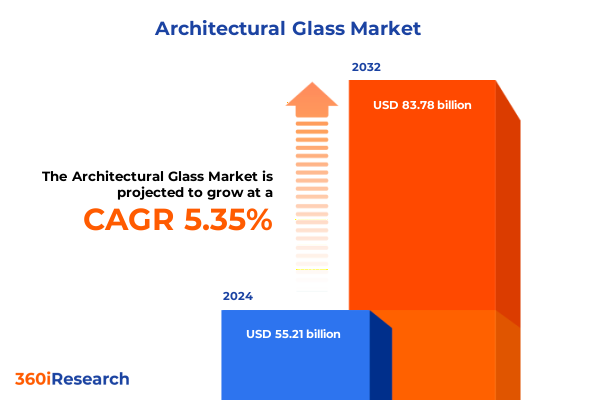

The Architectural Glass Market size was estimated at USD 58.02 billion in 2025 and expected to reach USD 61.02 billion in 2026, at a CAGR of 5.38% to reach USD 83.78 billion by 2032.

Exploring the Intersection of Aesthetic Design Sustainability and Technological Advancement Driving Unprecedented Growth in the Architectural Glass Sector

The architectural glass industry stands at a pivotal juncture, where aesthetic ambitions converge with an urgent mandate for environmental stewardship and cutting-edge innovation. Contemporary urban landscapes and visionary architectural designs are increasingly defined by the seamless integration of glass, elevating the built environment with transparency, natural light, and sophisticated material expression. Developers, designers, and specifiers are demanding solutions that not only meet stringent performance standards but also embody the principles of sustainability, energy efficiency, and occupant wellbeing.

As a result, manufacturers are racing to advance both conventional and smart glass technologies, pushing the boundaries of functionality while preserving visual appeal. Electrochromic, gasochromic, photochromic, and thermochromic variants have transitioned from niche applications to mainstream considerations, delivering dynamic light control and adaptive shading in façades and skylights. At the same time, low-emissivity coatings, self-cleaning surfaces, and advanced laminations are redefining performance benchmarks for noise reduction, solar heat gain mitigation, and structural resilience.

Transitioning smoothly from traditional float and tinted glass, these technological leaps underscore a broader industry evolution. Today’s market is characterized by a convergence of digital integration, stringent building codes, and heightened consumer awareness of carbon footprints. This introduction sets the stage for an executive summary that delves into transformative shifts, tariff impacts, segmentation insights, regional dynamics, competitive landscapes, and strategic recommendations shaping the next era of architectural glass.

Embracing Digital Integration and Regulatory Evolution Revolutionizing Material Selection and Energy Efficiency in Modern Architectural Glass Solutions

Over the past decade, architectural glass has undergone a fundamental transformation as digitalization, regulatory imperatives, and evolving design philosophies converge. Advances in sensor integration have enabled façades to respond dynamically to environmental conditions, adjusting tint and transparency to optimize daylight harvesting and minimize energy consumption. Simultaneously, building performance standards have been revised globally to demand greater thermal insulation and solar control, compelling glass manufacturers to innovate rapidly.

This regulatory evolution has dovetailed with a rising emphasis on occupant comfort and health. Architects and facility managers are prioritizing daylight access, glare reduction, and acoustic attenuation, driving demand for laminated, insulated, and anti-reflective glass solutions. The result is a more holistic approach to façade design, where aesthetic objectives align with stringent performance criteria, fostering collaborative partnerships across the value chain.

Moreover, the emergence of digital twin technologies and augmented reality tools is revolutionizing project workflows. These platforms enable real-time modeling of glass performance under varying climatic scenarios, facilitating informed decision-making early in the design phase. As a result, the once-linear process of product specification and procurement has become a dynamic ecosystem, where data-driven insights inform every step from material selection to post-occupancy evaluation. This confluence of digital and regulatory forces marks a new chapter in the architectural glass landscape, characterized by unprecedented agility and integrated innovation.

