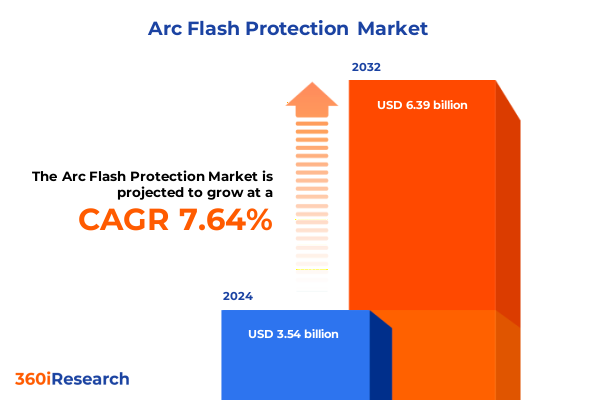

The Arc Flash Protection Market size was estimated at USD 3.81 billion in 2025 and expected to reach USD 4.10 billion in 2026, at a CAGR of 7.66% to reach USD 6.39 billion by 2032.

Unveiling the Critical Imperative of Arc Flash Safety and Protection in Today’s Electrified Industrial Environment, Regulatory Pressures, and Evolving Global Standards

Arc flash incidents represent one of the most insidious hazards in modern electrical systems, capable of inflicting severe damage on infrastructure, personnel, and operational continuity. As industries across the globe accelerate their adoption of automation, renewable energy integration, and smart grid technologies, the imperative to safeguard against these high-energy electrical events has grown exponentially. Root causes often stem from equipment failure, human error, or system design limitations, yet the consequences can reverberate through entire operations, leading to costly downtime, regulatory fines, and endangering lives.

Against this backdrop, the field of arc flash protection has evolved from a niche engineering discipline into a cornerstone of industrial safety protocols. Pioneering advancements in protective relays, sensor arrays, and personal protective equipment have reshaped how organizations approach electrical hazard mitigation. Simultaneously, stricter standards and guidelines, such as the NFPA 70E and IEEE 1584, have elevated the benchmarks for safe work practices and incident energy analysis. Consequently, businesses spanning manufacturing, infrastructure, and energy sectors are reevaluating their safety frameworks to align with these heightened expectations.

As we embark on this executive summary, the pivotal role of arc flash protection in ensuring continuous, safe operations becomes clear. This report delves into the transformative shifts that are redefining the landscape, examines the cumulative impact of recent United States tariffs on equipment costs and supply chains, and uncovers critical segmentation and regional insights. By synthesizing the strategies employed by leading companies and offering actionable recommendations, this summary provides a roadmap for decision-makers to enhance their safety posture and drive resilient growth.

Charting the Technological Evolution of Arc Flash Protection Through Digitalization, Wearable Innovations, and Predictive Safety Analytics

The arc flash protection landscape is undergoing a seismic shift, propelled by the convergence of digital technologies, regulatory tightening, and a deepening commitment to operational excellence. Gone are the days when protection strategies relied solely on static hardware configurations; today’s solutions integrate real-time monitoring, advanced analytics, and connectivity to unlock a new era of proactive hazard management. Smart sensors embedded within switchgear and protective relays now capture granular data on current fluctuations, temperature variances, and other precursor indicators, enabling predictive maintenance protocols that preempt incidents before they materialize.

Concurrently, the rise of wearable technologies and augmented reality tools is empowering field technicians with on-demand safety insights. Technicians can visualize incident energy levels and safe approach boundaries through head-mounted displays, dramatically reducing the risk of human error. In parallel, the incorporation of AI-driven algorithms into protection systems is refining arc flash modeling, generating more accurate incident energy calculations, and facilitating optimized equipment selection. These analytics-driven capabilities represent a fundamental departure from traditional time-current curve analyses and underscore a transition toward dynamic, data-centric safety frameworks.

Moreover, regulatory bodies across regions are increasingly mandating digital recordkeeping and remote testing capabilities, driving vendors and end users to invest in integrated software platforms that streamline compliance. As a result, partnerships between electrical equipment manufacturers and software providers have proliferated, giving rise to holistic safety ecosystems that unify device-level protection with enterprise-wide risk management. This technological evolution not only enhances the speed and precision of protective responses but also aligns with broader Industry 4.0 objectives, positioning arc flash protection as a strategic enabler of digital transformation.

Evaluating How the Latest United States Tariff Regime of 2025 Is Reshaping Supply Chains, Cost Structures, and Production Dynamics in Arc Flash Protection

In 2025, the United States government implemented a series of tariff adjustments targeting imported electrical safety equipment, including arc flash protection devices and associated components. These measures were designed to bolster domestic manufacturing and reduce reliance on foreign supply chains but have introduced complex variables for procurement and cost management. Suppliers and end-users have been compelled to reassess sourcing strategies, balancing the imperative for regulatory compliance with the financial impacts of higher import duties on transformers, relays, and specialized fuses.

