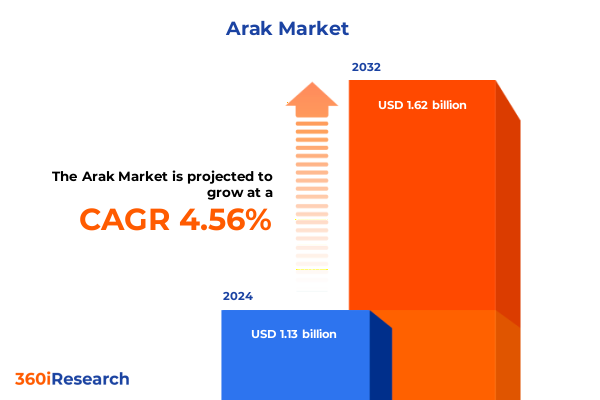

The Arak Market size was estimated at USD 1.19 billion in 2025 and expected to reach USD 1.23 billion in 2026, at a CAGR of 4.57% to reach USD 1.62 billion by 2032.

Rediscovering Arak’s Global Renaissance and Enduring Legacy Through Cultural Heritage, Innovative Craftsmanship, and Expanding Market Opportunities

Arak’s journey from a storied Levantine spirit to a global phenomenon underscores the timeless allure of cultural authenticity paired with modern innovation. Originating centuries ago, this anise-flavored distillate has long been intertwined with communal rituals and celebratory traditions. In recent years, however, its story has evolved beyond village gatherings and regional festivals. Today’s connoisseurs seek genuine provenance and artisanal craft, driving producers to refine traditional pot-still methods with precision-controlled column distillation. This fusion of heritage and technology ensures consistency in flavor while preserving the nuanced aromatic profile that defines premium Arak.

Moreover, consumer fascination with narratives-be it the historic wells of Bekaa Valley or family‐run distilleries in Syria-has elevated Arak from a regional staple to a centerpiece in upscale bars and boutique retail outlets. Tastemakers emphasize narrative-driven brand storytelling as a powerful differentiator, prompting many distillers to spotlight generational recipes and locally sourced botanicals. As a result, investment in small‐batch production facilities has surged, marrying the warmth of age‐old traditions with the rinse-and-repeat reliability demanded by export markets. In sum, the resurgence of Arak highlights a broader shift in alcoholic beverages: authenticity reigns supreme, and innovation proves vital for capturing a new generation of global consumers.

Unveiling Transformative Shifts Driving Arak’s Evolution From Artisan Distillery Traditions to Innovative Craft Techniques and Premiumization Trends

The Arak sector is undergoing a transformative metamorphosis that touches every aspect of production and consumption. Initially anchored in purely artisanal practices, distillers are now integrating advanced fermentation controls and precision distillation to ensure optimal yield and consistency. This technical evolution runs parallel with creative experimentation-infusing Arak with complementary botanicals such as saffron, rose petal, and citrus peel to appeal to adventurous palates. These limited-edition releases not only cater to premium segment expectations but also fuel consumer curiosity and social‐media buzz.

Furthermore, the rise of ready-to-drink formats featuring Arak as a core ingredient exemplifies the spirit’s adaptability to modern lifestyles. By pre-mixing Arak with tonic, bitters, or fruit extracts, producers create accessible entry points for first-time drinkers while retaining the distinctive licorice‐like backbone. Simultaneously, mindful consumption trends have spurred the development of lower-alcohol and flavored variations, allowing Arak to participate in the broader no-/low-proof movement without sacrificing its signature character. Consequently, Arak’s production landscape now melds traditional customs with emerging consumer demands, underscoring a pivotal shift toward versatility and premiumization.

Analyzing the Cumulative Impact of 2025 United States Tariff Measures on Global Arak Trade Flows Production Costs and Competitive Positioning

In early 2025, the United States introduced a 25% tariff on alcoholic imports from Canada and Mexico, with layered reciprocal duties and incremental increases on products from China, catalyzing heightened cost pressures across the spirits industry. This cumulative tariff architecture has amplified landed costs for Arak producers reliant on cross-border supply chains, prompting a reevaluation of pricing strategies and margin structures. As a result, many importers have sought to offset the financial burden by renegotiating freight contracts, optimizing bulk shipments, and passing a portion of the tariff costs to end consumers in the form of higher shelf prices {{Avalara, May 2025}}.

Moreover, the prospect of sustained trade barriers has accelerated structural adjustments within the value chain. Notably, several European and Middle Eastern distilleries have established localized bottling hubs in the United States to circumvent tariffs and reduce unit costs for domestic distribution. This onshore bottling trend not only mitigates direct tariff exposure but also enhances supply chain resilience, enabling faster replenishment cycles and customized labeling. As the 2025 tariff framework solidifies into a new baseline, stakeholders must navigate a “new normal” of elevated trade costs balanced by logistical ingenuity and strategic network realignment.

