

- AR & VR Software Market, by Application

- AR & VR Software Market, by Region

- AR & VR Software Market, by Group

- AR & VR Software Market, by Country

- United States AR & VR Software Market

- China AR & VR Software Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Drawing Conclusive Perspectives on AR and VR Software Evolution Highlighting Core Takeaways Strategic Implications and Future Trajectories

Synthesizing the insights from this executive summary reveals a dynamic ecosystem where AR and VR software solutions are evolving from niche applications to enterprise-grade platforms that drive efficiency, engagement, and innovation. Key technological advancements in spatial computing and edge processing are enabling richer, more responsive experiences, while hardware accessibility improvements are lowering barriers to adoption. Concurrently, segmentation analyses have highlighted the differentiated needs of consumer and enterprise users, varied device preferences, and the importance of industry-specific functionalities.

Regional considerations underscore that tailored strategies and partnerships are paramount for capturing market share, as economic, regulatory, and infrastructure variables diverge across the Americas, Europe Middle East and Africa, and Asia-Pacific. The 2025 tariffs scenario illustrates the critical need for agile supply chain management and strategic sourcing approaches to safeguard cost structures and delivery timelines. Despite these challenges, the collective resilience and innovation capacity of industry participants promise sustained momentum in the AR and VR software sector.

Looking forward, convergence between augmented and virtual reality modalities, underpinned by open-source collaboration and developer community growth, will shape the next wave of immersive solutions. Organizations that align strategic pilot deployments with robust governance frameworks and metric-driven performance reviews will be best positioned to translate vision into measurable outcomes. Ultimately, the evolution of AR and VR software will reflect a broader transformation in how individuals interact with digital information, unlocking new avenues for value creation across industries.

Secure Your Advantage Today by Partnering with Ketan Rohom to Acquire the Definitive AR VR Software Market Research Report for Informed Decision Making

To explore the full potential of augmented reality and virtual reality software solutions and secure invaluable competitive intelligence for strategic decision making, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing. Engage with industry experts to tailor a comprehensive research package that aligns precisely with your organizational priorities and objectives. By partnering with this research leader, you will access unparalleled insights, deep-dive analyses, and actionable data that can guide your innovation roadmaps and investment strategies. Don’t miss this opportunity to empower your executive team with the definitive AR and VR software market research report founded on rigorous methodology and industry best practices. Connect today to translate insights into sustained growth and market leadership.

- How big is the AR & VR Software Market?

- What is the AR & VR Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?