The cumulative effect of these tariffs has manifested in extended lead times as domestic producers endeavor to ramp up capacity. For some organizations, this has necessitated the diversification of supplier networks to manage price volatility and ensure continuity. Meanwhile, equipment vendors have responded by launching capacity expansion initiatives and forging joint ventures with local manufacturers to mitigate the tariff burden. These collaborative ventures are gradually reshaping the competitive landscape, elevating domestic players and altering the traditional cost hierarchies within the arc flash protection value chain.

Despite initial concerns about inflationary pressures on safety budgets, many end users are leveraging this period of disruption as an opportunity to modernize legacy systems and adopt more sophisticated protection architectures. The rise in total landed costs for imported hardware has, paradoxically, accelerated investment in comprehensive safety audits and the replacement of outdated switchboards. As a result, the aftershock of tariff-induced market realignment has catalyzed a reorientation toward higher-value, integrated solutions that deliver long-term reliability and compliance assurance.

Uncovering In-Depth Segmentation Perspectives Across Components, Voltage Classifications, End-User Verticals, and Application Modalities Driving Market Dynamics

The analysis of market segmentation reveals a multifaceted landscape defined by component classes, voltage tiers, industry verticals, and application categories, each exerting unique influences on purchasing behaviors and deployment strategies. On the basis of component type, protection devices are categorized into circuit breakers, fuses, and protective relays. Circuit breakers continue to serve as a foundational safeguard, while fuses are distinguished between expulsion variants, prized for their simplicity and cost-effectiveness, and semiconductor fuses, valued for their rapid clearing times and compact form factors. Protective relays, in contrast, are examined through the lens of electromechanical designs that boast proven reliability, numerical relays offering programmable logic and enhanced data capture, and static relays recognized for their cost efficiency and minimal moving parts.

Further stratification by voltage type underscores the distinct requirements of high-voltage systems used in bulk power transmission, medium-voltage networks prevalent in industrial facilities, and low-voltage installations common to commercial buildings and data centers. Each voltage category imposes specific design criteria for insulation, fault detection thresholds, and coordination with upstream protective devices, driving product innovation tailored to the electrical environment.

Equally critical is the breakdown by end-user industry, which encompasses infrastructure, manufacturing, oil and gas, and power generation. Within infrastructure, the focus spans commercial buildings, data centers that demand high uptime and precision cooling, and transportation hubs that blend passenger safety with complex electrical grids. The manufacturing sector is further dissected by automotive assembly lines, chemical processing plants, food and beverage operations, and pharmaceutical manufacturing, each presenting unique arc flash risk profiles shaped by process cycles, material handling, and regulatory audits. Oil and gas stakeholders, from upstream exploration platforms to midstream pipeline systems and downstream refineries, prioritize equipment ruggedness and remote monitoring capabilities. Finally, power generation facilities, whether nuclear, renewable, or thermal, operate under stringent reliability mandates that dictate the selection of specialized containment and resistance solutions.

In the context of application, detection mechanisms leverage current sensors to identify rapid current surges, optical sensors to detect light emissions indicative of arcing, and pressure sensors to capture transient shock waves. Prevention strategies range from ground fault protection schemes that detect leakage currents to overcurrent protection systems that react to sustained faults, and zone selective interlocking architectures that enable coordinated device tripping. At the apex of defense, containment solutions confine arc energy to specified compartments, arc-resistant systems channel fault energy away from critical workspaces, and personal protective equipment serves as the last line of defense for maintenance personnel.

This comprehensive segmentation framework serves as a roadmap for stakeholders seeking to align product portfolios with the nuanced demands of diverse electrical environments, ensuring that investment decisions resonate with operational requirements and safety protocols.

This comprehensive research report categorizes the Arc Flash Protection market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Voltage Type

- Application

- End-User Industry

Analyzing Regional Variations in Arc Flash Protection Demand Across the Americas, Europe Middle East & Africa, and Asia-Pacific Power Ecosystems

Regional dynamics in the arc flash protection domain exhibit pronounced variations driven by regulatory landscapes, infrastructure maturity, and industrial activity. In the Americas, regulatory bodies have intensified enforcement of safety codes, prompting organizations to retrofit aging electrical installations with advanced protection devices. The emphasis on grid modernization and the transition to renewable integration has further heightened the demand for digital relays and sensor-based monitoring, as utility operators seek to safeguard along increasingly decentralized networks.

