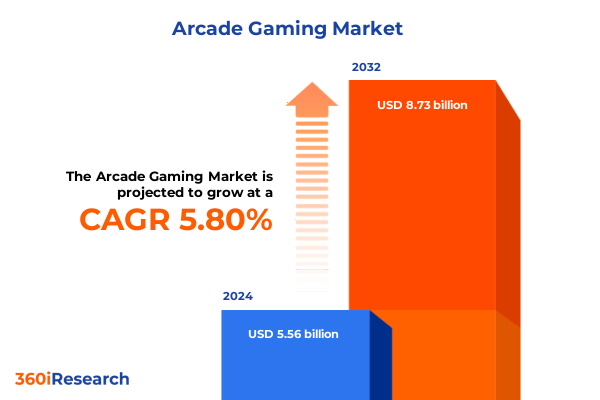

The Arcade Gaming Market size was estimated at USD 5.88 billion in 2025 and expected to reach USD 6.22 billion in 2026, at a CAGR of 5.80% to reach USD 8.73 billion by 2032.

How Pioneering Technologies and Consumer Behaviors Are Reshaping Arcade Gaming Into an Immersive, Socially Driven Entertainment Phenomenon

The arcade gaming industry is undergoing a profound renaissance, propelled by shifting consumer expectations, technological breakthroughs, and a renewed appetite for shared, immersive experiences. Once sidelined by the rise of home consoles and mobile gaming, modern arcades are reinventing themselves as social hubs where nostalgia meets next-generation interactivity. This resurgence is evident in both retail environments and at home, where experiential design has become central to how enthusiasts engage with arcade hardware.

Home-based leisure spaces are increasingly incorporating cabinet-style gaming setups that mirror the experiential richness of public arcades. In these refined environments, machines blend with upscale décor, featuring sleek profiles, customizable lighting, and integrated sound systems that deliver both visual allure and tactile satisfaction. Meanwhile, the casual dining and nightlife sectors have seized on this momentum by launching hybrid venues where food, drink, and gaming converge. Drawing on the beloved franchise of Chuck E. Cheese, the newly established Chuck’s Arcade spin-off chain invites adults to relive the classic arcade atmosphere with titles like Galaga and Halo alongside themed animatronics and retro prize counters.

Simultaneously, next-level technologies are redefining the very notion of location-based entertainment. From virtual reality (VR) motion rigs to mixed-reality racing simulators, operators are delivering experiences that far exceed what is possible in the average living room. Industry innovators report that nearly two in five new arcade venues now feature VR components, driving foot traffic and extending dwell times as visitors seek out high-impact immersion beyond home systems. As this evolution continues, the arcade is emerging not as a relic, but as a vanguard of multi-sensory social entertainment.

Transformative Market Shifts Accelerated by Digital Convergence, Hybrid Experiences, and Cross-Industry Collaborations Revolutionizing Arcade Gaming

The arcade gaming landscape is being radically transformed by converging trends that extend far beyond brighter screens and faster processors. Today’s market is characterized by the seamless integration of digital and physical realms, where cashless payment ecosystems, mobile connectivity, and networked leaderboards unite to blur the lines between online and on-site play. As operators embrace these capabilities, they unlock granular consumer insights while delivering frictionless access that resonates with tech-savvy audiences.

At the forefront of this shift is the widespread adoption of VR and AR technologies, which have redefined the experiential promise of arcades. Lucid Worlds reports that location-based VR venues have become critical differentiators, drawing crowds eager for multi-player virtual adventures that transcend the confines of traditional gaming cabinets. Concurrently, the rise of social arcade lounges-often branded as barcades-underscores the potency of combining interactive gameplay with curated food and beverage offerings. This eatertainment model has proliferated across urban centers, positioning arcade play as a cornerstone of nightlife and social engagement.

Beyond hardware, skill-based gaming and eSports integration are injecting new layers of competitiveness and community engagement. Modern arcades routinely host local tournaments where players face off under standardized rulesets, with prize-based redemption mechanics enriching the revenue mix. These events cultivate loyal followings and recurring attendance, cementing arcades as grassroots incubators for competitive gaming talent and communal ritual. Taken together, these transformative forces underscore a pivotal reality: the arcades of 2025 are not simply bringing machines to life-they are reimagining the social conventions of play for a digitally native generation.

