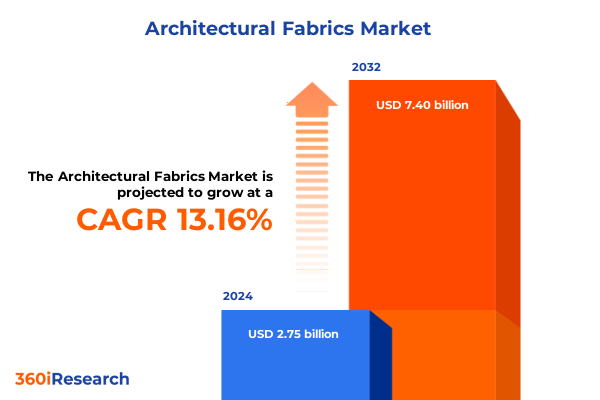

The Architectural Fabrics Market size was estimated at USD 3.07 billion in 2025 and expected to reach USD 3.44 billion in 2026, at a CAGR of 13.36% to reach USD 7.40 billion by 2032.

Exploring the Evolution and Emerging Drivers Shaping the Future of Lightweight and Sustainable Architectural Fabrics in Modern Construction and Design Trends

Architectural fabrics have undergone a remarkable transformation from purely functional materials to high-performance elements that define modern building aesthetics and sustainability standards. Over the past decade, designers and engineers have increasingly embraced tensile membrane structures, fabric facades, and retractable roofing systems as innovative solutions for light, durable, and visually impactful building envelopes. This evolution is driven by the dual imperatives of energy efficiency and design flexibility. Polyvinylidene fluoride (PVDF) coatings, for instance, have become integral to facades due to their exceptional durability, chemical resistance, and capacity to reflect solar radiation, thereby reducing cooling loads in urban environments.

At the same time, advances in bio-based and recycled content within upholstery and canopy fabrics underscore the industry’s commitment to circular economy principles. The launch of Batyline [Stam]Skin Feel by Serge Ferrari Group, which incorporates 47 percent bio-based materials and meets stringent fire-retardancy standards, exemplifies how sustainability is no longer optional but a core design consideration. These material innovations not only meet green building certification criteria but also resonate with environmentally conscious end users.

Looking ahead, the intersection of material science breakthroughs and aesthetic aspirations will continue to propel the architectural fabrics market. Fabric manufacturers and project teams now collaborate closely from conceptual design through installation, leveraging digital modeling tools and performance-driven material specifications. This trend signals a new era where architectural textiles are recognized as essential design elements rather than mere cladding alternatives, setting the stage for further evolution across global construction markets.

Understanding the Transformative Technological Advancements and Sustainability Trends Revolutionizing the Architectural Fabrics Landscape Across Global Markets

The architectural fabrics landscape is being reshaped by transformative shifts in technology, sustainability imperatives, and regulatory frameworks. Digital printing capabilities now allow full-color graphics, patterns, and branding elements to be directly integrated onto membrane surfaces without compromising tensile strength or longevity. This digital integration enhances project differentiation while accelerating production timelines and reducing waste associated with traditional post-printing processes.

Moreover, a wave of eco-innovation is redefining fabric coatings and composite structures. Manufacturers are developing water-based PVDF formulations that dramatically lower volatile organic compound (VOC) emissions, aligning with increasingly stringent environmental regulations in North America and Europe. Concurrently, bio-based polymer blends are emerging in upholstery and canopy fabrics, driven by consumer demand for materials derived from renewable sources. These innovations reduce carbon footprints and improve product life cycles through recyclability and reduced raw material extraction.

Another significant shift involves modular and prefabricated fabric systems, which allow rapid on-site installation and minimize project downtime. By adopting standardized yet adaptable modules, project teams can respond to complex architectural geometries while controlling costs and ensuring consistent quality. Taken together, these technological advancements, sustainability trends, and offsite fabrication strategies constitute a fundamental change in how architectural fabrics are specified, manufactured, and deployed. The result is a more agile, resource-efficient, and design-forward industry poised to meet the evolving demands of stakeholders across commercial, industrial, and leisure sectors.