Across Europe, the Middle East, and Africa, stringent European Union directives and the widespread adoption of harmonized safety standards have catalyzed investments in predictive maintenance platforms and remote diagnostic capabilities. In oil-rich Middle Eastern nations and rapidly industrializing African economies, government-subsidized infrastructure projects have accelerated the deployment of arc-resistant switchgear and advanced containment enclosures to support high-capacity power distribution.

Meanwhile, the Asia-Pacific region is characterized by surging urbanization, expanding manufacturing hubs, and a robust pipeline of power generation initiatives. Countries such as China and India are scaling up both renewable and thermal power projects, fueling demand for specialized protection relays designed for harsh environmental conditions. Simultaneously, industrializing Southeast Asian nations are prioritizing workforce safety training and the integration of portable detection kits to bridge gaps in legacy installations. In all cases, regional procurement strategies are increasingly influenced by the need to harmonize global standards with local regulatory requirements, driving vendors to tailor solution portfolios accordingly.

This comprehensive research report examines key regions that drive the evolution of the Arc Flash Protection market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Market Movers Shaping the Future of Arc Flash Safety Through Technology and Alliances

The competitive arena for arc flash protection is dominated by a cadre of companies that blend deep domain expertise with aggressive innovation roadmaps. Global electrical equipment manufacturers are enhancing their value propositions through a combination of organic R&D and strategic acquisitions, aimed at expanding digital monitoring capabilities and software analytics. These market leaders maintain extensive global service networks, enabling rapid deployment of retrofit solutions and emergency support for critical infrastructure.

In parallel, specialized safety technology firms are forging alliances with software providers to create integrated safety management platforms that converge device-level protection with enterprise-wide risk dashboards. These partnerships deliver a unified user experience for configuration, testing, and compliance reporting, reducing operational complexity and supporting data-driven decision-making.

Mid-tier and regional players are also capitalizing on opportunities by focusing on niche segments such as high-voltage transformer protection and portable arc flash detection devices. By offering tailored maintenance contracts and training services, these companies differentiate on customer intimacy and local market responsiveness. With the market’s trajectory leaning toward digital twins and AI-enhanced fault analysis, established players and emerging contenders alike are racing to secure intellectual property in algorithms that refine incident energy modeling, underscoring the growing intersection between electrical engineering and software analytics.

This competitive dynamic underscores the importance of strategic collaborations and continuous innovation as companies strive to deliver comprehensive, end-to-end arc flash protection ecosystems. Organizations evaluating partner selection and system upgrades must therefore weigh product performance alongside service agility and software integration capabilities to optimize their safety investments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Arc Flash Protection market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Arcteq Relays Ltd.

- Basler Electric Company

- Bulwark Protection LLC

- CATU Electrical (France) S.A.S.

- Cementex Industries, Inc.

- DuPont de Nemours, Inc.

- Eaton Corporation plc

- G&W Electric Company

- General Electric Company

- Honeywell International Inc.

- Lakeland Industries, Inc.

- Larsen & Toubro Limited

- Littelfuse Inc.

- Mersen S.A.

- Mitsubishi Electric Corporation

- National Safety Apparel, Inc.

- NR Electric Co., Ltd.

- Oberon Company

- Rittal GmbH & Co. KG

- Rockwell Automation, Inc.

- Schneider Electric SE

- Schweitzer Engineering Laboratories, Inc.

- Siemens AG

- Tranemo Workwear AB

Strategic Action Plan for Industry Leaders to Enhance Arc Flash Hazard Mitigation, Optimize Operational Resilience, and Advance Regulatory Compliance

To navigate the evolving arc flash protection landscape, industry leaders must adopt a proactive posture grounded in technology adoption, robust supply chain strategies, and workforce empowerment. First, embracing predictive analytics platforms facilitates the early detection of arc flash precursors, enabling maintenance teams to intervene before faults escalate. Investing in connected sensor networks and integrating them with centralized asset management systems will yield actionable intelligence that drives both safety and operational efficiency.

Simultaneously, diversifying supplier relationships and strengthening domestic manufacturing collaborations can mitigate the financial and logistical impacts of international trade fluctuations. By establishing strategic partnerships with local fabricators and forging joint development agreements, organizations can secure a stable flow of critical protective devices while fostering innovation tailored to regional needs.

Another critical measure involves elevating personnel training programs to align with the latest safety standards and technological capabilities. Implementing immersive training modules that utilize augmented reality simulations will accelerate skill acquisition and reinforce safe work practices in high-voltage environments. Furthermore, standardizing inspection and testing protocols across facilities ensures consistent performance benchmarks and simplifies compliance reporting.