Assessing the Comprehensive Impact of Escalating U.S. Tariffs and De Minimis Policy Changes on Arcade Gaming Supply Chains and Import Strategies

A rapid succession of tariff measures enacted in 2025 has introduced unprecedented complexity to the global supply chains supporting arcade gaming hardware. As momentum builds behind reshoring and diversification strategies, importers and manufacturers must navigate a layered mosaic of duties that directly impact sourcing economics and competitive positioning.

Beginning in February 2025, an Executive Order imposed an additional 10% ad valorem tariff on most imports originating from China, including Hong Kong, and effectively eliminated the de minimis exemption for parcels under $800, mandating formal entry procedures for low-value shipments. Shortly thereafter, U.S. Customs and Border Protection raised the surcharge to 20% on March 7, 2025, further amplifying cost pressures on goods that fall outside free-trade agreements.

The cumulative impact has been starkly illustrated by manufacturers such as Guangzhou-based iFun, whose American orders were suspended when Washington slapped a staggering 145% levy on their amusement-equipment exports, prompting U.S. clients to pause investments ranging from tens to hundreds of thousands of dollars per installation. Adding to the disruption, the removal of the de minimis exemption triggered the application of punitive 54% duties on small shipments from China as of May 2, 2025, effectively closing a key channel for rapid, low-cost replenishment of parts and components.

In response, leading operators are accelerating efforts to regionalize their manufacturing footprints, secure alternative suppliers in Southeast Asia and Latin America, and redesign product architectures to reduce reliance on components subject to the heaviest levies. These strategic pivots, though complex to execute, are becoming imperative for maintaining margin integrity and safeguarding the uninterrupted rollout of next-generation gaming experiences.

Uncovering Deep Segmentation Insights Through Game Type, Platform Evolution, Operation Modes, and End User Dynamics Driving Growth in Arcade Gaming

Within the burgeoning arcade gaming arena, distinct market segments have crystallized around four critical dimensions that shape customer engagement and revenue pathways. By analyzing game types, platforms, operation modes, and end-user profiles, stakeholders can fine-tune investment and deployment strategies to match evolving preferences.

On the frontlines of game type segmentation, operators navigate a spectrum that spans Photo Booths, Prize Vending, Redemption, and Video cabinets. In particular, the Video category expands into immersive Racing simulators, precision Shooter games, and broad-based Simulation experiences, each commanding unique floor footprints, engagement cycles, and refurbishment cadences. Coupled with this, platform segmentation distinguishes between Networked environments that facilitate competitive and social gameplay, autonomous Standalone units optimized for themed spaces, and nascent Virtual Reality installations delivering fully immersive, multi-sensory excursions.

Equally pivotal is operation mode segmentation, which delineates machines by payment systems-Bill-Operated core legacy equipment, Coin-Operated classics harnessing simple mechanical ingenuity, and advanced Cashless architectures integrating RFID cards and mobile wallets. The migration toward cashless solutions is unlocking subscription-style models and digital loyalty incentives that deepen monetization beyond individual plays.

Finally, end-user segmentation disaggregates demand across Adults seeking experiential novelty and social settings, Children gravitating toward brightly colored ticket redemption formats, Families prioritizing shared entertainment across generational lines, and Teenagers drawn to high-performance, skill-based apparatus. Taken together, these segmentation dimensions provide a robust framework for optimizing game mix, site selection, and marketing outreach in an industry defined by rapid innovation and niche differentiation.

This comprehensive research report categorizes the Arcade Gaming market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Game Type

- Platform

- Operation Mode

- End User

Examining Regional Market Dynamics Across the Americas, Europe, Middle East & Africa, and Asia-Pacific Revealing Diverse Growth Trajectories in Arcade Gaming

Arcade gaming’s global resurgence is manifesting in regionally nuanced ways, with three macro areas-Americas; Europe, Middle East & Africa; and Asia-Pacific-each charting distinct evolutionary paths rooted in consumer culture, policy frameworks, and infrastructure maturity.

In the Americas, a consolidated network of casual dining chains and family entertainment centers anchors demand, while innovative spin-offs like Chuck’s Arcade cater to nostalgic young adults seeking premium social experiences. Operators here benefit from robust retail footprints and a consumer base acclimated to cashless payments and hybrid entertainment formats, making North America the benchmark for experiential diversification.

