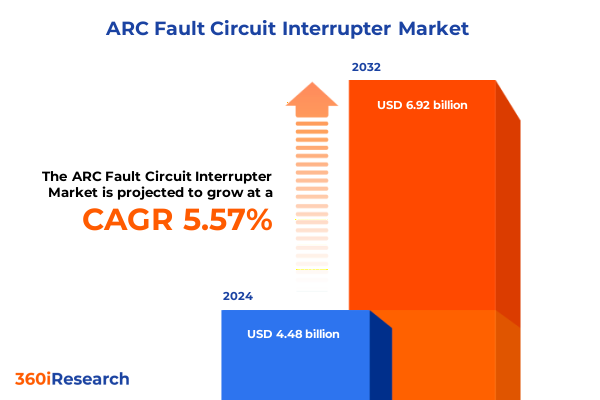

The ARC Fault Circuit Interrupter Market size was estimated at USD 4.72 billion in 2025 and expected to reach USD 4.97 billion in 2026, at a CAGR of 5.60% to reach USD 6.92 billion by 2032.

Discovering the Pivotal Importance and Evolutionary Journey of Arc Fault Circuit Interrupters in Enhancing Electrical Safety and System Reliability

Arc fault circuit interrupters represent a critical advancement in electrical safety, designed to detect and interrupt dangerous arcing faults that can lead to fires in residential, commercial, and industrial systems. These devices monitor the signature waveform of arcing currents, distinguishing them from normal load currents, and rapidly isolate the affected circuit. Introduced as a response to rising concerns over electrical fires, arc fault circuit interrupters have evolved from rudimentary thermal units to sophisticated electronic assemblies incorporating algorithmic and microprocessor-based detection. This evolution underscores the growing emphasis on preventing arc-related hazards while preserving circuit integrity and continuity.

Over the past decade, regulatory bodies and standards organizations have progressively strengthened requirements for arc fault protection in new construction and existing installations. National electrical codes in leading markets now mandate AFCI integration in a broadening range of circuits, extending beyond bedroom outlets to kitchens, living areas, and even dedicated appliance circuits. Consequently, manufacturers have intensified research and development efforts, leveraging advances in sensor technologies, digital signal processing, and self-diagnostic features to create more reliable and cost-effective solutions. As innovations continue to emerge, the arc fault circuit interrupter market is poised to deliver enhanced safety performance without compromising electrical efficiency or surge resilience.

In today’s infrastructure landscape, the role of arc fault circuit interrupters extends beyond hazard mitigation. By integrating real-time monitoring and connectivity features, modern units can feed data into building management systems, support predictive maintenance, and enable remote diagnostics. This shift toward intelligent protection architectures reflects a broader trend toward smart, resilient power networks capable of adapting to dynamic load profiles and emerging renewable energy sources. As stakeholders prioritize safety, efficiency, and digital integration, arc fault circuit interrupters have transitioned from niche safety devices to indispensable components of modern electrical ecosystems.

Exploring the Dynamic Technological Advancements Regulatory Frameworks and Market Forces Reshaping the Arc Fault Circuit Interrupter Industry Landscape

The arc fault circuit interrupter market has experienced transformative shifts driven by converging technological breakthroughs and evolving regulatory mandates. In recent years, digital signal processing algorithms and microprocessor-based detection have supplanted legacy thermal magnetic mechanisms, unlocking greater sensitivity and faster response times. Moreover, the integration of solid-state components and self-diagnostic routines has elevated product reliability, reducing nuisance trips and facilitating seamless maintenance cycles. These developments coincide with smart grid proliferation, where interoperability and data communication capabilities are increasingly viewed as essential attributes of next-generation safety devices.

Simultaneously, regulatory frameworks have expanded the scope of arc fault protection, compelling stakeholders to retrofit older installations and adopt more stringent standards for new construction projects. Code revisions in multiple jurisdictions now require comprehensive AFCI coverage in commercial build-outs, healthcare facilities, and multi-unit residential projects. This broader regulatory landscape has prompted manufacturers to diversify their product portfolios, introducing combination fault interrupters that address both arc and ground-fault conditions in a single unit. As a result, the market has witnessed accelerated adoption, underscored by partnerships between code authorities, utilities, and industry associations focused on raising awareness and driving compliance.

In addition to these drivers, the competitive terrain is reshaping through strategic alliances and targeted acquisitions. Companies are collaborating with semiconductor suppliers and software firms to embed advanced analytics and predictive capabilities into their offerings. At the same time, supply chain optimization efforts, including regional manufacturing hubs and localized component sourcing, are mitigating lead-time pressures and enhancing responsiveness to customer requirements. Together, these forces are redefining the arc fault circuit interrupter market, fostering a more adaptive, data-driven ecosystem capable of meeting escalating safety expectations and evolving infrastructure demands.

