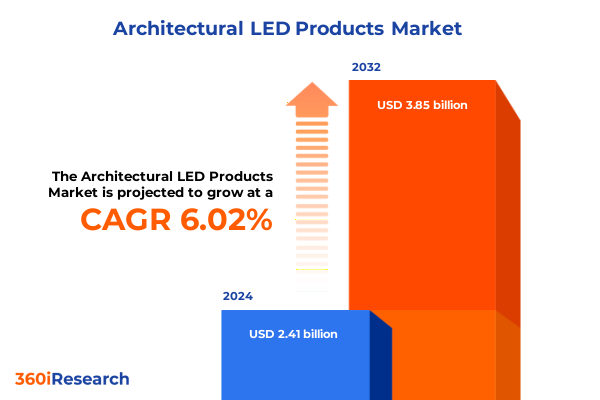

The Architectural LED Products Market size was estimated at USD 2.55 billion in 2025 and expected to reach USD 2.71 billion in 2026, at a CAGR of 6.04% to reach USD 3.85 billion by 2032.

Introducing the Evolving Landscape of Architectural LED Solutions Shaping Modern Lighting Design and Sustainability Efforts Across Multiple Sectors

Architectural LED products have rapidly emerged as a cornerstone of modern lighting design, redefining aesthetic and functional parameters across commercial, industrial, outdoor, and residential environments. The shift toward energy-efficient, digitally controllable, and environmentally sustainable illumination technologies has propelled LEDs from niche applications to ubiquitous fixtures in architectural projects, urban infrastructure, and smart building initiatives. Innovations in form factor, light quality, and integration with building automation systems have further elevated LEDs as strategic assets for designers and facility managers.

In recent years, advancements in semiconductor materials, phosphor coatings, and driver electronics have driven continuous improvements in luminous efficacy and color rendering, enabling more nuanced control of ambiance and occupant comfort. Concurrently, the growing emphasis on carbon reduction and regulatory mandates for energy performance have accelerated adoption of LED solutions across major economies. As a result, manufacturers are investing heavily in R&D to deliver modular designs, interoperability standards, and enhanced thermal management, ensuring both performance and reliability in diverse installations.

This executive summary provides a comprehensive introduction to the architectural LED market, situating key trends within broader transformations in lighting technologies and regulatory frameworks. By examining the technological, economic, and policy dynamics shaping the industry, this report delivers critical insights for decision-makers seeking to navigate competitive pressures and capitalize on emerging growth avenues. Subsequent sections delve into transformative shifts in the landscape, the impact of United States tariffs, nuanced segmentation analyses, and regional variations that inform targeted strategies.

Transitioning from this introduction, the next section explores the most disruptive technological breakthroughs and policy evolutions redefining supply chains, production methodologies, and end-user expectations in the architectural LED domain.

Unprecedented Technological and Regulatory Transformations Redefining Architectural LED Manufacturing Supply Chains and End User Expectations Worldwide

The global architectural LED industry is experiencing a confluence of technological breakthroughs and stringent regulatory mandates that are reshaping the entire value chain from component manufacturing to end-user deployment. Innovations in micro-LED arrays, tunable white solutions, and networked smart controls have accelerated functional versatility, enabling dynamic lighting scenes and responsive occupancy sensing for enhanced energy management. At the same time, policy interventions such as updated energy codes and minimum efficiency standards in key markets are compelling original equipment manufacturers and drivers to optimize designs for both performance and compliance.

Materials science advancements have yielded novel semiconductor substrates and phosphor blends that boost lumen output per watt while improving color consistency. These developments, coupled with the rise of integrated digital control platforms based on IoT protocols, are enabling seamless integration of lighting systems into broader building automation frameworks. Advances in additive manufacturing and modular fixture assembly are further streamlining production processes, reducing lead times, and supporting more agile customization to meet diverse architectural specifications.

Regulatory landscapes across North America, Europe, and parts of Asia-Pacific are converging on stricter energy performance metrics and environmental impact thresholds. Legislation targeting refrigerants, light trespass, and circadian rhythm considerations is driving increased adoption of tunable and circadian lighting solutions. Procurement policies in government and corporate facilities increasingly favor fixtures with third-party certifications and transparent lifecycle assessments, placing a premium on supply chain traceability and end-of-life recyclability.

These transformative shifts are not only elevating product innovation but also redefining expectations among specifiers, installers, and facility managers. Stakeholders now demand ecosystem interoperability, data-driven analytics for predictive maintenance, and turnkey project support, signaling a new era of performance-driven design. Additionally, the growing focus on ESG metrics is driving M&A activity and strategic partnerships as firms seek to align their value chains with sustainability benchmarks. Building on this context, the following section examines how cumulative United States tariff measures enacted in 2025 have influenced import costs, sourcing strategies, and competitive dynamics throughout the architectural LED market.