Assessing the Compound Consequences of 2025 U.S. Tariff Measures on Supply Chains Pricing Strategies and Competitive Dynamics in the Glass Industry

In 2025, the United States enacted a series of targeted tariffs on imported glass components aimed at bolstering domestic manufacturing and addressing trade imbalances. These measures prompted supply chain realignments as fabricators sought alternatives to traditionally low-cost imports. Early in the year, lead times for electrochromic and specialty coatings extended by several weeks, driving temporary price escalations and compelling buyers to explore closer suppliers.

As market actors adapted, strategic partnerships with regional suppliers helped to mitigate cost pressures. Companies increased investment in North American manufacturing facilities, accelerating work on local capacity expansions and throughput enhancements. However, the cumulative effect of tariffs extended beyond immediate pricing adjustments; it reshaped procurement strategies, incentivizing long-term contracts and volume commitments to secure price stability and reliable logistics.

Furthermore, new cost structures fed into product innovation cycles. Manufacturers prioritized modular designs that reduced material intensities while maintaining performance. In parallel, coating formulators intensified research on low-cost, high-performance anti-reflective and low-E chemistries that could be produced domestically without reliance on tariff-affected supply lines. Taken together, the 2025 tariff regime has catalyzed a wave of domestic reinvestment, optimized supply networks, and a recalibrated focus on innovation that will influence market dynamics for years to come.

Unlocking Strategic Opportunities Through Comprehensive Insights into Technology Construction End Use Coating Distribution Channel Application and Glass Type Segmentation

The architectural glass market offers a rich tapestry of segments influenced by technology, construction type, end use, coating characteristics, distribution channels, applications, and glass formats. By technology, the sector balances conventional float and tinted glass with advanced smart glass variants, where electrochromic alternatives deliver on-demand tint adjustments and photochromic systems leverage ambient light to modulate transparency. Construction typologies further shape demand, as commercial high-rise projects often require sophisticated insulated glass units for thermal and acoustic performance, while residential developments prioritize aesthetic options like colored and tempered glass for façade and interior accents.

End-use distinctions between new construction and renovation drive specification strategies, with retrofits often favoring self-cleaning coatings and laminated glass for heritage preservation and occupant safety. Coating diversity introduces another layer of complexity; low-E layers minimize heat transfer in cold-climate projects, anti-reflective treatments enhance clarity in high-glare environments, and reflective coatings deliver privacy and solar control in premium corporate campuses. Distribution pathways span direct sales agreements for large architectural firms, distributors catering to regional glazing contractors, and online platforms enabling smaller builders to access customized glass solutions efficiently.

Applications range from expansive curtain walls and skylight systems to more nuanced uses in balustrades, partition walls, roofing elements, and window-door assemblies. Glass formats such as float, laminated, Insulated Glass Units, and tempered variants each carry unique fabrication and installation logistics, influencing lead times and cost structures. Integrating these segmentation insights reveals targeted strategies for portfolio optimization, enabling suppliers to tailor offerings to distinct project needs and customer preferences across the market continuum.

This comprehensive research report categorizes the Architectural Glass market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Coating Type

- Processing Method

- Application

- End-Use Sector

- Distribution Channel

Exploring Key Market Dynamics and Growth Drivers Across the Americas Europe Middle East Africa and Asia Pacific Architectural Glass Markets

Across the Americas, robust infrastructure spending and urban densification continue to fuel demand for high-performance glass in commercial towers and mixed-use developments. North American markets exhibit a growing appetite for smart glass applications that contribute to net-zero objectives, while Latin American countries lean heavily on low-cost tempered and tinted solutions to modernize aging building stock with minimal capital outlay.

In Europe, Middle East & Africa, stringent energy codes and heritage preservation regulations coexist, driving a dual demand for advanced low-E coatings in new developments and carefully engineered laminated glass in historic renovation projects. Western European countries push the envelope with dynamic glass installations in sustainable office parks, while GCC nations increasingly integrate solar control coatings to combat harsh climatic conditions. Africa’s expanding commercial hubs, meanwhile, are adopting off-the-shelf float and insulated glass units to meet rapid construction timelines.