Analyzing the Cumulative Impact of Recent United States Trade Tariffs on Architectural Fabrics Supply Chains and Cost Structures in 2025

In early 2025, U.S. trade policy introduced significant import tariffs on coated textile materials, profoundly affecting architectural fabrics supply chains and cost structures. On February 4, the U.S. implemented an initial 10 percent tariff increase on a broad range of coated fabric imports, including polyurethane-coated offerings, elevating landed costs and prompting buyers to reassess supplier portfolios. This adjustment led to an immediate uptick in the unit value realized for imported polyurethane-coated fabrics, constraining price-sensitive applications and shifting procurement toward domestic or low-tariff markets.

Less than one month later, on March 4, tariff rates rose again, reaching approximately 22.7 percent for polyurethane-coated variants and similarly elevated levels for PVC-coated fabrics, where initial duties climbed to 12.7 percent before matching the 22.7 percent threshold. These successive increases further disrupted traditional sourcing patterns and fueled near-term inflationary pressures on project budgets, especially in sectors such as sports facilities and large-scale tensile membrane installations where coated fabrics represent a significant material input.

The cumulative impact of these tariffs has been twofold: first, accelerating domestic production initiatives in North America as manufacturers expand capacity to capture repatriated demand; and second, redirecting import flows to non-tariff-affected regions such as Southeast Asia and India. While these shifts enhance resilience and reduce exposure to tariff volatility, they also introduce complexity in quality assurance and logistics, as product specifications and regulatory compliance vary across alternative sourcing jurisdictions. As a result, industry players must navigate a more fragmented global supply chain landscape, balancing cost containment with performance and sustainability objectives.

Uncovering Key Segmentation Dynamics by Coating Material Fabric Construction Application and End Use Industry to Drive Informed Strategic Decisions

Coating material selection remains the cornerstone of performance in architectural fabrics, with PTFE, PVC, and PVDF each offering distinct property profiles. PTFE is celebrated for its self-cleaning surface and extreme temperature resilience, making it ideal for exposed tensile structures in harsh environments. PVC continues to be a cost-effective solution for canopies and temporary installations, while PVDF excels in facades and roofing membranes due to superior UV stability and color retention.

Fabric construction further refines application performance. Non woven substrates such as meltblown and spunbond variants deliver light-blocking properties and acoustic damping in indoor installations, whereas reinforced composites that blend carbon fiber hybrid or glass fiber hybrid layers bring high tensile strength and minimal elongation for long-span tensile roofs. Woven architectures, including plain weave, satin weave, and twill weave patterns, offer predictable mechanical behavior and improved tear resistance, catering to both decorative facades and structural roofing elements.

Application-specific demands also shape market segmentation. Air supported structures leverage lightweight inflation membranes for rapid deployment in temporary venues, while canopies and roofing systems balance sun shading with weather protection. Facades require thin-profile films that integrate with curtain wall systems, and sports facilities often combine large-span tensile fabrics with acoustic and lighting considerations. End-use industry dynamics range from commercial office buildings with emphasis on daylight integration to industrial warehouses where durability and fire performance are paramount, and sports & leisure applications demand bold visual imagery and quick installation cycles. By understanding these layered segmentation dimensions, stakeholders can tailor material choices to project requirements, optimize supply chain reliability, and align design aspirations with performance outcomes.

This comprehensive research report categorizes the Architectural Fabrics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Coating Material

- Fabric Construction

- Application

- End Use Industry

Key Regional Perspectives Highlighting Unique Drivers and Challenges Shaping Architectural Fabrics Adoption Across Americas EMEA and Asia Pacific

The Americas region is characterized by a strong domestic production push, driven by recent trade policy shifts that incentivize onshore manufacturing of coated fabrics. The U.S. market benefits from robust infrastructure spending, particularly in transportation hubs and sports venues, where tensile membranes and architectural enclosures are prioritized for their aesthetic impact and cost efficiency. Canada’s focus on sustainable building codes has accelerated the adoption of PVC and PVDF membranes in green-certified projects, reinforcing North America’s role as both an innovator and adopter of advanced fabric technologies.

Europe, the Middle East & Africa (EMEA) features a diverse range of drivers, from Europe’s stringent environmental regulations that promote water-based PVDF coatings to the Gulf Cooperation Council’s high-profile architectural projects that showcase monumental tensile structures. In EMEA, sustainability credentials and long-term durability are critical, leading fabric suppliers to emphasize life-cycle assessments and recycled content. The Middle East continues to invest in iconic stadiums and exhibition halls, while Africa’s growing urban development has introduced market entrants to emerging opportunities in low-cost, rapid-deployment fabric systems.