Assessing the Aggregate Consequences of 2025 United States Tariff Measures on Architectural LED Imports and Their Ripple Effects Across Production and Pricing Dynamics

The imposition of Section 301 tariffs by the United States government in early 2025 introduced additional duties on a range of imported LED components and finished luminaires, primarily targeting goods originating from major manufacturing hubs in East Asia. While the specific tariff rates varied depending on product classification, duties averaging between 15 and 25 percent have significantly increased landed costs for importers, distributors, and original equipment manufacturers relying on global supply chains. This policy shift has prompted swift recalibration of sourcing and pricing strategies among market participants.

As a result of the tariff adjustments, several manufacturers have sought to mitigate cost pressures by diversifying their procurement footprints. This has included reallocating production capacity to Southeast Asian facilities with existing trade agreements favorable to the United States market and accelerating the nearshoring of certain assembly operations within North America. Although establishing new manufacturing lines entails significant capital expenditure, these moves promise long-term resilience against tariff volatility and geopolitical disruptions.

Price sensitivity among end users has also shaped the market response to higher import duties. Commercial real estate developers and institutional buyers have engaged in more rigorous supplier negotiations and have increasingly specified fixtures with domestically sourced critical components to avoid tariff-related markup. On the distribution side, channel partners have reevaluated inventory strategies, balancing the risks of holding higher-cost stock against the potential for supply constraints in the absence of tariff-compliant alternatives.

In summary, the cumulative impact of the 2025 United States tariff regime on architectural LED products has reverberated across sourcing, manufacturing, and purchasing tiers. While short-term cost increases have challenged profit margins and tested supply chain agility, the broader effect has been an accelerated restructuring toward regionalized production networks and more transparent cost structures. Moreover, planned tariff reviews later in 2025 have introduced an additional layer of uncertainty, prompting some stakeholders to hedge through long-term supplier contracts and blended sourcing strategies. The next section builds on these market shifts to explore granular segmentation insights, illuminating how product type, application, end use, and distribution channel dynamics intersect to reveal targeted pathways for growth and differentiation.

Deep Dive into Architectural LED Market Segmentation by Product Type Application End Use and Distribution Channel Revealing Targeted Growth Opportunities

An in-depth segmentation analysis of the architectural LED market highlights distinct opportunities and challenges across product typologies, application environments, end-use categories, and distribution pathways. From a product type perspective, downlights stand out for their aesthetic integration in interior spaces, with the 15 to 30 watt range capturing widespread adoption in upscale hospitality and corporate office fit-outs, while sub-15 watt modules serve niche retrofit projects and ultra-efficient residential upgrades. Flood lights used primarily for expansive commercial and industrial zones thrive in the 50 to 100 watt bracket, whereas high-output variants above 100 watts are increasingly specified for large-scale outdoor security perimeters.

Linear lighting systems have carved a niche in both functional task lighting and decorative cove installations, with mid-range 30 to 60 watt modules balancing luminous efficacy and thermal management for open-plan environments. Meanwhile, panel lights within 20 to 50 watt offerings dominate ceiling applications in institutional settings such as universities and hospitals, as sub-20 watt ultra-thin fixtures address the demand for minimalist residential interiors. Street lighting solutions reveal a bifurcation between municipal initiatives specifying 100 to 200 watt high-output luminaires for roadway illumination and emerging smart city pilots that leverage sub-100 watt fixtures for pedestrian zones and sensor-enabled street furniture.

Application-driven segmentation further underscores divergent purchasing priorities. Commercial environments, encompassing hospitality venues, office complexes, and retail galleries, emphasize both design flexibility and total cost of ownership, whereas industrial sites such as manufacturing plants and warehouses prioritize ruggedness and photometric uniformity. Outdoor applications extend beyond simple parking lot installations to encompass landscape accentuation in urban parks and sports facilities requiring dynamic dimming to accommodate multi-sport scheduling. Residential adoption bifurcates into indoor ambient and outdoor landscape categories, each with differing preferences for color temperature and fixture aesthetics.