Asia-Pacific remains the fastest-growing region, where megacity expansions in China, India, and Southeast Asia are underpinned by ambitious net-zero targets. The region demonstrates diverse preferences, from bent glass façades in luxury retail districts to gasochromic glass in high-end hospitality. Regional glass manufacturers are scaling production of self-cleaning and anti-reflective variants to cater to urban centers grappling with pollution and glare. By understanding these regional dynamics and growth drivers, stakeholders can align their strategies to capture opportunities in established and emerging markets alike.

This comprehensive research report examines key regions that drive the evolution of the Architectural Glass market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Competitive Positioning Innovation Portfolios Collaborative Ventures and Strategic Direction of Leading Architectural Glass Manufacturers

Leading manufacturers are differentiating themselves through strategic investment in R&D, vertical integration, and mergers to expand production capacities. Several global players have recently forged partnerships with technology startups specializing in adaptive glass control systems, enabling accelerated product development cycles and pilot installations in landmark projects. Meanwhile, established suppliers are pursuing carbon-neutral glass manufacturing by integrating waste-heat recovery systems and increasing the share of recycled cullet in furnace operations.

Competitive positioning also hinges on comprehensive service offerings, including digital specification tools and managed maintenance programs. Firms that provide cloud-enabled performance monitoring have reported higher customer retention, as building owners leverage real-time analytics to optimize energy usage and maintenance schedules. In parallel, well-capitalized enterprises are exploring adjacent markets such as automotive and specialty mirrors, leveraging their coating expertise to diversify revenue streams and achieve economies of scale.

Furthermore, several key players are expanding geographic footprints through targeted acquisitions in under-penetrated regions. By acquiring local float glass producers and retrofit specialists, these companies gain immediate access to established distribution networks and project pipelines. This strategic expansion underlines the importance of a balanced global footprint and localized capabilities to meet region-specific demand profiles and regulatory landscapes.

This comprehensive research report delivers an in-depth overview of the principal market players in the Architectural Glass market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agarwal Toughened Glass India Pvt. Ltd.

- AGC Inc.

- Asahi India Glass Limited

- Cardinal Glass Industries, Inc.

- Central Glass Co., Ltd.

- China Glass Holdings Limited

- Compagnie de Saint-Gobain S.A.

- CSG Holding Co., Ltd.

- Emirates Glass LLC

- FŰSO Glass India Pvt. Ltd.

- General Glass International, Inc

- Glas Trösch Group

- Glasfabrik Lamberts GmbH & Co. KG

- Glasswerks

- Gold Plus Glass Industry Limited

- Guardian Industries Corp. by Koch Inc.

- Jinjing Group Co., Ltd.

- Mannlee Glass Co., Ltd.

- Nippon Sheet Glass Co., Ltd.

- Oldcastle BuildingEnvelope, Inc.

- Schott AG

- Taiwan Glass Industry Corporation

- Türkiye Şişe ve Cam Fabrikaları A.Ş.

- Viracon, Inc. by Apogee Enterprises, Inc.

- Vitro, S.A.B. de C.V.

- Xinyi Glass Holdings Limited

Proposing Practical Steps for Industry Leaders to Optimize Supply Chains Embrace Smart Technologies Enhance Sustainability and Strengthen Market Position

Industry leaders should consider forging strategic alliances with technology innovators to accelerate the deployment of smart glass solutions. Collaborations with digital platform providers can streamline specification workflows and enable predictive maintenance capabilities that enhance overall lifecycle value. By integrating sensor networks and cloud analytics into product offerings, organizations can create service-based revenue models, positioning themselves as indispensable partners in sustainable building management.

Optimizing supply chain resilience is equally critical. Companies ought to diversify sourcing strategies by balancing domestic and international suppliers, establishing safety-stock buffers for critical coating materials, and negotiating long-term agreements that hedge against tariff volatility. Simultaneously, investing in advanced manufacturing technologies such as automated cutting, tempering, and lamination systems can reduce lead times and drive cost efficiencies, reinforcing competitive advantage.

Finally, embedding sustainability at the core of product development and operations remains a non-negotiable imperative. Pursuing third-party environmental certifications, increasing the proportion of recycled content, and adopting closed-loop water management systems can both meet regulatory demands and appeal to ESG-focused capital. By implementing these recommendations, industry stakeholders can strengthen market positioning, drive profitable growth, and contribute meaningfully to global sustainability objectives.

