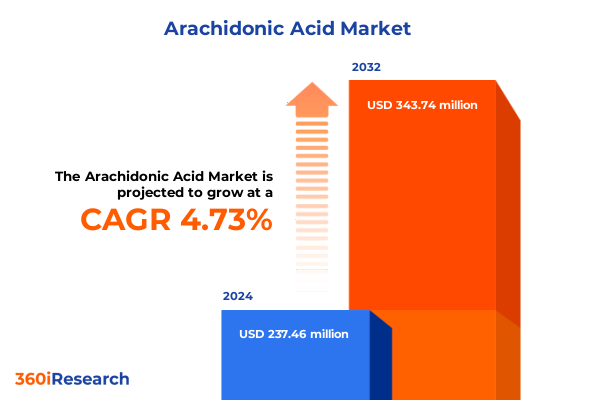

The Arachidonic Acid Market size was estimated at USD 248.84 million in 2025 and expected to reach USD 260.71 million in 2026, at a CAGR of 4.72% to reach USD 343.74 million by 2032.

Understanding Arachidonic Acid’s Crucial Role in Human Health and Its Expanding Applications Across Nutrition, Pharmaceutical, and Cosmetic Industries

Arachidonic acid (ARA) represents a vital omega-6 polyunsaturated fatty acid that plays a foundational role in cell membrane fluidity, inflammatory signaling, and neurological development, positioning it as an indispensable ingredient across diverse industries. Historically sourced from deep-sea fish oils, ARA’s supply faced sustainability and variability challenges linked to seasonal catches and overexploitation of marine ecosystems. In response, advanced biotechnology has elevated microbial fermentation platforms, notably using oleaginous fungi such as Mortierella alpine, to establish stable, high-yield production processes that alleviate ecological pressures and ensure consistent purity levels for pharmaceutical and nutritional applications. Concurrently, plant-based extraction from leaf derivatives and seed oils has emerged as a complementary source, aligning with growing consumer preferences for renewable, non-animal-derived ingredients.

Exploring Transformative Shifts Driving Arachidonic Acid Production from Fish Oils to Cutting-Edge Microbial and Plant-Based Technologies for Sustainability

The landscape of ARA production and utilization is undergoing transformative shifts driven by technological innovation, evolving consumer health paradigms, and regulatory advancements. Metabolic engineering strategies, including modular co-expression of pathway enzymes implemented via 2A peptide platforms, have delivered substantial yield improvements, exemplified by a 77.6% titer enhancement in engineered Mortierella alpine strains. At the same time, microalgal species like Lobosphaera incisa are gaining attention for their versatile carbon utilization and streamlined downstream processing, offering scalable alternatives to traditional fungal systems. On the regulatory front, the recognition of ARA oil as GRAS (Generally Recognized as Safe) in the United States in 2011 and its listing as a novel food in the European Union have paved the way for broader adoption in infant formula and functional nutrition products, reinforcing industry confidence in safety and compliance. Complementing these developments, rising demand for personalized nutrition and sports performance supplements is intensifying interest in ARA’s immunomodulatory and muscle recovery benefits, underscoring its evolving relevance in preventive health.

Assessing the 2025 United States Tariff Landscape and Its Cumulative Implications on Arachidonic Acid Supply Chains, Sourcing Strategies, and Cost Structures

In 2025, revised United States tariff policies are exerting cumulative pressure on global ARA supply chains by imposing layered duties that affect sourcing costs and procurement strategies. As of April, a universal tariff of 10% on non-exempt imports has been enacted alongside reciprocal duties ranging from 11% to 50% on ingredients from designated countries, while Section 301 measures continue to levitate tariffs to over 145% on certain Chinese-origin components. Although fatty acids broadly benefit from exemptions when imported in bulk oil form, powders and encapsulated formats-commonly used for high-purity ARA-remain subject to full duty application, heightening landed costs for manufacturers. Consequently, U.S. producers and formulators are recalibrating supply portfolios, exploring domestic microbial fermentation partnerships to circumvent steep import levies, and renegotiating long-term contracts to buffer margin erosion and uphold stable pricing for downstream customers.