Finally, integrating digital twin models into electrical distribution systems offers a powerful tool for scenario planning and risk assessment. These virtual replicas enable stakeholders to simulate fault events under varied load conditions, refine coordination studies, and validate mitigation strategies without disrupting live operations. By charting a course that blends advanced analytics, strategic supply chain resilience, and comprehensive training initiatives, industry leaders can build a robust arc flash protection framework that safeguards people, assets, and productivity.

Elucidating the Comprehensive Methodological Framework Employed for Rigorous Primary and Secondary Research in Arc Flash Protection Analysis

The research methodology employed to develop this executive summary is grounded in a rigorous, multi-phased approach that leverages both primary and secondary data sources to ensure a comprehensive understanding of arc flash protection dynamics. Initially, an exhaustive secondary research phase was conducted, encompassing an array of industry publications, technical white papers, regulatory documents such as NFPA 70E and IEEE standards, and company filings. This phase established the foundational context for market drivers, regulatory imperatives, and emerging technological innovations.

Subsequently, a structured primary research initiative was undertaken, involving in-depth interviews with electrical engineers, safety managers, procurement leaders, and technology providers. These interviews provided qualitative insights into decision-making criteria, budget allocation frameworks, and the operational challenges associated with managing arc flash hazards in diverse environments. Data triangulation techniques were then applied to correlate qualitative findings with quantitative indicators, ensuring consistency and validity.

The final stage employed a bottom-up analytical framework to synthesize regional and segment-level perspectives. This process included mapping device performance parameters against industry requirements and overlaying tariff and trade policy variables to project supply chain impacts. A panel of subject matter experts reviewed the resulting analyses, providing an additional layer of validation to uphold methodological rigor. This layered research design guarantees that the executive summary is informed by both granular field-level intelligence and a broad strategic lens.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Arc Flash Protection market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Arc Flash Protection Market, by Component

- Arc Flash Protection Market, by Voltage Type

- Arc Flash Protection Market, by Application

- Arc Flash Protection Market, by End-User Industry

- Arc Flash Protection Market, by Region

- Arc Flash Protection Market, by Group

- Arc Flash Protection Market, by Country

- United States Arc Flash Protection Market

- China Arc Flash Protection Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2226 ]

Synthesizing Core Insights to Navigate the Complex Arc Flash Protection Ecosystem and Drive Strategic Decision-Making Excellence

This executive summary illuminates the pivotal trends and considerations shaping the arc flash protection domain, from the integration of cutting-edge digital technologies to the ramifications of shifting trade policies. By dissecting the nuanced segmentation of components, voltage classes, end-user industries, and application categories, stakeholders can align their safety investments with operational realities. Regional analyses further reveal how regulatory stringency, infrastructure development, and market maturity inform procurement strategies across the Americas, EMEA, and Asia-Pacific.

Moreover, the competitive landscape underscores the necessity of strategic alliances and continuous innovation, as leading companies and emerging challengers navigate a terrain increasingly defined by software analytics and predictive maintenance. The actionable recommendations provided herein serve as a roadmap for decision-makers to bolster their arc flash mitigation initiatives, optimize supply chain resilience, and foster a culture of safety excellence through targeted training and digital twin simulations.

Ultimately, this summary equips executives, safety directors, and engineering teams with a synthesized view of market dynamics and practical guidance for enhancing electrical safety frameworks. By leveraging these insights, organizations can not only reduce the risk of catastrophic arc flash events but also drive efficiency and compliance in an era of heightened regulatory and operational complexity.

Connect with Ketan Rohom to Secure Comprehensive Arc Flash Protection Insights and Empower Your Organization with In-Depth Market Research Today

As you look to fortify your organization’s approach to electrical safety and operational resilience, partnering with seasoned experts can make a transformative difference. Reach out directly to Ketan Rohom, the Associate Director of Sales & Marketing at 360iResearch, to explore how our in-depth market research on arc flash protection can equip your team with the strategic insights and data-driven analyses needed to mitigate risk, optimize equipment selection, and stay ahead of regulatory demands. By engaging with Ketan Rohom, you will gain a tailored consultation on how to leverage the latest trends, technological advancements, and regional dynamics to craft a robust safety roadmap. Take decisive action now to secure a comprehensive report that empowers your leadership with the clarity and confidence to drive project planning, capital investment, and compliance strategies. Elevate your arc flash protection strategy today; connect with Ketan Rohom to discover how our expert guidance and proprietary analysis can become the catalyst for your next phase of growth and safety excellence

- How big is the Arc Flash Protection Market?

- What is the Arc Flash Protection Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?