Analyzing the Far Reaching Cumulative Consequences of United States Sectional Tariffs Enacted in 2025 on Arc Fault Circuit Interrupter Supply Chains and Cost Structures

In 2025, the imposition of cumulative tariffs on electrical components imported into the United States has exerted tangible pressure on arc fault circuit interrupter manufacturing and distribution channels. Initially targeting a broad array of semiconductor and metal parts, the tariff schedule aimed to bolster domestic production but also elevated raw material costs for AFCI producers reliant on global supply networks. Consequently, manufacturers have confronted margin compression and have been compelled to reassess sourcing strategies, with many accelerating their diversification of supplier bases across multiple regions.

Furthermore, the interplay between tariff rates and fluctuating currency valuations has introduced volatility into procurement planning. Some firms have responded by negotiating multi-year contracts to secure pricing stability, while others have increased vertical integration efforts by acquiring chip fabrication capabilities or forging long-term partnerships with downstream electronics foundries. These measures seek to minimize exposure to abrupt duty escalations and safeguard production continuity.

Despite these challenges, the tariff environment has also catalyzed investments in automation and process optimization at domestic facilities. In an effort to offset added duties, companies are deploying advanced manufacturing equipment and lean process methodologies to reduce unit costs and increase throughput. Moreover, the uncertainty surrounding future trade policies has underscored the importance of agile supply chain frameworks, enabling rapid realignment of logistics and inventory buffers. As these adaptive strategies take hold, the arc fault circuit interrupter sector is navigating a complex tariff landscape while simultaneously advancing operational resilience.

Unveiling Critical Segmentation Perspectives Across Installation Type Technology End Use Product Type and Distribution Channel for AFCI Market Insight

The arc fault circuit interrupter market exhibits a layered structure when viewed through the lens of installation type, technology, end use, product type, and distribution channel. Within installation type, the distinction between new work and retrofit applications reveals divergent adoption pathways. New build projects spanning commercial complexes, industrial facilities, and residential developments have prioritized factory-fresh installations that integrate AFCI devices from initial wiring designs. In contrast, retrofit initiatives across office buildings, manufacturing plants, and housing units focus on enhancing safety in existing infrastructures, often requiring tailored solutions to navigate legacy wiring configurations.

By technology, thermal magnetic units persist in certain cost-sensitive segments, but electronic platforms-encompassing both algorithmic and microprocessor-based detection-have captured a growing share due to their superior fault discrimination and diagnostic capabilities. Solid-state modules further extend this trend by eliminating moving parts, thereby reducing maintenance demands and extending device lifespans. These technical distinctions influence performance benchmarks and feature sets, guiding end-users toward specific AFCI types that align with operational priorities.

End use segmentation highlights the broad applicability of arc fault protection across commercial, industrial, and residential realms. Healthcare and hospitality venues emphasize zero-downtime performance, while retail spaces and office blocks balance safety with energy efficiency targets. Industrial sites, including energy utilities, manufacturing plants, and oil and gas facilities, demand robust fault tolerance under extreme conditions. Within the residential domain, both multi-family and single-family structures seek to comply with updated codes while preserving architectural aesthetics and user convenience.

Product type variations further refine market choices: combination units address both arcing and ground faults, dual function interrupters blend overcurrent and arc detection, and outlet-integrated devices offer point-of-use protection. Distribution channels span direct sales relationships with original equipment manufacturers, electrical wholesale networks-anchored by both independent and national chain partners-and online retail platforms featuring manufacturer storefronts and third-party marketplaces. These intertwined segmentation layers inform product development roadmaps, channel strategies, and customized service offerings across the AFCI landscape.

This comprehensive research report categorizes the ARC Fault Circuit Interrupter market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Installation Type

- Technology

- End Use

- Distribution Channel

Highlighting Distinct Regional Market Nuances and Growth Potential Across the Americas Europe Middle East Africa and Asia Pacific for Arc Fault Circuit Interrupters

Geographic analysis of the arc fault circuit interrupter market reveals varied regulatory drivers, infrastructure demands, and innovation ecosystems across the Americas, Europe Middle East and Africa, and Asia Pacific. In the Americas, code authorities have instituted stringent arc fault protection requirements for both residential and nonresidential structures, spurring significant retrofitting campaigns and robust new-build specifications. This region benefits from established manufacturing bases and a mature distribution framework, enabling rapid deployment of advanced AFCI products.

Meanwhile, the EMEA region presents a mosaic of regulatory regimes and market maturity levels. Western European countries have aligned closely with international safety standards and are early adopters of intelligent monitoring features, whereas certain Middle Eastern markets, buoyed by large-scale infrastructure investments, are gradually incorporating AFCI technology into new developments. In Africa, urbanization trends and power reliability concerns have stimulated pilot programs leveraging resilient AFCI designs adapted for fluctuating supply conditions.