End-use distinctions between commercial, industrial, institutional, and residential buyers illuminate bespoke specification requirements and procurement cycles. Distribution channels ranging from direct sales agreements with project contractors to distributor networks and e-commerce platforms reveal shifting buyer behavior, particularly as online procurement platforms gain traction for smaller retrofit purchases while bulk orders remain anchored in traditional distributor relationships. A cross-sectional examination reveals that high-watt street lighting solutions are frequently secured through direct sales agreements with municipal procurement offices, contrasting with online retail’s growing role in small-batch residential retrofit purchases. This interplay between product specifications and channel preferences underscores the importance of aligning go-to-market tactics with the unique procurement dynamics of each customer cohort.

This comprehensive research report categorizes the Architectural LED Products market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Application

- End Use

- Distribution Channel

Comparative Overview of Regional Market Dynamics for Architectural LED Solutions Highlighting Unique Drivers and Challenges in Americas EMEA and Asia-Pacific

Regional dynamics play a pivotal role in shaping the adoption and evolution of architectural LED products, as regulatory frameworks, infrastructure investments, and climatic conditions vary significantly across the Americas, Europe-Middle East-Africa (EMEA), and Asia-Pacific regions. In the Americas, mandates for zero-net energy buildings at state and provincial levels, coupled with incentives for retrofits in aging commercial real estate portfolios, have spurred demand for high-efficacy luminaires capable of delivering both energy savings and enhanced occupant wellness. Public-private partnerships in smart city installations further reinforce the need for networked outdoor lighting solutions that integrate sensors and data analytics.

Within the EMEA cluster, stringent energy performance directives have catalyzed rapid phase-outs of legacy lighting systems in Western Europe, positioning panel lights and tunable white downlights as favored solutions in office and institutional environments. Meanwhile, the Middle East’s architectural signature and large-scale hospitality developments drive demand for premium linear accent and flood lighting, with environmental conditions necessitating robust thermal management and corrosion-resistant enclosures. African markets, though at earlier stages of modern lighting infrastructure, are increasingly exploring LED retrofits in public sector projects to reduce operational costs and enhance public safety in urban centers.

Asia-Pacific exhibits a diverse spectrum of market maturity, with highly developed economies such as Japan, South Korea, and Australia leading in smart lighting deployments and circadian-controlled fixtures, while Southeast Asian nations invest in large-scale manufacturing capacity to serve both domestic and export markets. Rapid urbanization in China and India has created substantial opportunities for street lighting modernization programs, pairing high-output roadway luminaires with Internet of Things–enabled control networks designed to optimize energy use and maintenance schedules.

Trade flow imbalances and logistic bottlenecks have also shaped regional strategies, with the Americas facing extended lead times for Asian-sourced components, while EMEA benefits from intra-regional distribution hubs reducing transit durations. In Asia-Pacific, robust export infrastructure supports rapid deployment to global markets, yet domestic manufacturers contend with local raw material shortages that can impede production schedules. Across all regions, the intersection of local policy frameworks, infrastructure financing mechanisms, and climatic considerations dictates unique product requirements and project delivery models. Stakeholders must navigate regional certification regimes, such as Energy Star and the European Union’s Ecodesign Directive, while also accounting for import tariffs, logistical constraints, and labor cost differentials. With these regional nuances in mind, the subsequent section offers insights into leading companies that are shaping the competitive landscape through innovation, partnerships, and strategic market positioning.

This comprehensive research report examines key regions that drive the evolution of the Architectural LED Products market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Critical Competitive Landscape Analysis Revealing Strategic Initiatives and Innovation Highlights from Leading Architectural LED Manufacturers and Suppliers Globally

The architectural LED market is characterized by a handful of influential players whose strategic initiatives and innovation roadmaps are shaping competitive dynamics and driving industry standards. One of the most prominent companies has leveraged its broad product portfolio-spanning downlights, linear systems, and integrated control solutions-to establish partnerships with leading building automation platform providers, reinforcing its position in large-scale commercial and institutional tenders. A second key player has prioritized digital transformation, introducing cloud-based lighting management software that enables real-time analytics and predictive maintenance services, thereby strengthening its recurring revenue streams and deepening customer engagement.

Another leading supplier has focused its efforts on sustainable manufacturing, announcing targets for carbon-neutral operations and recycled content requirements for LED modules and drivers. This commitment is complemented by strategic acquisitions of specialized optics and thermal management firms, enabling enhanced fixture performance in extreme operating environments. Meanwhile, a specialist in high-performance industrial and outdoor luminaires has expanded its global footprint through joint ventures in Asia-Pacific and the Middle East, tailoring product configurations to meet stringent regional standards and on-site assembly requirements.

R&D investment levels and patent activity further distinguish market leaders from challengers. Analysis of recent IP filings indicates a surge in patents related to high-efficiency semiconductor architectures and advanced driver algorithms. Companies allocating upwards of five percent of annual revenue to R&D are consistently first-to-market with breakthrough products, while those with leaner R&D budgets pursue partnerships or licensing agreements to access critical innovation pipelines.