Outlining a Robust Framework of Data Collection Techniques Analytical Approaches and Validation Mechanisms Supporting the Architectural Glass Market Research

The research underpinning this executive summary combines qualitative and quantitative methodologies to ensure robustness and validity. Primary interviews were conducted with senior executives, architects, and facility managers across North America, EMEA, and Asia-Pacific to capture firsthand insights into evolving performance requirements and procurement behaviors. These discussions were supplemented with expert commentary from coating chemists, glass fabricators, and tariff specialists to contextualize emerging trends and regulatory shifts.

Quantitative data was aggregated from proprietary industry databases, government trade statistics, and company financial disclosures, focusing on production volumes, import-export flows, and technology adoption rates. Advanced analytical approaches, including regression modeling and scenario analysis, were employed to evaluate the sensitivity of pricing structures to tariff regimes and supply chain disruptions. Validation mechanisms such as triangulation, peer review, and data reconciliation were integrated throughout the process to mitigate biases and ensure consistency.

By leveraging a multi-pronged research framework that balances stakeholder perspectives with rigorous data analysis, this study provides a comprehensive and reliable foundation for strategic decision-making in the architectural glass market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Architectural Glass market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Architectural Glass Market, by Product Type

- Architectural Glass Market, by Technology

- Architectural Glass Market, by Coating Type

- Architectural Glass Market, by Processing Method

- Architectural Glass Market, by Application

- Architectural Glass Market, by End-Use Sector

- Architectural Glass Market, by Distribution Channel

- Architectural Glass Market, by Region

- Architectural Glass Market, by Group

- Architectural Glass Market, by Country

- United States Architectural Glass Market

- China Architectural Glass Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2067 ]

Summarizing Core Findings Strategic Imperatives and Future Outlook Shaping the Next Generation of Architectural Glass Innovations

This executive summary has illuminated the convergence of aesthetic aspirations, technological breakthroughs, and regulatory imperatives shaping the architectural glass landscape. Key findings reveal a pronounced shift towards smart glass technologies, accelerated by digital integration and sustainability mandates. The 2025 U.S. tariffs have served as a catalyst for domestic reinvestment and supply chain diversification, prompting innovations in modular design and coating chemistries.

Segmentation analysis underscores the importance of tailored strategies across technology, construction type, end use, coating, distribution, application, and glass format. Regional insights highlight unique demand patterns-from net-zero office developments in North America to dynamic façade installations in Europe and rapid urban expansion in Asia-Pacific. Competitive evaluations reveal that leading manufacturers are scaling through strategic acquisitions, R&D partnerships, and service-based offerings that leverage digital analytics.

Looking ahead, the integration of cloud-enabled monitoring, advanced manufacturing automation, and circular economy principles will define market leaders. By embracing collaborative innovation and robust supply-chain strategies, stakeholders can navigate evolving design standards and tariff landscapes, capturing long-term growth opportunities.

Engage with Ketan Rohom to Access Comprehensive Market Intelligence Unlock Growth Potential and Stay Ahead in the Architectural Glass Industry

To gain unparalleled insight into emerging trends and strategic growth avenues, connect directly with Ketan Rohom, the Associate Director of Sales & Marketing. Partnering with Ketan will grant you early access to in-depth analysis on groundbreaking technologies such as thermochromic and electrochromic innovations that are reshaping facades, skylights, and partition walls. Engaging with his expertise ensures you receive tailored recommendations on optimizing direct sales channels and distributor networks while leveraging digital platforms for maximum market penetration.

Take advantage of a personalized consultation to uncover actionable steps for navigating 2025 tariff landscapes, enhancing sustainability credentials through low-E and anti-reflective coatings, and capitalizing on renovation and new construction segments. With Ketan’s guidance, your organization can position itself at the forefront of the bent glass, laminated glass, and insulated glass unit markets, driving profitable partnerships across the Americas, EMEA, and Asia-Pacific regions.

Secure your competitive edge today by reaching out to Ketan Rohom. Elevate your strategic decision-making, unlock premium market intelligence, and accelerate your path to market leadership within the architectural glass industry.

- How big is the Architectural Glass Market?

- What is the Architectural Glass Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?