In the Asia Pacific domain, dynamic economic growth, expanding urban centers, and rapid electrification of rural areas form the backdrop for escalating AFCI demand. Key markets within the region are enacting progressive building codes that mandate arc fault protection in high-occupancy structures, driving manufacturers to localize production and forge joint ventures. Furthermore, the region’s technology hubs contribute to ongoing R&D efforts, fostering next-generation AFCI configurations that integrate seamlessly with smart home and industrial automation platforms.

These regional distinctions underscore the necessity for tailored market entry strategies, regulatory engagement plans, and localized support models. Recognizing the unique safety priorities, economic contexts, and infrastructure trajectories across each geography enables stakeholders to optimize resource allocation and forge partnerships that resonate with regional end-user requirements.

This comprehensive research report examines key regions that drive the evolution of the ARC Fault Circuit Interrupter market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Mapping Strategic Movements Partnerships and Innovation Profiles of Leading Manufacturers in the Arc Fault Circuit Interrupter Sector to Identify Competitive Strengths

Leading companies in the arc fault circuit interrupter domain have charted distinct strategic pathways encompassing product innovation, partnerships, and geographic expansion. Some top manufacturers have doubled down on electronic and microprocessor-based offerings, collaborating with semiconductor firms to embed real-time analytics and self-testing algorithms. These initiatives not only elevate diagnostic precision but also facilitate remote firmware updates, positioning devices for longer lifecycles and reduced field service costs.

Other market participants have pursued inorganic growth through acquisitions of specialized safety equipment providers, thereby broadening their portfolio to include combination ground-fault and arc-fault units. This consolidation trend has enabled rapid scaling of distribution networks and enhanced access to niche markets such as marine electrification and renewable energy installations. In parallel, several firms have launched joint ventures in emerging regions to establish localized manufacturing and assembly facilities, effectively mitigating trade-related uncertainties and meeting regional content requirements.

A subset of players is distinguishing itself through investments in digital platforms that interconnect AFCI devices with building automation systems. By leveraging cloud-based dashboards and intuitive user interfaces, these offerings empower facility managers to monitor circuit health metrics remotely and receive proactive notifications of abnormal arcing patterns. This convergence of safety hardware and software services underscores an evolving competitive landscape, where the integration of digital capabilities constitutes a key differentiator in customer engagement and value delivery.

This comprehensive research report delivers an in-depth overview of the principal market players in the ARC Fault Circuit Interrupter market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd

- Altech Corporation

- Carling Technologies, Inc.

- CHINT Group Co., Ltd.

- E-T-A Elektrotechnische Apparate GmbH

- Eaton Corporation plc

- ETA Circuit Breakers GmbH

- Fuji Electric Co., Ltd.

- General Electric Company

- Hager Group

- Honeywell International Inc.

- Hubbell Incorporated

- Hyundai Electric & Energy Systems Co., Ltd.

- Larsen & Toubro Limited

- Legrand SA

- Leviton Manufacturing Company, Inc.

- Littelfuse, Inc.

- LS ELECTRIC Co., Ltd.

- Mitsubishi Electric Corporation

- NHP Electrical Engineering Products Pty Ltd

- Nippon Kaiji Kyokai

- Panasonic Corporation

- Phoenix Contact GmbH & Co. KG

- Rockwell Automation, Inc.

- Schneider Electric SE

- Schurter AG

- Sensata Technologies Holding plc

- Siemens AG

- TE Connectivity Ltd.

- Toshiba Corporation

- Weidmüller Interface GmbH & Co. KG

Presenting Practical Strategic Initiatives and Best Practices for Industry Leaders to Navigate Challenges and Capitalize on Opportunities in the AFCI Market

Industry leaders seeking to excel in the arc fault circuit interrupter market should adopt a multi-pronged strategic framework that emphasizes technological differentiation, supply chain resilience, and proactive regulatory engagement. First, dedicating R&D resources toward advanced electronic detection algorithms and predictive maintenance features will set offerings apart in an environment increasingly focused on smart safety solutions. Concurrently, cultivating relationships with semiconductor and software partners can accelerate time to market and enable seamless integration of firmware updates and cloud connectivity.

Secondly, organizations must bolster supply chain agility by diversifying sourcing across multiple geographies and developing contingency plans for tariff-induced disruptions. Establishing regional assembly hubs and fostering closer collaboration with logistics providers will minimize lead times and maintain customer service levels under shifting trade conditions. Close monitoring of policy developments and early dialogue with policymakers will further equip companies to anticipate regulatory changes and influence standard-setting processes.