Asia-Pacific stands out for its large-scale infrastructure programs and burgeoning sports & leisure facilities in markets such as China, India, and Australia. Asia-Pacific fabricators are integrating digital printing and smart membrane technologies to differentiate offerings and meet evolving architectural aesthetics. Regional supply chains in Southeast Asia have expanded rapidly as manufacturers seek tariff-neutral production sites, enabling competitive pricing on PVC and polyurethane-coated fabrics. Together, these regional dynamics underscore the need for a nuanced approach to market entry, supply chain diversification, and product development strategies tailored to localized end-use drivers across the globe.

This comprehensive research report examines key regions that drive the evolution of the Architectural Fabrics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Market Players and Their Strategic Initiatives Driving Innovation Sustainability and Competitive Advantage in Architectural Fabrics

Major players continue to innovate across the architectural fabrics spectrum, leveraging proprietary coatings and hybrid composites to differentiate their portfolios. DuPont remains a pioneer in PVF films, with its Tedlar® solutions recognized for exceptional color stability and weather resistance in high-profile façades. The Chemours Company leads in PTFE-coated membranes under the Teflon® brand, delivering seismic performance certifications and LEED contributions for demanding architectural envelopes, while Arkema’s Kynar® PVDF films set benchmarks for color retention and aesthetic versatility in dynamic façade designs.

Sustainable innovation is also a focal point among fabric manufacturers. Serge Ferrari Group introduced Batyline [Stam]Skin Feel, which integrates nearly half of its composition from bio-based sources and aligns with emerging biobased product programs. Heytex Bramsche GmbH and Mehler Texnologies are enhancing their product lines through expanded color collections and water-based coating technologies that reduce VOC emissions. OMNOVA Solutions and Cooley Group compete vigorously in polymer-coated PVC fabrics, emphasizing performance additives that deliver anti-microbial and self-cleaning functionality within hospital, commercial, and sports applications.

Mid-tier specialists such as Taconic and Fiberflon focus on highly technical PTFE-coated glass fabrics used in architectural canopies and tensile structures, while Tencate’s composite membranes cater to modular building systems with integrated insulation layers. Collectively, this competitive landscape underscores a sector in flux, where sustainability, technical differentiation, and agility in responding to trade policy adjustments are the hallmarks of industry leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Architectural Fabrics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ceno Membrane Technology GmbH

- Chukoh Chemical Industries, Ltd.

- Dickson‑Constant S.A.

- Endutex Coated Technical Textiles Ltd.

- Glen Raven, Inc.

- Heytex Holding GmbH

- Hightex GmbH

- Hiraoka & Co., Ltd.

- Hyosung Corporation

- Low & Bonar PLC

- Mehler Texnologies GmbH & Co. KG

- Obeikan Coated Fabrics Ltd.

- Saint‑Gobain S.A.

- Sattler AG

- Seaman Corporation

- Serge Ferrari Group S.A.S.

- Sika AG

- Sioen Industries N.V.

- Taiyo Kogyo Corporation

- Verseidag‑Indutex GmbH

- W. L. Gore & Associates, Inc.

Actionable Recommendations for Industry Leaders to Enhance Resilience Innovation Sustainability and Operational Excellence in the Architectural Fabrics Value Chain

To navigate the increasingly complex architectural fabrics market, industry leaders should pursue a multi-pronged strategy. First, diversifying supply chains through partnerships with manufacturers in tariff-neutral jurisdictions and expanding domestic production capacity can mitigate the impact of future trade policy volatility. This approach not only controls costs but also enhances supply certainty for project-critical deliveries amid shifting global tariffs.

Second, investing in research and development around eco-friendly coatings-such as water-based PVDF formulations and bio-based polymer blends-will align product offerings with evolving environmental regulations and green building certification standards. Collaborative innovation with material science institutes and end users can accelerate go-to-market cycles for sustainable membrane solutions.

Third, accelerating the adoption of digital fabrication techniques and modular assembly systems will drive operational efficiencies and reduce project lead times. Integrating real-time quality monitoring and predictive maintenance analytics into production lines can further ensure consistent fabric properties and minimize on-site installation risks. Lastly, strengthening after-sales support services-including training programs for fabric installation and maintenance best practices-will differentiate brands in highly competitive segments such as sports facilities and large-scale tensile structures. By embracing these strategic imperatives, market participants can secure resilience, foster innovation, and enhance long-term profitability in the architectural fabrics sector.