Decoding Key Segmentation Insights Revealing How Distribution Channels Alcohol Content Packaging Sizes and Price Tiers Shape Arak Market Dynamics

Discerning nuanced consumer preferences reveals that Off-Trade channels, encompassing retail stores and e-commerce platforms, continue to dominate purchase volumes, driven by expanded shelf presence and targeted promotional campaigns. Conversely, On-Trade venues such as high-end restaurants and cocktail bars serve as critical touchpoints for experiential marketing, showcasing Arak’s versatility in curated tasting menus and signature cocktails. Transitioning from one channel to the other, savvy producers refine packaging aesthetics and communication strategies to align with each environment’s expectations.

Alcohol content emerges as an equally influential dimension, with mid-range strengths between 43 to 45% alcohol by volume garnering the broadest appeal among enthusiasts seeking a balance between the classic licorice intensity and drinkability. At the same time, expressions at or above 45% cater to purists who prize an unadulterated aromatic punch, while the 40 to 42% variants offer a gentler introduction for new consumers. In parallel, packaging formats ranging from large-format 1.5L and 1L bottles-favored for social gatherings and high-visibility displays-to more modest 750mL and 500mL sizes underscore the importance of occasion-based offerings. Finally, price segmentation into Economy, Premium, and Luxury tiers guides product positioning, from value-driven everyday selections to collectible limited editions that underscore exclusivity. Together, these intersecting variables underpin a multifaceted segmentation framework that drives targeted innovation and strategic portfolio design.

This comprehensive research report categorizes the Arak market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Alcohol Content

- Packaging Size

- Price Tier

- Base Ingredient

- Distribution Channel

Highlighting Key Regional Insights Into How Americas Europe Middle East Africa and Asia Pacific Markets Are Driving Arak Adoption and Growth Patterns

Regional dynamics exert a profound influence on Arak’s market trajectory, beginning with the Americas where multicultural urban centers serve as incubators for spirit-forward experimentation. In the United States and Canada, growing diaspora communities and adventurous mixologists have elevated Arak’s profile, positioning it as both a cultural ambassador and a novel craft component. Distribution networks in these markets increasingly leverage on-premise collaborations and dedicated shelf space in specialty liquor stores to educate consumers and build trial.

Across Europe, the Middle East, and Africa, Arak retains its historical strongholds while experiencing pockets of revitalized interest. In traditional Levantine territories, decades-old family producers reinforce brand equity through heritage-driven narratives, even as economic headwinds and fluctuating regulatory regimes introduce uncertainty. Conversely, Western European markets exhibit rising curiosity for Mediterranean and Middle Eastern flavors, spawning partnerships with boutique importers and participation in regional spirit festivals.

Meanwhile, the Asia-Pacific sphere presents notable expansion opportunities as rising disposable incomes and evolving taste preferences converge. In key metropolitan hubs such as Singapore, Hong Kong, and Sydney, Arak has been featured in premium cocktail programs, and educational events have cultivated new demographics. Moreover, collaborations with East Asian distillers exploring anise-based fusions signal fertile ground for co-branded innovations, reinforcing Arak’s global ascent.

This comprehensive research report examines key regions that drive the evolution of the Arak market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Uncovering Key Company Insights That Illuminate Competitive Strategies Partnerships Innovation and Investment Activities Within the Arak Industry Ecosystem

Leading players in the Arak industry exemplify diverse strategic approaches, from heritage-driven cellar masters to agile newcomers capitalizing on craft spirit trends. Established family-owned distilleries continually invest in modern quality controls and expanded visitor facilities, transforming legacy sites into experiential destinations that strengthen brand loyalty. At the same time, specialist importers and distributors build dedicated portfolios, nurturing relationships with sommeliers and bartenders to generate organic word-of-mouth momentum.

Innovation-oriented companies, meanwhile, collaborate with research institutions to refine yeast strains and botanical infusion techniques, accelerating product development cycles. By leveraging data insights and direct consumer feedback, these brands can introduce limited-edition blends or seasonal variants that resonate with shifting preferences. Private equity involvement further underscores the category’s maturation, channeling capital into brand scaling, global distribution partnerships, and strategic acquisitions.

In addition, some multinational spirits conglomerates have begun exploring white-label production agreements with traditional Arak distillers, allowing for controlled brand extensions within premium lineups. This cross-pollination fosters knowledge transfer while expanding reach through established global supply chains. Ultimately, the convergence of artisanal expertise, scientific innovation, and strategic investment shapes a competitive landscape where both enduring heritage names and dynamic disruptors can thrive.

This comprehensive research report delivers an in-depth overview of the principal market players in the Arak market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Al Wadi Al Akhdar S.A.L.

- Bekaa Valley Distillers S.A.L.

- Château Ksara

- Coteaux de Tannourine S.A.R.L.

- Eagle Distilleries Co.

- Gantous & Abou Raad

- Haddad Bros. S.A.L.

- Jallab Distillers S.A.L.

- Kefraya S.A.L.

- Lebanese Arak Corporation

- Massaya S.A.L.

- Société des Produits Vinicoles du Liban S.A.L.