Finally, a customer-centric approach that combines technical training, value-added services, and data-driven insights will strengthen market positioning. Deploying digital platforms that provide real-time circuit health analytics and integrating AFCI performance data into broader facility management systems will cultivate deeper customer relationships. By aligning product roadmaps, channel strategies, and service offerings around evolving customer priorities, industry leaders can capture emerging opportunities and sustain competitive advantage in a rapidly transforming electrical safety landscape.

Detailing the Comprehensive Research Framework Data Collection Techniques and Analytical Approaches Underpinning the AFCI Market Study to Ensure Rigor and Validity

The research underpinning this analysis followed a rigorous framework combining primary and secondary methodologies to ensure comprehensiveness and validity. Initially, secondary data sources encompassing industry whitepapers, regulatory documents, and academic journals were systematically reviewed to establish foundational context on AFCI technology, market regulations, and competitive dynamics. This baseline was then enriched through dialogues with subject matter experts, including electrical engineers, code inspectors, and senior executives from leading manufacturing firms.

Primary research efforts included structured interviews and targeted surveys to capture nuanced perspectives on technology adoption barriers, supply chain adjustments, and customer use cases. Responses were triangulated against third-party procurement data and trade association statistics to validate emerging trends and reconcile potential discrepancies. Additionally, in-depth case studies illuminated best practices in deployment across diverse end-use environments, from critical infrastructure facilities to residential retrofit projects.

Quantitative data analysis employed advanced statistical techniques to identify correlations between regulatory milestones and market uptake, while sensitivity analyses assessed the impact of tariff fluctuations on production costs. Quality assurance protocols involved cross-verification of data points by an independent research oversight panel, ensuring methodological rigor and minimizing bias. This multifaceted approach delivered robust insights into both current market conditions and strategic trajectories for the arc fault circuit interrupter sector.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our ARC Fault Circuit Interrupter market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- ARC Fault Circuit Interrupter Market, by Product Type

- ARC Fault Circuit Interrupter Market, by Installation Type

- ARC Fault Circuit Interrupter Market, by Technology

- ARC Fault Circuit Interrupter Market, by End Use

- ARC Fault Circuit Interrupter Market, by Distribution Channel

- ARC Fault Circuit Interrupter Market, by Region

- ARC Fault Circuit Interrupter Market, by Group

- ARC Fault Circuit Interrupter Market, by Country

- United States ARC Fault Circuit Interrupter Market

- China ARC Fault Circuit Interrupter Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Synthesizing Key Findings and Strategic Imperatives from the AFCI Market Analysis to Inform Stakeholders and Drive Informed Decision Making

This market analysis has underscored the critical interplay between advanced detection technologies, evolving safety regulations, and strategic supply chain adaptations in shaping the arc fault circuit interrupter landscape. The shift toward electronic and microprocessor-based platforms has elevated the performance threshold for arc fault detection, while regulatory mandates continue to expand device applicability across residential, commercial, and industrial settings. Concurrently, tariff-driven cost pressures have prompted manufacturers to recalibrate sourcing strategies and invest in domestic automation to preserve margins.

Segmentation insights reveal that installation type, technology preferences, end-use demands, product configurations, and distribution channels collectively influence purchasing decisions and deployment models. Regional nuances across the Americas, EMEA, and Asia Pacific further highlight the importance of localized strategies and regulatory alignment. In addition, competitive analysis indicates that leading players are leveraging partnerships, mergers, and digital integration to differentiate their solutions and build resilient market positions.

Looking ahead, stakeholders who invest in next-generation detection algorithms, predictive maintenance capabilities, and flexible supply chain frameworks will be best positioned to capitalize on emerging growth opportunities. By synthesizing these findings, decision-makers can prioritize strategic initiatives that enhance operational resilience, drive product innovation, and meet heightened safety expectations across diverse application domains.

Connect with Associate Director of Sales and Marketing to Secure Exclusive Access to a Comprehensive AFCI Market Research Report and Drive Strategic Advantage

To gain unparalleled visibility into emerging market dynamics and strategic growth pathways, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. By engaging in a brief consultation, you can explore the full breadth of analysis covering regulatory impacts, technology innovations, and competitive strategies within the arc fault circuit interrupter space. This report offers actionable intelligence tailored to senior executives, product developers, and supply chain managers seeking to mitigate risk and capture new revenue streams. Schedule a personalized briefing to discuss customized insights that align with your organizational objectives and strengthen your decision-making process. Secure your copy of this comprehensive market research report today and position your team for sustained success in an evolving electrical safety environment.

- How big is the ARC Fault Circuit Interrupter Market?

- What is the ARC Fault Circuit Interrupter Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?