Across Europe, the Middle East & Africa, themed entertainment complexes and pop-up social gaming lounges are rekindling interest in retro and VR-powered offerings alike. While Western Europe sees barcade concepts thrive under strong nightlife cultures, the Middle East is capitalizing on entertainment-driven tourism development, and select African markets are piloting skill-based gaming machines under evolving regulatory regimes. Notably, EU policy incentives for digital innovation and infrastructure grants have catalyzed the rollout of networked, multi-location loyalty platforms that enhance cross-border visitation.

In Asia-Pacific, the cradle of arcade manufacturing and home to venerable game-center traditions, operators are doubling down on location-based experiences that fuse gaming with retail, education, and cultural themes. Manufacturing powerhouses in China and Japan continue to innovate across VR, AR, and haptic-feedback domains, even as rising real-estate costs prompt creative deployment models in redeveloped shotengai districts and tourism destinations. This region’s intricate blend of heritage arcades and cutting-edge adoption makes it a bellwether for next-generation engagement strategies.

This comprehensive research report examines key regions that drive the evolution of the Arcade Gaming market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Exploring Key Industry Players, Technological Innovations, and Strategic Partnerships Steering Competitive Leadership in the Arcade Gaming Ecosystem

The competitive landscape of arcade gaming is shaped by a handful of leading manufacturers and operators whose innovation roadmaps and partnership strategies set the sector’s technological and experiential benchmarks.

Raw Thrills, headquartered in Skokie, Illinois, leverages cinematic IP partnerships and proprietary motion-platform technology to deliver high-impact Racing and Shooting attractions. Founded in 2001 by industry veteran Eugene Jarvis, the company’s titles consistently top operator preference surveys for visual fidelity and repeat-play engagement.

Bay Tek Entertainment, based in Pulaski, Wisconsin, dominates the redemption game segment with ticket-dispensing titles that blend carnival aesthetics with home entertainment brands. With roots dating back to 1977, Bay Tek’s machines, including the popular Skee-Ball and branded handheld releases, underscore the enduring consumer appetite for skill-based reward mechanics.

Globally, Bandai Namco Holdings maintains its heritage of classic arcade IP while expanding into console and home markets, as illustrated by the recent special edition Atari 2600+ Pac-Man console reveal, underscoring the company’s agile cross-platform strategy. Meanwhile, Innovative Concepts in Entertainment (ICE) and Triotech continue to push boundaries in location-based VR and interactive dark-ride installations, often collaborating with regional entertainment parks on bespoke, multi-sensorial attractions.

According to Technavio’s recent analysis, other strategic players such as Capcom, Sega Sammy Holdings, and UNIS Technology are also accelerating R&D investments and regional partnerships to fortify their market reach, highlighting a dynamic competitive tableau defined by IP alliances, technological differentiation, and global scale.

This comprehensive research report delivers an in-depth overview of the principal market players in the Arcade Gaming market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Activision Blizzard, Inc.

- Adrenaline Amusements, Inc.

- Andamiro Co., Ltd.

- Atari SA

- Bandai Namco Amusement Inc.

- Bay Tek Entertainment, Inc.

- Beijing UNIS Technology Co., Ltd.

- Bowlero Corp.

- Brunswick Corporation

- Capcom Co., Ltd.

- CXC Simulations

- D-BOX Technologies Inc.

- Gameloft SE

- Helix Leisure USA, Inc.

- International Game Technology PLC

- Konami Holdings Corporation

- LAI Games, LLC

- Microsoft Corporation

- NetEase, Inc.

- Netmarble Corp.

- Nexon Co., Ltd.

- Nintendo Co., Ltd.

- Raw Thrills, LLC

- Sega Sammy Holdings Inc.

- Sony Interactive Entertainment LLC

- Square Enix Holdings Co., Ltd.

- Stern Pinball, Inc.

Delivering Strategic Recommendations for Industry Leaders to Navigate Technological Innovation, Supply Chain Challenges, and Shifting Consumer Expectations

To capitalize on the industry’s resurgence and navigate the evolving regulatory landscape, arcade gaming leaders should adopt a multifaceted strategy that addresses technology adoption, supply chain resilience, and consumer engagement. First, prioritizing investments in modular, cashless payment platforms will streamline operations and unlock subscription and loyalty-driven revenue models. By integrating RFID cards and mobile wallets, operators can capture real-time usage data and deploy targeted promotions to boost repeat visits.

Second, diversifying the supply base through nearshore partnerships in Mexico, Southeast Asia, and Eastern Europe will mitigate the impact of escalating tariffs and facilitate agile production runs. Establishing joint ventures or licensing deals with regional assemblers can also reduce lead times for parts and enable local customization of game cabinets.