Across the spectrum, these companies differentiate through investments in adjacent technology domains such as Li-Fi-enabled fixtures, circadian lighting systems, and smart city pilot projects that integrate roadway and pedestrian lighting networks with data platforms for traffic management and public safety. By aligning product roadmaps with sustainability frameworks and digital value propositions, market leaders are not only capturing share in mature markets but are also laying the groundwork for growth in emerging economies with nascent LED infrastructure. As competition intensifies, smaller innovators and emerging entrants are carving out niches by focusing on specialized applications-such as boutique hospitality lighting and bespoke residential design segments-and by offering agile manufacturing models that cater to expedited project timelines.

This comprehensive research report delivers an in-depth overview of the principal market players in the Architectural LED Products market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acuity Brands, Inc.

- Advanced Lighting Concepts, LLC d.b.a Environmental Lights

- Alcon Lighting Inc.

- Anolis LED Lighting

- Coolon Pty Ltd.

- Cooper Lighting LLC

- CORE Lighting

- Cree, Inc.

- Eaton Corporation plc

- ERCO GmbH

- GE Lighting, LLC

- Gemstone Lights

- General Electric Company

- Hubbell Incorporated

- IDEAL Industries Lighting, LLC dba Cree Lighting

- Koninklijke Philips N.V.

- LED Linear GmbH

- Ledvance GmbH

- Lumasense

- Lumileds Holding B.V.

- Mitsubishi Electric Corporation

- OSRAM GmbH

- Panasonic Corporation

- PreciseLED Inc.

- Pro Lighting Group Inc.

- Q-Tran Inc.

- Samsung Electronics Co., Ltd.

- Signify N.V.

- WAC Lighting

- XAL GmbH

- Zumtobel Group AG

Strategic Framework of Actionable Recommendations for Industry Leaders to Enhance Product Development Supply Chain Agility and Market Penetration in Architectural LED

To capitalize on emerging opportunities and fortify market positioning in the architectural LED domain, industry leaders should first intensify investments in modular, platform-based fixture designs that can be swiftly configured for diverse applications. By embracing a plug-and-play ethos and leveraging standardized optical and driver modules, manufacturers can accelerate time-to-market and lower engineering costs associated with custom specifications. Integrating digital control capabilities at the fixture level will further enhance value propositions, enabling data-driven insights and differentiation through advanced lighting services.

Supply chain resilience can be markedly improved by adopting a dual-sourcing strategy that balances nearshore production hubs with strategically located overseas facilities. Conducting regular supplier risk assessments, complemented by collaborative demand forecasting and vendor-managed inventory agreements, will mitigate tariff and logistical uncertainties while optimizing working capital. Establishing flexible contract manufacturing partnerships with regional assemblers can also provide rapid response capabilities for local codes compliance and small-batch customization requirements.

Collaboration across the ecosystem will be critical in navigating regulatory and technological complexities. Forming alliances with building automation platform developers, standards bodies, and utility program administrators can facilitate seamless integration into smart building frameworks and energy efficiency initiatives. Co-developing pilot projects with end-user organizations-such as property management firms or municipal authorities-will not only validate new product concepts in real-world settings but also bolster marketing narratives around sustainability and operational cost reduction.

In parallel, maintaining proactive engagement with regulatory bodies through industry associations and scenario planning exercises will ensure readiness for evolving energy codes and environmental mandates. By conducting periodic compliance audits and lobbying for feasible implementation timelines, firms can influence standards development and avoid costly retrofits, further solidifying their competitive posture. Finally, leaders should cultivate an innovation culture that spans R&D, operations, and customer-facing teams, fostering experimentation with emerging technologies like Li-Fi communication, human-centric circadian lighting, and advanced materials for improved thermal performance. Supplementing internal capabilities with targeted acquisitions-particularly in optics, sensors, and software-can bridge gaps in expertise and accelerate go-to-market for next-generation offerings. By implementing this strategic framework, organizations can enhance agility, deepen customer partnerships, and secure a competitive edge in the evolving architectural LED landscape.

Robust Multi-Stage Research Methodology Outlining Data Collection Techniques and Analytical Approaches Employed to Ensure Accuracy and Reliability of Market Insights

This report’s findings are underpinned by a rigorous multi-stage research methodology designed to deliver comprehensive, validated insights into the architectural LED market. The initial phase entailed exhaustive secondary research, examining publicly available documents, industry white papers, regulatory filings, and technical specifications to establish a foundational understanding of market dynamics, product technologies, and policy frameworks. This analysis was augmented by a systematic review of patent databases, standards organization publications, and regional energy efficiency directives to capture the latest advancements and compliance requirements.