- Société des Vins du Liban S.A.L.

- Wardy S.A.L.

Delivering Actionable Recommendations for Industry Leaders to Navigate Tariff Complexities Enhance Segmentation Strategies and Seize New Opportunities

Industry leaders seeking to navigate this dynamic environment must adopt a multi-pronged strategy that addresses both external pressures and internal capabilities. First, optimizing distribution channel focus can yield disproportionate returns: enhancing Off-Trade visibility through targeted retail activations and digital engagement, while simultaneously staging immersive On-Trade experiences to demonstrate mixology applications and flavor pairings.

Second, fine-tuning product attributes-in alcohol content, packaging format, and price positioning-enables precise market segmentation. Flexibility in bottle sizes and ABV concentrations can cater to both entry-level consumers and connoisseurs, while tiered pricing strategies preserve brand prestige alongside accessible offerings. Third, diversifying production and supply chain footprints through localized bottling hubs or contract manufacturing mitigates tariff exposure and strengthens resilience against geopolitical shifts. Furthermore, proactive engagement with policymakers and trade associations can influence tariff negotiations and secure favorable exemptions.

Finally, embracing innovation in product development-whether through limited-edition botanical infusions, low-proof expressions, or sustainability-focused packaging-can differentiate brands in a crowded marketplace. By integrating consumer insights into R&D roadmaps and fostering collaborative ecosystems with hospitality partners, industry players can remain agile and responsive to emerging trends.

Explaining Rigorous Research Methodology Combining Secondary Analysis Expert Interviews Data Triangulation and Robust Segmentation Techniques

This analysis synthesizes a comprehensive research methodology grounded in both secondary data acquisition and primary stakeholder insights. The process began with an exhaustive review of trade publications, regulatory filings, and industry reports to construct a detailed landscape of production methods, tariff developments, and global distribution networks. Concurrently, structured interviews with distillery founders, importers, and on-trade specialists provided qualitative depth, validating emerging trends and uncovering operational challenges.

Data triangulation played a pivotal role in ensuring robustness and accuracy. Market intelligence was cross-referenced against customs statistics, shipment volumes, and retail audit figures, enabling the identification of coherent patterns across disparate sources. Segmentation analysis employed a multi-dimensional framework-encompassing distribution channels, alcohol content ranges, packaging sizes, and price tiers-to reveal actionable insights and prioritize areas for targeted innovation.

Finally, scenario modeling of tariff trajectories and regional growth forecasts allowed for the exploration of strategic pathways under varying external conditions. This iterative process, combining quantitative rigor with on-the-ground perspectives, delivers a reliable foundation for decision-making. The result is an integrated perspective that empowers stakeholders to navigate complexity with confidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Arak market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Arak Market, by Alcohol Content

- Arak Market, by Packaging Size

- Arak Market, by Price Tier

- Arak Market, by Base Ingredient

- Arak Market, by Distribution Channel

- Arak Market, by Region

- Arak Market, by Group

- Arak Market, by Country

- United States Arak Market

- China Arak Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesizing Critical Conclusions That Highlight Arak’s Resilience Strategic Pathways and Imperatives for Sustainable Growth Amid Market Challenges

The narrative of Arak’s resurgence culminates in several key conclusions that underscore both opportunity and caution. First, the interplay of cultural authenticity and technical innovation has reignited global interest, positioning Arak as a distinctive alternative in the crowded premium spirits arena. Second, the intricate segmentation landscape-spanning distribution channels, alcohol strengths, packaging formats, and price points-offers a multitude of entry points but necessitates precise alignment of product attributes with consumer expectations.

Third, regional variations highlight the importance of localized strategies: while diaspora-driven adoption fuels momentum in the Americas, heritage markets in EMEA sustain traditional volumes, and Asia-Pacific’s evolving palate demands education and experiential engagement. Fourth, the ripple effects of the 2025 tariff regime have introduced cost pressures that require strategic supply chain recalibrations and policy advocacy to preserve competitiveness.

Ultimately, Arak’s trajectory hinges on the ability of producers and distributors to harness data-driven insights, embrace adaptive innovation, and cultivate authentic storytelling. By internalizing these imperatives, industry stakeholders can navigate external headwinds and capture sustainable growth, ensuring that this timeless spirit continues its journey from regional treasure to global mainstay.

Contact Ketan Rohom Today to Secure Exclusive Access to the Comprehensive Arak Market Research Report and Unlock Strategic Insights for Your Organization

To secure a comprehensive understanding of market drivers, regional dynamics, and strategic imperatives within the evolving Arak landscape, we invite you to connect directly with Ketan Rohom, Associate Director of Sales & Marketing. Ketan brings a wealth of expertise in beverage alcohol research and can tailor insights to your organization’s unique needs. Engage today to explore how deep segmentation analysis, tariff impact assessments, and emerging regional trends can inform your strategic approach and optimize growth opportunities. Reach out now to arrange a personalized briefing and obtain immediate access to the full Arak market research report.

- How big is the Arak Market?

- What is the Arak Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?