Diving into Multifaceted Segmentation of the Arachidonic Acid Market Across Applications, Sources, Forms, Purity Levels, and Distribution Channels for Strategic Insights

The multidimensional ARA market can be dissected through five axes that illuminate strategic opportunities and risk gradients across the value chain. Application diversity spans animal feed-where ARA enhances growth in aquaculture, pet food, poultry, and swine operations-to cosmetic formulations targeting hair, skin, and personal care benefits, while food and beverage fortification increasingly leverages ARA’s functional properties in beverages and specialty ingredients. Nutraceutical and pharmaceutical uses further differentiate the market, with softgels, capsules, powders, tablets and oral or injectable therapies demanding tailored purity and formulation expertise. Source segmentation bifurcates into microbial platforms-driven by fermentation innovation-and plant-based extractions from leaf and seed matrices, reflecting divergent supply chain dynamics and sustainability profiles. Product form distinctions between oil and powder dictate processing, stability and end-use applications, while purity tiers distinguish high-purity isolates for clinical use from standard-purity grades for general nutrition. Lastly, distribution channels span direct sales, distributor networks encompassing retailers and wholesalers, and e-commerce avenues via company websites and third-party marketplaces, revealing intricate layers of go-to-market approaches that companies must navigate to optimize reach and operational efficiency.

This comprehensive research report categorizes the Arachidonic Acid market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Application

- Source

- Product Form

- Purity

- Distribution Channel

Unveiling Key Regional Dynamics Shaping Arachidonic Acid Demand Across the Americas, Europe Middle East Africa, and Asia-Pacific Market Ecosystems

Regional dynamics in the ARA landscape reflect distinct demand drivers and regulatory environments across the Americas, Europe Middle East & Africa, and Asia-Pacific zones. In the Americas, robust consumer commitment to preventive health and high penetration of dietary supplements underpin sustained uptake of ARA in infant nutrition, sports performance and functional wellness products, supported by GRAS status and stable supply chains within North America. Within Europe, Middle East & Africa, stringent novel food regulations mandate robust safety dossiers and alignment with Codex Alimentarius standards, elevating the importance of traceability and certification for ARA oils derived from Mortierella alpina and plant sources. Meanwhile, Asia-Pacific registers the fastest growth trajectory fueled by rising birth rates, increasing disposable incomes, and expanding fast-moving consumer goods channels; local manufacturing hubs in China and India are scaling fermentation capacity to meet both regional and export demand, reflecting a shift toward self-sufficiency and cost-effective production models.

This comprehensive research report examines key regions that drive the evolution of the Arachidonic Acid market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players and Strategic Partnerships Shaping the Competitive Landscape of Arachidonic Acid Development and Commercialization Worldwide

Arachidonic acid production and commercialization are shaped by leading specialty ingredient firms, biotechnology innovators, and contract manufacturing organizations collaborating to advance capacity and product pipelines. Cargill’s pioneering GRAS approval for ARA-rich Mortierella alpina oil and its global distribution infrastructure position it as a benchmark supplier for infant formula and functional nutrition applications. Concurrently, biochemical companies leverage strategic partnerships to integrate synthetic biology platforms, enabling modular metabolic engineering approaches that fine-tune elongase and desaturase pathways for higher yields. At the same time, agile emerging players focus on microalgae-based production, capitalizing on low-cost heterotrophic fermentation and simplified downstream processing to meet purity requirements for pharmaceutical-grade ARA. On the distribution front, specialized nutraceutical distributors are forging direct-to-consumer e-commerce initiatives, while traditional wholesalers deepen collaborations with retailers to navigate shifting buying behaviors and regulatory demands.

This comprehensive research report delivers an in-depth overview of the principal market players in the Arachidonic Acid market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Avanti Polar Lipids Inc

- BASF SE

- Bio-Techne Corporation

- CABIO Biotech Wuhan Co Ltd

- Cargill Incorporated

- Cayman Chemical Company

- Croda International Plc

- DSM-Firmenich AG

- GlaxoSmithKline plc

- Guangdong Runke Bioengineering Co Ltd

- Hubei Fuxing Biotechnology Co Ltd

- Jarrow Formulas Inc

- Kingdomway Nutrition Inc

- Koninklijke DSM N.V.