Comprehensive Research Methodology Integrating Primary Expert Interviews Secondary Data and Rigorous Analytical Frameworks for Architectural Fabrics Insights

This study employs a robust research methodology that combines primary data collection with comprehensive secondary analysis to ensure accuracy and depth. Primary insights were gathered through interviews with industry experts, including fabric manufacturers, design consultants, and project developers, providing first-hand perspectives on material performance, supply chain dynamics, and end-user requirements.

Secondary research incorporated a wide range of published sources such as trade publications, technical journals, and company disclosures. Custom tariff data was analyzed to quantify the impact of U.S. import duties on coated fabrics, while patent filings and regulatory documents informed the assessment of emerging material technologies and environmental compliance trends.

Quantitative modeling utilized both bottom-up and top-down approaches. The bottom-up method synthesized raw material cost structures and capacity utilization metrics, whereas the top-down analysis reviewed macroeconomic indicators, construction spending patterns, and import-export flows. Data triangulation techniques validated findings by cross-referencing industry benchmarks and peer-validated reports. A qualitative risk assessment framework was also applied to evaluate geopolitical, regulatory, and sustainability-related uncertainties.

Collectively, this mixed-methods approach ensures that the research outputs are both grounded in empirical evidence and enriched by expert insights, delivering a rigorous foundation for strategic decision-making in the architectural fabrics market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Architectural Fabrics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Architectural Fabrics Market, by Coating Material

- Architectural Fabrics Market, by Fabric Construction

- Architectural Fabrics Market, by Application

- Architectural Fabrics Market, by End Use Industry

- Architectural Fabrics Market, by Region

- Architectural Fabrics Market, by Group

- Architectural Fabrics Market, by Country

- United States Architectural Fabrics Market

- China Architectural Fabrics Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Concluding Insights Highlighting Key Takeaways Trends and Strategic Imperatives for Stakeholders in the Evolving Architectural Fabrics Market

Throughout this analysis, several overarching themes have emerged. Technological innovation and sustainability have become intertwined imperatives, driving the development of eco-friendly coatings, bio-based materials, and digital fabrication technologies. These advancements are redefining performance criteria for architectural fabrics, positioning them as critical enablers of energy efficiency and design distinguishability.

Trade policy shifts in 2025 have underscored the importance of supply chain resilience, prompting a strategic realignment toward domestic and tariff-neutral production hubs. While these adjustments introduce complexity, they also create opportunities for local manufacturers to expand capacity and capture repatriated demand.

Segmentation insights reveal that nuanced material selection-whether PTFE for extreme environments, PVC for cost-sensitive applications, or PVDF for color-critical facades-remains paramount. Similarly, regional dynamics across the Americas, EMEA, and Asia-Pacific reflect distinct drivers, from infrastructure investment to regulatory mandates, necessitating tailored go-to-market strategies.

Key industry players are leveraging differentiated technology portfolios and sustainability credentials to maintain competitive advantage. Moving forward, success will hinge on the ability to integrate strategic supply chain diversification, advance material science research, and deliver turnkey solutions that meet evolving stakeholder expectations. This conclusion offers a strategic roadmap for organizations seeking to thrive amid the dynamic forces shaping the architectural fabrics sector.

Secure Your Comprehensive Market Research Report on Architectural Fabrics by Contacting Ketan Rohom Associate Director Sales and Marketing Today

To obtain your definitive guide on the architectural fabrics market, reach out to Ketan Rohom, Associate Director of Sales & Marketing at our firm. This comprehensive report offers deep insights into emerging trends, tariff impacts, segmentation analysis, and regional dynamics that inform strategic decisions. By securing your copy, you gain a competitive edge through access to exclusive research findings, expert recommendations, and a robust methodology tailored to deliver actionable intelligence.

Elevate your understanding of this dynamic market and align your strategic initiatives with the latest technological advancements, sustainability imperatives, and regulatory developments. Engage directly with an experienced sales and marketing professional who can customize the report to address your specific business needs and ensure timely delivery. Don’t miss this opportunity to leverage premier industry data and inform your next steps with confidence.

- How big is the Architectural Fabrics Market?

- What is the Architectural Fabrics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?