Third, embracing hybrid omnichannel experiences that fuse on-site play with digital extensions-such as remote tournament access, companion mobile apps, and cloud-based game streaming-will broaden audience reach and extend revenue windows beyond physical visits. Operators that seamlessly connect in-venue leaderboards and eCommerce platforms will foster deeper community engagement.

Lastly, fostering strategic alliances with entertainment precincts, retail developers, and lifestyle brands will unlock opportunities to embed arcade experiences within diverse footfall drivers. By curating themed gaming zones in mixed-use venues-from experiential malls to adult-focused lounges-industry leaders can tap into new demographics and reinforce arcades as must-visit social destinations.

Detailing a Rigorous Research Methodology Combining Primary Expert Interviews and Secondary Data Analysis to Generate Deep Insights Into Arcade Gaming Dynamics

This analysis synthesized insights through a structured research methodology blending primary and secondary approaches. Primary data collection included in-depth interviews with senior executives at leading arcade operators and equipment manufacturers, as well as consultations with regulatory and logistics experts to unpack the implications of tariff developments and de minimis policy changes.

Complementing these interviews, secondary research encompassed a thorough review of public disclosures, industry news sources, government tariff schedules, and specialized trade publications. We examined U.S. Customs and Border Protection announcements, Executive Order texts, and Section 301 tariff lists to accurately quantify duty structures and policy timelines.

Quantitative analysis leveraged shipment data from global trade databases, cross-referenced with manufacturer disclosures to validate the operational impact of cost escalations. Segmentation frameworks were constructed based on standardized classifications for game type, platform, operation mode, and end-user cohorts, ensuring consistent comparative evaluation across market segments.

Finally, iterative validation occurred through a peer review process engaging external advisors from leading amusement trade associations and technology consultancies. This multi-layered approach ensured that findings are robust, actionable, and reflective of the rapidly shifting dynamics shaping the future of arcade gaming.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Arcade Gaming market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Arcade Gaming Market, by Game Type

- Arcade Gaming Market, by Platform

- Arcade Gaming Market, by Operation Mode

- Arcade Gaming Market, by End User

- Arcade Gaming Market, by Region

- Arcade Gaming Market, by Group

- Arcade Gaming Market, by Country

- United States Arcade Gaming Market

- China Arcade Gaming Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Synthesizing Critical Findings and Strategic Outlooks to Illuminate the Future Trajectory and Opportunities Within the Evolving Arcade Gaming Sector

The arcade gaming sector is poised for sustained growth, driven by a confluence of digital transformation, experiential demand, and strategic realignment across global markets. By leveraging segmentation intelligence-spanning game types, platforms, payment models, and consumer cohorts-operators can align their value propositions with precisely defined audience needs.

Regional dynamics underscore the importance of flexibility: North America’s matured hybrid venues, EMEA’s nightlife-driven barcades, and Asia-Pacific’s confluence of manufacturing prowess and cultural affinity all present distinct opportunities for tailored expansion. Meanwhile, escalating tariffs and policy shifts have crystallized the need for supply chain diversification, compelling industry leaders to forge nearshore partnerships and reevaluate sourcing strategies.

As hardware innovations converge with cloud-based services, eSports integration, and cashless ecosystems, the role of arcades is evolving from standalone attractions into integrated social-entertainment platforms. Stakeholders who act decisively to optimize their technology roadmaps, operational footprints, and partnership networks will capture disproportionate upside in this revitalized landscape.

In closing, the arcade segment stands at an inflection point where bold investment and strategic agility will define market leadership. The insights presented here chart a clear path for turning emergent trends into sustainable competitive advantages.

Partner With Ketan Rohom to Unlock Exclusive Arcade Gaming Market Research Insights and Drive Strategic Decision-Making With the Market Analysis Report

Don’t let market disruptions and competitive pressures leave your business behind. Reach out directly to Ketan Rohom to discuss how our comprehensive market analysis report can inform your strategic roadmap, optimize your product portfolio, and elevate your sales and marketing efforts in the rapidly evolving arcade gaming industry. With tailored insights on consumer behaviors, technology adoption patterns, and regulatory impacts, you can make data-driven decisions that drive growth and profitability. Contact Ketan today to secure your copy of the full report and unlock the actionable intelligence you need to stay ahead of the curve.

- How big is the Arcade Gaming Market?

- What is the Arcade Gaming Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?