Building upon secondary inputs, primary research was conducted through in-depth interviews with key stakeholders, including C-suite executives, R&D directors, procurement managers, and design consultants. These conversations provided direct perspectives on strategic priorities, operational challenges, and technology adoption timelines. Additionally, structured surveys were distributed to a broader panel of end users across commercial, industrial, institutional, and residential segments to quantify preferences regarding fixture performance, control integration, and supplier selection criteria.

To ensure robustness, data triangulation techniques were employed, comparing insights from primary research with market intelligence gathered from multiple geographies. Cross-validation workshops were held with subject matter experts to challenge preliminary assumptions and refine segmentation frameworks, encompassing product type subcategories, application environments, end-use classifications, and distribution channels. Quality control measures, including data consistency checks and outlier analysis, further reinforced the reliability of the conclusions drawn.

By integrating qualitative and quantitative methodologies, this research delivers a nuanced perspective on architectural LED trends, enabling stakeholders to make informed strategic decisions. The final section synthesizes these insights and presents a clear path forward for market engagement and innovation.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Architectural LED Products market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Architectural LED Products Market, by Product Type

- Architectural LED Products Market, by Application

- Architectural LED Products Market, by End Use

- Architectural LED Products Market, by Distribution Channel

- Architectural LED Products Market, by Region

- Architectural LED Products Market, by Group

- Architectural LED Products Market, by Country

- United States Architectural LED Products Market

- China Architectural LED Products Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2226 ]

Synthesis of Core Findings Underscoring Key Trends and Industry Imperatives Driving Innovation Adoption in the Architectural LED Lighting Ecosystem

The synthesis of our analysis reveals a dynamic architectural LED landscape defined by the convergence of performance-driven innovation, policy mandates, and competitive differentiation. Energy efficiency remains the foundational driver, with advanced semiconductor materials and optimized fixture designs enabling new levels of lumen output and color rendering, while regulatory frameworks continue to elevate minimum performance thresholds. Simultaneously, the proliferation of digital control platforms and IoT-enabled systems is forging deeper integration between lighting and broader building automation networks, unlocking value through data analytics and enhanced maintenance capabilities.

Trade policy adjustments, particularly the 2025 United States tariff measures, have catalyzed strategic recalibration of supply chains and pricing structures, prompting both nearshoring initiatives and diversification of manufacturing footprints. Segmentation analysis underscores the importance of tailoring product characteristics-such as wattage ranges, form factors, and control features-to specific application and end-use contexts, while distribution strategies must balance traditional channel partnerships with the growing influence of online procurement platforms. Regionally, market maturity varies, with North America and Western Europe leading in smart lighting deployments, and emerging economies in Asia-Pacific and EMEA demonstrating rapid uptake through urban infrastructure investments.

Competitive forces are intensifying as leading global manufacturers invest in digital services, sustainability commitments, and strategic acquisitions to maintain differentiation. Smaller innovators play a vital role by addressing specialized niches and agile customization demands. Emerging technologies such as micro-LED arrays and Li-Fi-enabled fixtures represent additional frontier areas, promising ultra-high resolution lighting and integrated wireless communication capabilities. These innovations will continue to redefine the architectural LED landscape and offer early adopters significant differentiation advantages.

These core findings emphasize the necessity for industry participants to adopt a holistic strategy that integrates modular product platforms, resilient supply chains, collaborative partnerships, and a culture of continuous innovation. Such an approach will be instrumental in securing long-term growth and market leadership in the architectural LED sector.

Engage with Associate Director of Sales and Marketing to Secure Comprehensive Architectural LED Market Intelligence Deliverables Tailored to Strategic Business Needs

For organizations seeking to gain a competitive edge and access deeper insights into the architectural LED market, we invite you to engage directly with Associate Director of Sales and Marketing, Ketan Rohom. Leveraging extensive expertise in lighting technology research and market intelligence, Ketan and his team can provide tailored deliverables that address your specific strategic objectives, whether they involve product innovation roadmapping, regional expansion assessments, or supply chain optimization studies.

Purchasing the full market research report will equip your leadership with actionable data and analysis, empowering you to make informed decisions in a rapidly evolving industry landscape. To explore customized engagement options and discover how our insights can drive your business forward, please reach out to Ketan Rohom and unlock the comprehensive intelligence you need to thrive in the architectural LED sector.

- How big is the Architectural LED Products Market?

- What is the Architectural LED Products Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?