- Lallemand Inc

- Merck KGaA

- Nordic Naturals Inc

- Novotech Nutraceuticals Inc

- Nu-Mega Ingredients Pty Ltd

- PerkinElmer Inc

- Suntory Beverage & Food Ltd

- Thermo Fisher Scientific Inc

- Xi'an Lyphar Biotech Co Ltd

- Xiamen Huison Biotech Co Ltd

Formulating Actionable Strategies for Industry Leaders to Leverage Innovation, Mitigate Regulatory Challenges, and Capitalize on Emerging Arachidonic Acid Opportunities

Industry leaders can drive competitive advantage by prioritizing investments in next-generation bioprocess platforms that harness advanced metabolic engineering and real-time fermentation analytics to enhance ARA titers and reduce production costs. To mitigate tariff exposures, organizations should cultivate multi-jurisdictional supply networks, exploring domestic microbial partnerships and strategic alliances with non-Tariff-301 countries. Emphasizing high-purity segments for flagship pharmaceutical applications can unlock premium pricing, while tailored nutraceutical formulations leveraging personalized nutrition trends will resonate with health-conscious consumers. Strengthening collaborations with regulatory authorities and participating in industry consortia to shape evolving guidance on novel food approvals and label claims will ensure smoother market access. Finally, optimizing omnichannel distribution strategies-balancing direct sales, distributor networks, and e-commerce platforms-will maximize market reach and customer engagement across diverse end-user segments.

Outlining Comprehensive Research Methodology Employing Primary Stakeholder Interviews, Secondary Data Analysis, and Rigorous Validation for Arachidonic Acid Market Intelligence

This market research employed a robust mixed-methods approach blending primary and secondary data to ensure analytical rigor and comprehensive market insights. Primary research included in-depth interviews with senior executives from leading fatty acid producers, ingredient formulators, and distribution partners across multiple regions, as well as proprietary surveys of key procurement managers to quantify strategic priorities and procurement patterns. Secondary research incorporated peer-reviewed literature from authoritative journals covering microbial fermentation, metabolic engineering and novel food regulations, including recent PubMed reviews on advanced ARA bioproduction strategies , alongside regulatory data from the U.S. International Trade Commission’s Harmonized Tariff Schedule revisions and FDA GRAS notices. Triangulation of qualitative insights, quantitative trade data, and academic research underpinned the segmentation framework and validated thematic findings, ensuring the report’s conclusions are grounded in empirical evidence and industry best practices.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Arachidonic Acid market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Arachidonic Acid Market, by Application

- Arachidonic Acid Market, by Source

- Arachidonic Acid Market, by Product Form

- Arachidonic Acid Market, by Purity

- Arachidonic Acid Market, by Distribution Channel

- Arachidonic Acid Market, by Region

- Arachidonic Acid Market, by Group

- Arachidonic Acid Market, by Country

- United States Arachidonic Acid Market

- China Arachidonic Acid Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Synthesis of Critical Findings Highlighting Strategic Imperatives and Market Dynamics Guiding Future Direction in the Arachidonic Acid Industry

The synthesis of technological, regulatory, and market trends underscores the strategic imperative for stakeholders to embrace innovation, diversify sourcing, and fortify compliance frameworks within the ARA value chain. Advances in metabolic engineering and fermentation analytics offer scalable solutions to deliver high-purity ARA at competitive cost structures, while evolving GRAS and novel food designations provide clear pathways for global product approvals. However, shifting tariff regimes necessitate agile supply network strategies to preserve profitability and secure uninterrupted ingredient flows. Concurrently, the convergence of functional nutrition, personalized wellness and performance supplementation continues to expand product development horizons, creating new niches for tailored ARA-infused formulations. Moving forward, collaboration between research institutions, industry consortia and regulatory bodies will be essential to sustain momentum, drive continuous improvement and maintain consumer confidence in the safety, efficacy and environmental sustainability of ARA-based products.

Connect with Ketan Rohom to Secure In-Depth Arachidonic Acid Market Research Insights and Drive Strategic Decision-Making with Expert Team Support

Ready to unlock comprehensive insights and future-proof your strategic roadmap with specialized Arachidonic Acid market intelligence, connect today with Ketan Rohom, Associate Director, Sales & Marketing, to discuss how this in-depth report can power your growth and operational decisions. Whether you are expanding production capabilities, exploring new partnerships, or navigating complex regulatory landscapes and tariff overlays, Ketan stands ready to guide you through tailored research solutions that align with your organizational objectives. Engage directly to arrange a personalized consultation, gain early access to executive summaries, and secure the full market research report. Empower your team with actionable data and expert analysis to drive market share expansion and innovation in the evolving Arachidonic Acid sector.

- How big is the Arachidonic Acid Market?

- What is the Arachidonic Acid Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?